In India, Form 26AS is an important tax document that each and every taxpayer should consult when filing their taxes. Annual Statement, often known as Form 26AS, keeps a consolidated track of all tax-related details linked with a PAN, such as TDS, TCS, and refunds.

The days of manually downloading Form 26AS to file your IT returns are long gone. When filing income tax returns, you can now easily import information from Form 26AS online. The employer deducts tax at source (TDS) and deposits it with the tax department. The amount of TDS deducted is specified on Form 16 and Form 26AS.

What is the purpose of Form 26AS?

The Income Tax Department maintains Form 26AS, which is a consolidated yearly statement. It contains information about each taxpayer’s tax credit matched with their PAN. The following is a list of the most essential details contained in Form 26AS:

- It contains details about the tax collected by the collectors,

- Self-assessment tax payments,

- Advance tax paid, as well as information on any refunds you’ve received throughout a fiscal year,

- Data on high-value transactions involving mutual funds, stocks, and other investments.

- Salary, interest income, and other incomes that have tax deducted at source.

- Any refund of income tax received from the IRS during the relevant fiscal year, as well as other relevant information

- Annual Report of Information (AIR) filed by various businesses according to the amount of money an individual has invested or spent, usually for high-value transactions.

Form 26AS

You can take a look at the image of Form 26AS to understand its components more clearly:

The 26AS Form’s Structure

Every financial assessment year’s Form 26AS is broken down into seven sections, each of which is outlined below.

- Form 26AS Part A: Information on Taxes Deducted at Source

- Part A1- Form 15G/Form 15H Information of Tax Deducted at Origin

- Part A2- Information of Tax Deducted at Source u/s194(IA) on the Sale of Immovable Property

- Form 26AS Part B: Information on Taxes Collected at the Source

- Form 26AS Part C: Information on Taxes Paid (Other than TDS or TCS)

- Form 26AS Part D: Refund Payment Information

- Form 26AS Part E: AIR Transaction Specifications

- Form 26AS Part F: Information of the tax deducted on the sale of immovable property under Section 194IA (For real estate buyers)

- Form 26AS Part G: Defaults for TDS (processing of defaults)

Also Read: TDS On Salary Under Section 192

Form 26AS Part A: Information on Taxes Deducted at Source

It gives you information on Tax Deducted at Source (TDS) in Indian rupees (INR). This Form focuses solely on the government pension, salary, and TDS that banks deduct from the interest you earn on your investments on a quarterly basis when this data is published.

Part A1- Form 15G/Form 15H Information of Tax Deducted at Origin

This area of the form is reserved for TDS information from Form 15G/15H. This section of the form details transactions made at financial organisations such as banks when Form 15G/15H was submitted. Since the taxpayer completed Form 15G or Form 15H, details of income for which no TDS has been deducted have been provided. This section will show “no transactions present” if Form 15G/15H has not been submitted. Based on the information on this form, they would not deduct any tax. This area also allows you to keep track of any interest you’ve earned that hasn’t been taxed.

Part A2- Information of Tax Deducted at Source u/s194 (IA) on the Sale of Immovable Property

It contains information about TDS on the sale of immovable property, such as land, under section 194-IA of the Income Tax Act.

Form 26AS Part B: Information on Taxes Collected at the Source

The details of the Tax Collected at Source (TCS) are kept in this part of the form. When selling a specific category of products, the seller collects this tax from the buyer (such as toll plaza, liquor, parking lot, etc.) The collector deposits the funds with the government every quarter.

Form 26AS Part C: Information on Taxes Paid (Other than TDS or TCS)

Part C of Form 26AS analyses and records the specifics of taxes paid that are not subject to TDS or TCS. This section will show whether you paid advance tax or self-assessment tax. When customers deposit advance tax straight to the bank, it will upload this information within 3 days of the cheque clearing.

Form 26AS Part D: Refund Payment Information

The details regarding paid refunds are kept in this section of Form 26AS. This part of the annual tax statement will include all the refunds you have applied for and received. It’s a good idea to maintain track of these details, so you can see if you’ve been reimbursed for all the tax refunds you’ve requested.

Form 26AS Part E: AIR Transaction Specifications

The Annual Information Return (AIR) transactions must be kept in Part E of Form 26AS. If you undertake certain high-value activities, e.g., property purchase, mutual fund investment, Banks and other entities, automatically report these activities to the Income Tax Department via the AIR.

