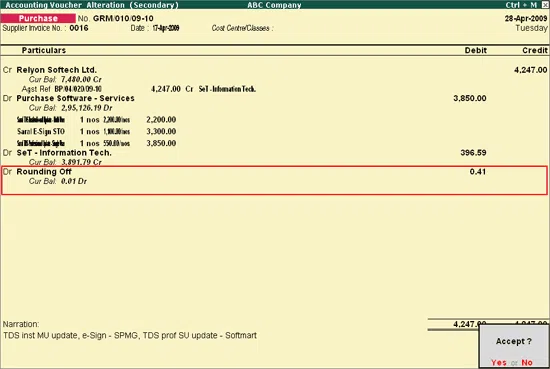

The most common accounting entries are made in Sales and Purchases. Additionally, Auto Rounding is used in various types of vouchers like Credit, Debit, Delivery and a Receipt note. Rounding off involves adjusting the smaller fractions of amounts in paise to the nearest bigger values in rupees. A classic example of upward rounding is rounding off ₹10.55 to ₹11. Rounding off ₹10.55 to ₹10 is an example of downward rounding. If the Round off ledger shows a debit balance, this is an expense to the business. If it shows a credit balance, you can treat it as an income. This is then used in the profit and loss account for calculating the profit at the end of a financial year.

Did you know?

In accounting, you can treat Rounding as an income or even as an expense.

Different types of Sales and Purchase Recording in Tally

There are two methods to record sales and purchase entries. The first is the invoice type and the other is the voucher type.

Invoice Type: In such a type of recording the sales and purchase transactions have an item-wise breakdown. This method is generally used by traders and manufacturers so that they can record transactions, especially those that have multiple GST rates.

Voucher Type: In this, the sales and purchases transactions are recorded as vouchers and no item-wise breakdown is done. This method is generally used by traders and service-based businesses who don’t maintain stocks and do not require an item-wise breakdown.

What is Automatic Round Off?

One of the most important features of Tally ERP 9, Automatic Rounding off helps to quicken up the recording of the transactions of Sales and Purchases. It can also be used in some other voucher types such as Debit Note, Credit Note, Receipt Note and a Delivery Note.

Also read: All About Banking Entry In Tally ERP 9

Meaning and Types of Rounding Off

Rounding off means the smallest fraction of the amount is adjusted to the nearest bigger value. Eg: Paisa can be rounded off to Rupee. Automatic Rounding off can be of three types:

