Maintaining accounts is a must for all businesses, immaterial of their size. This can be done through ledgers which is a book of financial accounts . Using ledgers in Tally ERP9 means that you can account well, and there are rarely any accounting problems. A Balance Sheet or the Profit & Loss (P&L) Statement can be easily generated using the Tally ledgers option. Also, maintaining Goods and Services Tax (GST) compliance is also easy and less time-consuming in Tally. Read on to learn about creating ledgers in Tally.

Ledgers in Tally:

All ledgers are maintained in the specific group known as ledgers in Tally. The entries from these ledgers groups are then calculated from where they can be put in a balance sheet or profit and loss statement.

In Tally.ERP 9, you have two predefined ledgers such as:

1. The Profit and Loss (P&L) Ledger: This ledger in Tally has the entries that find their way into the profit and loss statement and hence the name. The account ledger is a primary ledger where the balance from the previous year’s profit or loss statement is carried over as the opening balance of the ledger. It also consists of the total amount of loss or profit made in the previous financial year. In the case of new companies, this figure is zero. This figure is shown in the liabilities side of the profit and loss account statement in the balance sheet. The ledger entries can be modified but not deleted.

2. The Cash Ledger: This ledger is typically a cash ledger, also called the cash-in-hand ledger, where you enter the opening cash balance starting from the day the books are started to be maintained. The entries in the cash ledger can be deleted or altered as the case may be. In new companies, though the P&L ledger entry is a zero value, the cash-in-hand always means the amount of cash you start the company with.

How to create a ledger in Tally-9 with an example?

The one-on-one guide to creating ledgers in Tally involves the following steps.

- F irstly, go to Gateway of Tally. This can be done by either double-clicking on the Tally icon on the desktop or using the shortcut to create ledger in Tally ALT F3.

- Look under the Accounts Info tab for the Ledgers tab from the drop-down list.

- Under the Ledgers tab, select from the drop-down list the Create tab to create a Single Ledger.

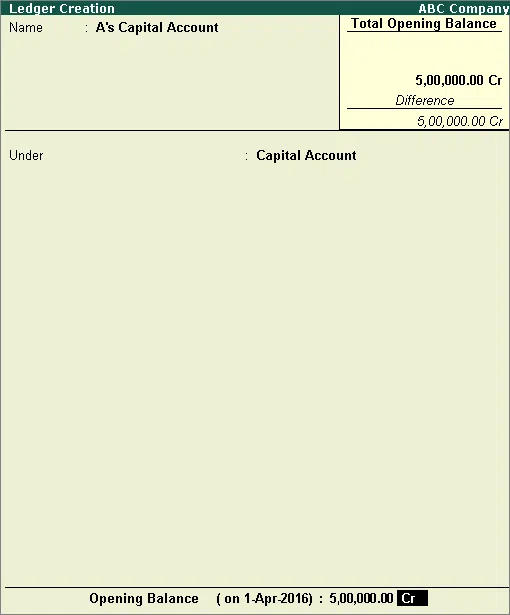

- The screen shown below appears and is called the Ledger Creation screen.

- On the Ledger Creation screen, you must name the ledger with a Name. Note that for this ledger account, duplicate names cannot be used. You cannot just call it a Capital Account. Try using B’s or A’s Capital Account instead. Name the account using the alias name of the ledger account if it does not accept the Capital Account’s name. You can then access the Capital Account ledgers using the alias/original ledger name (i.e. A’s or B’s Capital Account).

- Select from the List of Groups a group category for these ledgers.

Tally ledger entry:

- Creating a new group of ledgers

This process is easy where you can press Alt C to create a new ledger group in Tally. Note that the ledger account and its group classification can be altered as you wish at any time.

Entry in your ledger is created using the Opening Balance. This field denotes the value of the opening profit/loss and is entered as a liability or asset with its value from the opening date of the accounting books. In an existing company, the balances of credits and assets are debited to the account. For example, when you transfer your manual accounts to Tally ERP9 in the middle of a year, say June 1st of 2018, you enter the balances as revenue accounts and specify whether these are credit or debit balances.

-

Altering, Displaying or Deleting Ledgers in Tally:

The master ledger can be used if you wish to alter, display or delete any information. Note that the closing balance in the master ledger or stock-in-hand under this group cannot be altered or deleted.

