GST has been implemented since July 2017, which has brought a whole new era in the indirect tax regime. Since it is different from the previous laws, GST is treated differently and every person concerned with this change will have to adapt to these changes. One such change goes in the accounting of this system. Developers have customised Tally ERP 9 with GST so that users can easily get their accounting done and get desired reports at the click of a button. So let us know about several features offered by Tally ERP 9 for GST purposes in the GST tally PDF.

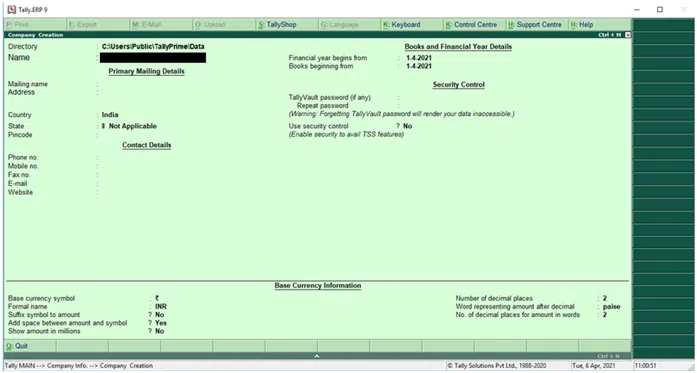

Company Creation in Tally ERP 9

The first step for accounting in tally ERP 9 is the creation of a company in the software. After a company is created, one can set the conditions for accounting and then do their accounting easily. So let us look at the steps of company creation and make tally GST notes for easy understanding.

Step 1: In the Gateway of Tally, click ALT F3 for getting into the Create Company screen.

Step 2: Enter basic details like the name of the company, mailing name, address, country, state, pin code, contact details, books and financial year details, etc.

Details to be filled in company creation:

A. Directory- This is the location on your device where all the company’s data you have created in tally will be stored. By default, the link will be inside the installation folder.

B. Name- This is the name of your company.

C. Primary mailing details-

- Mailing Name- Here you have to type the name of the company.

- Address- Enter the complete address of your company.

- Country- Enter the name of the country where the business operations are being carried out.

- State- Mention the name of the state where the company would comply with the laws.

- Pincode- Mention the Pincode of the location of the office.

D. Contact details-

- Phone No.- Mention the contact number of the office.

- Mobile No.- Mention the mobile no. of the person responsible for managing the accounting data.

- Fax No.- Mention the fax no. where any data could be received or sent.

- Email- Mention the official email Id of the company where communications can be made.

- Website- Mention the company’s website, if any.

E. Books and financial year details-

- Financial year begins from- Mention the year in which you want to create the company.

- Books beginning from- Mention the dates starting in the middle of the financial year or companies migrating from Manual Accounting to Tally ERP 9.

F. Security Control-

- Tally Vault password (if any)– One can opt for creating a password for security reasons. When one creates a password, tally also has the feature to show the strength of the password where the green colour indicates a strong password. But once you set a password, and if you forget it, then data cannot be retrieved.

- User security control- This tab enables control over the use of data by specific users. Only the person assigned the task can do it with a user ID and password.

G. Base Currency Information-

- Base Currency symbol- The currency is auto-populated based on the origin of the country selected.

- Formal Name- This is the formal name of the currency

- Suffix symbol to amount- You can add Rs., INR or ₹ in case of Indian currency or change as per your requirements and specifications

- Add space between amount and symbol- You can choose ‘yes’ or ‘no’.

- Show amounts in millions- If you select ‘yes,’ all figures will be displayed in millions and if you select ‘no,’ normal figures will be displayed.

- Number of decimal places- If you want to add decimals, you can select accordingly.

- Word representing the amount after a decimal- This is the name given to amounts after the decimal. For example in India it’s paisa and so on.

- Number of decimal points for the amount in words- You can add or skip as per your convenience.

Step 3: In the ‘maintain field’, select ‘Accounts Only’ or ‘Accounts with Inventory’ as per the specification of the company’s requirement.

Step 4: Press ‘Y’ to accept and save.

Below is the image of the company creation screen for reference.

In this way, a company is created in tally and GST features need to be activated for accounting, as discussed in the next topic.

Also Read: Reporting In Tally ERP 9 Software

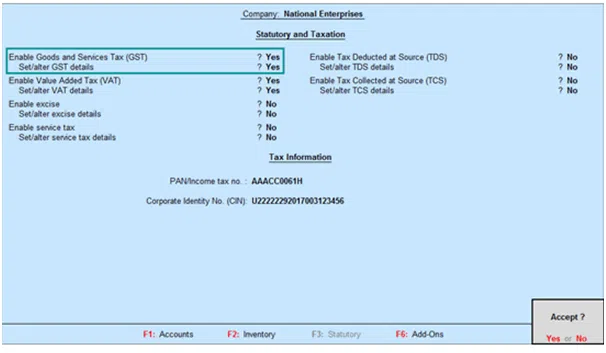

Activate GST features in Tally ERP 9

It is essential to make sure that accounting specifications are set for GST on Tally ERP 9. So let us look at the steps on how to activate GST features.

- In the ‘Gateway of Tally’, go to ‘F11: Features’ then select ‘F3: Statutory & Taxation.

- In the ‘Enable Goods and Service Tax (GST): Select ‘yes’. After selecting yes, another screen will pop up for details such as state of registration, type of registration, GST Number, etc.

- Press Y to save

After all the activation is done, you can do GST entry in tally easily.

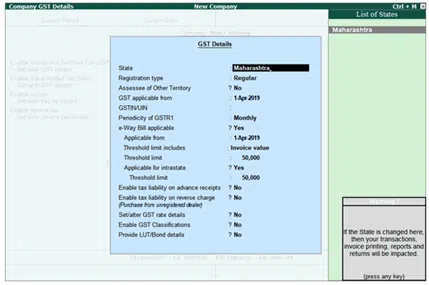

Activate GST for Regular dealers

Most of the dealers in GST are regular taxpayers. Let us have a look at the features for activating GST on tally for them.

Step 1: In the ‘Gateway of Tally’, go to ‘F11: Features’ then select ‘F3: Statutory & Taxation’.

Step 2: In the ‘Enable Goods and Service Tax (GST): Select ‘Yes’.

Step 3: In ‘Set/Alter GST details’, select ‘Yes’. After selecting ‘yes’ a new screen will pop up for entering GST details.

Step 4: In the ‘State’ option, select the state which was selected for creating a company for identifying interstate or intrastate. The state can be changed in the GST details and a warning message will appear when the state changes.

Step 5: Set ‘Registration type’, select ‘Regular’.

Step 6: In the option ‘Assessee of Other Territory’, select option ‘Yes’, if the company is located in an Exclusive Economic Zone

Step 7: Input ‘GST Applicable from’ date and GST will be charged for those transactions

Step 8: Mention ‘GSTIN/UIN’ of the business.

Step 9: Select the periodicity of GST returns- monthly or quarterly.

Step 10: Select ‘e-way bill applicable’ to ‘yes’ or ‘no’ as applicable and select value for ‘Threshold limit includes’.

Step 11: Few states have additional features. Select if applicable. Example- Kerala has ‘Kerala flood cess applicable’

Step 12: For the option, ‘Enable tax liability on advance receipts’ choose ‘Yes’ for calculating the tax on advance receipts. By default this option is disabled.

Step 13: For the option, ‘Enable tax liability on reverse charge (Purchase from unregistered dealers)’ choose ‘Yes’ for calculating the tax on reverse charge on URD purchases. By default this option is disabled.

Step 14: In the ‘Set/alter GST rate details?’ tab, enable to enter the details.

Step 15: In the ‘Enable GST Classification?’ tab, select ‘Yes’ to create and use the classifications in the GST Details screen.

Step 16: In the ‘Provide LUT/Bond details?’ tab, select ‘Yes’ and enter the period of validity

Step 17: Press Enter to save.

We hope you have understood the steps for the activation of normal taxpayers. Now let us look at the steps for activating features in the case of composition dealers of GST for tally functionality.

