The matching concept in accounting is an accounting principle used for keeping a record of revenues and expenses. According to this principle, a business must keep a record of expenses along with earned revenues. For clear and easy tracking, it’s ideal that both of them fall within the same time period. This principle works with the concept that a business must incur expenses to earn revenues.

Did you know? If an expense is recognised too early, it will reduce net income, and if recognised too late, it will increase net income.

Matching Concepts in Accounting

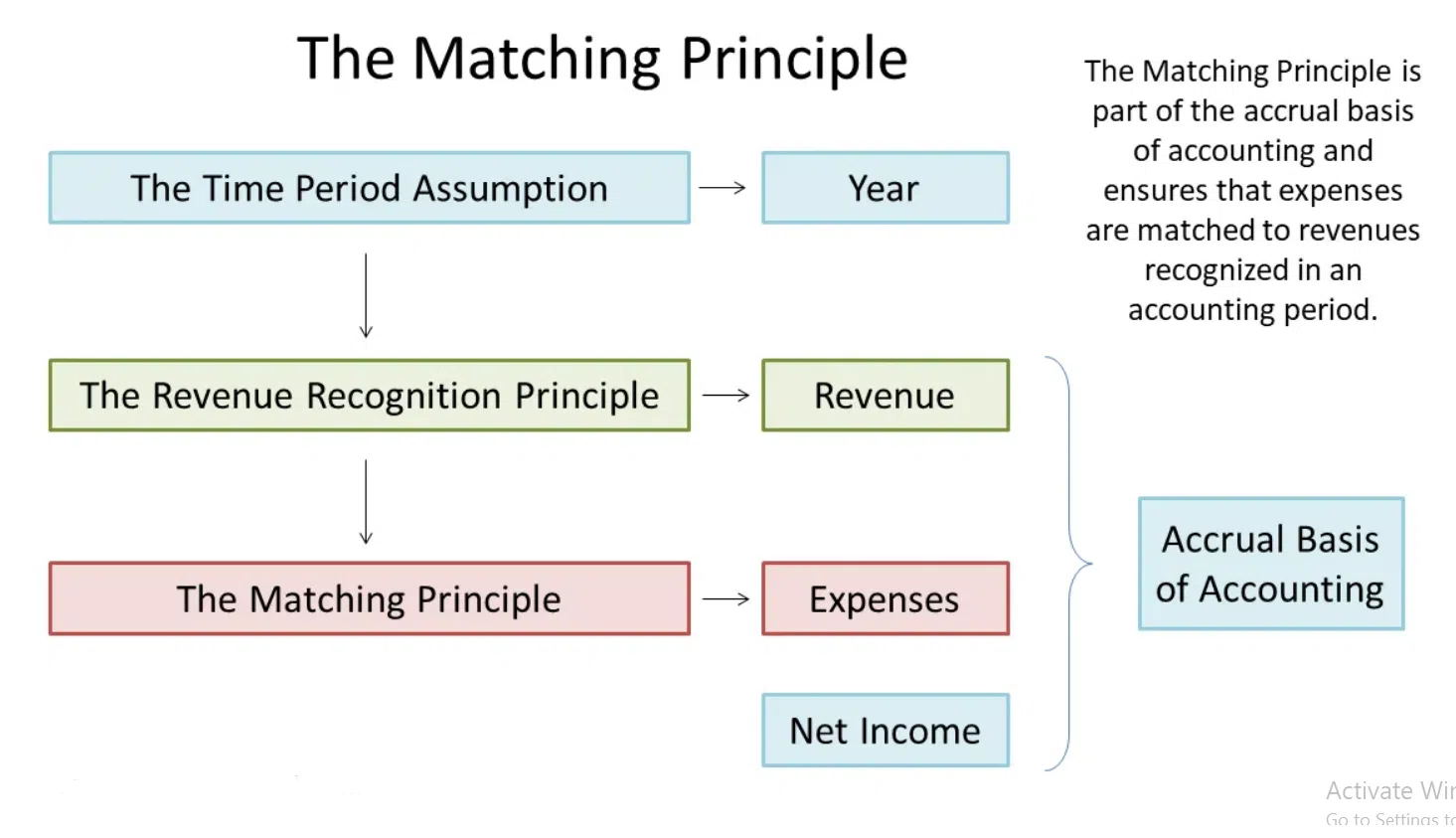

The matching concept or principle has special importance in the accrual accounting concept. According to the matching principle, a business must match related revenues and incurred expenses within the same period.