- Normal Rounding

- Upward Rounding

- Downward Rounding

Example of Upward Rounding – ₹ 11.68 rounded off to ₹12

Example of Downward Rounding – ₹ 11.68 rounded off to ₹11

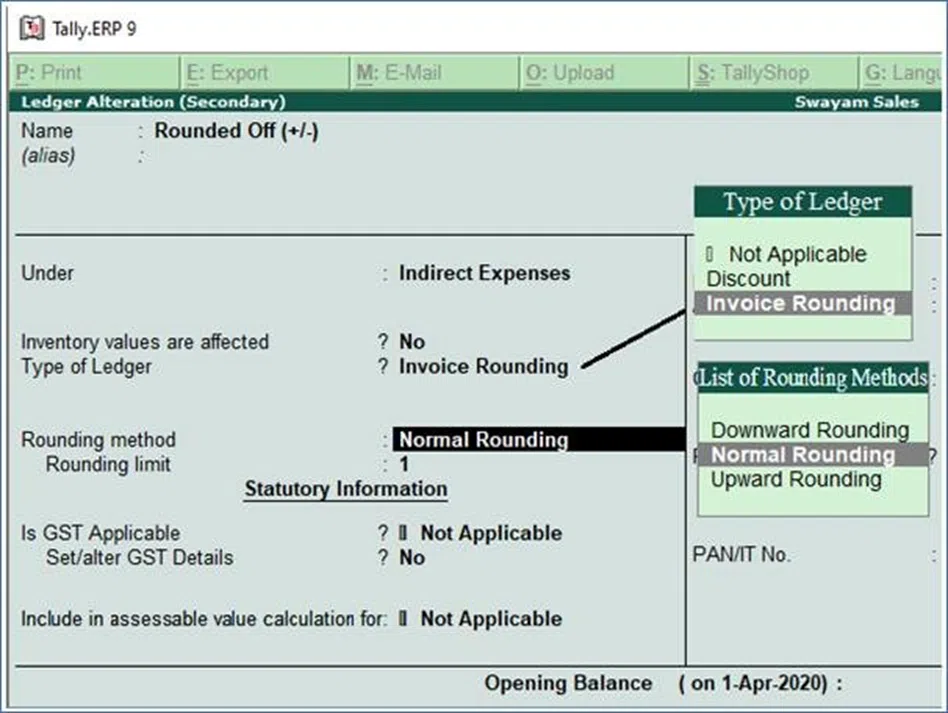

Rounding can be treated as either an expense or an income in Accounting. If the Round off ledger shows a credit balance, you have to consider it as an income gain. If the round-off ledger shows a debit balance, you have to consider that as an expense. This Rounding Off helps to calculate the amount of profit the organisation has earned at the end of a financial year. This is reflected in the profit and loss account. Therefore, in Tally ERP 9, the rounding off ledger is created under indirect expense or indirect income.

Process of automatic round off in the sales voucher

At the start, you create a ledger named Round off under indirect income or indirect expense.

You then create a voucher class. The voucher class is important as it has a number of uses in Tally accounting. You can create a voucher class in the following manner:

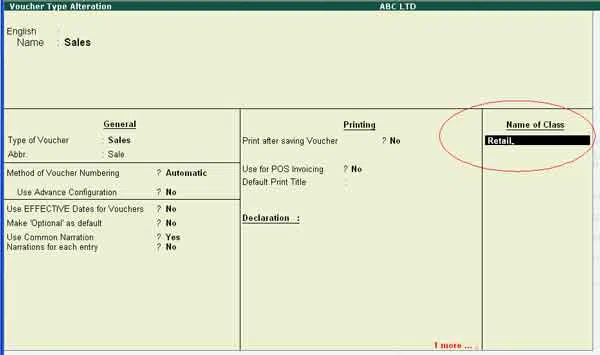

Open the Gateway of Tally, and then go to Accounts Info. Here, you will come across the voucher types. In the voucher type alteration screen, you need to select the sales voucher and press enter. Continue to press enter until you reach the “Name of the class”. A voucher class name needs to be entered there eg. Retail.

Also read: Know About Receipts and Payments Report in Tally

Under additional accounting entries

Under Additional accounting entries, we will have to enter the following:-

Ledger Name – Round off (ledger created at the beginning should be selected)

Type of calculation – Select as total amount rounding.

(There are a number of rounding calculations available such as Flat Rate, like a surcharge, as additional exercise, as user-defined value, based on quantity, on current subtotal, on item rate, on total sales, etc.)

- Press enter and a new screen named the class screen will be displayed.

- In the class screen again press enter and under default accounting allocations for each item invoice, you will have to select–

- Ledger name: Select any sales ledger here sale

- Percentage: 100 %

- Method of Rounding- Out of the three methods available Normal, Downward and Upward. Let us select Normal Rounding.

- Rounding Limit – A limit for rounding can be set up, which will be the maximum limit to which an amount is to be rounded. This can be up to ₹1, ₹10, ₹50, or ₹100. This is based upon the decision of the management. Hypothetically, set the limit to ₹ 1 in this case.

- Remove if zero: Yes

You now save the screen by pressing enter and save the voucher type alteration screen as well.

Example of entering a sales transaction

- Sold a shirt for ₹ 599.99

- Go to Gateway of tally and open an accounting voucher for sales

- Press F8 or click on the sales button to have the sales voucher screen.

- The voucher class needs to be selected from the voucher class list, where you can select the retail class created above.

- In the sales voucher, a round ledger would already exist. As soon as you put the sales entry for the sale of the shirt for ₹599.99, the quantity, rate, and round-off amount will automatically be calculated.

Also read: How to Enter Sales Return Entry in Tally ERP 9?

Conclusion

Automatic Rounding off is a very important feature of Tally ERP. Automatic Round off helps you to match things to the exact amount. At the same time, it enables making the process faster and quick. With the three types of rounding off, you can select the one which is most suitable to you. We hope the article has given you the relevant information, regarding the meaning and types of Round Off. We hope you have got clarity on the process of Automatic Round Off in sales and purchase entries in Tally ERP.