The cheque basically is a record that orders a financial institution to pay a certain amount of money from one account and issue is to the person whose name is written. The person who is writing the cheque is known as a drawer. He has a transaction banking account wherein the cash is held. The drawer writes the numerous information, including the financial quantity, date, and a payee on the cheque and signs it, ordering their financial institution, called the drawee, to pay that character or organisation the quantity of cash stated.

Did you know?

In India, the cheque was introduced by the Bank of Hindustan, the first joint-stock bank. As a result of the Negotiable Instruments Act (NI Act), which was enacted in 1881, instruments like cheques, bills of exchange, and promissory notes began to be formalised in India.

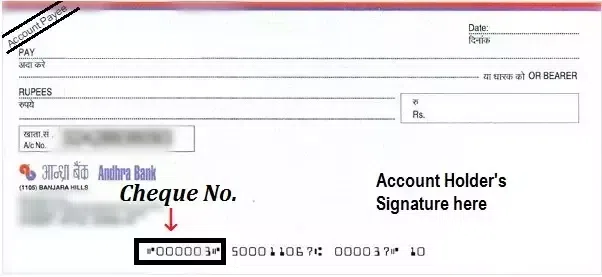

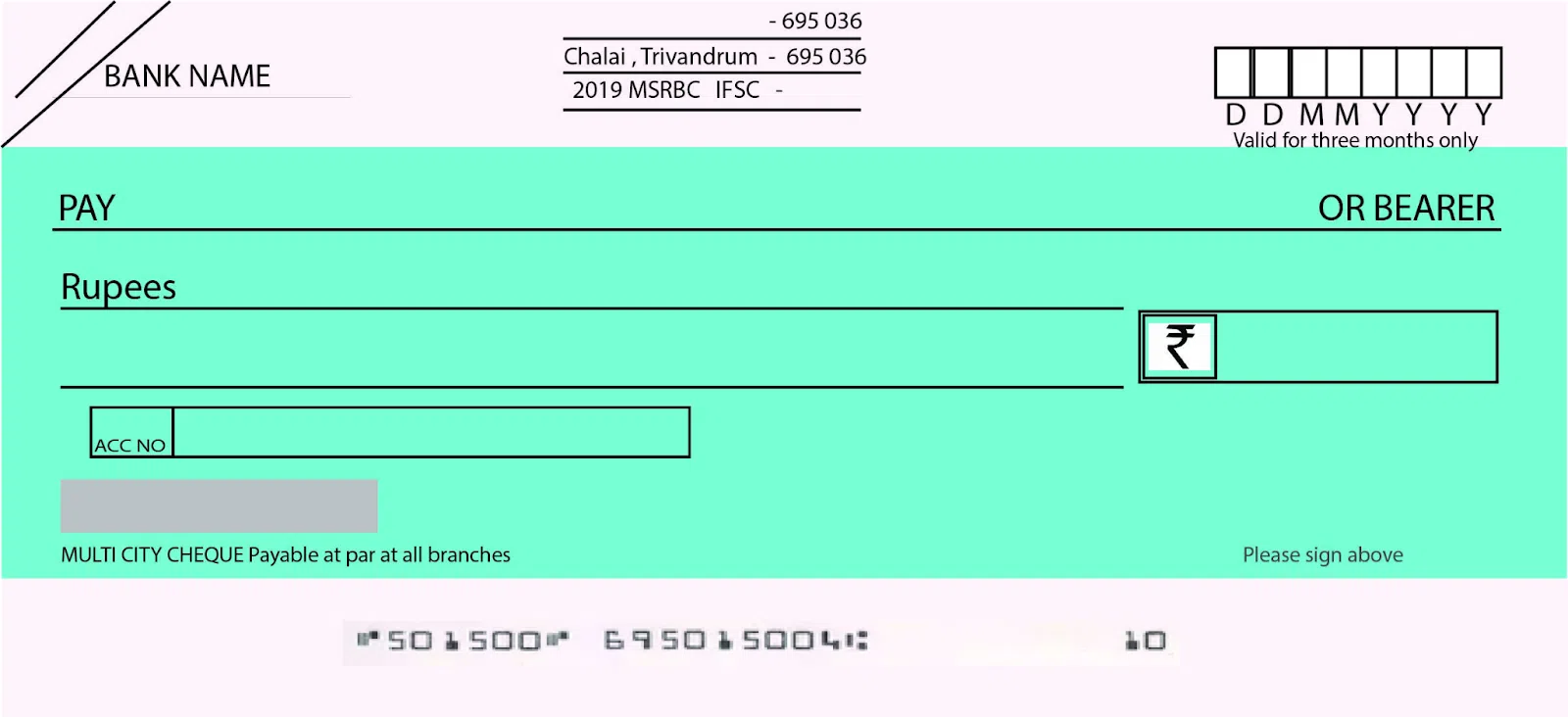

A cheque number is frequently required through us to track the cheque repute. The cheque quantity is a unique number that enables one to perceive a Cheques. The following factor will assist you in recognising the cheque layout.

- The six-digit quantity written at the lowest left-hand corner of cheque is the cheque quantity.

- The MICR code is the character code of the magnetic connection character. The nine-digit MICR code suggests the financial institution and department issuing cheque account holder. The first three numbers are basically the city code; the following three digits reflect the financial institution code, the remaining three are for the department.

- Following MICR code, the six digits cited in the cheque are part of the account quantity.

- The remaining digits at the lowest of a cheque are the transaction ID. It helps us to understand that the cheque issued is local or payable at par. A local cheque may be cashed best with the issuing financial institution, and payable at par cheque may be cashed at any department of the issuing financial institution. Most of Cheques are payable at par with the central banking device.

Where Can I Find the Cheque Number on the Cheque?

