As the name suggests, Bank Reconciliation Statement (BRS) is a statement that reconciles the balances between the bank statement and the book of accounts. Many times, the balances as per bank statements and cash books do not match. That is when the role of the Bank Reconciliation Statement (BRS) came into the limelight.

What is the Importance of Bank Reconciliation in Tally

BRS in Tally is ideal for the higher management to reach out to the bank if the difference between cash book and passbook is not justified. The bank may have passed the entries that do not pertain to the company. With BRS, transactions can be easily tracked, and it helps the auditor find how old the unreconciled balance is so that they can have an overall view of the business. Even if a situation occurs when the cashier tries to inflate the bank balances, the Auditor can get a true picture by viewing the BRS.

There are many ways to reconcile the BRS. There is various software available in the market that provides Bank reconciliation features. As a result, we are seeing a shift from the manual process of making the BRS to the electronic method. However, the principle of making the BRS remains the same. The manual process of making a BRS will take days, given the volume of transactions. It is always advisable to use software tools such as BRS in Tally ERP 9 to prepare BRS.

What differences can occur in Bank Reconciliation?

1. Cheques: The company may have issued the cheque, but the vendor may not have presented it for payment. Similarly, the cheque deposited in the bank might not have gotten cleared. The maximum time which a bank takes to clear a cheque is 3 days. The entries in the books of transactions cannot stop since the accountant continues to pass the entries. To keep a check on the unreconciled amount, the cashier prepares a Bank Reconciliation Statement. Once the cheques get cleared, the amount moves from the BRS to the books of transactions of the account. In business lines, issuing post-dated cheques is a common practice. The entries about the post-dated cheques get passed in the books of accounts. But since it’s a post-dated cheque, it will not appear in the bank statement unless its date arrives. Consequently, these cheques will lie unreconciled in the BRS.

2. Interest Entries: The bank provides interest income on the Fixed deposits. This income, at times, does not tally with the income recorded in the books. Also, the interest on loan figures may not match. This is because the bank has a different method for the calculation of interest. This practice varies from bank to bank, and the interest gets recorded monthly or daily.

3. Bank charges: Bank debits its charges on account of the service provided by it. The management of the company may not agree with these charges. Hence, the same may still show in the BRS till the matter gets resolved.

4. Forgotten Mandates: The company might have given the bank some standing instructions. These may include instructions to transfer the funds as per the requirement to the chosen account. But the accountant might forget those mandates at the time of passing entries in the books.

5. Stale Cheques: The company may have issued cheques to its vendors. But if the vendor fails to encash the cheque within 3 months of the cheque date, it becomes stale as per the RBI mandate. As a result, a new cheque has to be issued. Otherwise, the accountant needs to reverse the payment entry and record the corresponding liability. This entry gets passed against the appropriate ledger. Until the reverse process is not done, the previous balance will continue to appear in the BRS.

What is the structure of the Bank Reconciliation Statement?

- The first thing to note on how to prepare a Bank Reconciliation Statement is evaluating the balance of cash as per books or as per bank statements.

- After that, matching every transaction is necessary, as shown in the books or the bank statement. The idea is to reach the actual balance as per the bank statement if you start the balancing process as per the books of accounts.

- On the other hand, balance the amount as per books of accounts if you start with balance as per bank statement.

The cashier does the addition or deletion of amounts accordingly. He ticks every transaction shown in both bank statements and that in books of accounts. The reconciliation process continues until the target balance gets reached.

Why do we need tally?

Tally is an Enterprise Resource Planning (ERP) software generally used for bookkeeping and accounting purposes. It works with the Windows platform and is used for payroll management, banking, accounting, inventory management, GST reconciliation, and many other financial needs of the company. It is a multipurpose software designed to meet bookkeeping needs with ease. Therefore, it can be asserted as a one-stop solution for all managing accounting needs of a business.

The manual process of making a BRS can be easily streamlined using Tally ERP 9. BRS in tally ERP 9 offers ease of use, especially when there is a huge volume of transactions. When the transactions are numerous, then matching every bank transaction becomes a challenging task. It offers both auto and manual reconciliation features. With the aid of Tally ERP 9 Bank reconciliation, the preparation of BRS becomes seamless.

