Any provider who has received GST Registration in India must issue an invoice when supplying goods or services. You can use a tally GST invoice in the appropriate format, as per GST rules.

Thus, any business transaction involving products for supply to the receiver or the services to the recipient can only be done by issuing GST invoices to the recipient, irrespective of whether such a provider performs such business online or offline.

What is a GST Tax Invoice in tally?

Invoice is the most vital part of the sales procedure. It is the primary document that works as a bill for the services or products sold by your company.

What Information Must Every GST Invoice Include?

The following information must be included on a Tally GST invoice:

- The supplier’s name, address and GSTIN (Goods and Services Tax Identification Number) details.

- An invoice serial number of not more than 16 characters, in one or more series, containing alphabets or numerics or any unique characters such as slash or dash where slash is denoted as “/” and dash as “-” respectively, and any combination made accordingly, special for a financial year.

- The date it was issued.

- The recipient’s name, address, and, if registered, Goods and Services Tax Identification Number or Unique Identity Number

- If the buyer is unregistered and the value of the taxable supply is Rs 50,000 or more, the name and address of the recipient, the address of delivery, and the name of the State and its code must be provided.

- Suppose the receiver is unregistered, and the value of the taxable supply amounts less than Rs 50,000, and the recipient demands that such details be recorded in the tax invoice. In that case, the HSN system code for goods and or Service Accounting Codes for services, the recipient name and address, and the State’s name and its code must be entered.

- Product or service description

- In the case of commodities, quantity and unit or Unique Quantity Code

- The total value of products or services supplied, or both

- The taxable value of the provision of goods or services, or both, after any discount or abatement.

- The tax rate CGST/ SGST/ IGST / UTGST or cess

- The amount of tax levied on taxable products or services CGST/ SGST/ IGST / UTGST and Cess.

- In the case of a supply made within the state, trade or commerce, the place of supply and the State’s name must be added.

- Where the delivery address differs from the site of supply

- Whether or not the tax is levied on a reverse charge basis; and

- The supplier’s or his authorised representative’s signature or digital signature

Sales Types and Ledger Creation for Invoicing in tally

There are two kinds of sales –

- Local sales that are subject to CGST and SGST/UTGST

- Intestate Sales that are subject to IGST

To construct a GST invoice, sales ledgers must be created before generating sales entries in Tally.

|

Ledger Name |

Under |

Description |

|

Local Sales/ Intra State Sales |

Sales Accounts |

For intrastate sales entries |

|

Interstate Sales |

Sales Accounts |

For interstate sales entries |

|

CGST, SGST/UTGST, IGST |

Duties and Taxes |

CGST and SGST/UTGST ledgers will be used in the case of intrastate sales. IGST ledger will be selected for Inter-State Sales |

|

Item Name |

Creating an Inventory Item and using Inventory Voucher |

Arrange the goods and services by including details such as

|

|

Party Ledger |

Under Sundry Debtors |

Under Party account, mention whether the receiver is a composite dealer, consumer, registered, or unregistered dealer. |

Also Read: How to Use GST in Tally ERP 9?

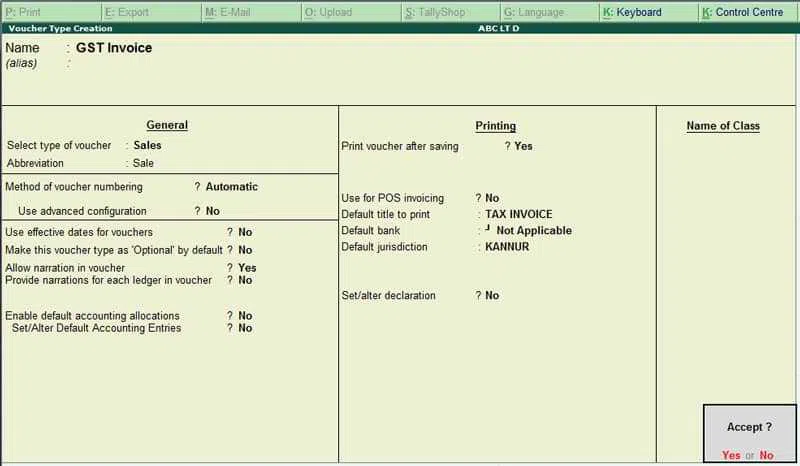

How to generate a GST Invoice in Tally. What is ERP 9?

