A Journal voucher in Tally is a crucial voucher in Tally ERP 9 that involves making adjustment entries, entries regarding fixed assets and credit purchases or sales. You need to press the shortcut key “F7” from the accounting vouchers to use Journal Vouchers. There are innumerable examples of journal vouchers which we will be presenting below. By the end of this article, you will have complete knowledge on how to enter Journal vouchers in tally with ease.

What is a Journal

A journal is the book of accounts where transactions of financial nature are recorded from the source documents. The transactions are recorded on an actual basis when the transactions take place.

What is Journalising?

The process of recording financial transactions can be termed journal entries in the books of accounts, known as Journalising. It is based on the Double-Entry system of accounting. This form of accounting or bookkeeping is a system of accounting where every transaction has dual effects. It means that the Debit amount must be equal to the Credit amount for every transaction.

What is a Journal Voucher in Tally?

Every transaction requires a piece of documentary evidence like a Journal voucher. Journal Voucher in Tally ERP 9 is used to record transactions other than cash and bank. Transactions related to depreciation, provisions, purchase and sale of fixed assets on credit, write-off balances, adjustment entries are recorded in Journal Voucher. It is the most important voucher in accounting vouchers.

You can easily trace these vouchers in any accounting system. Auditors generally use Journal Vouchers during an audit as a part of Audit Procedures. These transactions are of routine nature.

Purpose of Journal Vouchers

Do you know the reason behind the preparation of Journal Vouchers in tally? Why are they so important? Journal vouchers are prepared to serve multi-fold purposes as described below:

- To record non-cash transactions in the books of accounts

Non-cash transactions are those transactions that do not involve a cash payment. For example- depreciation, loss or gain on fixed assets, provision for discount expenses, asset write-downs and deferred income taxes.

- To rectify any business transaction which was wrongly recorded in the books of accounts.

There may be situations when the business transactions are wrongfully recorded in the books of accounts. It may be incorrect debit or credit of accounts. Journal Vouchers helps in a reversal of the first entry using a journal entry in Tally ERP 9.

- To record the transactions not recorded by other accounting vouchers in Tally ERP 9.

All accounting vouchers record transactions of specific nature or type. Some are described as follows:

- The receipt voucher records all the money received.

- Payment voucher records all the money paid.

- Contra voucher records the transactions involving cash and bank.

- Sales voucher records the transactions involving the sale of goods or services.

- Purchase voucher records the transactions involving the purchase of goods or services.

- Journal voucher records the transaction entries not recorded by other accounting vouchers.

Also Read: All About Banking Entry in Tally ERP 9

Types of Journal Vouchers

Every voucher has its respective bifurcation. Journal Vouchers are divided into different types:

- Depreciation Voucher: This voucher records the depreciation expense on fixed assets for the year. Generally, we use a payment voucher to book an expense. In this case, we use Journal Voucher as depreciation is a non-cash expense. Non-cash expenses are not booked through payment vouchers.

- Prepaid Voucher: Prepaid Voucher records all the pre-paid expenses paid during the year. For example- payment of salary for 6 months in advance during the financial year 2020-2021.

- Fixed Assets Voucher: This voucher records the purchase of fixed assets during the year. Note that fixed assets purchased for cash are recorded in a payment voucher. On the other hand, credit purchases or sales of fixed assets are booked through a journal voucher.

- Adjustment Vouchers: These vouchers record all the closing entries for the year. The main purpose of the adjustment entries is to communicate an accurate and fair view of the company’s finances.

- Transfer Voucher: These vouchers involve the shifting of balances of one account to another account. Also, you can record the transfer of materials from one warehouse to another.

- Rectification Voucher: These vouchers record the rectification entries of the tally. Sometimes, wrong transactions are recorded due to a wrong journal entry in tally or journal voucher. All the mistakes are corrected using rectification entries in the journal voucher.

- Provision Voucher – This voucher involves the booking of the provision of expenses on an estimation basis. Provisions are made for future contingent liability. You can book your losses in advance to prepare for future liability.