- Alter or Display a ledger in Tally:

The pathway for this operation is that you go to Gateway of Tally, and under the Accounts Information, you choose Ledgers and then go to the Alter or Display tab.

The single and multiple ledgers can be altered successfully using the above selection pathway. However, do remember that not all fields in a multiple-ledger can be modified or altered.

- Deleting a ledger in Tally ERP9:

Note that a ledger with no vouchers can be deleted straight away. If you need to delete a ledger with vouchers, delete all vouchers in the particular ledger and then delete the concerning ledger.

-

Options with buttons in Master Ledger:

To make it easy and have a ready-reckoner of Master Ledger, print these short-cuts or save this table of buttons for easy operations on Master Ledger.

|

Button options |

Key options |

Uses and Description |

|

|

Groups or G |

Press Ctrl + G |

Use the Ledger creation screen and click to create a new group of accounts. |

|

|

Currency or E |

Press Ctrl + E |

Use the Ledger creation screen and click to create a Currency group. |

|

|

Cost Category or S |

Press Ctrl + S |

Use the Ledger creation screen and click to create a Cost Category. |

|

|

Cost Centre or C |

Press Ctrl + C |

Use the Ledger creation screen and click to create a Cost Center. |

|

|

Budget or B |

Press Ctrl + B |

Use the Ledger creation screen and click to create a Budget. |

|

|

Voucher Types or V |

Press Ctrl + V |

Use the Ledger creation screen and click to create a Voucher Type. |

|

Also Read: How to do Payroll Management in Tally ERP 9

Current Liabilities and Assets Ledgers:

The Current Liabilities Ledger has the account heads like Statutory Liabilities, Outstanding Liabilities, minor liabilities etc., while the assets are filed or noted in the Current Assets Ledger.

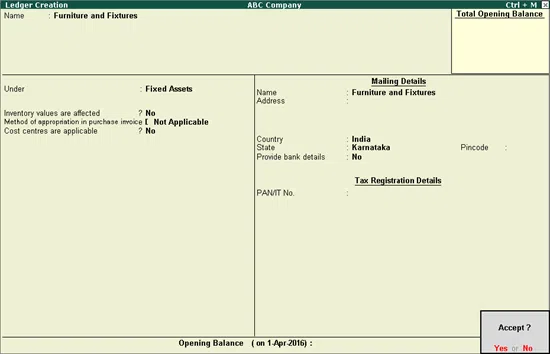

To create the Fixed Assets ledger and its various heads in the how to make ledger in Tally shortcut, you need to use the pathway of logging in to the Gateway of Tally and from there choosing the heads Accounts Info, Ledgers and Create as shown on the ledger screen below.

If you maintain an inventory of your stoc ks, you need to enable the Inventory values option. Accounts like direct purchase expenses, custom duty etc., can also use this option.

If you have to post transactions to a particular Cost Centre, you need to use the ‘Cost Centers are applicable’ option.

- To enable this option, set the option Maintain Cost Centers using a Yes with an F11 click for the Accounting Features from the Ledger creation screen.

- You can also set the Activate Interest Calculation with the Yes choice for auto calculation of interest with its rate and style like half-yearly/ quarterly etc., specified.

- If interest rates change periodically, use the Yes option to Use Advanced Parameters o ption for auto-calculation of interest.

Tax Ledgers:

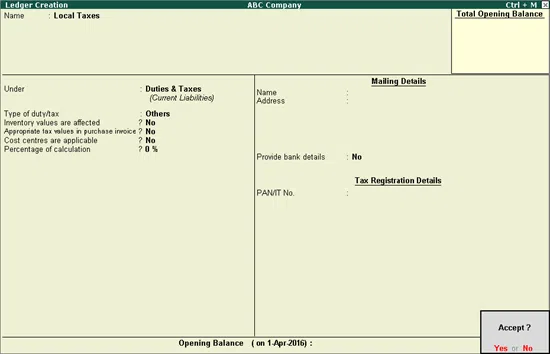

The Taxes and Duties group is to create the Tax Ledgers with tax accounts like GST, CENVAT, VAT, Sales, and Excise with their total liability.

You can create your tax ledger using the log in to Gateway of Tally and from there choosing the heads Accounts Info, Ledgers and Create ledger in Tally as shown on the ledger screen below.

