When goods bought with credit have to be returned to the seller, and the supplier, the details for such transactions are noted in the purchase return book or the purchase return daybook. The goods purchased can be returned to the purchaser because of defects or poor quality. A separate book is kept for these returns as the returns aren’t included in the purchase amount in the purchase book.

This book is called a purchase return journal, and when any sold item is returned, an entry is made in this journal, which is called a purchase return journal entry.

Did you know?

Accountants have controlled the ballot for the Academy Awards every year since 1935. A team of 9 CPAs spend up to 1,700 hours before Oscar night, the votes cast in each category by hand.

What is the Purchase Return Journal Entry?

Many businesses struggle with this very common entry. This journal entry aims to record purchases and returns for sales. But what is it exactly, and how do you create it?

Here are some examples of purchase return journal entries. The first example shows the reduction in net sales of a business from a purchase. Let’s assume you purchased goods worth ₹1,50,000 on the 1st of September, paid cash and returned them on the thirteenth. To record the purchase and return of goods, you need to record these two transactions. The purchase return is negative because the original purchase was made in cash. It means that the seller can expect immediate payment.

The seller must write this amount on the income statement and journal entry. Alternatively, he can offer a discount if the buyer pays in cash. In either case, you must note the discount on the income statement. If the buyer doesn’t pay in cash, he may return the goods. The debit to the account marked as receivable indicates a decrease in the amount of money in the company’s cash. A purchase return is another important journal entry that is often overlooked—this type of journal entry records when a purchaser returns a product.

In many cases, the purchase return is made on account of a defect, poor quality, or incorrect specification. Either way, the company must account for the returned goods. The customer may receive compensation for returning goods. It will also be recorded in the same accounts as the original purchase.

Also Read: How to Enter Sales Return Entry in Tally ERP 9?

How to Make Journal Entries of Purchase Return?

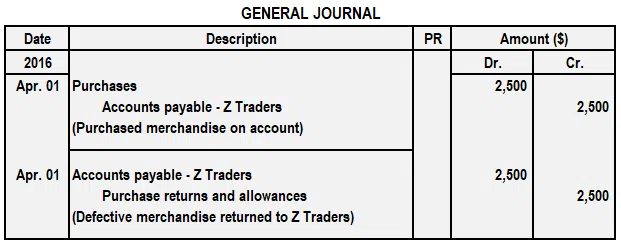

In the system of periodicity under the periodic system, the business must complete an entry in the journal of purchase entries. It’s possible to do so by debiting cash or accounts payable accounts and crediting purchase returns and allowances accounts.

|

Account |

Debit |

Credit |

|

Cash and accounts payable |

000 |

|

|

Returns on purchases and allowances |

000 |

The allowances and purchase returns are a loan account that normally has its balance in the direction of credit. The purchase account will offset the balances in this account, and it will then be eliminated when the company closes the accounts at the close of the period.

Similar to this entry in the journal, there’s no inventory account to account for. The company doesn’t keep track of inventory when it enters journal entries because of the periodic system.

Perpetual Inventory System

Under the perpetual system, companies can enter purchases and return journal entries by debiting accounts payable or cash accounts and crediting accounts for inventory.

|

Account |

Debit |

Credit |

|

Cash and accounts payable |

000 |

|

|

Inventory |

000 |

The journal entries in this entry show that the business directly reverses inventory to the value of the returned apparel. The company doesn’t need to establish an account for allowances and purchase returns to record transactions like those used in the inventory cycle system. This is because, under the perpetual system, when the business purchases items, it doesn’t keep track of the account for the purchase (nor does it have a purchase account). However, it can directly debit an inventory account. Therefore, when the items are returned, inventory needs to be reduced.

Purchase Return Journal Entry Example

Considering that the company ABC. is involved in the below-mentioned following transaction for the year 2021.

We’ve included companies 1, 2, 3 and 4 in the example.

- Oct 03: Company ABC bought apparel on account from company 1 with invoice number 303 for ₹951

- Oct 13: Company ABC bought apparel on account from company 2 with invoice number 313 for ₹2700

- Oct 15: Company ABC returned apparels to corporation 1 worth ₹300, Debit memo No. 853.

