Online Tax Accounting System or OLTAS is a system for online collection, accounting, and reporting of Direct Tax receipts and payments from all types of taxpayers (companies and individuals) via a network of bank branches. Online tracking of challans and e-challans for taxpayers is another benefit of this system. OLTAS issues a single challan with a tear-off strip to the taxpayer instead of the traditional system’s three challans. Data from taxpayers is transferred directly from banks to the Tax Information Network (TIN). The National Securities Depository Ltd. established and maintains TIN to manage all data and information about challans between the tax department and banks.

Why was the OLTAS challan introduced?

Direct taxes were previously collected manually by the Reserve Bank of India or State Bank of India branches. Other branches of public-sector banks were also involved in increasing the number of tax collecting locations. Further, to better serve taxpayers, the accounting system for direct taxes was given special attention. The manual procedure of tax collection and accounting was difficult to maintain and had many faults and flaws.

OLTAS was created in June 2004 to overcome the problems associated with the manual collection and accounting of direct taxes. It was also a result of the technological revolution that replaced electronic means with manual procedures.

OLTAS was created with the following goals in mind:

- Online direct tax accounting

- Online collection of direct taxes

- Online reporting of direct tax receipts and payments

The following bodies worked together to ensure that the process of creating OLTAS is carried out to its logical conclusion:

- The Central Board of Direct Taxes

- The Indian Banks Association

- The Controller of Accounts

- The Reserve Bank of India

OLTAS was introduc ed in three stages and currently authorises 32 banks from the public and commercial sectors. Initial work focused on data relating to tax information in the early stages. When the project went online in April 2005, banks were also required to reconcile daily tax collections with the information and data TIN received from the banks, a new requirement for the initiative.

What are the Features of OLTAS?

Listed below are some of the basic features of OLTAS:

1. Introduction of a single copy of OLTAS challan with a tear-off taxpayer’s counterfoil-

According to OLTAS, the taxpayer mu st use a single and common challan for the following:

- Deposit of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) – Challan No. ITNS 281.

- Deposit of corporate taxes and regular income tax – Challan No. ITNS 280.

- For making a payment towards equalisation levy – Challan No. ITNS 285

- For payment of direct taxes such as gift tax, hotel receipts tax, wealth tax, expenditure tax, estate duty, and securities transactions tax – Challan No. ITNS 282

- Payment as per the (PMGKY) “Pradhan Mantri Garib Kalyan Yojana” – 2016 – Challan No. ITNS 287

- Payment below Income Declaration Scheme, 2016 – Challan No. ITNS 286.

- For payment of Banking Cash Transaction Tax and Fringe – Challan No. ITNS 283

2. All types of tax, such as TDS, direct tax, income tax, TCS, etc., can be paid in person at any OLTAS-authorised bank branches, online via net banking, or by debit card.

3. Receipt and a unique serial number known as the Challan Identification Number (CIN)-

When taxes are paid, a tear-off portion of the counterfoil is given to taxpayers after rubber-stamping by the collecting bank. A challan is generated immediately if the payment is made online. CIN includes the following information:

- RBI assigns a 7-digit BSR Code to the bank branch (where the tax is deposited).

- Date of challan presentation (DD/MM/YY)

- Challan’s 5-digit serial number in that bank branch on the said date

An income tax return or communication with the income tax department must include the taxpayer’s CIN number as proof of tax payment. CIN has also eliminated the obligation to provide a hard copy of tax receipts to the income tax form. There are many reasons why it is critical to verify that all information on the tax-paid challan is correct.

4. The status of tax payments can be checked online at any time by a taxpayer. However, the method OLTAS operates is identical whether income tax is paid directly by the earner or through TDS. Detailed instructions for online TDS challan status verification are provided in the next section.

Also Read: TDS Challan ITNS 281- Pay TDS Online With E- Payment Tax

How to Make OLTAS Challan Payment Online

Following are the steps to pay tax online through the OLTAS portal:

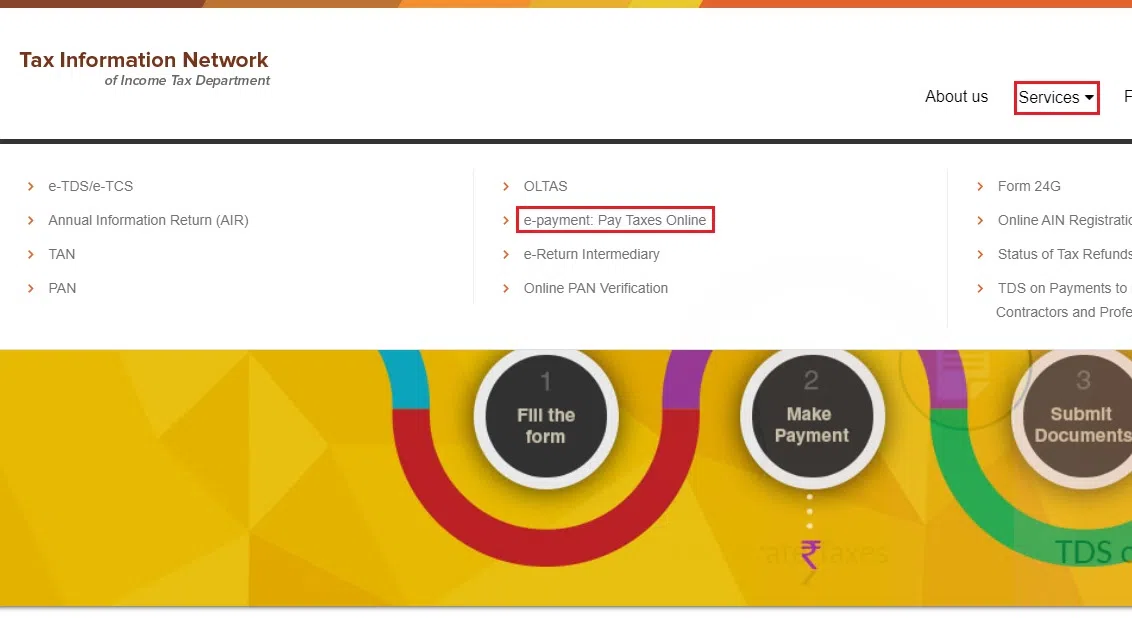

- Visit the official website at https://www.tin-nsdl.com.

