The idea of wealth maximisation has its roots in the economics of cash flows. Profit is a key part of wealth maximisation, so decision-making is based on cash flows. If the project is profitable, its net present value will exceed the expected rate of return.

This process of wealth maximisation allows investors to predict the net present value of the investment accurately and identify the underlying cause for its success.

This article highlights the definition, examples of wealth maximisation from business, advantages and a few intricacies.

Did you Know?

Value of shareholders is a commercial term that is sometimes referred to in the context of the “shareholder value” or “maximisation of shareholder value” model, meaning that the sole measure of the success of a business is beneficial to investors. It was popularised in the 1980s and 1990s in conjunction with the management concept of value-based decision making.

Let’s start with understanding wealth maximisation meaning. Wealth maximisation is a strategy for companies that seek to maximise profits while meeting the needs of all stakeholders. It also helps a business build reserves for future growth, recognise the value of regular dividends, and retain a fair market price for its stock.

While companies can make any number of decisions to increase profits, wealth maximisation is the best strategy for decisions that affect the interests of shareholders.

In many cases, shareholders prefer to pursue goals other than wealth maximisation. But managers are reluctant to do so, and they may not fully appreciate how pursuing these objectives increases shareholder wealth.

Pursuing such objectives in a business environment would probably be better in the political realm, where profits would be much higher. In any case, wealth-maximisation strategies are aware of socially responsible companies.

Also Read: Wealth Tax in India- Importance of Taxes in India

Profit maximisation is an effective strategy to maximise profits for shareholders, while wealth optimisation focuses on increasing the firm’s value for all of its stakeholders. It also focuses on the share price and affects a company’s competitiveness and growth strategy.

Finance managers act as the principal-agent relationship between shareholders and companies, and they must serve their needs. While shareholders expect a return on their investment, investors want their money to be secure. That’s why wealth maximisation plays such a crucial role in every business.

Example of Wealth Maximisation

There are many examples of wealth maximisation. In some examples, companies maximise the present value of expected future returns, such as dividends from common stock. The present value is the value of the payment today, discounted according to a discount rate that accounts for the future returns of alternative investments. The ultimate goal of wealth maximisation is to maximise shareholder wealth.

Here’s an example:

In the case of a business, the primary objective of wealth maximisation is to maximise the value of the business, which then increases the value of stockholders. To increase shareholder wealth, a company must maximise the unit price. Assuming that the sales remain constant, increasing the product’s price will generate a higher profit. This strategy can increase the value of a company, generating wealth for the owner.

Advantages of Wealth Maximisation

Now that you know wealth maximisation’s meaning let’s know its advantages. When a business is performing well, it can use wealth maximisation as a strategic planning tool to maximise profits and shareholder value. By building the profits per share of every common stock, this strategy is a much superior option to wealth expansion.

However, the inherent risks in wealth expansion cannot be compared with those of wealth maximisation. The following are some advantages of wealth maximisation. Read on to find out more.

- A firm that maximises its profits also ensures its long-term survival.

- Wealth maximisation is better for society. The financial institutions, workers and shareholders all have a stake in the business.

- A profitable business can attract investors, which leads to a positive environment for everyone.

- Wealth maximisation considers the time value of money. By using cash flows, businesses can pay higher wages to owners and invest in research & development. That way, a business can survive a downturn in the economy.

- It focuses on cash flows, which are more precise and definite, and this means that there is less room for ambiguity with accounting profits.

- It is operationally logical and feasible.

- While profit maximisation is still a valid business strategy, wealth maximisation is a much more versatile goal that helps businesses maximise their share in the market and maintain the satisfaction of consumers.

- It offers rational guidelines aiding in the effective usage of the resources available.

Profit maximisation requires a careful balance between retained earnings and dividends, but the benefits are well worth it.

Disadvantages of Wealth Maximisation

Wealth maximisation requires the management team to continuously seek the highest possible return while minimising risk and focusing on strategic direction. There are some disadvantages of this strategy, which we will discuss below.

- The market price is affected by various political and economic elements that are hard to forecast and evaluate.

- The assumption that underlies the whole thing is an efficient capital market in which the price paid for the share is accurately represented. This assumption is rarely true in actual practice.

- The different parties who stake in the company’s operations have competing interests, making it difficult to reconcile their different opinions.

What is Profit Maximisation?

Profit maximisation refers to the practice of maximising profits in a business. It is important to remember that not all profits are created equal, and some profits are generated when a company sells inferior products to its competitors.

Therefore, a company needs to communicate their brand purpose clearly and effectively. Furthermore, a company cannot simply ignore the impact of intangible assets by focusing on maximising profits. In such cases, customers may feel that the company has harmed them.

To maximise profits, an enterprise needs to identify a quantity q0 at which it can produce the maximum amount of profit. All other quantities will not generate the maximum profit. Three conditions must be met to achieve the maximum profit:

- The cost price p must equal the marginal cost MC, and the output must exceed the price VC.

- The profit must be greater than the marginal cost.

Once the three conditions are met, the firm can increase its revenues and profits.

This concept of profit is indefinite, and different people have different concepts of what profit is. Profit may be defined as net profit, EPS, profit before tax, or the ratio between revenue and cost.

Profit maximisation, as previously stated, assumes that the higher the profit, the better the performance. However, profit maximisation ignores the time value of money, which tells us that one unit of money today is worth less than the same amount of money a year later. Also, to expand your business traffic, you can lookout for the best Instagram for business strategies.

Also Read: Best methods to become rich in India

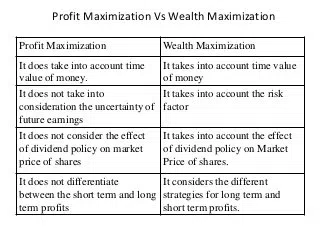

Difference Between Wealth Maximisation and Profit Maximisation

The main difference between wealth maximisation is discussed in the following paragraphs:

- The method by which a business can increase its capacity to earn money is called Profit maximisation. In contrast, the capability to increase their value stock on the market is called wealth maximisation.

- Maximising profits is the brief-term goal of the company, while wealth maximisation is a longer-term goal.

- Profit maximisation does not consider the risk of uncertainty and risk, contrary to wealth maximisation, which considers both.

- Profit maximisation does not take into account the cash value. However, wealth maximisation recognises it.

- Profit maximisation is essential to the longevity and expansion of an enterprise. However, wealth maximisation accelerates the increase in the company’s productivity and aims at achieving the largest market share in the economy.

Conclusion

The goal of wealth maximisation for a business is to maximise the firm’s common stock value. So, the key to wealth maximisation for business success is to invest in strategies that can increase the value of the company’s stock.

Why do business companies not pursue profit instead of increasing share prices? Profit maximisation doesn’t consider the notions of reward and risk as shareholders’ maximisation would. Profit maximisation is, at best, an interim objective of financial management.

Do you like automating procedures to save time?

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting