In simple words, accounting can be defined as the systematic process of recording and archiving all the information related to finance in an organisation. Accounting is an extremely vital function that needs to be done properly to plan strategies, fund the company, etc.

When accounting is done correctly, an organisation can reach new heights. However, if there are certain errors in accounting, a startup might fail, or an established company might be demolished.

Did You Know? The first accounting record is dated to the year 1494 which an Italian Mathematician recorded.

What is Accounting?

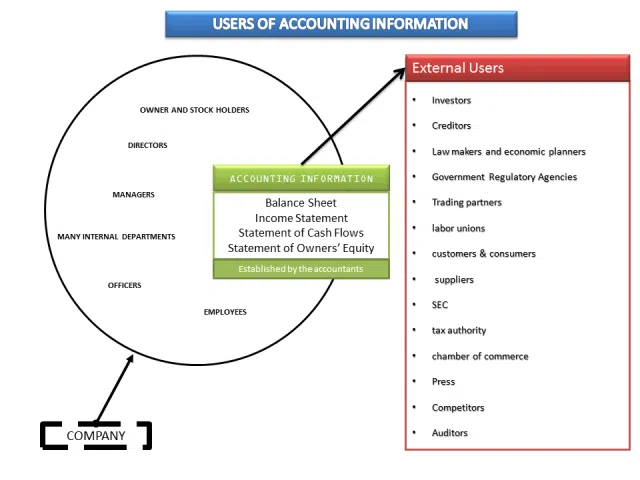

The key purpose of accounting is to keep track of the financial transactions that are taking place in the company. It is performed with the help of financial statements from respective financial years. These statements are prepared by expert accountants or Chartered Accountants (in India). They help to determine a company’s financial position and help streamline the company’s functioning and decision-making decisions.

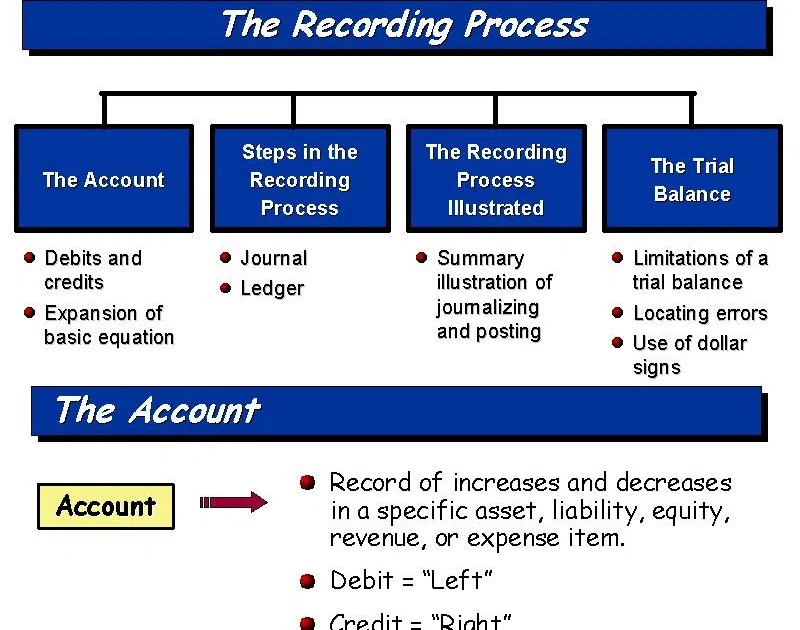

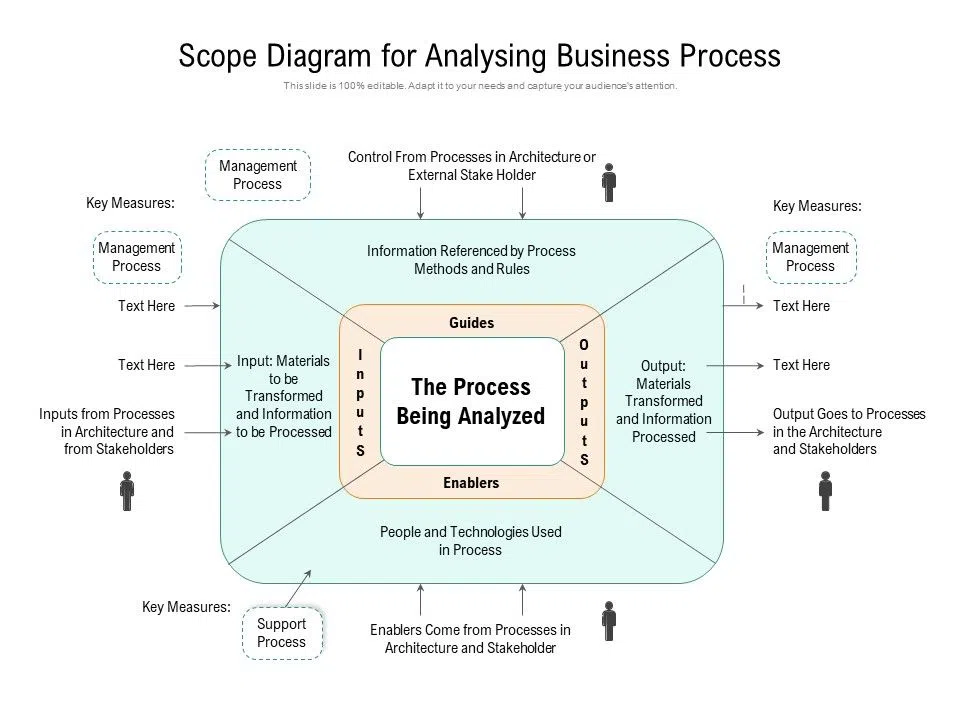

Process of Accounting

As mentioned earlier, accounting is primarily processed by preparing financial statements for a company. These are done by hiring accountants in a small firm or hiring finance-based companies that work with many accountants in the case of a big company. In the case of large companies, financial statements are based on financial reports and thousands of individual transactions.