It doesn’t matter whether or not you’ve got an account at Pnb [Punjab National bank], Indusind, ICICI, UCO, OBC, BOB, union, canara, Yes, Dena etc. The criteria of Cheque is always same identical for every banks. The number one 6 digits are considered as cheque numbers, the subsequent 9 digit is MICR codes.

Also Read: What is a Cancelled Cheque?

Features of Cheque

There are numerous features of cheques, such as:

1. Components in writing: A cheque should be written. Just the words does not represent any Cheques.

2. Cheque needs to be made by a banker: It is usually drawn by a certain banker. A cheque may be drawn on a financial institution wherein the drawer has an account, saving financial institution, or current.

3. Unconditional: the cheques are an order to pay, and it isn’t a request. The order needs to be unconditional.

4. The cheque has a certain amount on it that needs to be paid: The cheque must comprise an order to pay a certain sum of money only. If the cheques are interested in doing something further, aside from paying cash, it can’t be a Cheques.

5. It must be signed via the means of the drawer and must be dated: A cheque does not bring any validity except signed through the unique drawer. It must be dated as well.

6. It is payable on demand: A cheque needs to pay a certain amount of money on call; however, it isn’t important to use ‘on-demand ‘or similar words.

7. Certain timing: the cheques are typically legitimate for six months from date it bears. After that, it’s termed a stale Cheques. A submit-dated or antedated cheque will not be invalid. In each case, the validity of Cheque is presumed to begin from the date stated on it.

8. It can be payable to the drawer himself: Cheques can be payable to the drawer themself. It can be payable to the bearer on demand, unlike an invoice or a pro-note.

9. Specific/ certain banker only: basically, the cheques are drawn only from a specific banker. Usually, the name & deal with the banker is honestly imprinted on the cheque leaf itself.

10. It does not require reputation and stamp: Unlike an invoice of exchange, a cheque does not require reputation on the part of the drawee. There is, however, a custom amongst banks to mark cheques as ‘good’ for the motive of clearance. But this marking isn’t a reputation. Similarly, no sales stamp is needed to be affixed to cheques.