Here are the steps to be followed for Invoicing in Tally:

Tally Gateway > Accounting Voucher (using navigation keys – Arrows up/down, left/right)

Shortcut – From Tally Gateway > To access the Accounting Voucher book, use the letter V on the keypad.

Steps You Must Follow:

Step 1

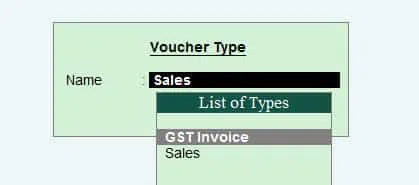

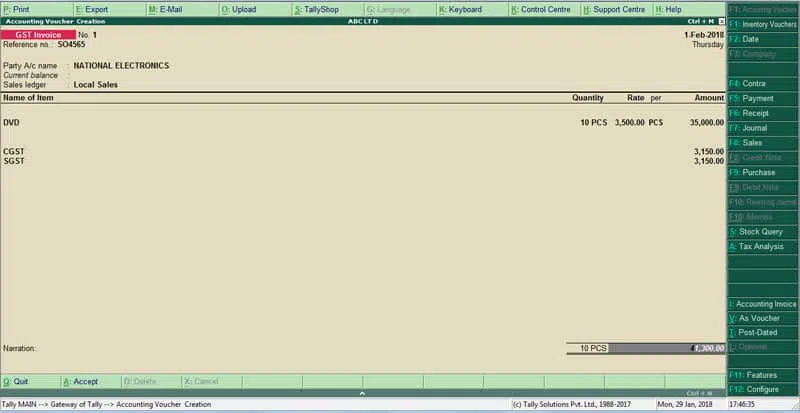

Navigate to Tally Gateway > Accounting Vouchers > F8 Sales. Write the bill’s serial number beside the invoice number, strictly adhering to the Invoicing requirements outlined above.

Step 2

Select the party ledger or the cash ledger in the Party A/c name column. Note: If the party ledger is used and the recipient is a registered dealer, it is critical to include accurate GST data of the product.

Step 3

Choose the appropriate sales ledger. Note: If the sale is local, choose the sales ledger for local taxable sales; if it is interstate, choose the sales ledger for interstate sales.

Step 4

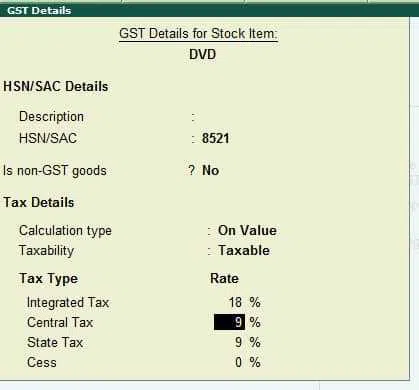

Choose the relevant Inventory item and enter the quantities and rates.

Step 5

Select the central and state tax ledgers for local sales. Select the integrated tax ledger if the sales are interstate.

Step 6

Finally, click Yes and enter to accept the GST Invoice that has been created.

Similarly, based on the situation, one could include additional information in the GST Service fee by selecting F 12: Configure such as buyer’s order number, delivery note number, additional product description, tax column, etc.