- Accrual Voucher – This voucher records the actual expenses or income. Actual means the transactions have occurred but were not paid or received during an accounting year.

Examples of Journal Voucher in Tally ERP 9

There are various examples of recording Journal Vouchers in Tally ERP 9. Some of them are described as follows:

1. Outstanding expenses

Outstanding expenses are those expenses that are due but not paid over the year. It is a liability. For example- Outstanding rent, outstanding salary, outstanding wages and outstanding subscription etc. Let’s say wages for the months from January to March are paid during May of the new Financial Year. As per the accrual concept, the expense should be recorded from January to March itself to show the accurate figure of a business.

You can record the Journal entry at the end of March as:

- Debit Salary Account XXX

- Credit Outstanding Salary Account XXX

2. Prepaid Expenses

Prepaid expenses are the expenses paid in advance. These expenses haven’t occurred in this financial year yet. As per accrual basis, the expenses should be booked in the year to which it pertains. But as per cash basis, we will record this transaction in the year of cash outflow. We will record these expenses as an asset in this financial year to reach an accurate net profit. Let’s say I have paid my house rent for the next financial year in this financial year only.

The Journal Entry for the same will be:

- Debit Prepaid Rent Account XXX

- Credit Rent Account XXX

3. Accrued Income/ Expense

Accrued Income is an income that is earned but not received. It is a current asset for the organization. For example- accrued interest receivable, accrued rent, accrued salary etc.

Journal entry for accrued income:

- Debit Accrued Income Account XXX

- Credit Profit and Loss Account XXX

Accrued Expense is an expense that is recognised in the books of accounts before it is paid. It is a current liability for the organization. For example- bonus, salary payable, unused sick leaves, accrued interest payable etc.

Journal Entry for Accrued Expense:

- Debit Profit and Loss Account XXX

- Credit Accrued Expense Account XXX

4. Credit Purchases or Sales

Credit purchases are made when fixed assets or materials are bought on credit. For example- Mohan bought Plant and Machinery from Sohan on credit for Rupees 10 lakhs.

The journal entry in tally for the transaction will be:

- Debit Plant and Machinery Account: 10,00,000

- Credit Sohan Account: 10,00,000

Credit sales are made when fixed assets or materials are sold on credit. For example- Rashi sold Land and Building to Komal on credit for Rupees 15 lakhs.

The tally journal entries for the transaction:

- Debit Komal Account: 15,00,000

- Credit Land and Building Account: 15,00,000

5. Transfer Entries

These Journal Voucher entries in tally are made when you require to transfer funds between different accounts. You can say it as writing off the accounts too. For example- A company has a debtor balance of Rupees 20,000 and a creditor balance of Rupees 25,000. I can write off the debtors from the creditors. It means that my debtors worth Rupees 20,000 can directly pay my creditors worth 20,000 and the values in the books of accounts will be:

- Debtors: 0

- Creditors: 5000

The journal entry for the transaction will be:

- Debit Creditors Account: 20,000

- Credit Debtors Account: 20,000

Also Read: How to Enter Sales Return Entry in Tally ERP 9?

Difference between a Journal Voucher and Journal Entry

Although these two important terms, “Journal voucher” and “Journal Entry,” are used interchangeably, but, they are different from each other. The following are key differences found between these two:

- The Journal Voucher is the commencement of any financial transaction & the Journal Entry is the effect of that financial transaction recorded in the books of accounts.

- Journal entries are recorded in the books of accounts, i.e., Journal while on the other hand, Journal Vouchers are the evidence of recorded documents for the journal entry.

- Journal entries can be of two types- Simple and compound. Simple Journal entries are those entries where debit or credit of only one account takes place. On the other hand, compound entries are those entries where debit or credit of more than one account takes place. However, there is no such difference found in journal vouchers. You can draw any number of the journal from a single Journal voucher.

