A nonprofit organisation is just a publically-funded entity where the founder or operator of such an organisation cannot earn or receive a payout. Such institutions can create a lot of money and an extra income, yet members can’t consume it; it just has to stay within the group. A non-profitable institution is categorised under a nonprofit organisation (NPO). In a nutshell, a nonprofit group aims to benefit the general population. Such nonprofit organisations typically participate in actions that support the public and the vulnerable and underprivileged.

Essentially, a nonprofit organisation (NPO) is something that is established by average citizens instead of by administrative agencies. Posts often raise the eye of the governmental authorities to an individual’s grievances and encourage civic engagement. A nonprofit organisation can indeed be founded as a trust under Trust Act, as both an organisation underneath the Societies Registration Act or even as a nonprofit organisation following paragraph 8 of the Companies Act 2013. Such an organisation does have a very vast operational area. NGOs often strive for the benefit of the region’s socio-economic development, as well as to spread consciousness.

Did you know?

Of the 30 types of nonprofits, public charity is the largest.

Also Read: What are Charitable Donations?

Characteristics of a Nonprofit Organisation

The major characteristics of a nonprofit organisation are mentioned below. They are:

1. Objective

Folks seem to believe that a charitable foundation cannot remain profitable. This is indeed a common misconception, and it’s not correct. To stay solvent, profits should always surpass costs, just like any other firm. Its primary goal is to pursue a public-beneficial objective or cause as a nonprofit. As an NGO, its principal objective is to attain a public-beneficial objective or cause.

2. Holdings

Nonprofit organisations aren’t commercially held or managed by a single individual; instead, organisations are owned more by the wider populace. Every holding maintained by the nonprofit is committed to the group’s philanthropic, cultural, religious, or economic objectives. Other assets or infrastructure and finances are not assigned to individuals and therefore can be leveraged for anyone’s gain unless the foundation receives reasonable market pay.

3. Control

The nonprofit is managed by a council of executives and trustees whose primary objective is to ensure that the company accomplishes its goal/mission. The trustees collaborate as a team rather than as individual personalities. This governance arrangement can prevent a charity from being controlled by a single person.

Overall compensation of the board members is regulated in several nations. Members of the committee of directors are not compensated except for travel and accommodation to/from public hearings.

4. Accountability

Provincial and municipal state laws require nonprofit organisations to file yearly information reports. The Income Tax Department requires organisations to file 44AB, which details the institution’s finances, including wages in the top five, especially non-office workers.

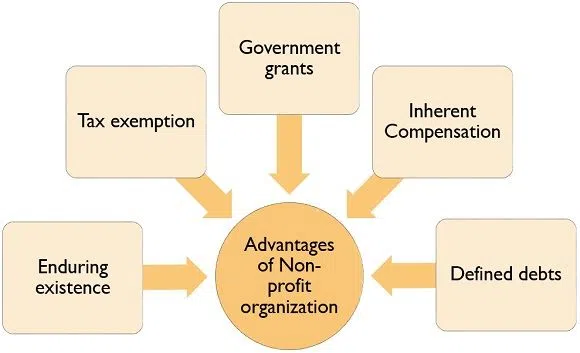

Benefits of Nonprofit Organisation

- The majority of the money generated by a nonprofit organisation is tax-free.

- Unlike corporations, which must employ several methods to get credit, nonprofit organisations may collect donations and assistance.

- NPOs assist to the greatest degree of social welfare.

What are For-Profit Organisations, and How do They Differ from Nonprofit Organisations?

A for-profit company is another term for a for-profit organisation. These sort of organisation are classified as private since it is not sponsored by authorities & operates only for revenue. As a reason, companies must work and pay taxes as obliged by legislation, but if a for-profit company gives to a nonprofit organisation, tax concessions may be available.

Corporate entities and private sector companies are two types of for-profit businesses. The general public can acquire stakes in publicly traded companies, but private firm ownership cannot be bought or sold openly since they are held discreetly.

Indeed, this type of organisation is advantageous to the nation’s economy since the more income they generate, the more money they have to pay the government, which will then be spent directly on the citizens of the nation. The better the efficiency, the bigger the economy, which would be connected to a greater level of prosperity.

With personal motivations, greater profit equals more engagement in the firm, leading to a faster growth rate. The majority of enterprises are for-profit entities worldwide, and a for-profit organisation could also include any neighbourhood store, store, or restaurant.