How to use Auto Reconciliation Function In tally?

First Activate Auto Bank Reconciliation in Tally ERP 9

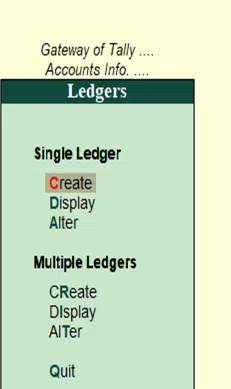

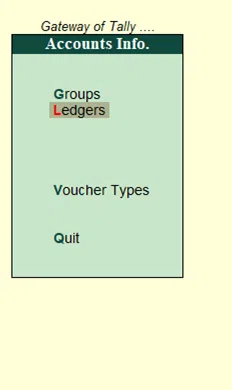

Step 1: Start with the gateway of Tally. Then select accounts info.

Then click on the ledger. If the bank ledger is already created, then click on alter else, click create.

Step2: Choose Yes in the option to Set /Alter Auto BRS configuration

Step 3: Press enter and accept the changes as required. After that, click on the Accept button at the bottom.

How to use the Auto Bank reconciliation statement for preparing Bank Reconciliation in Tally?

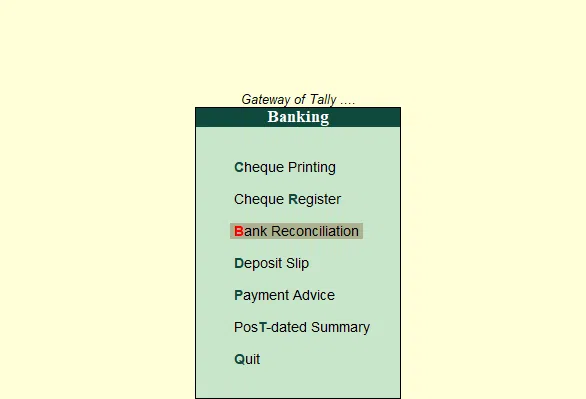

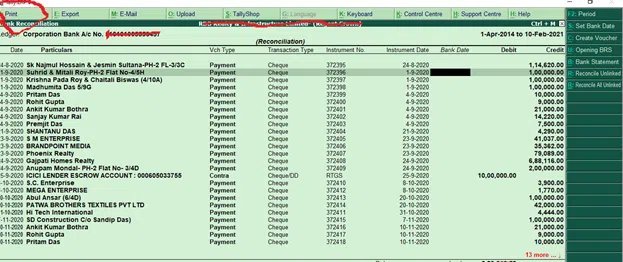

Step 1: Start with the gateway of Tally. Then select banking out of the available option in the utility head.

Step 2:Then click on bank Reconciliation out of the options available.

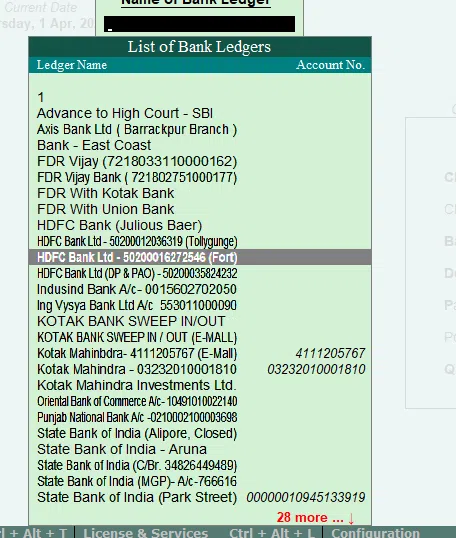

Step3: The list of banks will appear on your screen. If a bank name does not appear on the screen, there might have been some issue with the ledger creation. You might not have designated the concerned ledger as a bank account ledger. Go to the alter ledger option from the gateway of the tally. Do the necessary changes as desired.