- Journal entry in tally is posted to appropriate/ suitable ledgers. Whereas the Journal Vouchers are recorded into the system

How to pass Journal Entries in Tally

Passing Journal Entries in Tally through Journal Vouchers is very simple. If one knows the basic accounting rules, they can post the Accounting entries in Tally ERP 9 without serious effort. However, most people have a confusion regarding the basic rules of accounting. You need to clear some concepts regarding:

- The golden rules of accounting

- What is an expense or income?

- What comes under fixed assets?

- Sales or purchase of goods or services

- GST related entries

These are some issues that a layman faces while passing Journal Entries in Tally ERP 9. However, this problem is solvable. You can either refer to the accounting books, website articles and blogs or take the help of an expert or professional. More information can be found in the journal entry in tally ERP pdf.

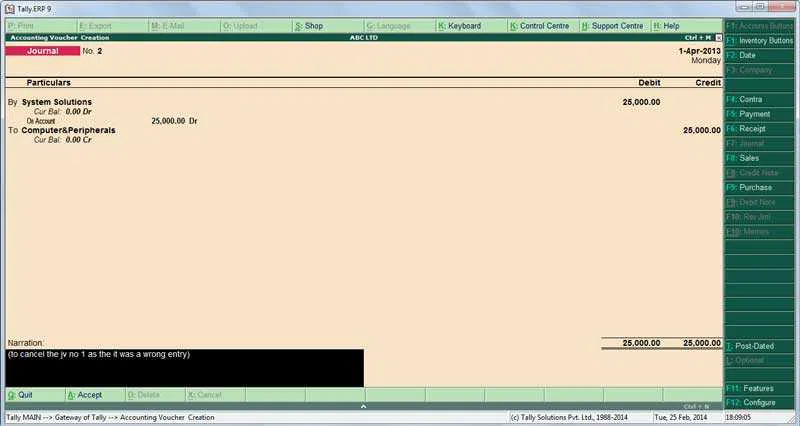

Steps to enter Journal Voucher in Tally ERP 9

Journal entries in Tally are posted through journal vouchers. Journal Vouchers are easily accessible by pressing the shortcut key “F7,” or you can move your cursor to the Journal Voucher to access the same.

There are some broad steps to enter the journal entries in Tally ERP 9 as described below:

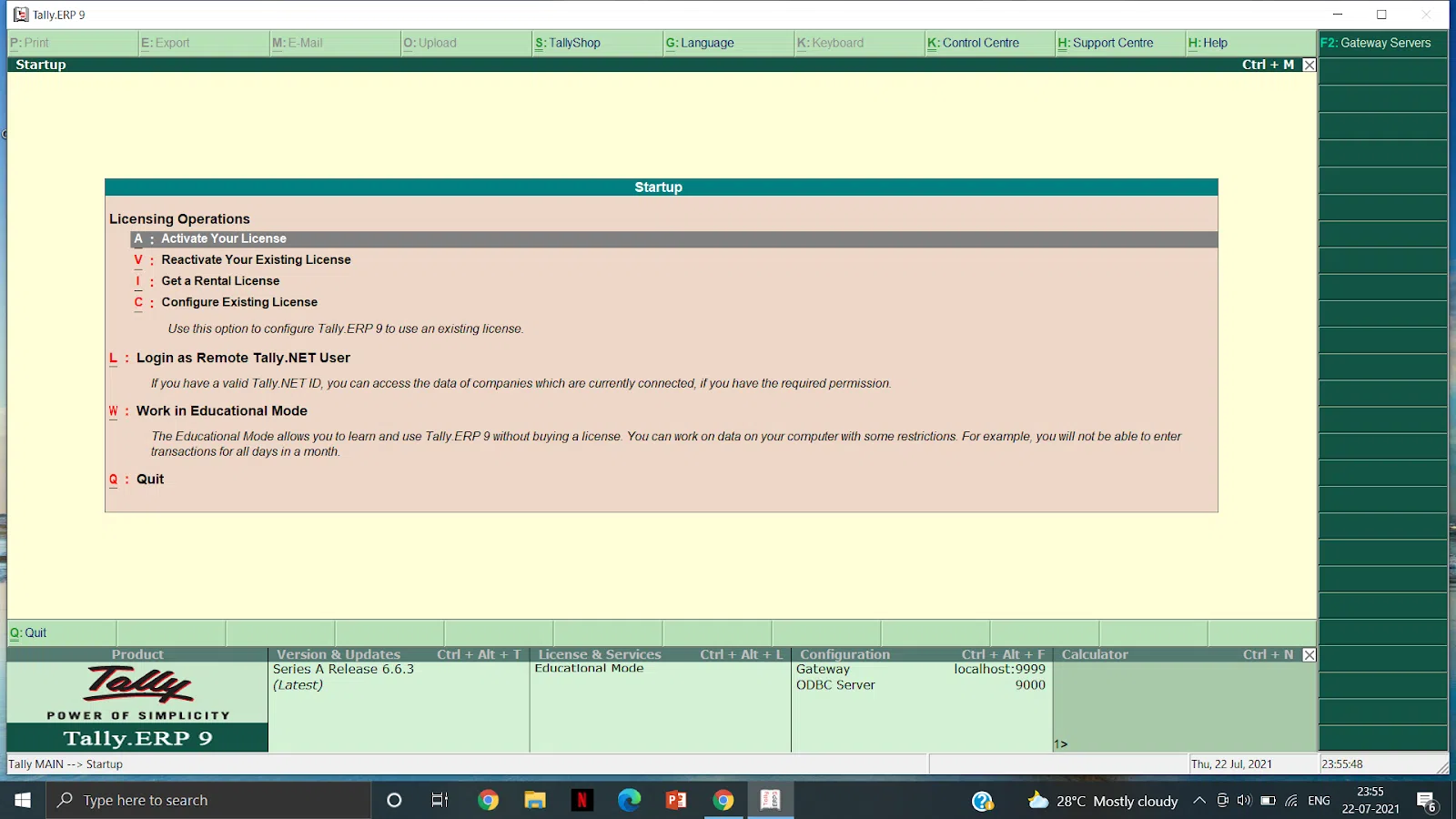

- Step 1: Open your Tally ERP 9. If you are working under the educational mode, click on the same. If you are a professional and have a license, open it under licensing operations.

