The government charges GST, or the goods and services tax, on products and services sold domestically for consumption. The final price of a commodity or service contains the GST, and consumers pay for it at the point of sale. ITC in GST stands for an Input Tax Credit to claim the GST paid to purchase goods and services in the course of the business. The apparatus of the input tax credit is the backbone of GST and is a fundamental reason for the introduction of GST. Section 19 of the Central Good and Services Tax (CGST) Act, 2017 describes provisions relating to ITC for inputs and capital goods sent as well as received for job work. The Principal or the registered person can claim ITC on inputs or capital goods sent to a job worker for job work.

There are four types of ITC forms, which are:

- ITC 01 – ITC for new GST registration

- ITC 02 – Transfer of ITC in case of sale or merger etc.

- ITC 03 – Reversal of ITC

- ITC 04 – ITC on goods sent to job worker

Did you know?

The standard GST rate varies from 1.5% in Aruba to 27% in Hungary. In India, it ranges from 5% to 28%.

GST ITC-04

Form GST ITC-04 is a declaration form to be furnished by registered people known as the Principal, containing the details of inputs or capital goods sent to or received from job workers in a particular quarter. The Principal must submit the GST ITC-04 form every quarter. In the form, the following transactional information needs to be present:

- Inputs or equipment sent to the employees in the quarter.

- Inputs or capital goods received from employees in the quarter.

- Capital goods delivered from one employee to another employee within that quarter

- Inputs or equipment supplied during that quarter by the employees.

The GST ITC-04 form contains subtleties of the information sources or capital merchandise shipped off and returned from such a task labourer. The enlisted makers or Chief should record such a form sending sources of information or capital products on work each quarter. Further, the Chief sends information sources or capital merchandise to a task labourer by giving a Challan to the gig specialist concerning such data sources or capital products.

So we can say that form GST ITC-04 is an announcement highlighting the data sources or capital merchandise released to or received from a task specialist.

Due Date to File ITC-04

The due date for filing form GST ITC-04 is the 25th day of the month following the quarter for which the return is being filed. For example, ITC-04 for the quarter ending on the 30th of September should be filed by the 25th of September.

There is no prescribed penalty or late fees prescribed in case of any delay in the filing of GST ITC-04. According to section 125, a general fine of up to ₹ 25,000 can be levied for infringement of provisions of the act and rules made thereunder.

ITC-04 was a quarterly form until the September of 2021, and it had to be filed on or before the 25th day of the month following the quarter. For example, the due date for the July to September quarter is the 25th of October 2021. However, with effect from the 1st of October 2021, it is a half-yearly and yearly form as follows:

(1) For those with a yearly aggregate turnover of more than ₹ 5 crores, the filing would be: Half-yearly from April to September, due on the 25th of October and from October to March, due on the 25th of April.

(2) For those with a yearly aggregate turnover of up to ₹ 5 crores, the filing would be: Yearly from FY 2021-22, due on the 25th of April.

Components of GST ITC-04 Form

There are 2 components contained within the ITC-04.

- Goods sent to the job worker: This includes the details of inputs or capital goods dispatched to the worker. Various details must be mentioned, such as GSTIN, challan number, tax amount etc. All details will be available from the challans.

- Goods received from the job worker: The details of goods received back are mentioned here, such as the goods which were acquired from the Principal or sent to another job worker directly from the first job worker’s place of business. All details of original challans and new challans must be included here.

GST ITC-04 Format

Guide to File GST ITC-04 Form Online

Here is a step-by-step guide for filing form ITC-04 on the GST portal.

Step 1: You need to log in to the GST Portal.

Step 2: Next, go the “Services”, click on “Returns”, and then “ITC Forms”

Step 3: Go to “Prepare Offline” in order to upload invoices.

Step 4: Once you have uploaded the invoices, then click on “Initiate Filing”.

Step 5: Select the tax period.

Step 6: Check the taxable amount and other details.

Step 7: Finally, file the return with DSC (digital signature certificate) or EVC (electronic verification code) as applicable.

The government provides considerable time to the job workers to return goods to the principal holder. GST will help in maintaining transparency in the details of input credit on goods sent for job work.

Also Read: Know About Return Filing, Format, Eligibility, and Rules of GSTR 6

Guide to File Form GST ITC-04 Offline

Step 1: You need to log in to the GST portal.

Step 2: Click on “Downloads”, then select “Offline Tools”.

Step 3: Within offline tools, you will find the option of “ITC-04 Offline Tools”.

Step 4: Save the downloaded file.

Step 5: After the download is complete, unzip the files and extract the ITC-04 offline file.

Step 6: Double click on the file to open it and click on “Enable Content”.

The excel utility contains four worksheets:

- The introduction sheet contains the “Introduction” and “Help” options.