Form 26AS Part F: Information of the tax deducted on the sale of immovable property under Section 194IA (For real estate buyers)

TDS must be deducted before making a payment to the seller if you have purchased a property. It is applicable when you have purchased a home for more than 50 lakhs. Part F looks into the specifics of such a deal.

Also Read: Form 26Q: TDS Return Filing for Non-Salary Deductions

Form 26AS Part G: Defaults for TDS (processing of defaults)

Defaults relevant to statement processing of TDS are filled by a deductor. It can be during a particular quarter within a financial year. It consists of information regarding the defaults in TDS that are required to be rectified by the deductor in filing correction statements, payment of required interest or other dues. They exclude any demands made by the assessing officer.

What is the procedure for viewing Form 26AS (Tax Credit Statement)?

Always check 26 AS before completing your income tax return to make sure the tax amount received in your account with the IRS is correct. There are two ways to check the 26AS form:

- By visiting the Income Tax Department’s e-filing site- https://incometaxindiaefiling.gov.in

- If your PAN is linked to your bank account, you can use your net banking account to view 26AS.

- On the TRACES website, you can view and download Form 26AS.

How to use the TRACES website to view and download Form 26AS?

Step 1: Use your income tax department login and password to access your account from the website www.incometax.gov.in. You’ll need to create an account if you don’t already have one.

Step 2: Enter your user ID, which can be a PAN, Aadhaar number. If the user ID is incorrect, an error notice will appear. Fill in the captcha code. Login by clicking on the link.

Step 3: Select the checkbox below the secure access notification to confirm it. The “Login” message is the default secure access message. This message serves as verification of the income tax website’s legitimacy. From “Profile,” the taxpayer can create their own personalised, secure access message.

Then enter your password and proceed.

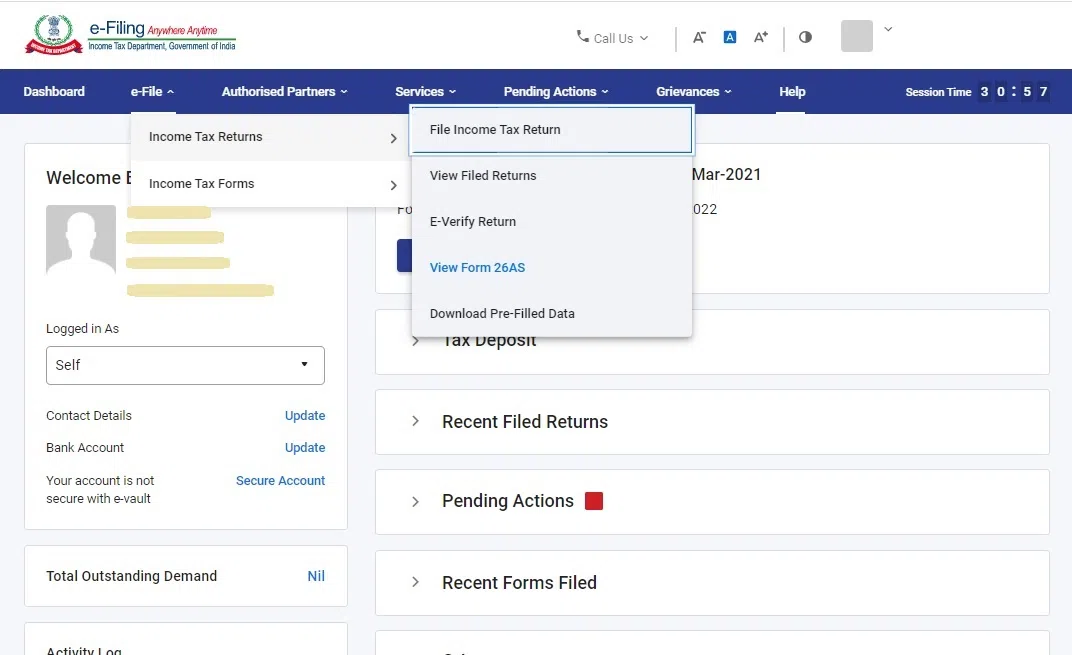

Step 4: The screen below will appear. Go to the ‘e-file’ section. Select “View Form 26AS” from the drop-down menu under “Income Tax Returns.” After that, you’ll be able to see the 26AS tax form.