The Tax Type/Duty in the Tally ledger is to be statutorily compliant. The Tally software sets the values to default and displays Others. Depending on the tax features under this Taxation and Statutory Taxes option (Use the F11 button for ledger creation shortcut in Tally), you can include options under the Type of Duty/Tax.

- If you maintain an inventory, enable the Inventory values affected option. This option can also contain Freight Inwards, direct expenses, Customs Duty, etc.

- Enable the ‘Cost Centres are applicable’ option when posting them under a particular Cost Center. You can also enable the Maintain Cost Centers Options using the option Yes in the F11 tab for Accounting Features in the Ledger creation screen.

- You can also set the Activate Interest Calculation with the Yes choice for auto calculation of interest with its rate and style like half-yearly/quarterly etc., specified. If interest rates change periodically, use the Yes option to Use Advanced Parameters option for auto-calculation of interest.

- Set the rate of Percentage of Calculation of tax as 5, 10, or 12.5% to use the auto calculate option for interest or negative values to show the discount calculation.

- In the field Method of Calculation, choose an option to calculate the Duty/Tax. For example, select monthly, quarterly, half-yearly or annual.

Rounding off Method:

Duty values may need to be rounded off in ledger creation in Tally. If the default rounding method is set to the blank value in the rounding limit option displayed, the rounding can be done upwards, downwards or normal.

Income and Expenses Ledgers:

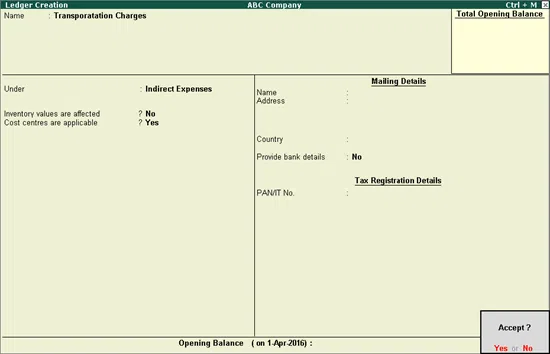

When creating ledgers, you must create a ledger account in Tally for the income and expenses.

- This is achieved by the how to create a ledger in Tally process of logging in to Gateway of Tally and choosing the heads Accounts Info, Ledgers and Create as shown on the ledger screen below.

- Next select Indirect Expenses from the Groups List in the Under field if creating the expenses ledger and choose Indirect Income to create a ledger for Indirect Income.

- Use the option Inventory values are affected? And set it to Yes if your company has inventory maintenance.

- Use the Ctrl + A option to accept the changes. You can also assign these to different cost centres using the Ledger Creation screen and the above method to assign values to cost centres.

How to Create Multiple Ledgers at a time?

- To create a ledger in Tally, you need to log in to Gateway of Tally and from there choose the heads Accounts Info, Ledgers and Create.

- Now select all items you want to group in the ledger using the Under option and enter the Ledger Name, Opening Balance, Credit/ Debit etc. specifications appropriately as in the screen displayed below.

- Save the Creation of Multi Ledgers screen. Remember that the Cost Centre is set to Yes for accounts of revenue and No for Non-revenue accounts in this mode.

- Also, since the field inventory values are affected for the Purchases and Sales accounts, you must enable the option with a Yes while it remains at No for other default options.

Enter Ledger Accounts Mailing Details

Ledger Accounts can be made to record the respective mailing addresses in Tally.

- For this, use a login to Gateway of Tally and then choose the Accounts Info, Ledgers and Create option. Now press F12 to Configure and view changes under the Ledger Configuration screen shown below.

- Use the Use addresses for ledger accounts? Option and enable it with a Yes to display the Ledger Configuration screen shown below.

- Before you enter the address, press Ctrl + A to save and accept the changes made to the Tally ledger entry, then, you can enter the mailing details required or alter the ledger creation using the Use addresses for revenue accounts option set to Yes.

Also Read: How to Generate, Print, and customize GST invoice In Your Tally ERP9

Conclusion:

Knowing how to make ledger in tally is an integral step for any business. Understanding ledger creation shortcut in tally can prove to be even more useful for accounting purposes where different financial information can be managed. We hope through this article, we have been able to convey the significance of the Tally ledger and how to use it. You can manage ledgers, even do data entry and thorough sales analysis to keep your business on track.