Also Read: How To Recover Deleted Entry in Tally ERP 9 With The Recycle Bin

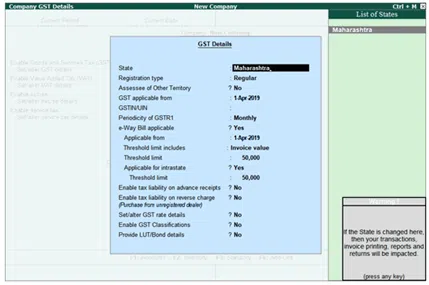

Activating GST for Composition Dealers

In GST, certain persons are registered as composition dealers. They have to pay tax as a percentage of the turnover without any GST credit. Let us look at how to activate GST in Tally ERP 9 India for Composition dealers.

Step 1: In the ‘Gateway of Tally’, go to ‘F11: Features’ then select ‘F3: Statutory & Taxation’.

Step 2: In the ‘Enable Goods and Service Tax (GST): Select ‘Yes’.

Step 3: In ‘Set/Alter GST details’, select ‘Yes’. After selecting ‘yes’ a new screen will pop up for entering GST details.

Step 4: In the ‘State’ option, select the state which was selected for creating a company for identifying interstate or intrastate. The state can be changed in the GST details and a warning message will appear when the state changes.

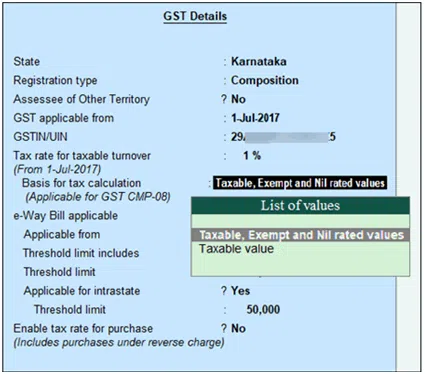

Step 5: Set ‘Registration type’, select ‘Composition’.

Step 6: In the option ‘Assessee of Other Territory’, select option ‘Yes’, if the company is located in an Exclusive Economic Zone

Step 7: Input ‘GST Applicable from’ date and GST will be charged for those transactions

Step 8: Mention ‘GSTIN/UIN’ of the business.

Step 9: In ‘Tax rate for taxable turnover’, the rate will appear 1%. If the registration type is changed from Regular to Composition, you can change the date of applicability.

Step 10: Select ‘Basis for tax calculation’ based on the business type. For outward supplies, the total of taxable, exempt and nil-rate will be considered as Taxable Value. Inward supplies in reverse charge will be considered as Taxable Value.

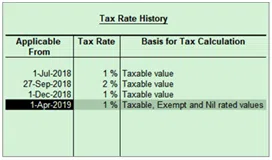

Select ‘L: Tax Rate History’, to get Tax Rates with the applicable from date and basis of calculation.

Step 11: Select ‘e-way bill applicable’ to ‘yes’ or ‘no’ as applicable and select value for ‘Threshold limit includes’.

Step 12: Few states have additional features. Select if applicable. Example- Kerala has ‘Kerala flood cess applicable’

Step 13: For the option, ‘Enable tax liability on advance receipts’ choose ‘Yes’ for calculating the tax on advance receipts. By default this option is disabled.

Step 14: For the option, ‘Enable tax liability on reverse charge (Purchase from unregistered dealers)’ choose ‘Yes’ for calculating the tax on reverse charge on URD purchases. By default this option is disabled.

Step 15: In the ‘Set/alter GST rate details?’ tab, enable to enter the details.

Step 16: In the ‘Enable GST Classification?’ tab, select ‘Yes’ to create and use the classifications in the GST Details screen

Step 17: In the ‘Provide LUT/Bond details?’ tab, select ‘Yes’ and enter the period of validity

Step 18: Press ‘Enter’ to save.

You would have found the activation features of composition dealers quite easy with the tally GST tutorial PDF. Now, the next step involves the creation of a Ledger before accounting.