Step 5: To be transferred to the TRACES website, click on the ‘Confirm’ button in the disclaimer. After that, you’ll be taken to the TRACES website.

Step 6: Once you’ve arrived at the TRACES (TDS-CPC) website, fill out the form. Select the box on the screen and then press the ‘Proceed’ button.

Step 7: To view yo ur Form 26AS, select the ‘Click View Tax Credit Form 26AS’ link at the end of the article.

Step 8: Select the Assessment Year and the Form 26AS format that you want to view. Keep the format as HTML if you wish to view it online. Once you’ve made your decision, type in the “Verification Code” and click “View/Download.” You can also save the file as a PDF.

Which banking firms allow you to view Form 26AS?

The following is a list of banks that have registered to view Form 26AS:

- Axis Bank

- Bank of India

- ICICI Bank Limited

- Bank of Maharashtra

- Bank of Baroda

- Citibank

- Corporation Bank

- City Union Bank Limited

- IDBI Bank Limited

- Indian Overseas Bank

- Kotak Mahindra Bank Limited

- Indian Bank

- Karnataka Bank

- Oriental Bank of Commerce

- State Bank of India

- State Bank of Mysore

- State Bank of Travancore

- State Bank of Patiala

- The Federal Bank Limited

- The Saraswat Co-operative Bank Limited

- UCO Bank

- Union Bank of India

What is the significance of the Form 26AS?

Since it covers all tax-related information, Form 26AS is regarded as a crucial financial document. The following are the primary goals of this form:

- It allows you to verify that the tax deducted or collected has been transferred into the government’s account on schedule.

- It assists in determining if the collector has correctly filed the TDS statement or the TCS, which describes the tax deducted or collected on your behalf.

- It facilitates the verification of tax credits and income computation before filing a tax return.

- It also includes information from the Annual Information Return (AIR), which various businesses report based on what an individual has spent their money on, typically for high-value deals.

- The citizen and the government are both addressed by Form 26AS.

- Suppose the taxpayer has no other obligations to the government. The Internal Revenue Service will enable a taxpayer to reclaim the tax credit shown on their Form 26AS.

How does Form 26AS help?

Let’s understand the aid provided by Form 26AS through an example- Mr X wishes to pay his yearly income tax on a salary of Rs. 5 lakhs (Rs. 41,000 per month) and other income of Rs. 3 lakhs. Mr X has no idea about the amount of tax that has been deducted from his other income, although his Form 16 shows the amount of tax that his employer deducted. However, TDS deducted by his employer and any other deductions will be reflected on Form 26AS.

Also Read: Form 24Q – e- Filing TDS on Salary – Procedures & Due Date

What should be checked in a TDS certificate using Form 26AS?

The details of the TDS certificate must be cross-checked and verified on Form 26AS to ensure that the TDS deducted from the payee’s earnings was indeed deposited with the IRS.

- Make sure to double-check your name, PAN, refund amount, and TDS amount on Form 26AS are all accurate. Since this is important tax information, a discrepancy could cause issues when you file your tax return.

- Check to see if your Tax Deducted at Source (TDS) has been received by the government, as indicated on the TDS certificate.

- You can double-check the TDS information on your paycheck by comparing it to the information on Form 26AS. It can be a problem for both of you if the deductor fails to file TDS or submit the tax on your behalf; you must then contact the deductor as soon as possible and request that he file the TDS return and pay the tax amount.

- It would be best to double-check that the TDS from Form 16/16A is accurately reflected in Form 26AS. If the TDS on your TDS certificate does not match the TDS reported on your Form 26AS, it means the deductor has taken the tax on your behalf and has not deposited the TDS with the IRS. In that scenario, you must act quickly by calling the deductor in question, asking for explanations for the mismatch, and having it addressed as soon as possible.

Conclusion

Having adequate information regarding Form 26AS is vital for proper tax filing. The tax deducted or paid to the collector is deposited into the government account for tax collection through this form. The overall process is effortless when all correct details are provided. By following the respective steps and guidelines highlighted in this article, we hope you will cater to this requirement with ease.