Kinds of Cheques

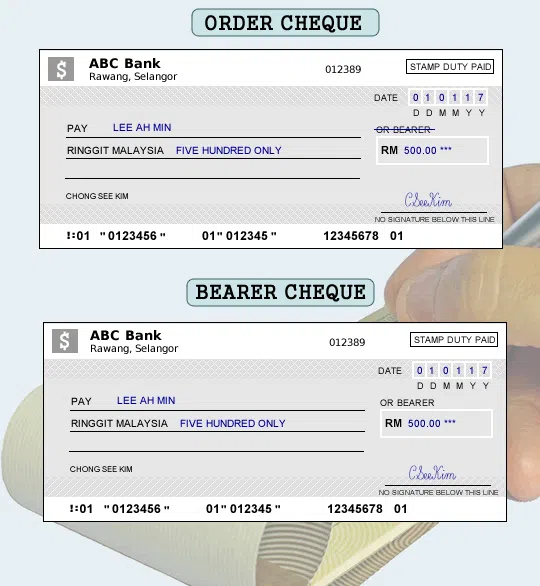

1.Bearer

This is the sort of cheque whichallows individual bearing cheque economic organization to gather the price particular on the cheques. The cheques are marked “or bearer” earlier than the beneficiary’s call. It is a technique wherein the quantity of the issued cheque may be acquired via way of means of each the beneficiary and the bearer. this additionally makes a cheque transferable, as all people wearing it is able to gather the rate. The economic organization now not requests the authorisation of the drawer to make the rate of cheques.

2. Order

The 2nd sort of cheque is the order. A cheque to reserve is the most effective one which bears the mention “or to bearer” cancelled. It is nice for the individual that call is referred to due to the fact the payee may gather the specified money. The economic organization not cheques the bearer’s identity in advance rather than making the price.

3. Crossed

This is the sort of cheque wherein the drawer makes a slight tilt, parallel strains on the top-left corner of cheque, with the word ‘a/c payee’ written. It is a technique via way of means of which the specific sum of cheques, that regardless of who are handing it over, will nice be transferred to individual/ enterprise whose call is referred to due to the payee. The check is also greater steady because of the truth it is able to be cashed nice at the payee’s economic oeganization.

4. Open

This has no cross-references and consequently is likewise referred to as an un-crossed cheques. The open cheque can be cashed at each of banks, namely, the payer’s economic group or the payee’s economic group. Also, the cheques are transferable via the payee. Because of this, they may be capable of making someone other the payee. The issuer of the open cheque is wanted to sign for every front and the back of cheques.

5. Submitted

A submitted cheque is dated after date it was issued. It can greatly be cashed after date specific via payer. The submitted cheque may be valid after date stated however now no longer before. Hence, even though its miles are furnished to the economic group, the economic group will now no longer process until the stated date.

6. Overdue

A past due cheque already has handed its date that is valid and might not be cashed. The cheques are taken into consideration valid until 3 months from its drawn date.

7. Traveller’s

Issued via an economic group, a traveller’s cheque may be cashed via the payee on another economic group in a different country. The charge may be acquired in that country’s currency. It turns into useful whilst you’re heading on an foreign place and enjoy and do now no longer prefer to maintain too many coins.

8. Self

This cheque has a word ‘self’ written due to payee. It is utilised with the aid of using the drawee to withdraw coins from their economic group account. A self check can be cashed great at the issuer’s economic group.

Also Read: All You Need To Know About Post-dated Cheques

9. Banker

A banker’s cheques are drawn via the economic group itself. An economic group problems a banker’s cheque in regard to the account holder to issue a rate to another individual in the identical town. Banker’s cheques are valid for 3 months. If their validity length has expired, revalidation can be viable if positive situations are met.

10. Blank

This is the simplest one which has a sign of an issuer, and no one of a kind data is stuffed in. These checks pose an immoderate danger because of the truth that if lost, all people who are famous are able to fill in the amount and hassle to themselves.

Conclusion

It doesn’t matter whether or not you’ve got an account at Pnb [Punjab National bank], Indusind, ICICI, UCO, OBC, BOB, union, canara, Yes, Dena etc. The criteria of Cheque is always identical for every bank. The number one 6 digits are considered as cheque numbers, the subsequent 9 number are MICR codes. Following from the left side, the primary 6 digits are considered as cheque numbers.

Follow Legal Tree for the latest updates, articles, and news blogs related to medium, small, and micro-businesses (MSMEs), business tips, income tax, GST, salary, and accounting.