It’s more crucial than ever to keep track of your credit report and score. Our credit ratings influence many aspects of our lives, including how much we pay for insurance, whether we can rent or purchase a house or automobile, and much more. Even the smallest error on your credit report might substantially alter your eligibility for anything, so it’s critical to refrain from unwelcome credit ratings. The Credit Information Bureau (India) collects data provided by banks and other financial institutions to publish a credit information report (CIR). It then assigns credit scores to individuals. These scores are in the range of 300 to 900. Since banks and credit institutions assess a person’s capabilities to repay loans, it is imperative that you furnish them with correct details about yourself. Inaccuracies in your credit report will pose difficulties in your securing of loans. Let’s look at the relevance of credit reports and how to get a CIBIL correction to rectify an error on our credit report.

Did you know?

Applying for multiple lines of credit will lower your Cibil scores even though you repay your loans on time.

Information in your Credit Information Report

The Credit Information Report (CIR) contains all critical information that determines your creditworthiness. It contains information on your credit history, which might be useful when applying for or repaying a loan to non-bank financial institutions (NBFCs) or banks.

The Credit Information Bureau (India) Limited (CIBIL) consolidates and integrates an individual’s loans and borrowings. They also integrate the credit history obtained from various credit agencies such as NBFCs and banks and compile all of the information in a single report known as the Credit Information Report.

Buy CIBIL report

You must first purchase a CIBIL report. The majority of individuals get free reports from various internet portals. This is not recommended because some companies may misuse your information, diminishing your CIBIL score. Therefore, it is wise to purchase a CIBIL report straight from CIBIL’s website: https://www.cibil.com/consumer

Also read: What is Emergency Credit Line Guarantee Scheme (ECLGS)

Errors in your credit report and their classifications

There are different forms of credit report flaws. However, the following are some examples of common mistakes in your credit report that you should be aware of:

1. Identity-related errors

- Errors in identity, such as an inaccurate name, contact information, residence, or PAN number

- A dispute can be raised in case of a duplication of your account in the credit report

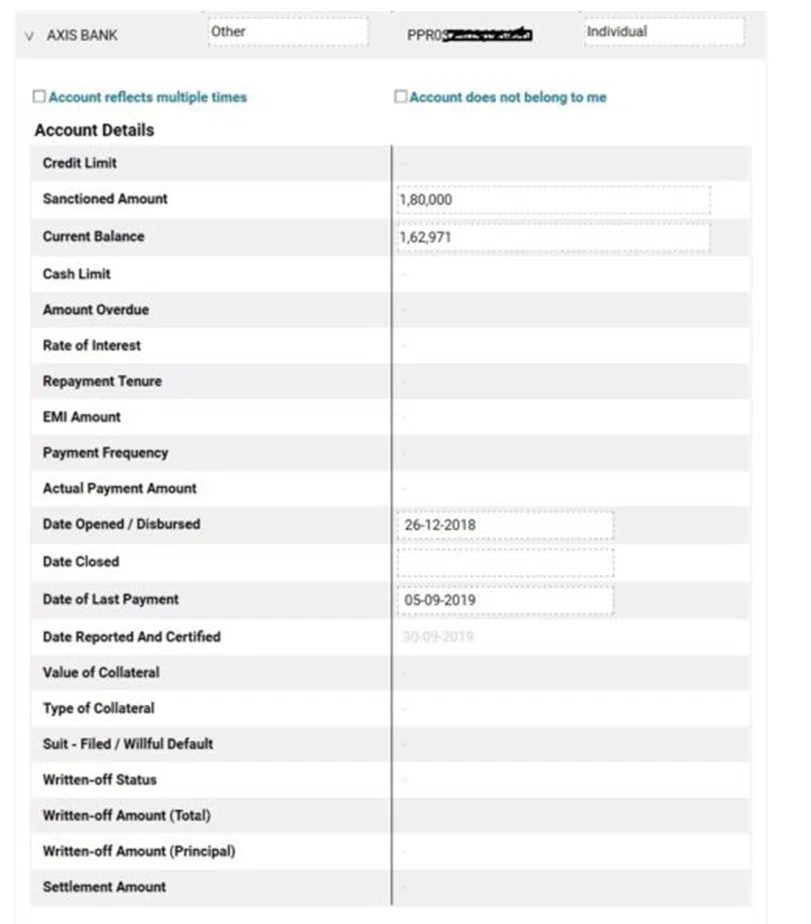

2. Errors in your account

- A new account isn’t showing up in any way.