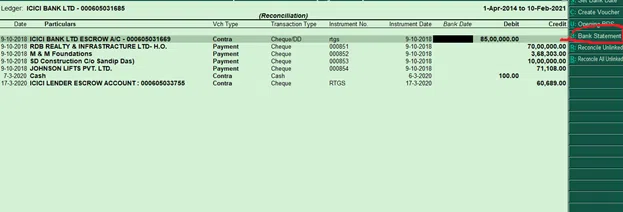

Step 4: Click on the bank statement button on your right. Alternatively, you can press the Alt B keys. It will have the same effect.

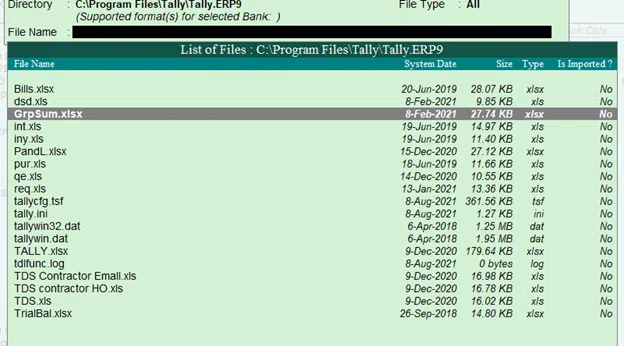

Step 5: Specify the Directory path. This path is the address of the bank statement. Select the supported option from the File type option on the Top. This will ensure that only supported versions appear before you.

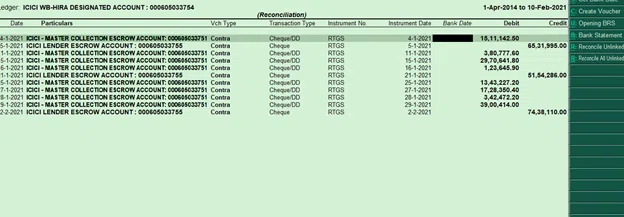

Step 6: Once you have selected the correct file, then click on it. After that, an auto-run will take place. Once the reconciliation takes place, a notification of success reconciliation will appear. At the bottom of the screen, the following details will appear.

Balance as per Company Books: The balance in the company’s book as per the latest accounting date will appear.

Amounts not reflected in Bank: Those amounts are, to date, not reflected in the bank statement. They can be there in the bank statement after the reporting date.

Amount not reflected in Company Books: The entries missing in the books of accounts and within the reporting date will appear here.

Balance as per Bank: This should tally with the balance per book if there is no mismatch.

Step 7: The Bank Reconciliation Statement with the bank statement will appear. You will view the list of entries from the bank statement that are not yet accounted for in the company’s books of accounts.

Step 8: Start the reconciliation process by passing entries of the transactions contained in the bank statement. If those entries do not pertain to the company, then leave it as unreconciled.

Select Amount not reflected in the company books. Then click on the reconcile unlinked button. This will show the most appropriate transaction from the company’s books of accounts. Select the most suitable transaction via the space bar and press enter button. The BRS will get reconciled.

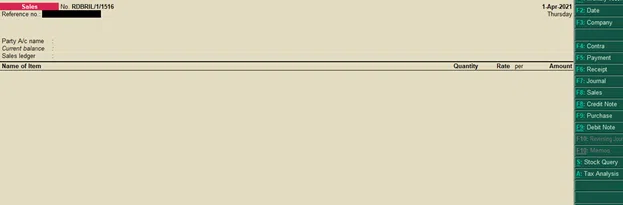

If there are no transactions in the company’s book for the unreconciled amount, you will have to pass separate voucher entries. To do this, click on the create voucher button or Alt C.

Alternatively,

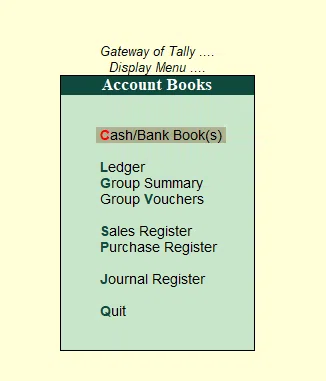

You can select the appropriate bank ledger from the display menu of the gateway of the tally.

