To start with, here are some mind-boggling numbers. As per CII (Confederation of Indian Industries), small scale industries contribute over 30% of the GDP. Small Scale Industries make up around 33.4% of India’s manufacturing output. Figuratively speaking, there is certainly nothing small about this. Now, if you are willing to consider the micro-scale industry along with the small scale, the scales tip a bit further. As per the latest survey, 55% of these units are located in rural India.

Definition of Small Scale Industries

The first thing to do naturally then would be to define what constitutes a small-scale industry. It is important to note what the government defines a small-scale industry as:

Prior to the new classification guidelines released in July 2020, the Government of India used to classify small scale industries in manufacturing and small scale industries involved in services separately. This has changed after an official notification by the government in July 2020.

As per the new notification, small scale industries involved in either manufacturing or services will be classified as small scale industries, if the capital investment in manufacturing plants or machinery does not exceed 10 crores and annual revenue does not exceed 50 crores.

Small Scale Industry as one of the pillars of employment

Some small scale businesses can be labour intensive, and in some other cases, they employ a small workforce. Nonetheless, small scale industries in India employ a sizable population across the country. According to a recent survey the small scale industry employs close to 2.5 crore people.

In the small-scale industry, you will notice that a good number of them are set up in the unorganised sector. Although there are provisions for registering a small scale industry, it is entirely voluntary. If the enterprise is in the manufacturing business with a certain number of employees, it then becomes mandatory for the proprietor to register the business under the Factories Act.

Types of Small Scale Industries

SSI are categorised into 3 types, based on the nature of work carried out.

- Manufacturing/Assembly/Processing industries

These types of industries are into manufacturing finished goods for consumption or used further in processing. Some examples of such small scale industries are power looms, food processing units, engineering units.

- Ancillary Industries

Ancillary industries are feeder industries that manufacture components for other manufacturers. These manufacturers then assemble or incorporate the final product. A good example is of a small unit that manufactures nuts and bolts of various sizes. You could also consider industries that manufacture electronic components or even engines.

- Service Industries

Service-based industries are not involved in any kind of manufacturing. They are mostly to do with repair, maintenance and upkeep of the products after-sales.

A few more, less frequently used categories also deserve mention.

- Export units

A small-scale industry is considered as an export unit if it is exporting more than 50% of its production.

- Cottage units

These small units do not involve a dedicated facility and are carried out within houses or living spaces of the owners or contributors.

- Village industries

Many industries in rural areas that are not part of the organised sector can be considered under village industries. Typically, these industries depend solely on human labour for production.

Also Read: Top 10 Cities for doing business in India

Registration of Small Scale Industries

Registration of small scale industries is voluntary. There are benefits offered by the government in the form of schemes, incentives and subsidies that you can enjoy if your business is registered as a small scale industry. We shall talk about those benefits and government schemes a little later.

For your business to be registered as a small scale industry, you will have to approach the Ministry of Micro, Small and Medium Enterprises (MSMEs).

We shall go through the process of online registration in the following sections. There are several online facilitators who offer their services to help with the registration process of any industry.