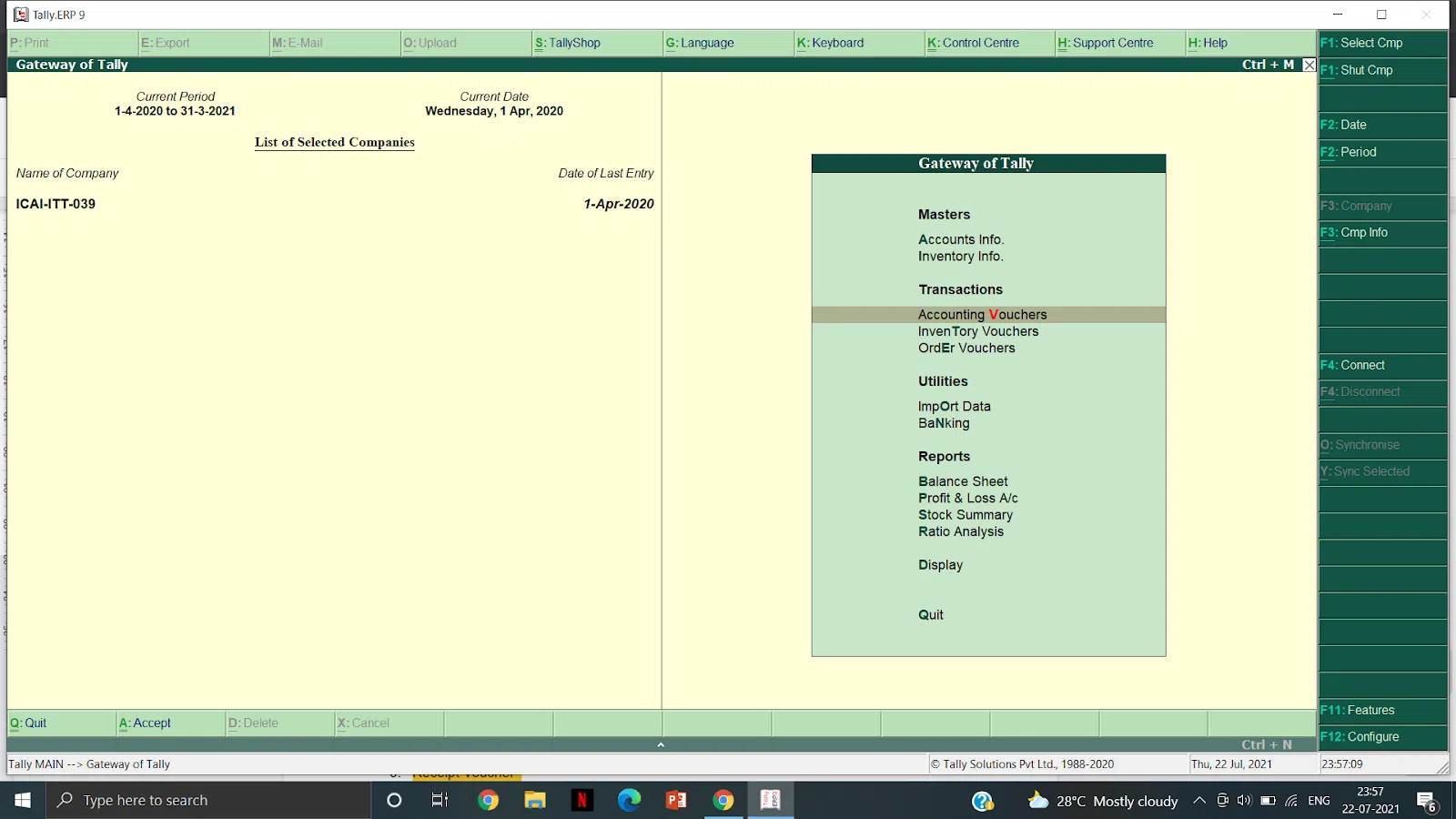

- Step 2: After opening the software, the screen will display the Gateway of Tally. There are significant heads like Masters, Transactions, Utilities, Reports, Display and Quit. Go to the transaction vouchers and select the accounting vouchers.