- An account that has been closed but is still being reported as active.

- Accounts that are incorrectly reported as defaulted.

- The EMI payment date is inaccurate, or the late payment is incorrectly shown.

- An account that is listed with various creditors more than once.

3. Errors in the balance

- Incorrect account balances

- Credit limits that aren’t accurate

Error Assessment in Details

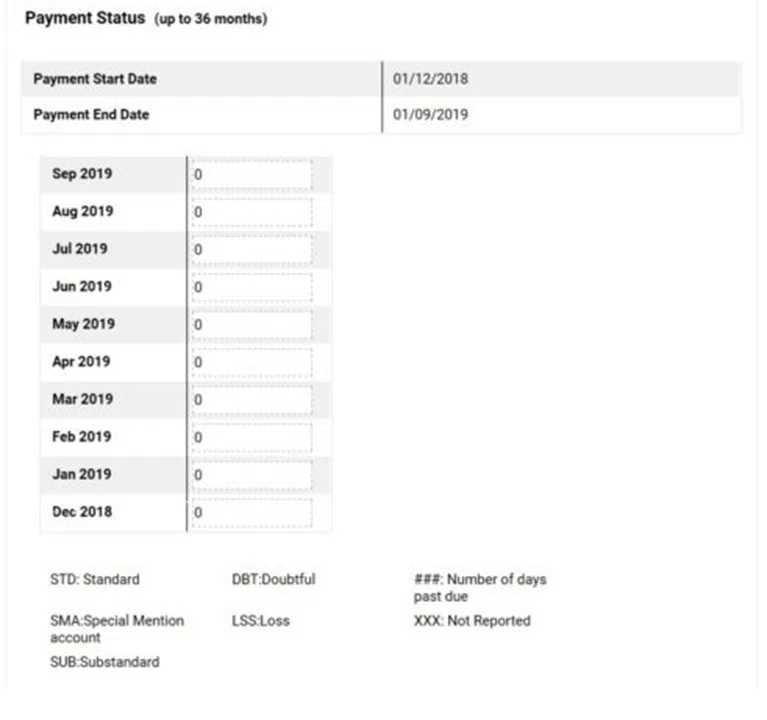

When you get a credit report with credit scores, you will receive a detailed list of all credit-related transactions for the specified period. Any inaccuracies or false entries on a credit report might negatively impact a person’s credit score. As a result, these credit reports must be carefully scrutinized to ensure that the person’s credit score is not harmed.

The probable inaccuracies that can be found on any credit report are listed below.

- Incorrect personal details

The most prevalent error in any CIBILcredit report is the applicant’s personal information. In the CIBILreport, the applicant must check their personal information such as name, residence, age, date of birth, PAN Card information, etc.

- Duplication of the account

Another common blunder is creating a duplicate account in the applicant’s name. Multiple accounts in the applicant’s name may exist, some of which may have a poor credit history. Such accounts may have an impact on the applicants’ CIBIL scores.

- Incorrect overdue amount

The overdue amount is the amount that is outstanding and has to be repaid by the applicant. Lenders or banks report this amount to CIBIL, which uses it to generate a credit report. It’s possible that this sum was misreported and is now included in the CIBIL report. The applicant’s CIBIL report will display a false credit score in such circumstances. To acquire an accurate credit score, the applicant must correct this inaccuracy.

- Improper balance

The applicant’s current outstanding balance and the actual amount due must match the applicant’s true credit position. This is yet another place where an error must be identified and corrected as soon as possible.

- Outstanding loans

An applicant’s outstanding loans are vital in determining their current credit score. If there is an error in reporting the applicant’s outstanding balance or the loan terms, such errors must be disclosed right once to avoid any negative influence on credit scores.

- Non-updating of the current balance

Another key aspect is ensuring that the applicant’s current balance is accurately updated. This means that if the outstanding amount has been paid, the information in the CIBIL report must be changed. There is frequently a lag between when a debt is paid and reflected in a credit report. Such errors must also be identified and corrected.