- Click on the drop-down menu under the button ‘Services,’ select the e-payment- “pay taxes online” option.

- When you select this option, you will be taken to a payment gateway, where you can enter the Challan number for your payment.

- Unde r ‘Taxes applicable,’ select the ‘major head code’*.

- Fill in the required fields on the form with the Assessment Year (AY) and the PAN.

- The screen will show you the information about the PAN that you entered.

- To complete the online form, you will need to provide your personal information- your registered address, email id, and phone number.

- Subhead ‘Type of Payment’ is where you’ll find the relevant minor head code to select.

- Your bank name will appear in the drop-down box when you select the payment method you like from “Debit Card” or “Net Banking.”

- Enter the Captcha code and press the “Proceed” button.

- After submitting the form, the PAN information is displayed on the confirmation screen. If everything is correct, click the “Submit” button. This is the final step in the process, and you’ll be taken to the bank payment portal.

TDS Challan Status

- The CIN or the Tax Deduction and Collection Account Number (TAN) of the deductor monitors the TDS Challan status.

- While CIN-based views are used to check the status of all sorts of tax payments, both CIN and TAN-based views are used to check the status of TDS challans.

- After depositing the challan at the bank, you can check its status online one week later.

- Taxpayers may contact the bank where they’ve paid their taxes if they receive a message like “no records found for the above query” or if there is any other mismatch in the data.

- Taxpayers can contact the National Securities Depository Ltd. if they don’t get a suitable response to their questions.

Different types of OLTAS Challan view

CIN Based View

Visit the OLTAS website here: https://tin.tin.nsdl.com/oltas/index.html

Under ‘For Taxpayers,’ select ‘CIN-based view.’ Enter the CIN, which is the Basic Statistical Return (BSR) code of the collecting bank branch, the Challan tender date (cash/cheque deposit date), the Challan serial number, and the amount (optional). When the taxpayer selects the option, they will be able to see the following information:

- BSR Code

- Deposit Date

- Challan Serial Number

- Major Head Code with description

- TAN/Permanent Account Number

- Taxpayer’s name

- Received by TIN on (i.e. date of receipt by TIN)

- Confirmation about the correct amount being entered (if the amount is entered)

TAN based View

Visit the OLTAS website here: https://tin.tin.nsdl.com/oltas/index.html.

Under ‘For Taxpayers,’ select ‘TAN-based view.’ Enter a required period’s TAN and Challan Tender Date range (within 24 months). A text file containing the following challan details for the selected TAN and period is downloaded when this option is selected.

- CIN

- Major Head Code* with description

- Minor Head Code**

- Nature of Payment

The system will verify if the taxpayer’s CIN matches the bank’s CIN when the taxpayer submits the amount. The challan details mentioned i n the Quarterly e-TDS/TCS statement can be checked using this file. For confirming the challan details, import the challan file and the text file (Quarterly e-TDS/TCS statement) in the File Validation Utility (FVU). When the Quarterly e-TDS/TCS statement is validated, FVU will supply the matching statistic for the challan details listed in the e-TDS/TCS statement.

Status inquiry for banks

To track the status of their challans deposited in banks, tax collecting branches and nodal branches must log in with their username and password.

Collecting bank branch

The tax collecting branch can access the total amount and a total number of challans for each major head code* by providing the branch scroll date and the major head code – description. Furthermore, the collecting branch can see the following information:

- Challan Serial Number

- Challan Tender Date

- PAN/TAN

- Name of Taxpayer

- Amount

- Date of receipt by TIN

Nodal Bank Branch

The nodal branch can view the following details after providing the nodal with ‘major head code’ description and scroll date :

- Nodal Branch Scroll Number

- Major Head Code – Description

- Scroll Date

- Total Amount

- Number of Branches

- Number of Challans

Furthermore, the following information can be accessed for each Nodal Branch Scroll Number:

- BSR Code

- Branch Scroll Number

- Branch Scroll Date

- Total Amount

- Number of Challans

- Date of receipt by TIN

(*Major head code – 0020 – Corporation Tax/company deductees, 0021 – Income Tax (other than Companies)/non-company deductees)

(**Minor head code – 200 – TDS/TCS payable by the taxpayer, 400 – Tax/TDS/TCS on Regular Assessment Tax). These codes are specific to a TDS challan.”

Also Read: Time Limit To Deposit TDS And File TDS Return

Conclusion

OLTAS has simplified the process of paying, collecting, and accounting for taxes for all parties involved. Thus, better tracking and fewer defaults are possible. After reading this article, we hope you’ve gained a better understanding of OLTAS and the procedures for OLTAS Challan Payment online and enquiring about OLTAS Challan status. For more information on OLTAS, you can use the Legal Tree app.