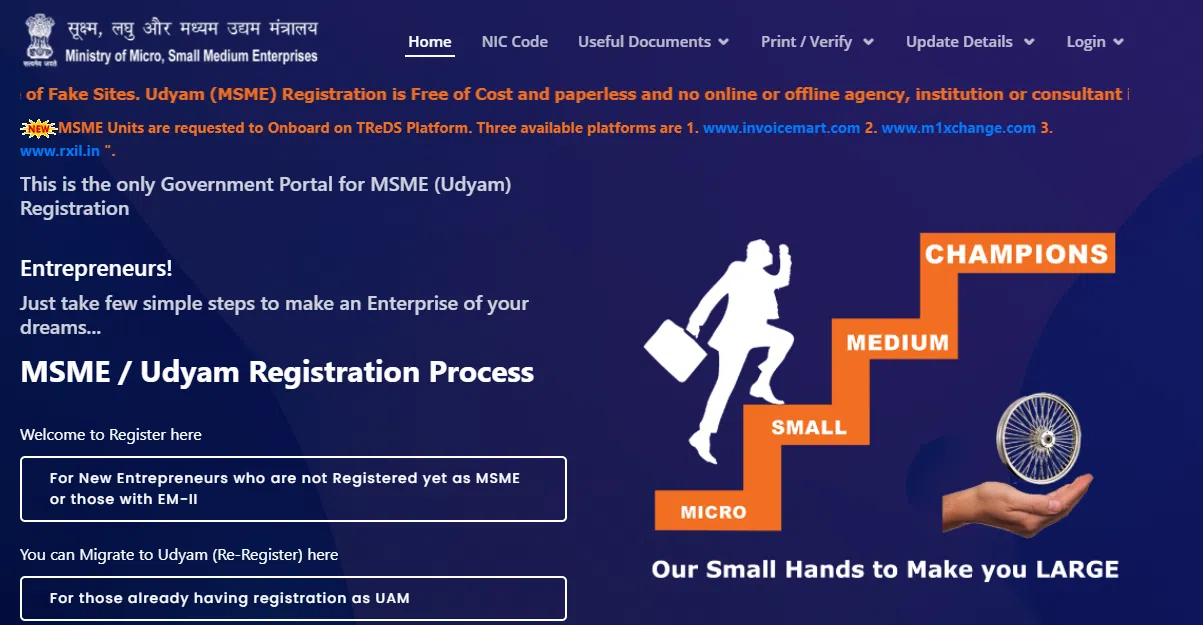

The only government portal for online registration is available at the following website- https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

As per the government notification on the website, no other private entity is authorized to do registration or even undertake any activity related to the process of registration. Please read the notification diligently before approaching these online facilitators.

For a detailed classification of MSMEs, a thorough document is provided by the ministry at https://udyamregistration.gov.in/docs/Udyam%20Registration%20Booklet.pdf

You may register your small scale business using the Udyam registration portal based only on a self-declaration without any requirement to post documents or proofs. Also, there is no fee charged on registration through the Udyam portal.

Steps to register a small scale industry using the Udyam portal

- Visit- https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

- Click on the button which reads,

- For New Entrepreneurs who are not Registered yet as MSME or those with EM-II

As highlighted in the image below:

- On the next page, enter your Aadhaar details i.e.your Aadhar number and your name as per your Aadhar. Remember that the Aadhar number and name that you enter should be of the person holding the proprietorship of the business unit, or managing partner or of a Karta in case it is a Hindu Undivided Family.

- Click on Validate & Generate OTP.

- After validation, PAN & GST linked details on investment will automatically be taken from the government databases.

- A permanent registration number will be issued to you.

- After the process is completed successfully, a certificate of registration is issued online.

The registration certificate thus issued does not expire. Remember the process is completely free and paperless. Also, District Industries Centre and Champions Control Rooms officials may get in touch with you as part of the registration process.

Here are a few important guidelines for those businesses which were already registered.

- All existing EM-II or UAM registered businesses will need to register again via the Udyam portal on or after July 2020.

- Any businesses registered prior to 30 Jun 2020 and not renewed registration under Udyam will stay valid only up to 31st of March 2021.

- Any business registered under the Ministry of MSME will need to register under Udyam registration.

Also Read: How to Apply for the Best Business Loan in India? – Types of Govt. Loan Schemes

Benefits of SSI registration

With your small scale industry being registered you are now eligible to take advantage of various schemes, tax rebates and relaxations.

Banking and Financial institutions can offer you loans under designated loan schemes for small businesses. You also stand eligible to participate in various tenders raised by the government.

Some of these benefits are:

- Registered small scale industries stand to benefit from collateral-free automatic loans for purchase or raw materials, fulfilling operational liabilities or restarting the business.

- With a focus on the Atma Nirbhar program, a central government initiative to improve made in India products, global tenders are disallowed to create opportunities for local businesses.

- There are several schemes that the government runs in support of small scale industries. These schemes are listed below, along with a brief description.

Prime Minister Employment Generation Programme and other credit support schemes

- The PMEGP sche me (Prime Minister‟s Employment Generation Programme) is aimed at generating employment opportunities through small scale industries. Various credit support schemes like CGTMSE and CLCSS are being run to help small scale industries with funding troubles.