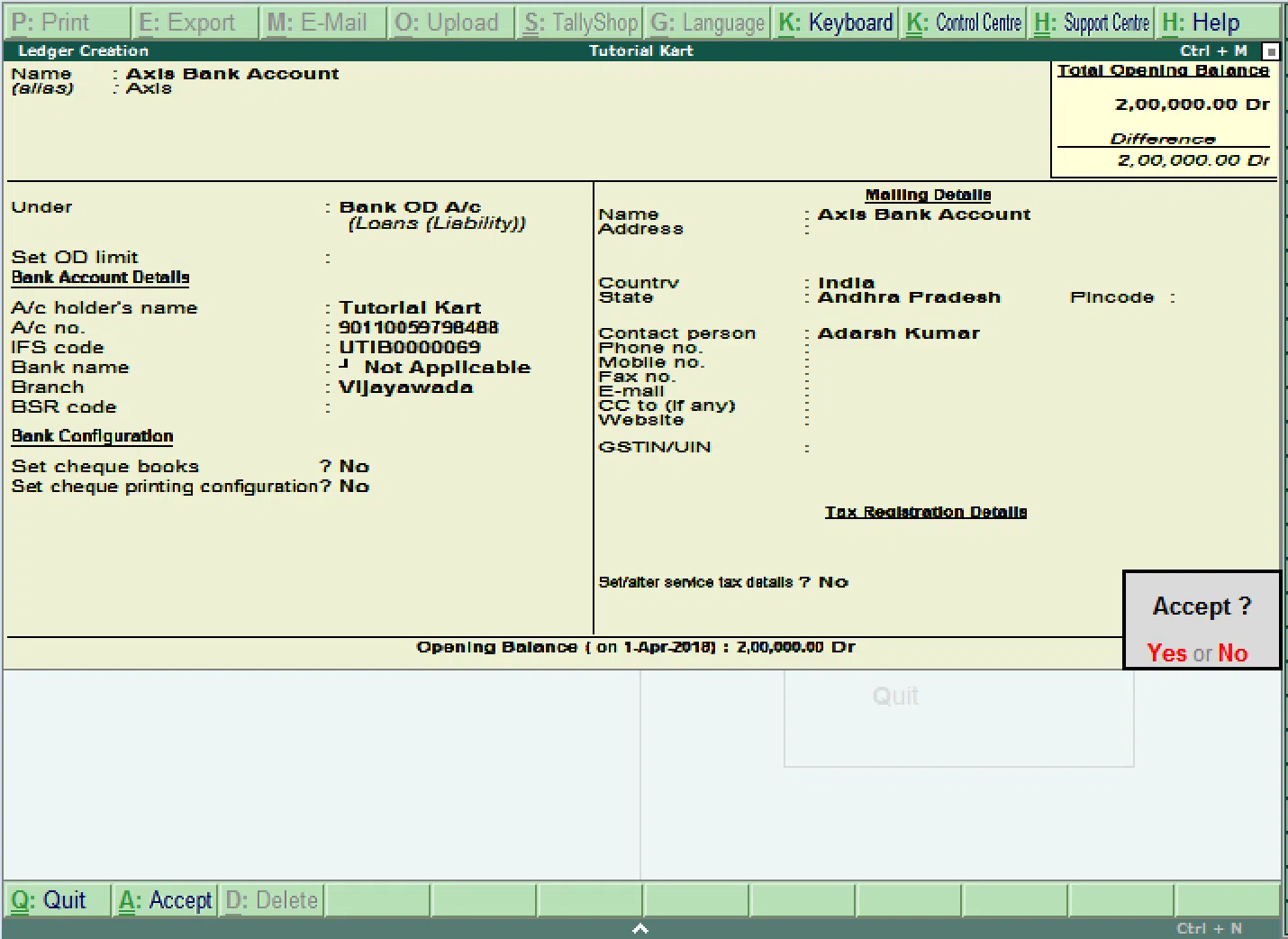

How to create Ledgers in Tally ERP9 with GST?

After activating features, you need to create ledgers for passing entries in Tally with GST. So let us have a look at the steps for creating ledgers.