Also read: Costing: Definition, Objectives, and Advantages

Matching Principle Example

An expense needs to relate to the time period that it occurred and not during the actual payment of the invoices. Assume that a business gives out commissions to its representatives at 10% of their sales, disbursed at the end of the month. If the business makes sales of ₹40,00,000 in January 2022, it will need to pay ₹400,000 in commission in February 2022.

The company that uses the matching principle in its expenses and revenue record-keeping will report the expense of the commission on its income statement for January 2022. Businesses that prefer to use the cash basis of accounting will report their commission expense in February 2022. It is due to the disbursement of the commission being done in February.

Besides commissions, there are several examples of this principle, such as depreciation, employee bonus, and wages.

Revenue Recognition Principle

One more accounting principle related to matching principle accounting is the principle of revenue recognition. According to this principle, the revenue should be reported and recorded at the time when it is realised. It needs to be done irrespective of the payment.

Here is a matching principle example. If a business that does landscaping has completed the work of building a swimming pool at a farmhouse, the business has earned the fee, irrespective of when the customer will release the payment for that job.

Benefits of Matching Principle Concept

The matching principle concept is extremely beneficial when it comes to reporting revenues and expenses.

- The main reason businesses use the matching principle for their accounting is to maintain consistency across their financial statements, such as the balance sheet and income statement.

- If an expense gets recognised incorrectly, it could significantly distort a business’s financial statements. In such a case, the business could have a wrong idea of what its financial position is in reality. With the matching principle, the business can prevent any possibility of misstating its profits for any given period.

Also read: Meaning of Accountancy and How it Differs From Accounting

- For example, if expenses are recognised too earlier, it will lead to lower net income. Recognising an expense too late can lead to a higher net income being depicted than the actual.

- Various financial elements related to business will be gained by using the matching concept. Long-term assets are prone to depreciation. In the matching principle, a business is allowed to distribute an asset and match it across the time period of its usefulness to balance the asset’s cost over that time.

Here is an example! Consider that a business purchases specialised machinery at the expense of ₹250,000. This machinery could remain working for 15 years or even more. In such a case, the business has the option to distribute the incurred expense on the machine across the 15 years rather than show it all in one year itself, at the time of its actual purchase.

Challenges of the Matching Principle

The matching principle works well in cases where revenues and expenses are clarified. But, there are times when the expenses will apply to more than one area of revenue, or it could even be vice versa. There is a need for the accounts department of a business to come up with estimates in cases where no clear correlation exists between revenues and expenses. Here is an example. A business will purchase office supplies for the employees that could be stationery items. While these notebooks, pens, staplers and staple pins are essential, they cannot be correlated with revenue.

Consider a business that buys a bigger property for its office. It is impossible to know if a better location or a bigger space will bring in more revenue. It is not possible to know if the employees will be more productive in the new location. Will customers find it easier to reach the office? As it can be seen, none of these factors is related directly to the business’s new location. Due to this lack of direct relation, businesses will generally spread the cost incurred in purchasing property for the business over several years or even decades.

Consider that a business incurs the cost of ₹10,00,00,000 on buying an office space expecting that it will serve the business for a period of ten years. Then the business disperses the amount across the following 10 years. In case a loan has been taken for the purchase, then the expense could also include all fees and the interest that is charged on loan for the term it was taken. The disbursement will be done across the ten years even though the business already spent the entire ₹10,00,00,000 upfront.

The example of online search ads is a similar one. Consider there is a marketing team that creates messages that will attract potential customers into visiting the website of a business. This will plant a seed when the customer visits the website, even if the customer does not make any purchase then or for several years. Revenue cannot be directly correlated to spending in this case or any other similar cases. So, the expenses incurred for online search ads are recorded in the period of the expense rather than dispersed over a period of time.

Also read: All Facts and Figures About the Nominal Account in Accounting

Conclusion

Business runs with the well-known concept that in order to make money, it is essential to spend money. The matching concept is aligned with adjusting entries and the accrual basis of accounting. It provides businesses with a means of recognising this idea while keeping their accounting records. This principle has its basis in the cause and effect relationship that exists between revenue and expenses. It needs a business to record all its business expenses in the same period as the revenues related to it.

In other words, when using the matching principle, a business needs to report the expense in the income statement for the period in which the revenues related to it have been earned. It also needs to be prepared on the balance sheet for the end of that accounting period.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.