The receipt and payment account summarises cash transactions for a period. Non-profit organisations prepare payment and receipt accounts at the end of each year. It begins with the cash and bank opening balances and ends with the bank closing balances. This account is called a “Real account“. It provides the foundation for preparing the balance sheet and income and expenditure account. This account is prepared using a cash basis, and it records cash inflow and cash outflow. This account does not record accrued or outstanding transactions. Let’s learn more.

Did you know?

Receipt and payment accounts are vital to fulfiling various governmental oversight norms. Besides that, they highlight the financial strength of the NPO and indicate whether it’s increasing or decreasing. Some famous NPOs in India include CRY and HelpAge India, and the Red Cross Society and The Salvation Army are the most popular international NPOs. The following section explains the overview of receipt and payment account format.

What is the Meaning of Receipt and Payment Account?

The receipt and payment account serves as a summary of an organization’s cash payments and receipts throughout the course of an accounting period. It gives an overview of a non-profit organization’s monetary position. It does not distinguish between capital and revenue receipts and payments, and records all cash and bank transactions, including capital and revenue. Non-cash transactions, such as depreciation, are not included in the receipt and payment account. At the end of each accounting period, the receipt and payment account is created.

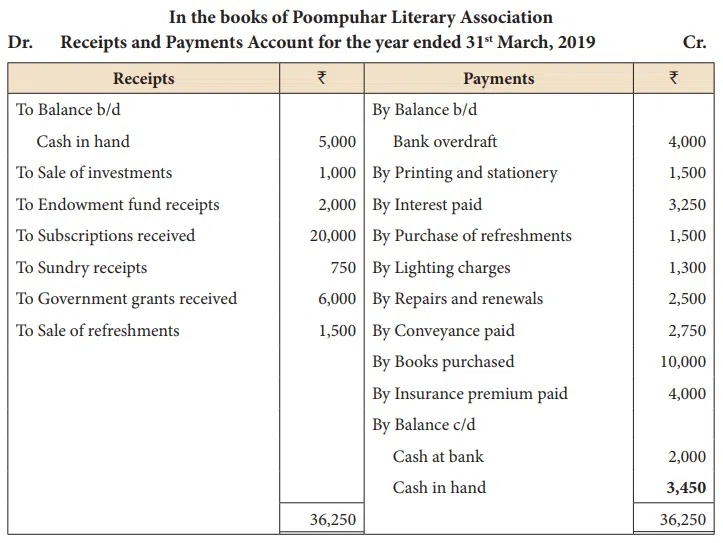

A Quick Overview of Receipt and Payment Account Format

All receipts can be grouped under entrance fees, donations, interest, lifetime subscriptions, etc. All payments are made on the credit side, under headings like printing, stationery, salaries, wages, office expenses, rent, taxes, etc. The cash balance at the beginning of the period is what opens the receipts and payments account, and the cash balance near the period is the closing point.

The receipts and payments account summarises cash transactions. It does not include any outstanding expenditure or income, and it does not show actual income or expenditure for the period it covers. You have understood the overview of receipt and payment account format, but what about the benefits? Check the full benefits of receipts and payment accounts.

Also Read: Know About Receipts and Payments Report in Tally

Benefits of Receipts and Payment Account

After knowing about what is receipt and payment account, let’s examine the benefits of a receipts-and-payments account:

- Verifying cash books, receipts and payments accounts is useful.

- A receipts and payments account displays payments and total receipts for different headings at a full glance.

- It makes it easy to prepare an income or expenditure account.

- This account contains classified records for different types of receipts or payments.

The following section explains the preparation and filing of accounts.

Preparation and Filing of Accounts

To prepare a receipts-and-payments account, you need to extract receipts from the cash book throughout the year. You’ll see each item in a cash book in separate and chronological order, and the items in a cash book are classified under different headings.

These steps will help you prepare a receipt payment account.

- On the left-hand side, write the bank balances and open cash.

- Use the format in the specimen to write the account’s title.

- Add all receipts that have different dates below the same head.