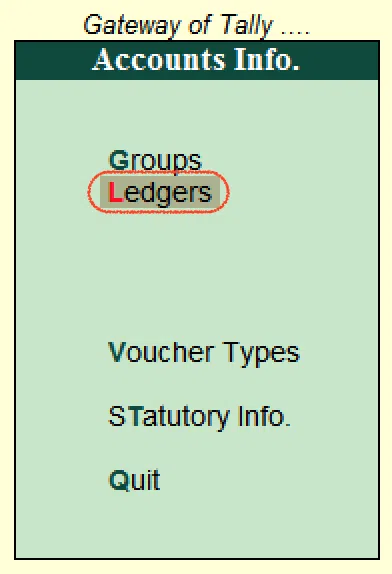

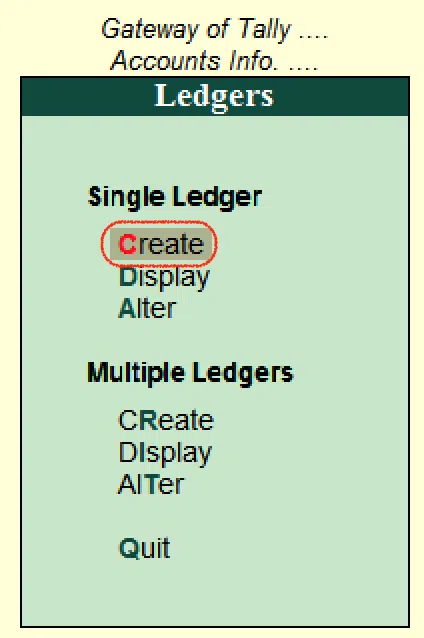

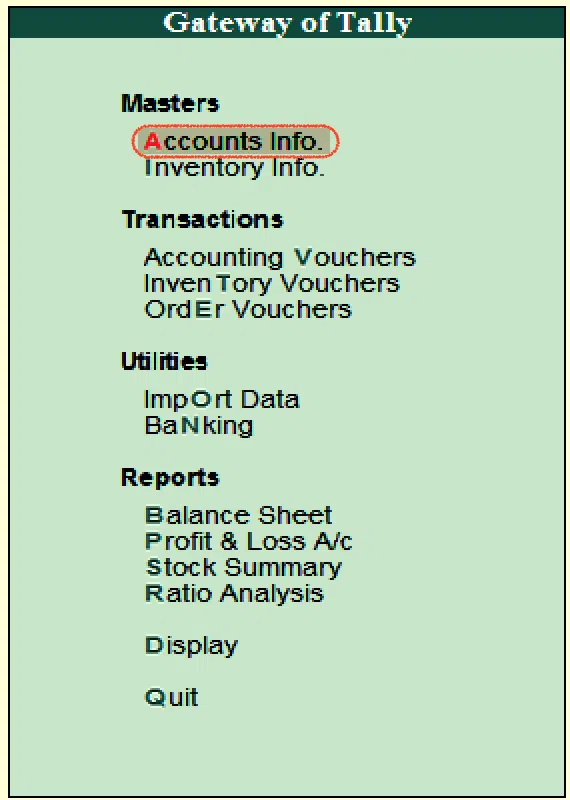

Step 1: In the ‘Gateway of tally’, go to ‘Accounts Info’. Then in ‘Ledgers’, select ‘Create’.

Step 2: Create Ledgers like Sales, Purchases, IGST, CGST, SGST, UTGST, stock item names, etc.

Step 3: Select the group to which the ledger belongs like IGST, CGST, SGST, UTGST will go under ‘duties and taxes.

Step 4: Enter other relevant details and press ‘Y’ to save.

After creating the ledger and activating features, you can pass accounting entries under Accounting Vouchers as per ERP 9 PDF.

Also Read: Displaying Cash Book in Tally

Conclusion

Tally has provided user-friendly ways for making accounting easy. You can also look at the implementation of GST in Tally ERP 9 PDF for better clarity. One can also generate GST returns from Tally ERP with functionalities provided in tally. Thus, all such functions of GST Tally ERP 9 are an ideal accounting software package.