With the help of TallyPrime, you may maintain distinctive transaction records when conducting business in several currencies. When creating a business in TallyPrime, base currency can be selected and set to a specific one. You can also see estimates of any gains or losses in foreign exchange along with conversion rates for a specific currency to the base currency.

Did You Know? You can produce vouchers in multiple currencies using ERP 9. After that, you can print an invoice. Tally 9 is the first inventory and concurrent multilingual corporate accounting program.

What do Tally Prime’s Multiple Currency Transactions Mean?

Since many organizations conduct business across countries, these transactions must be recorded in the base (home) or foreign currency. With TallyPrime’s multiple currencies in the tally feature, you can examine reports in a particular currency as needed and enter vouchers in a different one. Additionally, you may determine the exchange rates for a definite currency relative to the base currency and estimate any gains or losses in foreign exchange.

Features of Multiple Currency Transactions in TallyPrime:

There are many features of Tally in multiple–currency transactions. We will look at the most useful features from Tally in regards to multi-currency transaction in TallyPrime.

-

One Account to Track Multiple Currencies

Tally enables you to record the sending, receiving, and holding of many currencies. A multi-currency account enables you to utilise a single account number for each type of currency rather than opening multiple bank accounts with various account numbers to keep track of.

Also read: Learn How to Enable GST in Tally for your Company – Process

-

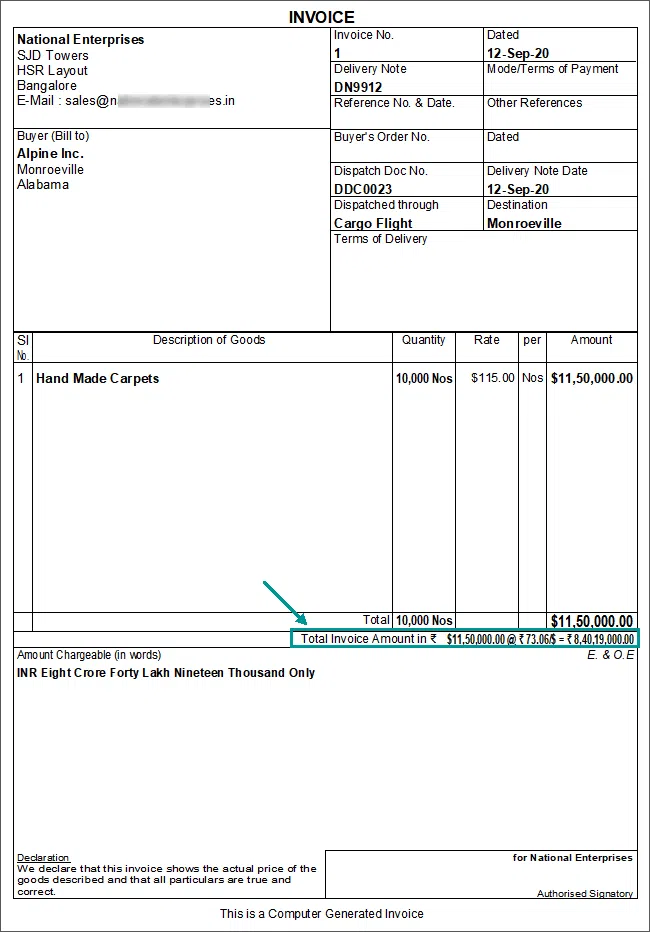

Print Invoices Using Different Currencies

Invoices with foreign currency may be required by your customer. Besides, for your records, you might also want to keep a copy of the foreign currency invoice. TallyPrime allows you to print invoices in the currency used during the transaction.

-

Record Purchase Vouchers with Multiple Currencies

You may need to buy products or services from a supplier headquartered outside of India. Additionally, the merchant may require payments to be made in that nation’s currency. Therefore, TallyPrime allows you to create a purchase voucher in the foreign currency when the base currency and the currency of the purchase transaction are different.

-

Changing Base Currency

Based on the nation that was selected when the firm was created, TallyPrime selects the base currency. For instance, TallyPrime sets ₹ as your base currency if you choose India as the country. Additionally, multiple currencies in TallyPrime feature will establish US$ as the base currency if you specify the USA as the country. Later, you may want to alter the same for your business, though. For instance, your base currency might be ₹, but depending on how often you use it for transactions, you might wish to switch to USD or another currency.

-

Forex Profit or Loss

Exchange rates fluctuate based on economic changes around the world. On a certain date or time, you may have sold a specific set of items or provided a service at a certain rate of exchange and received payment for the same on another date or time. It is possible that the exchange rate at both points in time may not be the same. Due to the fluctuating exchange rate, your business may experience forex gains or losses.

For example, assume that ₹ is your base currency in TallyPrime and USD is the other currency used for the transaction.