Also read: What are Sundry Creditors: Meaning & Examples

CIBIL report correction procedure

-

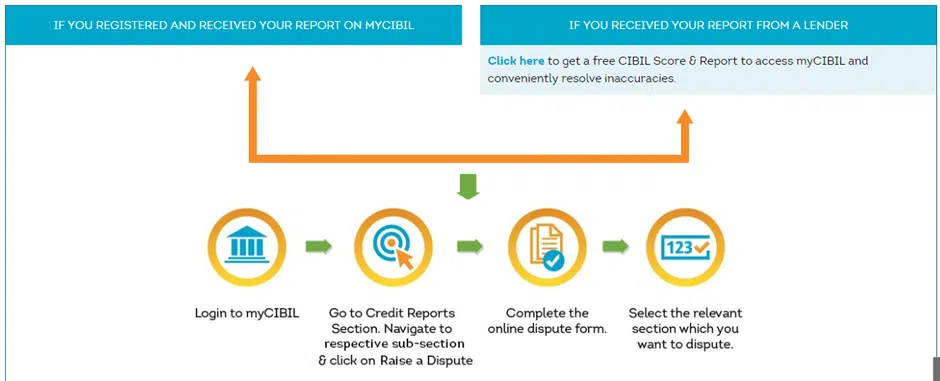

Step 1: Examine your CIBIL report

When you purchase a credit report from the CIBIL website, you receive a subscription that allows you to check your credit report regularly. You must first log in to the CIBIL website, then select “credit report” from the menu bar.

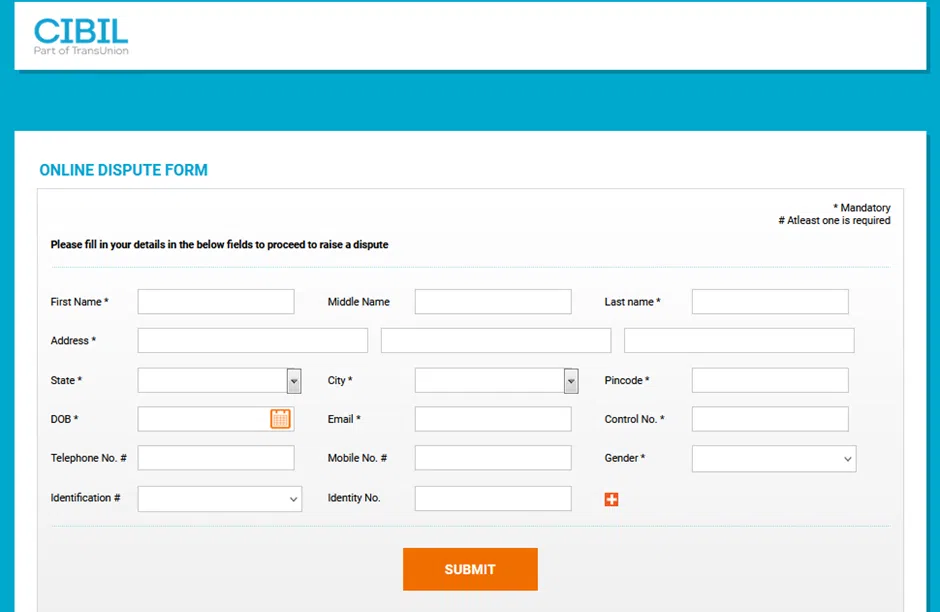

Locate the “dispute centre” after clicking on the credit report. Click on it. After clicking on dispute an item, a page will appear with a few sections, including personal details, contact info, employment, and inquiry information.

Change the section by clicking on it. In this example, we’ve chosen the account section. Here you will get a list of all the accounts specified in the order. Click on the account you wish to correct. Everything appears to be pre-filled in a form.

You can alter any field and then submit a dispute after you’ve changed it.

