Tax deduction at source (TDS) is a tax where the payer is required to deduct or collect tax at a specified percentage at the time of payment to the payee and deposit TDS to the revenue authorities. Forms like Challan 281 are means of collecting taxes on income, distribution of income, sale of assets by the government of India.

Tax deduction at source (TDS) is to be deducted and deposited as per Income Tax Act, 1961. Any payment covered under the provisions of the Income Tax Act, 1961 shall be made after deduction/ collection of TDS at the rate specified under the Income Tax Act, 1961. It is managed by the Central Board of Direct Taxes (CBDT) and is a part of revenue managed by the Indian Revenue Service (IRS).

Challan is an official document used to acknowledge the transfer of money from one’s bank account as a receipt for payment. In India, it is used for the payment of taxes to the government of India. Tax deduction at source (TDS) is a tax where the payer must deduct or collect tax at a specified percentage when payment is made to the payee and deposit the same with the revenue authorities.

Background of Challan 281

In 2004, the government introduced a new process for the collection of taxes called the Online Tax Accounting System (OLTAS), which replaced the existing manual process of collection of Taxes. The intention behind such a move by the government is to reduce human involvement. It minimises the chances of errors and helps in the online viewing for details of tax deposited, collected, refunded. OLTAS facilitates tracking the status of the challan online.

The following are the types of Challans that are issued for depositing taxes are as follows:

-

Challan 280

Challan ITNS 280 is a challan used for depositing income tax, advance income tax, regular assessment tax and self-assessment tax.

Also Read: Challan 280 : How To Pay Your Income Tax Online With Challan 280

-

Challan 281

Challan 281 is a challan used for depositing Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) by the corporate or non-corporate assessee.

-

Challan 282

For depositing gift tax, wealth tax, securities transaction tax (STT) on sale or purchase of securities, and for the payment of other direct taxes, Challan 282 is used.

Challan 281

Challan 281 is used for the payment of tax deducted at source (TDS), and Tax Collected at Source (TCS). The taxpayer has to comply with the provisions related to the time limit for payment of TDS specified under the Income Tax Act, 1961.

Time Limit for Payment of TDS and Filing of TDS return

The due date for depositing TDS and filing TDS return are summarised in the table below:

| Month | Due date of TDS | Due date for TDS return filing |

| April | 7th May | 31st July |

| May | 7th June | 31st July |

| June | 7th July | 31st July |

| July | 7th August | 31st October |

| August | 7th September | 31st October |

| September | 7th October | 31st October |

| October | 7th November | 31st January |

| November | 7th December | 31st January |

| December | 7th January | 31st January |

| January | 7th February | 31st May |

| February | 7th March | 31st May |

| March | 30th April | 31st May |

Also Read: Income tax Calculator – Calculate Your Taxes For FY 2021-22 Use Tax Calculator Online

However, TDS on purchase of immovable property is to be deposited within 30 days from the end of the month in which TDS is deducted.

Delay in Payment of TDS

As per Section 201 (1A) of the Income Tax Act, 1961, if an assessee fails to deduct TDS on payment being made to the deductee, he shall be liable to pay TDS along with interest at 1% per month or part of the month. Whereas, after deduction, failure to deposit TDS to the concerned authorities would be liable to interest at1.5% per month or part of the month from the date of actual deduction of TDS.

Late filing of TDS Return

As per Section 234E of Income Tax Act, 1961, if an assessee fails to furnish TDS return within the prescribed time limit, he/ she shall be liable to a penalty of Rs. 200/- per day till the date failure continues. However, the total amount of penalty shall not exceed the total amount of TDS collected.

In case of delay in filing TDS return beyond one year from the due date of filing TDS return can attract a penalty of Rs. 10,000 to Rs. 1,00,000.

What is the process of filing Challan 281?

The assessee can file Challan 281with Income Tax Department by any of the following two modes:

- Online Mode

- Offline Mode

Let’s discuss the processes of depositing TDS with revenue authorities in detail.

Online Mode

The procedure for making TDS payment online as listed below:

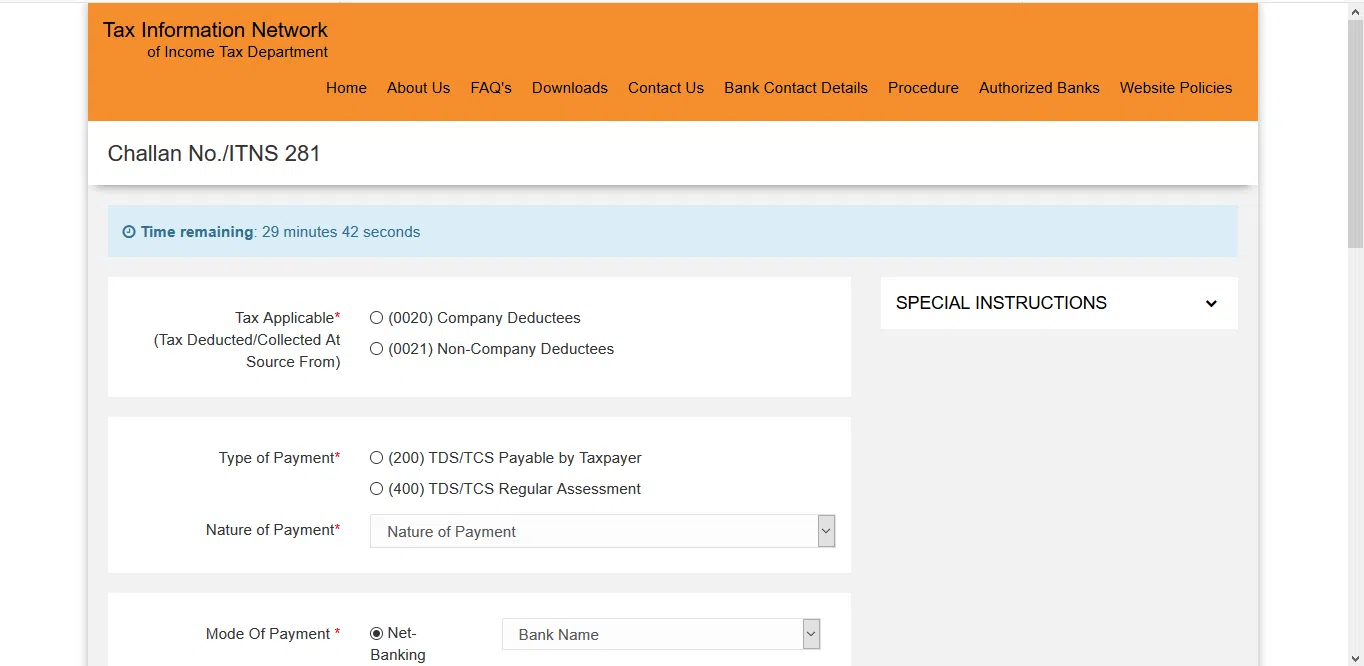

- Step 1– Go to TIN-NSDL website https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp for e- Payment of taxes.

- Step 2– Click on Challan No. 281 under TDS/ TCS section. It will direct you to the e- payment page.

- Step 3– Enter the following details:

- Select the appropriate column for ‘Deductees.’

If you are making payment to a company, select ‘Company Deductees’ under ‘Tax Applicable’. If you are making payment to any person other than the company, select ‘Non-Company Deductees.’

- Type of Payment

Select (200) TDS/ TCS payable by the taxpayer if TDS/ TCS is a regular transaction. Select (400) TDS/ TCS regular assessment if payment is made against demand raised by the income tax department.

- Nature of Payment

Select ‘Nature of Payment’ from the dropdown list.

- Mode of Payment

Select the mode of payment of TDS/ TCS

- Tax Deduction Number (TAN)

Enter TAN and select the assessment year for which payment is made.

- Assessment Year

Enter the assessment year for which the TDS is deducted

- Other Details

Enter the details such as flat number, district, state, Pin code, email-id, and mobile number.

- Enter Captcha. Then, click on the proceed button.

- Step 4– A screen will be displayed on your computer for confirmation to submit. The full name of the assessee will be displayed on the screen if TAN is valid.

- Step 5– On successful confirmation, the site will direct you to your bank’s net banking site.

- Step 6– The login to your bank account using user-id and password and make the payment

- Step 7– After a successful tax payment, a challan counterfoil will appear on your screen containing details such as CIN, bank name. Save this counterfoil on your computer because it acts as proof of the payment made.

Offline Mode

The taxpayer needs to visit the bank personally for making the payment and submitting the Challan. After submitting Challan and making payment, the bank will issue a counterfoil receipt which will act as proof of payment of tax.