Now, you made a total sale of $100 on May 11, 2022, to a specific consumer headquartered in the United States. Assume that the entire sum is ₹7000 according to the currency rate on May 11, 2022, which was ₹70 for every USD. When the consumer makes the payment on May 11, May 12, or a later date, the conversion rate becomes ₹71 for each USD.

The final billing amount is ₹7100 due to the fluctuation in the exchange rate. Therefore, the trade resulted in a ₹100 forex gain for you. Such earnings and losses are displayed in TallyPrime’s Balance Sheet as Unadjusted Forex Gain/Loss. To account for such foreign exchange gains or losses, you must record a transaction in accordance with accounting standards. You may easily record these transactions with TallyPrime.

Also read: Tally Prime Data Migration & Backup from Tally ERP 9

-

Cash Forecasting Programmes for Multiple Currencies

In cash forecasting, you examine one or more bank accounts and estimate cash flow for a given period of time.

In the cash forecasting method, three currencies are recycled:

- Basic currency: The company’s currency is the base currency. The currency code for the domestic side of a foreign currency transaction functions as the node currency.

- Money for nodes: The system uses the node currency to revalue and store cash forecast amounts associated with a single cash type.

- Displaying money: The node amounts for all cash types are dynamically revalued into this common currency by the system for presentation purposes.

-

Banking in Tally Prime

You can effortlessly handle your banking needs with the help of the numerous banking services and utilities that TallyPrime offers. Banking is made simple using TallyPrime’s features, such as automatic bank reconciliation, pre-defined cheque formats, cheque management, and e-payments.

-

GST/Exchange rate

The value of the service will be calculated when buying or selling foreign currency using the table below, and a GST of 18% will then be levied. However, when these transactions happen between banks, authorized dealers, or banks and dealers, they are not covered by the GST and are not charged. The price of one currency relative to another is known as the exchange rate. When nations use gold or another accepted standard, and each currency is worth a particular amount of the metal or other standard, the exchange rate is “fixed”. On July 1st, 2017, the Good & Service Tax came into effect. As a result, the goods and services tax on currency conversion was revised from 15% to 18% and was calculated using the following taxable value: (a) A minimum of 1% of the entire amount of foreign currency transactions for up to ₹1 lakh.

How to Use Different Types of Multi-currency Transactions in TallyPrime?

As you now know more about TallyPrime’s multi-currency transactions, we will learn how to use the different types of multi-currency transactions.

- Record sales invoices with multi-currency.

- Click on Sales, then select Sales Invoices.

- Click Record Payment after selecting the invoices.

- The total amount paid in foreign currency should be entered.

- The amount received is shown under Amount Received in your base currency.

Also read: How to view Stock Details for Each Godown in Tally?

Voucher Entry with Multi-Currency

You can produce vouchers in several currencies using ERP 9. After that, you can print an invoice using a voucher entry with multiple currencies.

- Go to Gateway of Tally > Accounting Vouchers / Inventory Vouchers > F9.

- Select the party’s A/c name.

- Select the name of item.

- Enter the quantity.

- Enter the rate of the item in the required foreign currency.

For example, you might only have customers in the United States who require USD invoices, and you can alter your base currency in such a situation.