-

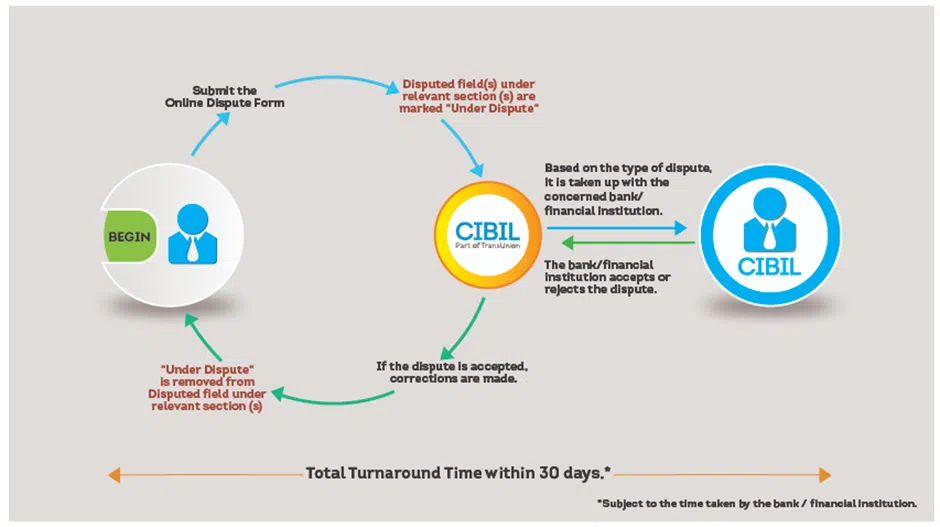

Step 2: Raise a Dispute Resolution with CIBIL

Once you’ve grasped the content of your report, make a note of all the errors and omissions. CIBIL is your initial point of contact after that. You should file a CIBIL Dispute Resolution application.

It’s important to note that CIBIL will never modify your report. They will only do it if the lender permits them because your CIBIL report compiles all the information CIBIL receives from various lenders.

Also read: Where Can Input Tax Credit under GST Not Be Availed?

-

Step 3: Make direct contact with lenders

If the dispute settlement process is successful, the report will be updated. However, some lenders may disagree with you on a point and refuse to make the revisions. CIBIL won’t be able to help you much at this point, so you’ll have to follow up with the lender on your own.

Contact the lender and explain your situation, including the proper dates and the reported inaccuracy. Attach a screenshot of the CIBIL report if feasible. Then wait a few days for an answer, and if you don’t hear back, go to their city branch.

Meet the manager or the person in charge of the CIBIL loans area. If 30 days have passed and you have not received a satisfactory response, you should file an online complaint with the financial ombudsman.

If you have any problems, please contact the CIBIL team. Call their customer service line and explain your problem; this might sometimes result in speedier answers.

-

Step 4: Write to CIBIL

Send an email to CIBILinfo@transunion.com describing the whole error found in your CIBIL report. Provide all your personal information, such as your PAN, Aadhaar card, voter card, Date of Birth (DOB), and mobile number. Supply all documentation, as well as the CIBIL report. You will be given a service request number right away, and you will receive a response to your query within 30 days.

You can also send a letter to the CIBIL office directly at

TransUnion CIBIL Limited

1, Indiabulls Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai – 400013

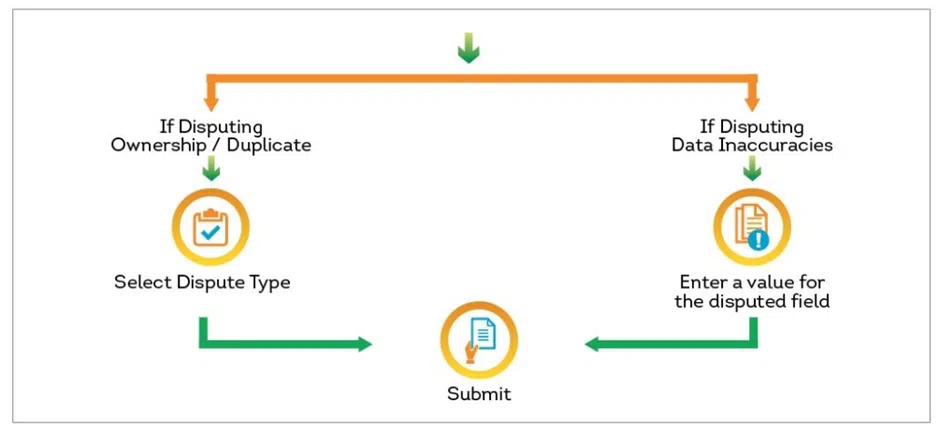

How does CIBIL’s online dispute resolution work?

Your dispute resolution could take anything from a few days to 30-45 days to be resolved. Even if you did not purchase the report yourself and received it from the lender while applying for a loan, you could file a dispute.

In this situation, the lender may refuse to alter some information because they believe they are correct and the investor is incorrect. The investor should proceed to the third step mentioned in the CIBIL report correction procedure if this is the case.

Conclusion

You will agree that a CIBIL report is a decisive metric that represents your creditworthiness and plays a critical role in the application of loans. You must review it consistently to ensure that all the details are accurate and file for CIBIL corrections in the case of any discrepancies. You can download the Legal Tree app and keep yourself apprised with more information on this.