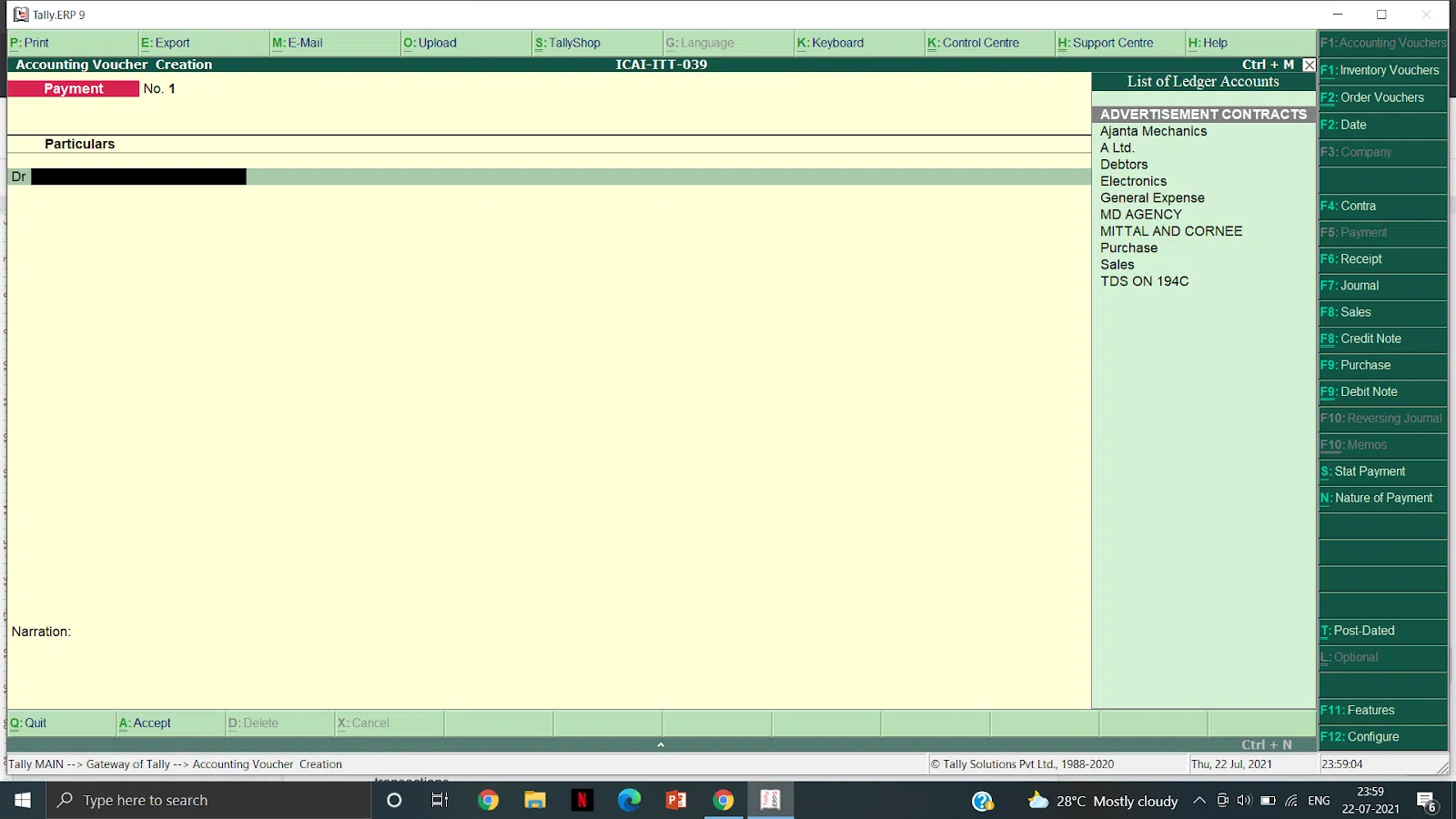

- Step 3: Under the Accounting Vouchers, different vouchers are displaying on the screen like:

- Inventory Voucher

- Order Voucher

- Contra Voucher

- Payment Voucher

- Receipt Voucher

- Journal Voucher

- Sales Voucher

- Purchase Voucher

- Credit Note

- Debit Note

Among these vouchers, select the Journal Voucher or press “F7” on the right side of the screen.