- Oct 17: Company ABC bought apparel on account from company 3 with invoice number 320 for ₹400.

- Oct 20: Company ABC bought apparel on account from company 1 with invoice number 343 for ₹550.

- Oct 15: Company ABC returned apparels to corporation 3 worth ₹245, Debit memo No. 854.

This data transaction information mentioned above is recorded both on the purchases journals and allowances journal. Update all these entries on the general and subsidiary ledger of account payable.

Purchase returns and purchase journal and allowances journal:

|

Purchase Journal |

||||

|

Date 2021 |

Account Debited |

Invoice Number |

PR |

Amount (₹) |

|

3 Oct |

Company 1 |

303 |

73 |

₹ 951 |

|

13 Oct |

Company 2 |

313 |

76 |

₹ 2700 |

|

17 Oct |

Company 3 |

320 |

77 |

₹ 400 |

|

20 Oct |

Company 1 |

343 |

73 |

₹ 550 |

30 Oct Total Amount transferred to purchase account ₹ 4601

|

Purchase Journal |

||||

|

Date |

Account Debited |

Debit Memo Number |

PR |

Amount (₹) |

|

17 Oct |

Company 1 |

853 |

73 |

₹ 300 |

|

22 Oct |

Company 3 |

854 |

77 |

₹ 245 |

30 Oct Total transferred to purchase returns and allowances account ₹ 145

Advantages of Purchase Return Journal Entry

Using the purchase return journal entry is advantageous for many reasons.

- The process helps record the sale made by the customer. For example, when a T-shirt printing company buys bulk shirts on credit, they do not pay for them in full up-front. Instead, they will pay in instalments.

- In some cases, the customer may return the items debited from accounts payable and credited to purchase returns.

- Another advantage of the purchase return journal entry is that it reduces the inventory balance.

- It can also help determine the actual inventory balance.

- Accounting mistakes can lead to the wrong impression of a company. The recording process can be very time-consuming, especially if many returns are made. However, this task is worth it if you’re looking to improve your brand loyalty and increase revenue.

- The customer’s name and address are recorded using the purchase return journal entry. The vendor can use this information to revise their revenue.

- The buyer can also use this information to determine whether the goods returned were cash sales or not.

- Another advantage of purchasing goods in bulk is that the seller gets paid in cash upfront. This is beneficial to both the buyer and the seller because he can expect to receive immediate payment. He must then debit his account payable, credit his accounts receivable and record the discount.

- The discount can be calculated, and the buyer’s income statement will reflect the discount.

Also Read: What does Books of Original Entry mean?

Disadvantages of Purchase Return Journal Entry

Here are some of the disadvantages of this method.

- Unlike sales transactions, a purchase return requires reverse accounting. Credits increase some accounts; debits decrease others. Hence, a purchase return lowers net sales.

- If you are in the business of selling products on credit, you should use this method. It will save you time and effort. However, it can be confusing.

- One of the major disadvantages of purchasing a return journal entry is its human factor. As the purchase return is recorded manually, a human could make a mistake and thus create a false impression about your company.

- Recording a large number of returns may be time-consuming. Therefore, purchasing journal entries is often not an option for a company with many returns.

- In case of a customer return, the seller may choose to refund the purchase and resell it. In this case, he may change the product or even return it to the supplier. As a result, the account payable will be reduced. On the other hand, a purchase return will reduce your expenses and liabilities.

Unlike the sales return, a purchase return will not reduce your cash inventory. A purchase return is also an opportunity to record an adjustment. The cost of goods sold will reduce the expense incurred on the return. Similarly, a purchase return will increase your apparel inventory. This is why the benefits of this journal entry outweigh the negatives. This method will save you time in the long run.

Conclusion

The Journal entry process isn’t in any way daunting. Today, much software is available, which makes the journal entry process effective and easy. If the online payment transaction wastes a lot of time, you can Log in and use free platforms like Legaltree.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.