As a business owner, you know that first impressions are essential. When sending a quotation to a potential customer, you want to ensure that it is clear, concise, and easy to understand. At the same time, you also want to ensure that you include all the necessary information, so there are no surprises later. Formatting a quotation in Excel for GST can seem daunting, but it does not have to be. By following the simple steps outlined in this article, you can create a quotation that is both accurate and visually appealing.

Did You Know? Quotation Format helps to save all the details we need to make it alright, regarding discounts and taxes

What is the Quotation in Business?

A quotation in business is the process of submitting a price for a product or service. The quotation can be for a single item, fixed price, or variable price. A quotation can be for a product or a service. The quotation can be for a physical product or a digital product. The quotation can be for a single item or a group of items. The quotation can be for a fixed price or a variable price. A well-prepared quote can help convert a potential client into an actual customer.

Also Read: How to Start Freelancing in 2023 – Complete Guide to Start a Successful Freelance Business

Key Takeaways

1. Quotation format in Excel GST helps to create a GST-compliant quotation quickly and easily.

2. It is important to ensure that all the information required by the GST is included in the quotation.

3. The GST number, name and address of the supplier and the GST rate should be clearly stated in the quotation.

4. The quotation should be signed and dated by the supplier.

Different Types of Quotation Formats

There are four types of quotation formats: the block format, the indented format, the short format, and the long format.

1. Block Format

The block format is the most familiar format for quoting. In this format, all the quotation’s lines are indented one inch from the left margin, and there is no extra space between the lines. The quotation’s lines are double-spaced, just like the rest of the paper.

2. Indented Format

In the indented format, the quotation’s lines are indented one inch from the left margin, but there is an extra space between each line. The quotation’s lines are double-spaced, just like the rest of the paper.

3. Short Format

The short format is like the block format, but the quotation’s lines are indented one-half inch from the left margin. The quotation’s lines are double-spaced, just like the rest of the paper.

4. Long Format

The long format is like the block format, but the quotation’s lines are indented one and a half inches from the left margin. The quotation’s lines are double-spaced, just like the rest of the paper.

Also Read: 10 Best Business Ideas to Start Under ₹5 Lakhs Investment

Choosing Right Quotation Format For Business

Your chosen format should be based on your company’s needs and preferences. Some factors you may want to consider include the following:

- The type of products or services you offer

- The size and scope of your business

- The geographical area you serve

- Your company’s branding and marketing objectives

When choosing a quotation format for your business, consider your industry, company size, and customer base. A simple format may be all you need if you are a small business. If you are in a more complex industry, you may need a more detailed format. Consider your customer base as well. When dealing with large businesses, they may prefer a more formal format. A simpler format may be fine if you are dealing with smaller businesses or individuals.

Step By Step To Format A Quotation

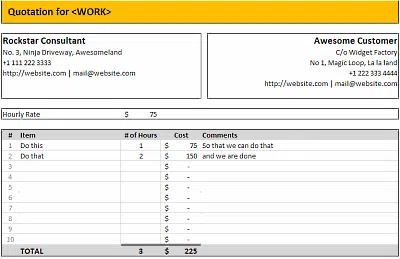

To format a quotation in Excel GST, you will need to:

1. Open Excel and create a new workbook.

2. Enter your data into the workbook.

3. Select the data that you want to format as a quotation.

4. On the Home tab, in the Styles group, click the arrow next to Conditional Formatting and then click New Rule.

5. Under Select a Rule Type, click Format only cells that contain.

6. Under Format only cells with, select Cell Value in the first list and equal to in the second list.

7. In the third list, type the value you want to format as a quotation.

8. Click Format.

9. On the Font tab, select the options that you want.

10. On the Number tab, select the options that you want.

11. On the Border tab, select the options that you want.

12. On the Patterns tab, select the options that you want.

13. Click OK.

14. Click OK again.

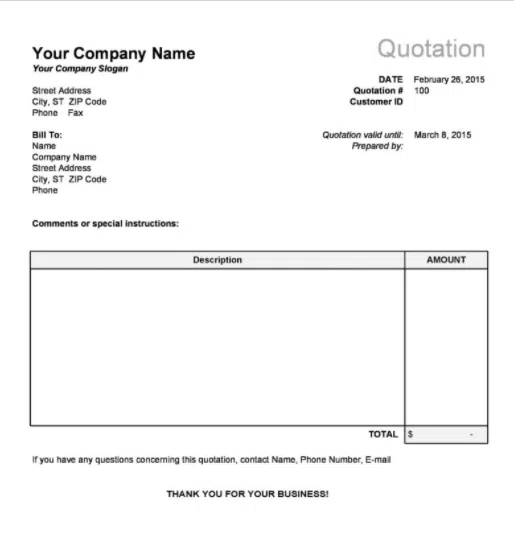

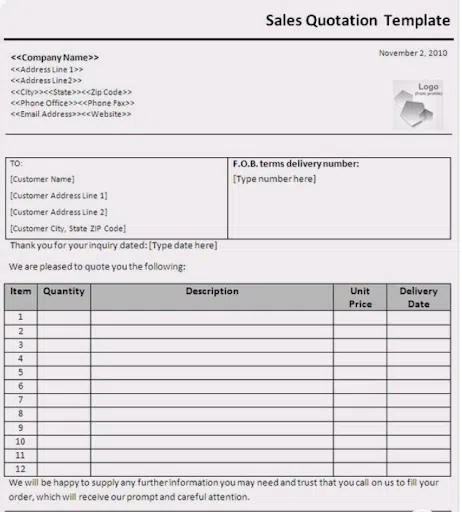

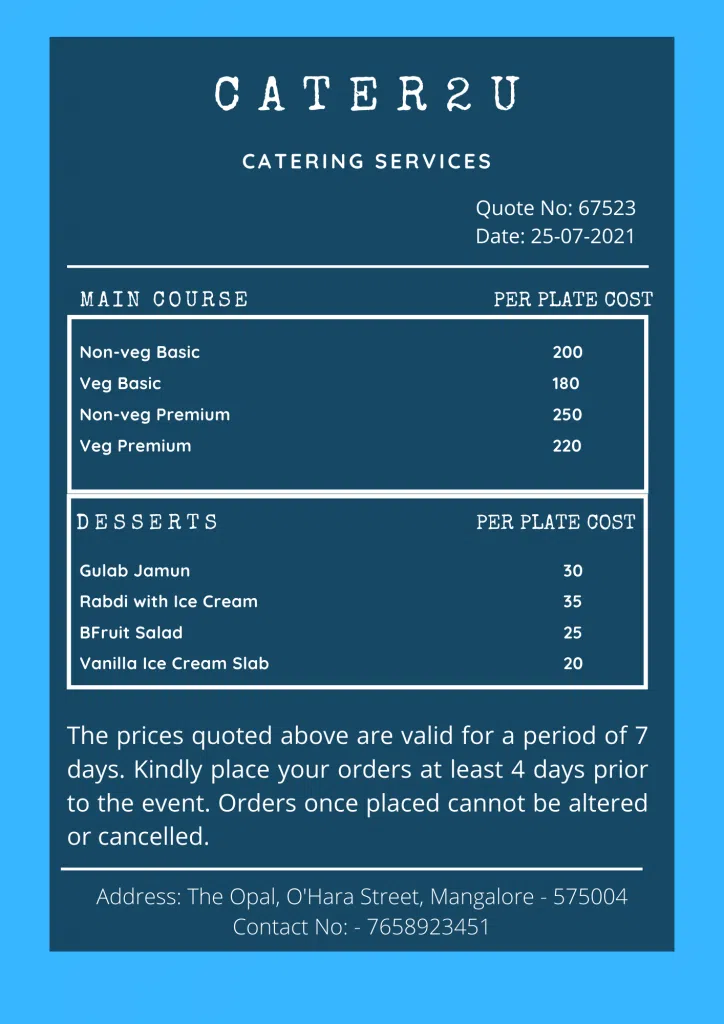

There are many small businesses that provide services in which there are no upfront prices available. It is because prices may vary depending on the materials used and the manpower required.The below template for sales quotation is used to provide clear and professional sales quotes to your clients or customers.

Also Read: Business Ideas Under ₹50,000 – Which Businesses Can You Start Under ₹50,000

Recommendations For Information on the Form

- Company name and logo

- Contact name and details

- A brief description of the goods or services being offered

- The price of the goods or services

- Any discounts or exclusive offers

- The terms and conditions of the sale

- The date the quotation is valid until

How To Make Sure Your Quotation Is Accurate?

You can do a few things to ensure your Quotation Format in Excel GST is accurate. First, ensure that the data you input into the template is correct. This includes the prices of the products and services you are quoting and the GST rate. Second, check the accuracy of the GST rate before you submit your quotation. You can find the GST rate by going to the GST portal and searching for the “GST rates” page. Finally, check the accuracy of the total price of the quotation. This includes the GST rate and the total price of the products and services you are quoting.

If you are unsure about the accuracy of your Quotation Format in Excel GST, you can always ask for help from a professional accountant or bookkeeper. They will be able to check your work and ensure everything is in order. You can also find many helpful resources online to help you with your GST return.

Also Read: What is a Business? – Business Meaning, Characteristics, Types & More!

Benefit To Use Excel For Quotations

When it comes to creating quotations, Excel is a powerful tool that offers several advantages. First, Excel allows you to create a professional-looking quotation quickly and easily. You can add your company logo, contact information, and other vital details with a few clicks. Additionally, Excel provides a wide range of built-in formulas and functions that can save you time and effort when calculating prices and discounts. Finally, Excel makes it easy to share your quotation with others via email or print.

Quotation Format in Excel Template

Example

|

“Quotation” To, [Name of the Company] Address Date: [date on which the quotation is made] Subject: Quotation for [subject of the quotation] Dear [Name of the person to whom the quotation is addressed], We are pleased to submit the following quotation for your approval. [Details of the quotation] Thank you for your time. Sincerely, [Your name] |

Example 2

Conclusion

The quotation document might include added information like taxes, cost of raw material and labour with some factors contributing to final pricing. It also comprises duration where service would be completed or goods delivered or duration for which it is valid.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.