- CGTMSE or Credit Guarantee Fund Trust for Micro and Small Enterprises is set up to catalyze institutional credit to small scale industries. To know more, visit https://www.cgtmse.in/

- CLCSS or Credit Linked Capital Subsidy Scheme is an extension of credit for the upgradation of technology in small scale industries, providing an upfront capital subsidy of 15% for institutional finance up to Rs. 1 cr. To know more, visit https:/ /clcss.dcmsme.gov.in/

- Development of Khadi, Village and Coir industries

There are various schemes that are listed under this programme, including,

- MPDA (Market Promotion & Development Scheme)

Under this scheme, the government takes on the major burden of setting up marketing complexes/khadi plazas to help expand the marketing network of Khadi & Gram Udyog products. To know more, visit- https://msme.gov.in/sites/default/files/Khadi_MPDA_Guidelines.pdf

- SFURTI (Revamped Scheme of Fund for Regeneration of Traditional Industries)

A scheme that is intended to sustain the employment of workers and artisans in the traditional industry in rural enterprises. To know more, visit- https://sfurti.msme.gov.in/SFURTI/Home.aspx

- Technology upgradation and quality certification

Some of the schemes running under this programme are:

- Financial aid to small scale industries in getting ZED certification.

This scheme aims to promote the Make In India initiative while achieving zero defects following Zero Defect & Zero Effect principles and practices.

- ASPIRE (A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship)

This scheme is aimed at creating more jobs, reducing unemployment while also promoting entrepreneurship culture.

- NMCP (National Manufacturing Competitiveness Programme)

This scheme supports:

- Credit linked subsidy on capital investment for a tech upgrade

- Support on the marketing front

- Promote lean manufacturing practices

- Assistance on design for small scale industries

- Support for upgradation of quality

- Incubation programs for entrepreneurial and managerial development

Marketing promotion schemes for SSI

Some of the schemes listed under this programme are:

- International Cooperation

This scheme arranges for delegations to other countries for exploring technology upgradation, facilitating buyer-seller meets in foreign states.

- Marketing Assistance scheme

This scheme allows for arranging overseas exhibitions, campaigns and other promotional activities.

- P&MS (Procurement and Marketing Support Scheme)

This scheme is aimed at improving the domestic markets and promoting new market access.

- Entrepreneurship and skill development programme

Among the various schemes included under this programme are

- ESDP (Entrepreneurship Skill Development Programme)

This scheme aims to develop entrepreneurial skills in youth who are keen on setting up small scale industries

- ATI (Assistance to Training Institutions)

This scheme facilitates capital grants to training institutions at the national level that operate skill development and training workshops for sustained skill development.

- Infrastructure Development Programme

One of the schemes under this programme is MSE-CDP (Micro & Small Enterprises Cluster Development). This scheme offers financial aid for the development of common facility centres that can be used for research and development or testing, helping shore up infrastructure available for small scale industries.

For a full listing of schemes offered by the government for small and medium scale industries, you may visit- Infrastructure Development Programme

Administrative bodies for small scale enterprises

There are several administrative bodies that get established over a period of time to help sustain and encourage small and medium scale industries. All of these operated under the Ministry of Small and Medium Scale Enterprises. Some of these government administrative bodies are listed here.

- Office of Development Commissioner (MSME)

- Khadi Village Industries Commission (KVIC)

- Coir Board

- National Small Industries Corporation Limited (NSIC)

- National Institute for Micro, Small and Medium Enterprises (NIMSME)

Conclusion

With initiatives like Make In India, the ease of doing business has improved for good. The best part is, you do not have to pay a penny to register your business online. Moreover, it is a paperless process now. In India, there are a wide variety of small scale industries. We hope through this article, we have been able to convey the list of small scale industries and the methods of registration. The various schemes available for industries have also been highlighted in this article. Wishing you all the success!

Tips

- For registering a small or medium-scale enterprise, you do not need to pay any money.

- Registration of your small or medium scale industry is now online and completely paperless.

- There are a number of schemes for small and medium scale industries to take advantage of for either capital infusion or technology upgrade to even marketing support.

- Remember, registration of a small scale industry is voluntary, but if your business employs the prescribed minimum number of people in a manufacturing setup, you are liable to register your enterprise under the Factories Act.

- Note that the classification of small and medium scale industries has changed starting July 2020

- If you are under the GST ambit, keeping your GST slate clean will help you with securing assistance from any of the several government schemes for MSMEs.

- Take advantage of the government training programs targeted at youth who are willing to startup in the small and medium scale industries.