Also Read: GST Invoice Excel Create GST Compliant Invoices on your PC

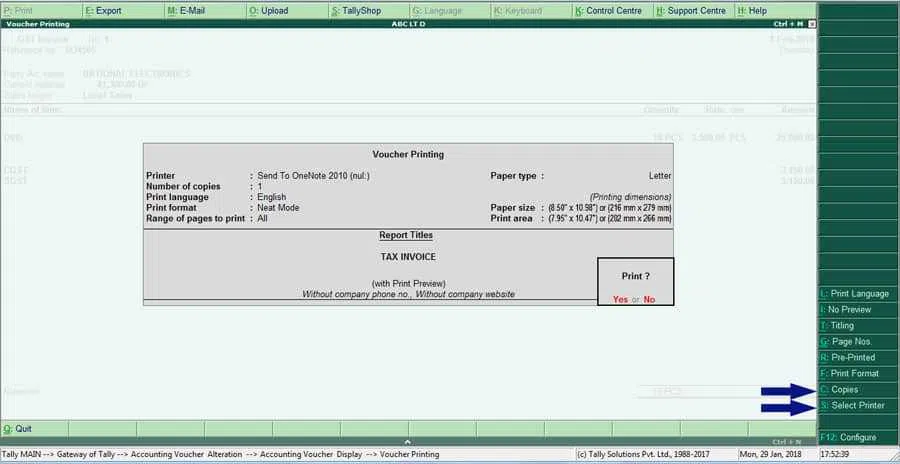

Tally GST Invoice Printing

Tally will immediately display the printing settings screen with the question Print or Not after you approve the sales voucher after billing in tally. Even if you leave without printing, you can still retrieve the voucher in alteration mode or push the page up button immediately after saving the sales voucher.

Now, either click the print button or press the shortcut key Alt P. Make any additional changes required in the configuration screen. Here, you can specify the number of copies and printers to be sent for printing. According to GST guidelines, if you are selling items with transportation, you must make 3 copies of the GST invoice: one for the buyer, one for the transporter, and one for you.

Tally Invoice Printing Customization

Tally now has more customization options for invoicing.

- Printing a Sales Invoice with an authorised Signature.

This add-on allows users to print GST Tax Invoices with pre-inserted Authorized Signatures.

E-way bill distance auto-fill

This add-on allows users to save this information in the ledger master and auto-fill it in the E-way bill. This feature will make data entering faster and error-free.

- Invoice for GST Tax 6.4

With the help of this add-on, one may efficiently print the GST Tax invoice. It displays the GST rate and amount for each line of items so that the buyer understands the tax percentages and amounts applied to the item.

- The most recent sale price of a stock item for a party 1.9

With such add on, you can learn about the past sales price and the most recent discount granted for a stock item to a specific customer at the time of invoicing. Consider the following scenario: A trader sells item ABC to client A. Customer A repurchases the item ABC after two months. When a merchant uses the Tally ERP solution to record a GST invoice, they will learn about the preceding sale price and discount.

- Print the total tax amount for each product

- Users can print the tax amount based on the product.

- The invoice is simple to understand for the customer.

- This add on is simple to use, and you configure it for Tally easily.

In addition to GST invoices, there are the following categories of invoices:

A bill of supply is similar to a GST invoice in tally ERP 9, except that it does not include any tax amount because the seller is not permitted to charge the GST to the buyer. In cases where tax can’t be levied, a bill of supply can be issued:

A registered person selling exempted goods or services and a registered person under the composition scheme.

If a registered person supplies both taxable and exempted goods or services to an unregistered person, he can issue a single invoice cum bill of supply for all such deliveries.

Combining multiple invoices into an Aggregate Invoice: If the total amount of the various invoices is less than ₹200 and the buyer is unregistered, the seller can issue a daily aggregate or bulk invoice for the multiple invoices at the end of the day.

Debit and credit notes– When goods supplied are returned, or there is a revision in the invoice value due to goods or services not being up to standard or additional goods being issued, the supplier and receiver of goods and services issue a Debit Note or Credit Note. This occurs in the following two situations: when the amount to be paid by the buyer to the seller gets reduced or when the amount due from the buyer to the seller increases.

Also Read: Types of GST in India – What is CGST, SGST and IGST?

Conclusion

Once you have taken the first and most important step, the rest of the GST procedure becomes relatively easy with the proper invoicing in place. Billing in Tally ERP 9 is a completely automatic one-step solution that, among other things, assures that your billing always adheres to the statutory GST invoicing requirements. It also separates reverse charge invoices from typical b2b (Business to Business) invoices by asking if the buyer is a registered or unregistered dealer when preparing ledger masters.

As a result, Business to Business and Business to Customer invoices are easier to distinguish. Tally ERP 9 converts all invoice input feeds to GST Returns in the same format as the GST portal, making GST returns filing easier.