Also Read: Everything You Need to Know About Hire Purchase: Benefits and Features

Four Objectives of Accounting

In businesses, accounting has a crucial role to play and it is also important to know about the main objectives of accounting, so to have a better understanding here is the list of functions:

-

Recording Financial Transactions of the Company

In any company, keeping records is the first and most important objective. As the definition of accounting says, accounting is the process of keeping accurate records of the financial transactions of an organisation. In large companies, there are thousands of transactions, and they need to be managed properly. Earlier, this was done by maintaining thick and heavy account books or files. Still, in today’s modern era, as everything is switching to online mode, transaction records can also be stored online and easily accessed whenever needed. These records are used at many stages of a company’s decision-making process.

-

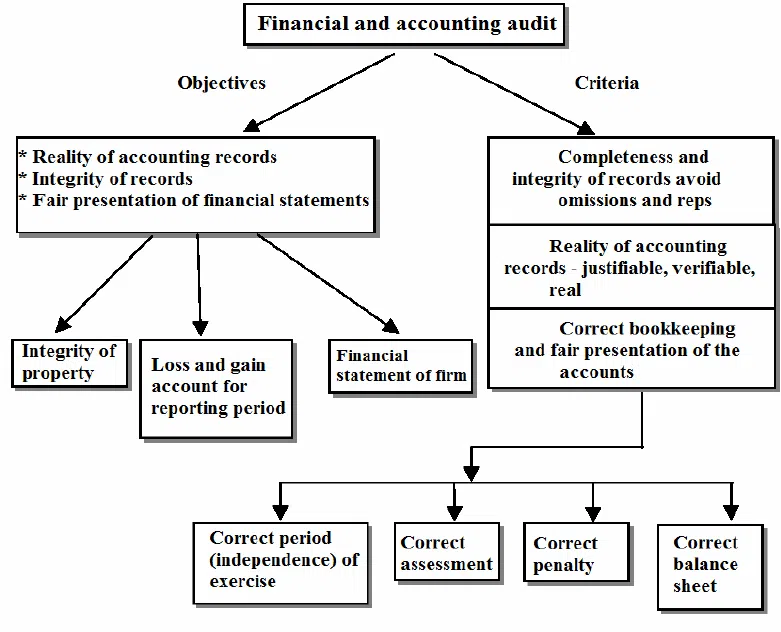

Analysing and Ascertaining the Final Results of the Records

Once the records have been maintained, the second objective comes into play, i.e. using those records. These financial records are used by the company to determine the current financial position of the company. To do so, transactions are categorized according to their type. They are presented in different statements which are known as the manufacturing, trading, and profit and loss account of the company.

After analysing the reports, if the company’s expenses are less than the company’s income, it results in a profit for the company. However, when the income of the company is less than its total expenses, it results in a loss for the company. This helps the people working in the company in taking firm decisions towards the growth and benefit of the company.

-

Analysis and Ascertainment of the Financial Position

This objective is fulfilled by preparing detailed balance sheets of the business enterprise. The balance sheets include every financial detail of the company. It includes information about liabilities, debt, profit, loss, expenses, etc. Everything is shown on the balance sheet.

Balance sheets provide a quick glance at the company’s financial position and help decision-makers in the company to make decisions accordingly.

Also Read: What does the word Impairment in Accounting mean?

-

Portraying Information of the Company to other Users

Shareholders of the company are interested in knowing their earnings per share in the enterprise, and the investors are interested in knowing whether their invested money will be earned back or not, etc. It can be carried out through various means like preparing presentations, portraying grapes, etc.

Few More Objectives to be Fulfilled

Before understanding accounting objectives, we need to understand what accounting is and how it is done. These reports are generated through many different types of accounting, like cost accounting and managerial accounting. Here is a list of some more objectives in accounting:

-

Encourage Proper Decision-Making

Accounting is performed so that decision-makers have a record of the company’s financial transactions and they get to know the company’s financial position. When accounting is performed poorly, it can lead decision-makers to make misguided decisions that might not be in the best interest of the company.

-

Help in Proper Financial Management in the Organisation

Accounting also helps maintain the enterprise’s financial tasks, like liquidity and inventory. An error in accounting can lead to mismanagement of the company’s finances. Right accounting allows the company’s leaders know about the available cash in the company and its current inventory, which helps them invest the money properly.

-

Legal Objectives

Accounting also helps maintain the enterprise’s financial tasks, like liquidity and inventory. An error in accounting can lead to mismanagement of the company’s finances. The right accounting system enables the company’s leaders to know about the company’s cash position and inventory levels, allowing them to invest money effectively.

-

Maintain the Records to Prevent Fraud and Scams

Financial mismanagement can often lead organisations to fall into fraud and ultimately lose a big chunk of money. Proper accounting can help bring all these factors to the table. This will help the company to stay away from such things and will be able to bring transparency to the functioning of the company. Recording actual transactions from time to time ensure that no fraudulent transactions are being made in the company.

Also Read: Goods in Transit (Meaning, Examples) and Accounting Treatment

Conclusion

The four main objectives of accounting are to provide information that is useful in making business and economic decisions, to measure the financial performance of a business, to comply with legal and regulatory requirements, and to support the planning and control activities of a business. These objectives are crucial for the smooth functioning of any organization and help stakeholders make informed decisions. Accounting is not just about recording transactions, but also about analyzing and interpreting financial data to make sound business decisions. By understanding and adhering to these objectives, businesses can ensure that their financial information is accurate, reliable, and useful for all stakeholders.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.