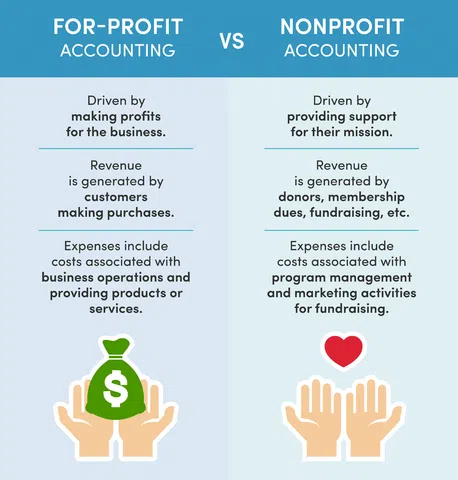

For-Profit Organisation vs Nonprofit Organisation

- A for-profit organisation develops goods or solutions to profit from its sale. On the other hand, nonprofit organisations provide aid with fundamental human requirements to address social issues.

- A for-profit corporation aims to create communication with consumers since they are primarily concerned with producing cash. Still, a nonprofit organisation seeks a broader audience, including funders, participants, and the public at large, among other things.

- Nonprofit and for-profit organisations have distinct organisational cultures, with the latter focusing on monetary benefit and valuing people for overall contributions to profitability. The neighbourhood nonprofit organisation supports the causes beyond their normal working hours.

- Any income obtained in excess by a for-profit corporation is moved to a cash book, whereas excess created by a nonprofit organisation is converted to investment capital.

- A for-profit company’s accounting statements comprise accounting records, cash flow summary, and revenue declaration. There is a revenue & expenditure account, receipt, repayment account, and income statement for the nonprofit organisation.