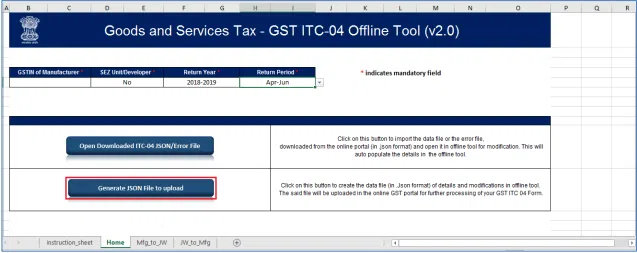

- Home: Update the basic details such as GSTIN and the period of filing the return. It has two options: import data from the file and generates JSON to upload.

- Mfg_to_JW: Here, provide the details of inputs and capital goods sent for job work.

- JW_to_Mfg: Provide the details of inputs and capital goods received from a job worker or details of inputs and capital goods sent out from the job worker’s premises.

Adding Details in the Worksheet

Step 1: In the excel file, go to the home sheet tab and enter the details mentioned below:

- GSTIN under the column “GSTIN of the manufacturer” field.

- Select “Yes/No” for whether the manufacturer falls under SEZ (special economic zone) unit or developer.

- Choose the quarter and return filing period.

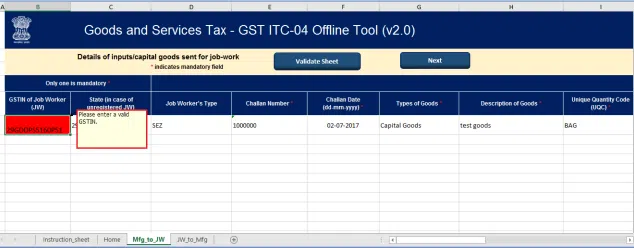

Step 2: Then proceed to the Mfg_to_JW tab:

- Enter the details of inputs and capital goods sent for job work.

- Select state, unique quantity code, types of goods and tax rates from the drop-down list.

Step 3: After updating all the details, click on the “Validate sheet”.

- If the validation were successful, the error column would report a message “The row is validated”.

- In case of unsuccessful validation, a message will pop up stating that “The errors are highlighted in red” click “OK” to proceed.

- Correct the errors as per the description mentioned in the yellow dialogue box.

- After correcting all the errors, again click on the ‘Validate Sheet’ button. If there are no errors, the error column will display a message – ‘The row is validated’.

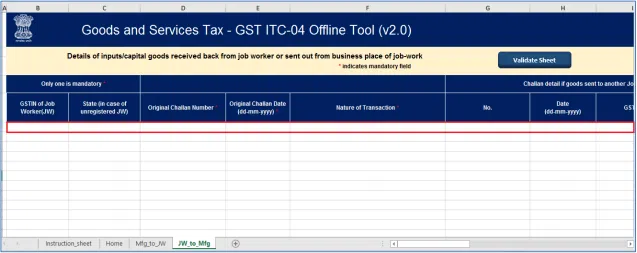

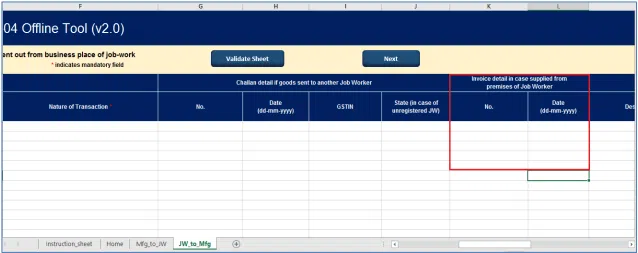

Step 4: Go to the JW_to_Mfg tab:

- Enter the details of inputs, and capital goods received back from a job worker or details of inputs and capital goods sent out from the job worker’s premises.

- Select state, unique quantity code, types of goods and tax rates from the drop-down list.

In case goods are sent to another job worker, enter the details of challan. If goods are sent from job workers’ premises, enter the details of the invoice.

Step 5: After updating all the details, click on the “Validate Sheet” button. Rectify any errors, if present.

Generating a JSON File

Step 1: After successful validation, go to the home sheet tab and click on “Generate JSON file to upload”.

Step 2: A message will pop up that processing will take some time. Click on “Ok”.

Step 3: You will see a message pop up that “Export is completed” upon successful export. Click “Ok”.

Step 4: Browse the folder to save the file. Enter the file name and click on “Save” to save the generated JSON file for upload.

Uploading the JSON File

Step 1: Go to the GST portal.

Step 2: Click on “Services”, the “Returns”, and then on “ITC Forms”

Step 3: Click on the “Prepare offline” button on the GST ITC forms page. Then, select the financial year and the period of filing the return. Click on “Search”.

Step 4: Select “Choose file” on the upload page. Browse the generated JSON file to upload and click “Open”.

The JSON file will be validated at the time of upload. If successful, all the details will be uploaded as a summary. If it fails, errors will be reported on the GST portal.

Conclusion

The ITC-04 form in GST helps in maintaining transparency in the details of the input tax credit on goods sent for job work. We hope this article gave you some perspective on the necessity and benefits of filing the ITC-04.

Do you have issues with payment management and GST? Install the Legaltree App, a friend-in-need and one-stop solution for all issues related to income-tax or GST filing, employee management and more. Try it today