- For that, click on display and select Account books. Then select the ledger option.

- Choose the bank you want to reconcile.

- Then click on the reconcile button on your left. As a result, the bank reconciliation statement will appear on your screen.

- Enter the date of clearing from the bank statement. Fill this in the bank date column.

Also Read: How to do Payroll Management in Tally ERP 9

How to change the details once fed into the BRS?

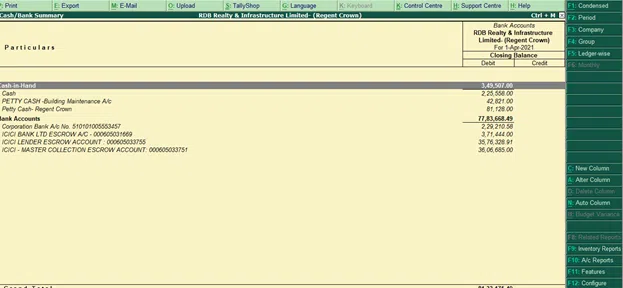

Step 1: From the gateway of tally, select the display option. Then select account books. Consequently, press on the Cash/Bank book.

Step 2: Select the required bank account from the list of ledgers appearing on the screen. Also, select the required period for which the reconciliation will be altered. Press the F5 button. This will redirect to the reconciliation screen.

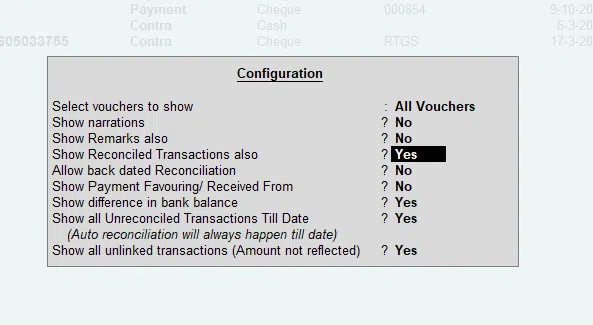

Step 3: Press the F12 button to reach the configuration option. Select “Yes” against the dialogue – Show also reconciled transactions.

Step 4: The reconciled transactions with the bank will open up. You can alter the reconciliation sheet as per your requirement.

Important Point to Consider while Using BRS in Tally ERP 9

1. You must ensure that the excel file starts with the column heading on the first row. All the other details must be there without any empty spaces.

2. The amount column for both withdrawal and deposit must contain ‘0’ for nil or empty values.

3. If any are opening unreconciled balances, then you have to reconcile them manually.

Printing of BRS in tally

The user may print the bank reconciliation statement. This is usually done to meet the record-keeping needs.

- Start with the gateway of the tally.

- Then select banking.

- After that, opt for Bank Reconciliation. The list of banks will appear on the screen. Choose the required bank for reconciliation. The bank reconciliation statement for that particular bank will appear on the screen.

- Then click on the print button. Alternatively, you can press the Alt and P buttons to gether. The Printing screen will appear.

Also Read: All About Banking Entry In Tally ERP 9

Important Points to remember when printing BRS in Tally

In the Select Vouchers to show, select all vouchers. You can also customise as per your needs. There are a host of other options available. These are:

Show narration also: Select this option if you want the narration to appear in the print result.

Show remarks also: Select this option if you have given some remarks earlier and want them to appear in the print result.

Show Forex details also: If there are any Forex transactions in your business, you can make them appear in the print statement.

Show reconciled transactions also: If you want the list of reconciled vouchers, then select this option.

Show payment received from: This gives the details of the recipient and source of payment. Click yes if you want it to get the view of the same.

A small box will appear in the bottom right corner. Click yes to proceed.

Conclusion

You can track any mismatch between the books of accounts and the bank statement via the BRS, even when the bank balances fluctuate daily. If required, an accountant can make the BRS daily through which cash defalcation and shortages can be tracked. It provides a simplified view of the differences between the balance per book and bank statement. Bank Reconciliation in tally ERP 9 offers numerous options to the users. These include auto reconciliation, recheck, and rectification of past transactions, and many more.