Also Read: Learn About Bookkeeping: Definition, Types & Importance

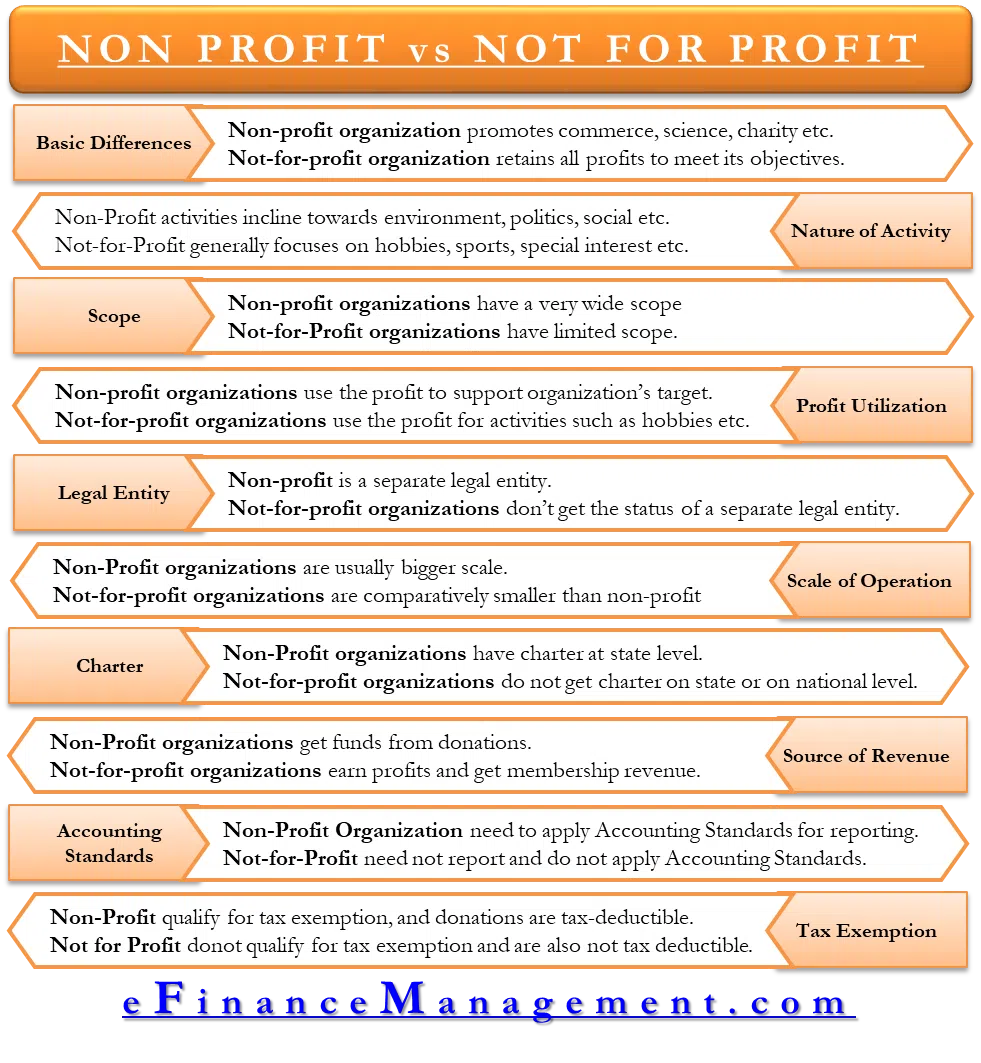

Not-For-Profit Organisation vs Nonprofit Organisation

The proprietors of a not-for-profit organisation must not benefit. In other words, income can be acquired via company activity or gifts. However, all earnings are reinvested in the organisation’s operational accounts. On the other hand, a not-for-profit organisation is still not compelled to exist for the general welfare. As a result, a not-for-profit may fulfil its members’ aims. An outstanding example seems to be a soccer club whose sole mission is to provide fun to its participants.

1. Revenue

Nonprofit and not-for-profit organisations utilise their earnings in different ways.

• Profits from nonprofit organisations are reinvested in the organisation.

• Profits from not-for-profit organisations are used to pay employees.

2. Memberships

Nonprofit staff and professionals do not get any funds from the institution’s fundraising events. They may well be compensated for one’s efforts. As a result, this seems to be unaffected by the amount of money raised by the organisation. Participants of not-for-profit organisations may also gain from institutions’ fundraising events.

3. Tax exemptions

• An individual or corporation that gives to a charity can reduce their gift from income tax return if they have tax exempt certification. As a result, any funds collected via crowdfunding are tax-free for the organisation.

• NFPOs need to apply for tax-exempt status for ITD (Income Tax Departments). This usually includes tax and real estate tax deductions. As a result, an individual’s donation to any NFPO cannot be discounted from their tax return.

Similarities

• It’s possible that neither group will earn a profit. However, they may also be paid to continue their operations.

• Neither sort of company gives investors returns.

Types of Nonprofit Organisations

There are mainly 8 types of nonprofit organisations and they are as follows:

1. Orientation Towards Philanthropy

Humanitarian orientation is a humanistic attempt in which the “donors” play a little role. It includes nonprofit organisations that run initiatives to meet the necessities of the underprivileged, such as garments or medication assistance, food aid, accommodation, education, and transportation. In the event of a tragedy, such nonprofit organisations also actively assist those in need.

2. Orientation to Service

NPOs with campaigns promoting literacy, healthcare, and family welfare are included in the Service Orientation category. These operations are usually split into programs that aim for active engagement from individuals to ensure that they are carried out smoothly.

3. Orientation With Participation

Self-help initiatives represent a collaborative orientation in which local people participate in implementing a program by contributing money, space, equipment, manpower, and materials, among other things.

Participation in a traditional redevelopment programme begins with the requirement for definitions and extends through the design and implementation process. A participative approach is common in unions.

4. Orientation That Empowers

The purpose of empowering orientation is to help those in need foster knowledge of the sociological, geopolitical, and economic aspects that influence their development and strengthen their realisation of their capability to control their life.

Such groups frequently have concerns or problems, and those who participate in their progress play an important role in their success. Personal engagement is maximised in any instance, with nonprofit organisations serving as intermediaries.

5. Community-Based Groups

Community-based groups emerge as a result of folks taking action on their own. Feminist organisations, leisure clubs, academic establishments, and communal organisations are nonprofit organisations examples of these.

There are many different types of such, and even have the assistance of many nonprofit organisations with varying scopes of operations, while others are self-sufficient. Some of these are dedicated to spreading awareness among the poor and increasing their knowledge of their entitlement to basic resources, whereas others are involved in providing essential infrastructure.

6. An Organisation that is Located Across the City

Organisations like the Rotary or Lion’s Club, enterprise confederations, Institute of Chartered Accountants of India, local nonprofit groups, and ethnocultural or academic groups are nonprofit organisations examples of nationwide organisations. Several are for unrelated reasons by becoming interested in helping the poor as a side gig, whereas others are created again for the express aim of helping the impoverished.

7. National Nonprofit Organisations

National nonprofit organisation lists (NPOs) comprise groups like Smile Foundation, Nanhi Kali, Helpage India, Pratham, and others. Some of them have state and duty divisions and help local nonprofits.

8. International NPOs

Transnational nonprofit organisations form religious and academic trusts to spread awareness amongst various populations. Their initiatives range from sponsoring local nonprofits, initiatives, and organisations to implementing the idea.

Conclusion

To fully realise our potential to make a more imaginative difference in the world, we must make fundamental changes in every facet of our activity in the nonprofit sector.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.