A salary is a type of payment made by an employer to an employee on a regular basis, as defined in an employment contract. Salary is paid at fixed intervals which are known as monthly payments which are one-twelfth of the annual salary. All salaries are documented in payroll accounts in accounting. An organisation makes this payment to its human resources which help in the daily operations. This payment is considered as an expense of the organisation.

Did you know?

There are six types of vouchers in Tally and you have to select the correct one to pass an entry.

Components of Salary

The salary paid to employees comprises of a number of different components namely basic salary, allowance, and perquisites. Salary structure is the details of the salary being offered, in terms of the breakup of the different components constituting the compensation.

Some of the components of the salary structure include:

Basic Salary: Basic salary is the base income of an employee, comprising 35-50 % of the total salary. It is a fixed amount that is paid prior to any reductions or increases due to bonuses, overtime, or allowances. Basic salary is determined based on the designation of the employee and the industry in which he or she works.

Allowances: Allowance is an amount payable to employees during the course of their regular job duty. It can be partially or fully taxable.

According to the employment policies, the allowances offered and the limit set on them will vary across organisations. Some of the allowances are as follows:

- Dearness Allowance: Dearness allowance is a certain percentage of the basic salary paid to employees, aimed at mitigating the impact of inflation.

- House Rent Allowance: A house rent allowance is that component of the salary which is paid to employees for meeting the cost of renting a home.

- Leave Travel Allowance: Leave travel allowance is eligible for tax exemption. It is offered by employers to their employees to cover the latter’s travel expenses when he or she is on leave from work. The amount paid as leave travel allowance is exempt from tax under Section 10(5) of the Income Tax Act, 1961.

Also read: Journal Voucher in Tally – Examples, & How to Enter Journal Vouchers in Tally

- Medical Allowance: Medical allowance is a fixed allowance paid to employees of an organisation to meet their medical expenditure.

- Gratuity: Gratuity is a lump sum benefit paid by employers to those employees who are retiring from the organization. This is only payable to those who have completed 5 or more years with the company.

- Employee Provident Fund: Employee Provident Funds are a type of employee benefit plan in which both the company and the employee invest each month. It’s a savings account that allows employees to save aside a percentage of their pay each month, with withdrawals possible after a month from the date of termination or retirement.

- Perquisites: Perquisites, often known as fringe benefits, are perks that some employees receive as a result of their job title. These are typically non-cash benefits that are provided in addition to monetary compensation. Provision of a personal car and rent-free housing are two examples of perquisites etc.

Meaning Of Salary Payable

Salary payable is the amount of liability or payment of the company towards its employees against the services provided by them. This is calculated for a specific period of time agreed upon by the employer and employee. The employee receives it at the end of the said time frame accordingly. The basic wage, overtime, bonus, and other allowances are all included in these figures. Salary payable is a current liability account containing all the balance or unpaid wages at the end of the accounting period. The amount of salary payable is reported in the balance sheet at the end of the month or year, and it is not reported in the income statement.

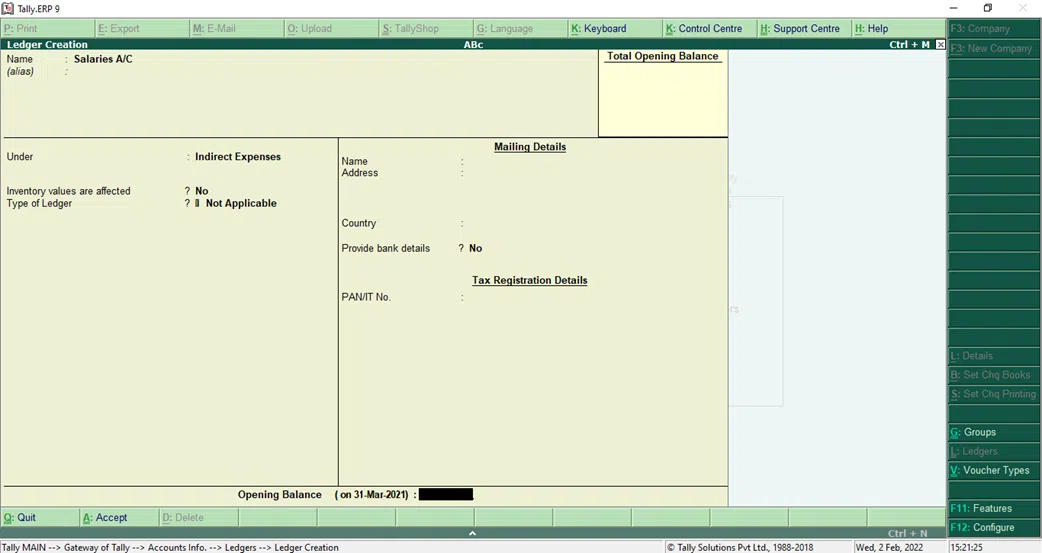

Creating Salary Account Ledger Master in Tally

Creating Salary Payable Account Ledger Master in Tally

The steps to create the salary payable master are as follows: –

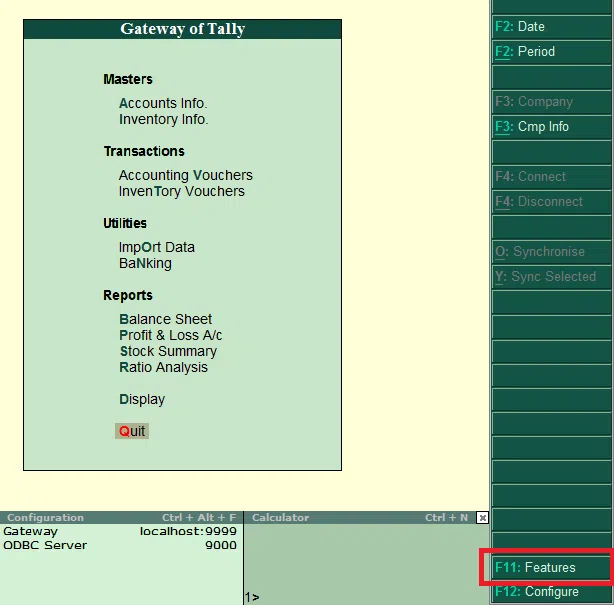

Step 1 – On the gateway of Tally, click on the Accounting Information.