- On the left-hand page, write the sums for each receipt and the total of all payments.

- Add all payments made under the same heading on different dates. Use a separate sheet for that.

- Minus all expenses and calculate the closing balance.

The Main Features of Receipts and Payment Accounts

A receipt payment account has many important features.

- All receipts in a receipts or payments account are recorded on one side (the debit side) and all payments on the other side (the credit side).

- A receipt payment account is a summary of a cashbook. It begins with the bank balance and opening cash, sometimes merged. The closing balances are then added.

- This account includes a record of all receipts and payments, both for capital and revenue. It also contains all cash and bank receipts for the current year. These can be related to past, present and future accounting periods.

- The double-entry system does not include receipts or payments accounts. These accounts only contain records of transactions involving cash and banks. Excluded are all non-cash items.

- These accounts only show cash positions and not surpluses or deficiencies for the period. These accounts usually show a debit balance. In case of a bank default, the bank balance will reflect the credit.

- Last but not least, receipts and payments accounts are always ready at the end of the accounting period. Although it is uncommon, a receipts or payments account could also have a nil balance.

This book will teach you the basics of double-entry accounting, and it is a very important first step for any accountant. All other complicated accounting procedures are based upon this simple concept, and it will make everything else easy once you understand it.

Added Benefits of a Receipt and Payment Account

Some of the added benefits of a Receipt and Payment accounts are as follows:

Accrual Basis Accounting

Accrual accounting records all economic transactions, regardless of whether they involve cash, in the books of accounts. This accounting method is used to give more detailed information about business transactions and allows companies to make better financial decisions.

Cash Basis Accounting

Cash basis accounting records only cash-related receipts and payments in books of accounts. Although this method is less popular than accrual-based accounting, many businesses still use it because of its simplicity. This system makes transactions easier to track and manage.

Now that you know everything about receipt payment accounts, you should learn accounting basics.

Some Tips to Help You Study Receipt and Payment Account Format

Read on to know some valuable tips to help you study about the format of receipt and payment account.

1. Look at Trends

Are there any signs that money is being withdrawn and no new funds entering the account? This could indicate financial trouble in the future. If you observe that your monthly transactions increase in volume, this could show that your business activity is growing. These trends can inform your financial decisions. Also, we’d recommend you not make big decisions in haste by analysing a short term trend and avoid ignoring other vital considerations.

2. Find Out What You’re Looking For

Before you begin searching for information in your payment and receipt account, it is important to understand what information it contains. Do you have interest in transactions from the last week or last month? Are you looking for all transactions or only those over ₹1,000?

3. Keep Track of Regular Payments

Regular payments will be made from the receipt & payment account for loan repayments or rent. You need to keep track to ensure they receive the payment on time.

4. Verify that All Receipts Match the Payments

You should ensure that there are no large discrepancies in receipts or payments. This could indicate fraud or theft. You should immediately contact someone in finance if this happens.

5. Check for Any One-Off Transactions

You may need to keep track of unusual transactions, such as major investments or purchases. You must record these transactions to manage them in the future easily.

Also Read: Know the Benefits of Cash Receipts With Examples

6. Keep Current Records

Many people don’t know about their payment and receipt accounts, and this is because they were neglected by generations that didn’t care about accounting. Keep accurate records of your account to ensure you are always in the loop.

7. Read the Review Notes Frequently

Repetition is the best way to learn. Make sure you review your notes about the receipt and payment accounts frequently. This will make it simpler to remember the information and more useful.

8. Compare Actual Numbers with Budget

After you have collected all relevant data from your payment account and receipt, compare that against your budgeted numbers. This will indicate whether you are on the right track to reaching your financial goals. If you are not on track, adjustments might be necessary. You may even have to compromise on expenses, especially if you’re planning to avail of any loan soon.

Conclusion

That was it for receipts and payment accounts and their advantages. This account records the amounts received and paid for each accounting year, and it also indicates the entity’s cash position. We hope you are now clear of all doubts. In addition, we have got a robust solution to decreasing your daunting calculations of debit and credits.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.