How to view the status of Challan 281

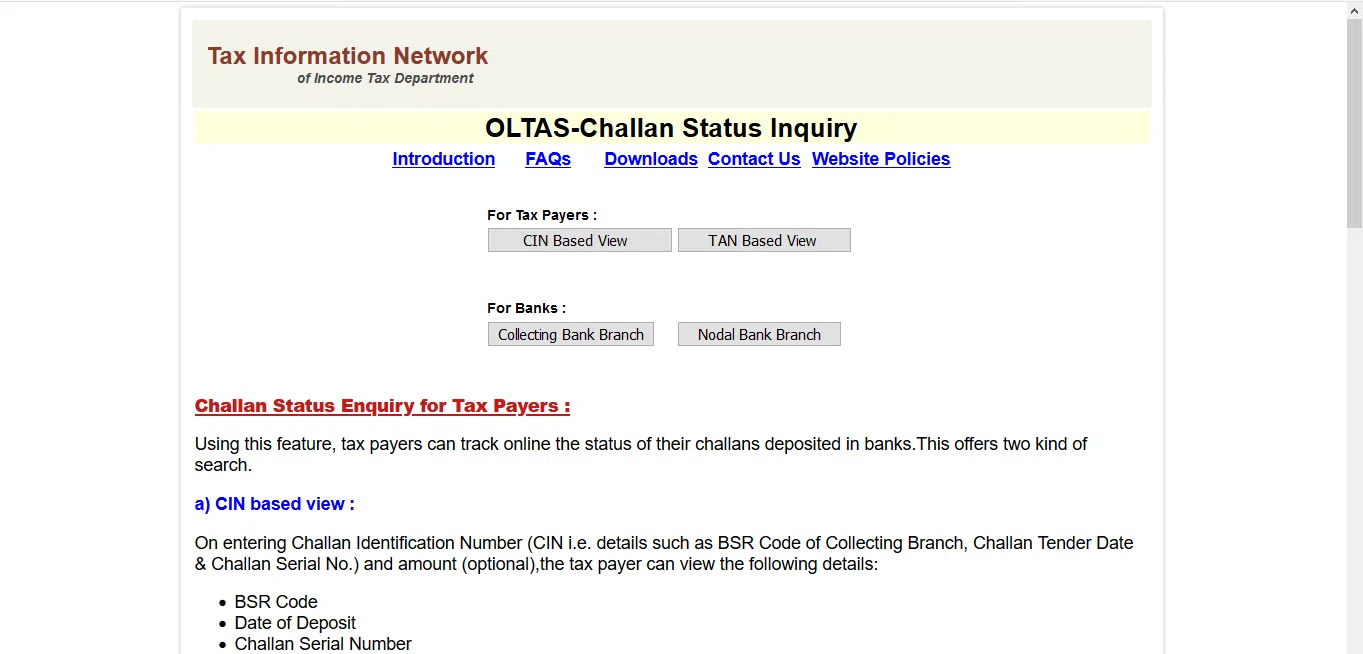

After successful payment of TDS against Challan, a taxpayer can view the status of Challan 281 by following the process explained below: There are two ways to check the status of Challan 281

- CIN based View

- TAN based View

Important Note: Please note that generally, it takes around 3 to 4 working days to update the challan on OLTAS. Hence, an assessee can check the status of the challan after a week from depositing the challan with the bank.

CIN Based View

Challan/counterfoil contains Challan Identification Number (CIN). It is a unique serial number containing the following details:

- 7 digits BSR Code of the branch of Bank where tax is deposited

- Date of deposit of the challan (DD/MM/YY)

- Serial number of Challan (5 digits)

To check that challan status through CIN based view, the assessee needs to follow the below-mentioned steps:

- Step 1– Go to the OLTAS website https://tin.tin.nsdl.com/oltas/index.html. Under ‘For Taxpayers’, click on ‘CIN Based View’.

- Step 2– Enter the 7 digit BSR code of the bank branch where the amount of TDS has been deposited by the taxpayer, Challan tender date (cash/cheque deposit date), Challan Serial Number, and amount (optional)

- Step 3– Enter the security code and then click on ‘view’.

After entering the above details, a taxpayer can view the following details:

- BSR Code

- Date of Deposit

- Challan Serial Number

- TAN/Permanent Account Number

- Name of Taxpayer

- Major Head Code with description

- Date of receipt by TIN

- If the amount is entered, then the confirmation that the entered amount is correct

Also Read: Income Tax Slabs 2021 & Tax Rates For FY 2020-21/ FY 2019-20/ FY 2018-19

TAN based view

TAN stands for Tax Deduction and Collection Number and is issued by the Income Tax Department to the person responsible for deducting tax against the payment made to specified persons. It is a ten-digit alphanumeric number that is compulsory to be mentioned in all TDS returns, payments, related documents, and any other communication with the income tax department as per Section 203A of the Income Tax Act, 1961. Failure to mention TAN would attract a penalty of Rs. 10,000.

To check that challan status through CIN based view, the assessee needs to follow the below-mentioned steps:

Step 1– Go to the OLTAS website https://tin.tin.nsdl.com/oltas/index.html. Under ‘For Taxpayers’, click on ‘TAN Based View’.

Step 2– Enter Tax Deduction Number (TAN), Challan Tender date/ Date of deposit. The taxpayer is required to enter a period for which the challan detail is required (the selected period should be within 24 months).

Step 3– Enter the security code.

Step 4– Click on ‘View Challan Details’ or ‘Download Challan file’.

After clicking the ‘View Challan Details’ button, a taxpayer can view the challan details for the selected period. After clicking the ‘Download Challan file’ button’, a taxpayer can download a text file comprising the following challan details for the selected TAN for the mentioned period:

- Challan Identification Number (CIN)

- Major Head Code

- Minor Head Code

- Nature of Payment

This text file will be used to confirm the challan details mentioned in the Quarterly e-TDS/TCS statement. For confirming the challan details, the taxpayer needs to import the challan file in the File Validation Utility (FVU) file and the text file (Quarterly e-TDS/TCS statement). On successful validation of the Quarterly e-TDS/TCS statement, FVU will provide the details matching with challan details mentioned in the quarterly e-TDS/TCS statement.

Also Read: Section 194I – TDS On Rent

Conclusion

After going through the above article, you can get a clear understanding of how to deposit TDS online through e- Payment Tax and get a detailed understanding of TDS Challan 281. It is an important official document for depositing TDS/ TCS to the Income Tax Department.