Step 2 – Select Ledgers.

Step 3 – Click on create ledger under the single ledger.

Step 4 – Enter the name as salary payable.

Step 5 – Place it under the head of current liabilities.

Step 6 – Save the Master.

How to Pass a Salary Entry in Tally

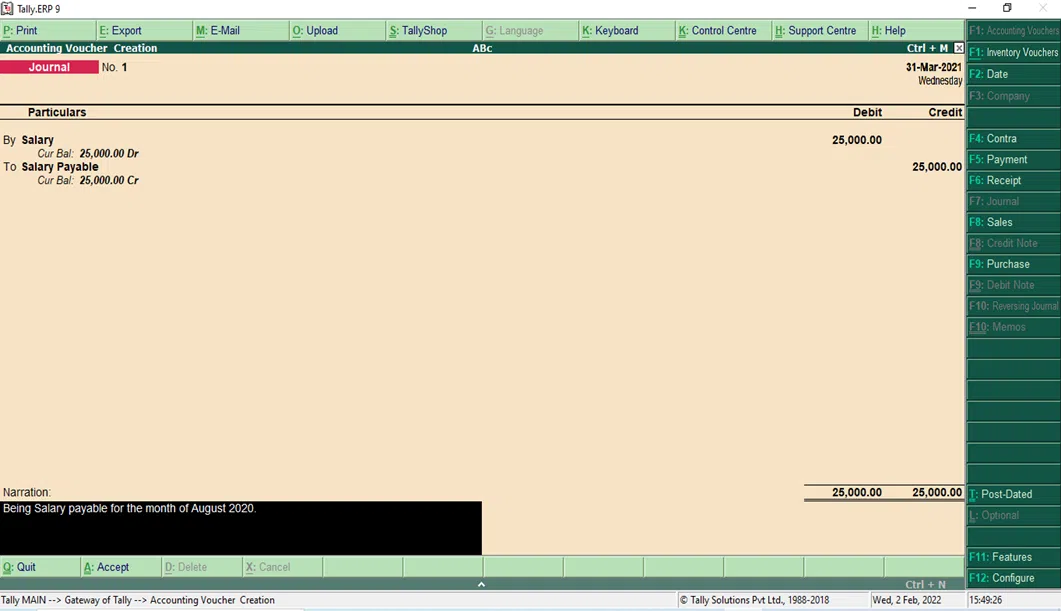

Let us take an example to understand how to pass a basic salary entry in Tally.

Cadmagnet Engineering Services Pvt Ltd has a salary payable for the month of August 2020 amounting to ₹25000. Pass a Journal Entry for this transaction.

Solution – The following steps need to be considered for passing the journal entry: –

Step 1 – On the gateway of Tally, go to Accounting Vouchers.

Step 2 – Press F7 for passing a Journal entry.

Step 3 – Now press F2 and enter the date i.e., 31.08.2020.

Step 4 – Under Particulars, pass the following entry:

By Salary ₹25000

To Salary Payable ₹25000

Step 5 – Press Enter and now write narration i.e., Being salary payable for the month of August 2020.

Step 6 – At last, press enters to save the Journal Entry.

Also read: What is an Accounting Voucher? Know Meaning and Types of Accounting Vouchers

The following is the image showing the journal entry to be passed for salary:

Passing Salary Entry after deduction of TDS by Employer

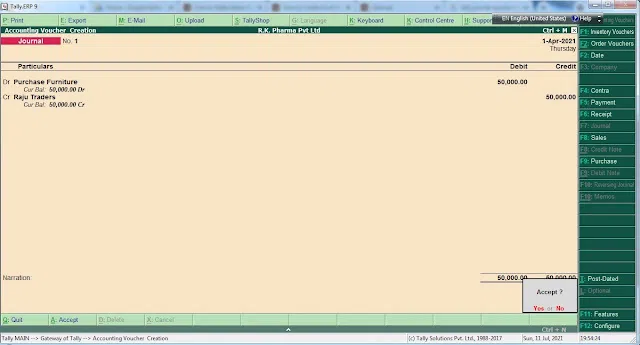

Let us take another example to understand how to pass a salary entry with deduction of TDS in Tally. The example is as follows:

Example – Cadmagnet Engineering Services Pvt Ltd has a salary payable for the month of April 2020 amounting to ₹344592.07 after deduction of TDS of ₹5600. Pass a Journal entry with respect to this transaction.

Solution – The following steps need to be considered for passing the journal entry: –

Step 1 – On the gateway of Tally, go to Accounting Vouchers.

Step 2 – Press F7 for passing a Journal entry.

Step 3 – Now press F2 and enter the date i.e., 30.04.2020.

Step 4 – Under Particulars, pass the following entry:

By Salary ₹350192.07

To Salary Payable ₹344592.07

To TDS Payable ₹5600

Step 5 – Press Enter and now write narration i.e., Being salary payable with TDS for the month of April 2020.

Also read: All About Vouchers in Tally.ERP 9

Step 6 – Finally, click on the enter button to save the Journal Entry.

Conclusion

In the above-mentioned article, we have clearly explained how to pass the salary payable entry in Tally.