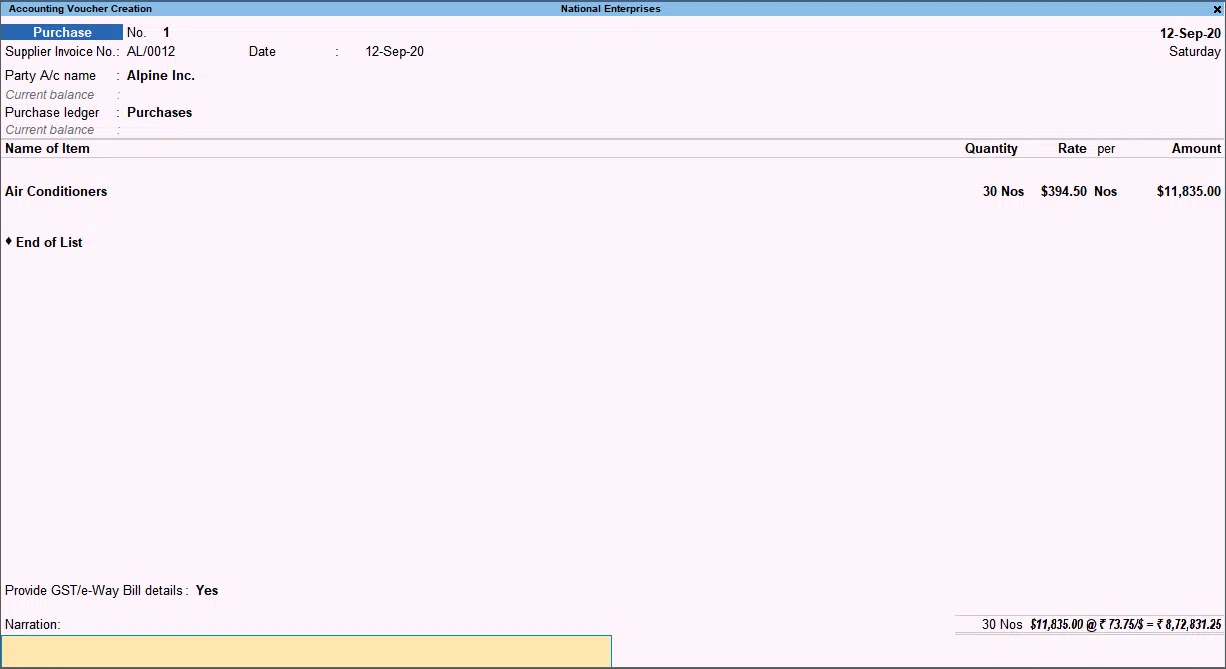

Record Purchase Voucher with multi-currency.

You can buy products or services from a supplier headquartered outside of India. Additionally, the merchant can require payments to be made in that nation’s currency. You must create a purchase voucher in the foreign currency when the base currency and the currency of the purchase transaction are different.

- Press Alt+G (Go To), then select Create Voucher and F9.

- A different option is to use Gateway of Tally > Vouchers > F9.

- Choose the name of the party a/c.

- Choose the item’s name, then type the quantity.

- Give the definite of the foreign currency.

- Enter the item’s foreign currency exchange rate.

- To view the Rate of Exchange screen, as displayed below, press Enter.

Type in the most recent exchange rate. To save, press Ctrl-A.

Create a Journal Voucher Class

After creating a ledger, you may use the predefined ledger to build a Journal Voucher Class in TallyPrime. After that, you can use the voucher class to track your foreign exchange gain or loss.

If necessary, you can make numerous Journal Voucher Classes for various currencies.

- Press Alt+G (Go To) > Alter Master > type or select Voucher Type> select Journal and press Enter.

- Specify a Voucher Class name.

- For example, Forex Gain Or Loss.

- Use Class for Forex Gain/Loss Adjustments: Yes.

- Select Forex gain or loss ledger, as shown below.

- As always, you can press Ctrl-A to save.

- View Reports in Foreign Currency

Your company could be a franchise of a multinational corporation even though it is situated in a particular nation. In such circumstances, you must provide your financial statements in the currency that the multinational firm employs with the finance department of your business.

Reports can be viewed in base money and any other TallyPrime-created tally currency.

Open the report and then take the actions outlined below.

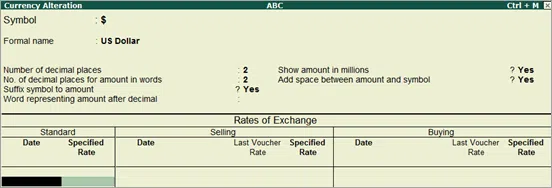

Alter Currency

You might have used a different Symbol, Formal Name, or ISO Currency Code for a currency you generated in TallyPrime from what is commonly used. Depending on the method recycled in your organization, you might also wish to adjust the number of decimal places. You can change the currency in TallyPrime in such circumstances.

The instructions below should be followed in the Currency Alteration screen.

- Date: the date at which the Specified Rate is applicable.

For example, the base currency is ₹, and the rate of $1 is ₹ 76.25 from 1-April-2022, then enter the date 1-Apr-22.

- Specified Rate: the rate of the foreign currency with respect to the base currency.

- Modify other details if needed.

Record Forex Gain or Loss Using Journal Voucher Class.

In TallyPrime, you can record forex gain or loss once you establish a Journal Voucher Class.

- Type Alt+G (Go To) > type “create voucher” or choose that option > press F7.

- Alternately, choose Vouchers in the Gateway of Tally and press F7.

- Choose the Forex Gain or Loss Voucher Class from the list.

- TallyPrime will show each ledger established to record a gain or loss in foreign exchange.

- Choose the necessary ledger, then enter the amount.

- To save, press Ctrl+A.

- As the adjusted amount is moved to the profit and loss account, it won’t appear on the balance sheet.

- Select the required ledger and enter the amount.

- Press Ctrl+A to save.

- The adjusted amount will not be displayed in the Balance sheet as it gets transferred to the Profit and Loss Account.

Also read: Learn How to Enable GST in Tally for your Company – Process

Conclusion

TallyPrime’s accounting solutions remove the burden of accountants and financial experts by automating their workflows and removing their massive workloads. The new TallyPrime is an improved and more intelligent version of Tally.

Various currencies can be created based on your company’s demands. To view and enter transactions in different currencies, turn on the Tally Multi-Currency functionality. Thanks to Tally ERP 9’s multi-currency capability, you may create vouchers in many currencies. After that, you can print an invoice using multiple currencies.