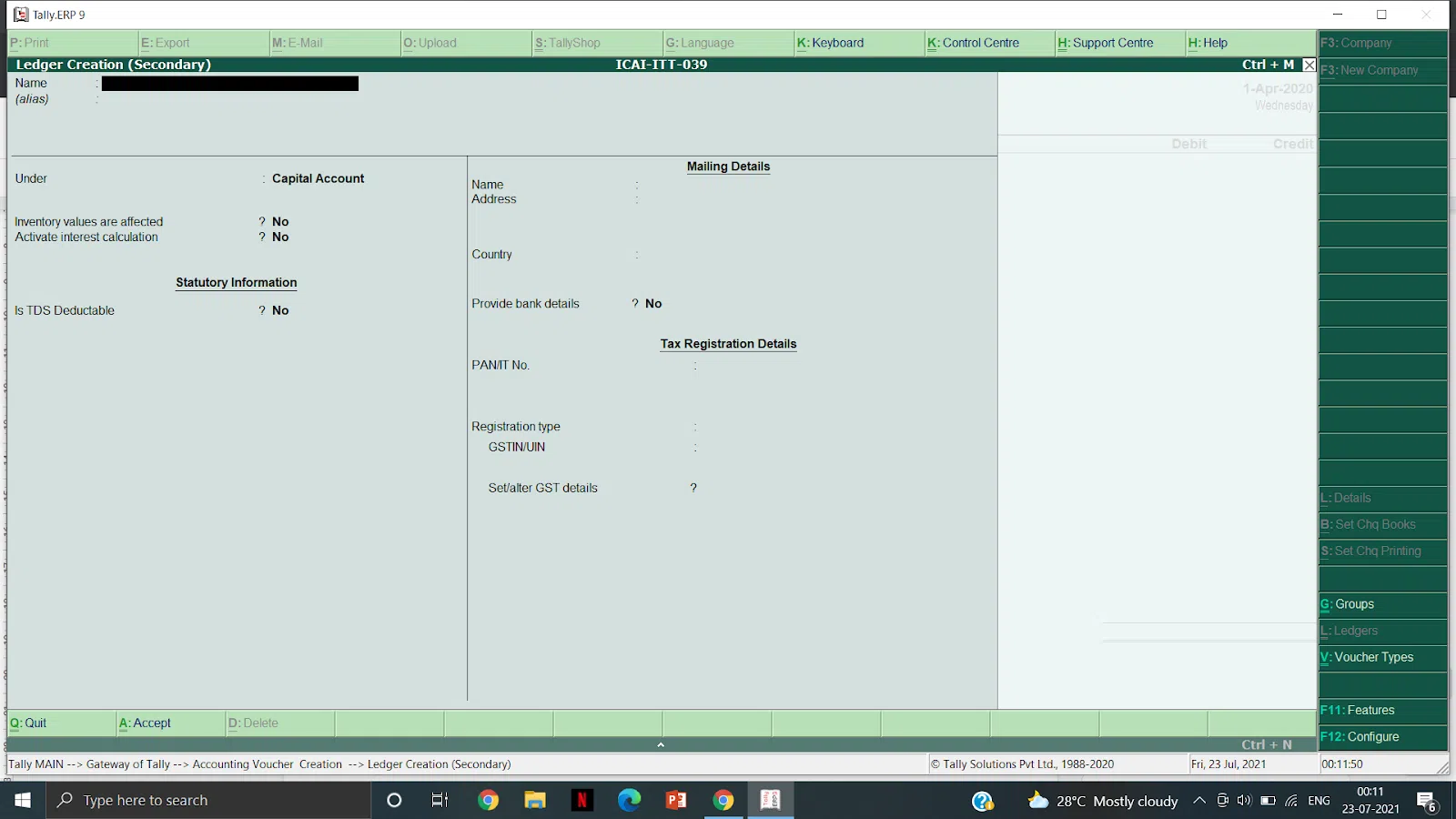

- Step 4: Enter the ledger to be debited or credited after By/Dr under the particulars column. One can enter multiple debit or credit entries one by one only if required. There may be some situations where you need to debit or credit various ledger accounts. Before debiting/crediting, you need to create an appropriate ledger by pressing alt+c for the same.

- Step 5: If you are debiting, use the option By/Dr or crediting the accounts, use To/Cr. Using these options, enter the respective amount.

- Step 6: After posting the entry and the amount, you will see the narration field on the screen’s bottom-left corner. Enter the narration (details of the transactions) and press enter to save the final Journal Voucher.

In this way, you can add multiple Journal Vouchers in Tally ERP 9 for the respective transactions.

Conclusion

This was all about tally journal entries. Students can practice the tally journal entry questions with answers using Journal Vouchers. Just go through the basic accounting steps and you are all set to pass the Journal Vouchers in Tally ERP 9.