Potential borrowers of commercial credit products are rated on this CIBIL score or CCR when banks, investors and lenders or financial institutions make lending decisions based on such rating and information. The CCR (or Commercial CIBIL Credit Information and Report) has a wide array of data, your business, personal information, its needs, risk scores, previous loan repayment history etc. This information is used to judge the commercial potential borrower’s risk capacity, financial responsibility, history of serial or concurrent defaults, etc and thus creates a better credit chance and opportunity when availing a business loan.

Did you know?If you have only credit cards and stay shy of availing of loans, you are considered a bad bet to lenders who require a mixed loans credit history.

What does CIBIL STD mean in your score?

Have you applied for a loan? The CCR report applies to public limited, proprietorship, partnership and private limited companies and is closely linked and impacts lending decisions based on your Credit Information Report. The CIBIL score or the account’s status is thus a rating of your financial information and loan repayments that are not fixed and keep changing. Are you aware that the STD account status which is contained in the multi-reported comprehensive rating of your CCR or Commercial CIBIL Report means that you have a creditworthy score? Your CCIR reflects your account as an STD meaning Standard Account.

CIBIL or the Indian Credit Information Bureau is the prime credit scoring and reporting agency. It is tasked with collecting and sourcing an individual’s financial information which is collated under various heads and provides an accurate picture of the individual’s prior financial commitments, history of repayments, loans availed with all details, credit card information and its repayment history, and more. Leading financial institutions, banks, investors, etc, use the CIBIL Credit Information Report or CCIR and a good credit score to base their risk assessment and lending decisions on whenever a loan application is made to them.

What Is Sub In Cibil? What Does Cibil Std Mean?

Let’s Learn About The Terminology Used To Rate Your Score:

The CIBIL score rating generally spreads from 300 to a score of 900, the highest attainable score. Responsible borrowers have a score of 750 and over. To help you understand your score here are the different CIBIL scores, ranges and terminology used.

DBT Meaning in CIBIL

This means you have no history considered doubtful for repayments of credit loans, cards etc. To avail of a loan from banks or other financial institutions, you must prove your credit history has been that of a good re-payer of loans, and that you are a responsible borrower with no doubtful or DBT loans.

NH/NA

If your score indicates an NH or NA then your CIBIL score is reflecting that your score is “not applicable” or NA and is generally because there is “no history” or NH to score your ranking. Such a situation occurs when you have never been issued a credit card or do not have any history of taking a bank loan. Consider having a credit card or personal loan so you build your credit history and become eligible to avail loans and credit products.

SUB in CIBIL or CIBIL Score of 350 to 549

A range of 350 to 549 is a bad score in the rating system. This score indicates general late payments on your loan EMIs or bill payments on your credit card. A bad CIBIL score makes it hard to obtain a credit card as the lenders fear you are a high-risk candidate for defaulting on bills and EMIs.

CIBIL Score of 550 to 649

An average score of 550 to 649 which is a fair CIBIL score and is considered average. But, lenders and financial institutions still think it is an average score and think that you have issues in paying your EMIs or bills on time. Most loans issued to this category of borrowers carry a higher loan interest rate. This score reflects that you have an urgent need to build your loan credentials and CIBIL score.

CIBIL Score of 650 to 749

A CIBIL score between 650 and 750 indicates that you have shown a good record of credit behaviour and are on the right and responsible track in availing of loans or a credit card. You must better your CIBIL score for lenders to lend you a CIBIL-score based loan with the best interest rates. Make sure you negotiate with the bankers and lenders for the best interest rate possible.

STD Meaning in CIBIL or a CIBIL Score of 750 to 900

This range of scores shows that you are a safe bet for a loan or credit card as you are disciplined and have been promptly paying off your loan EMIs and credit card payments. Financial institutions, banks etc consider you the lowest default risk and will gladly offer you their credit products and loans.

Also Read: Steps To Correct Credit Information Report (CIR) Mistakes

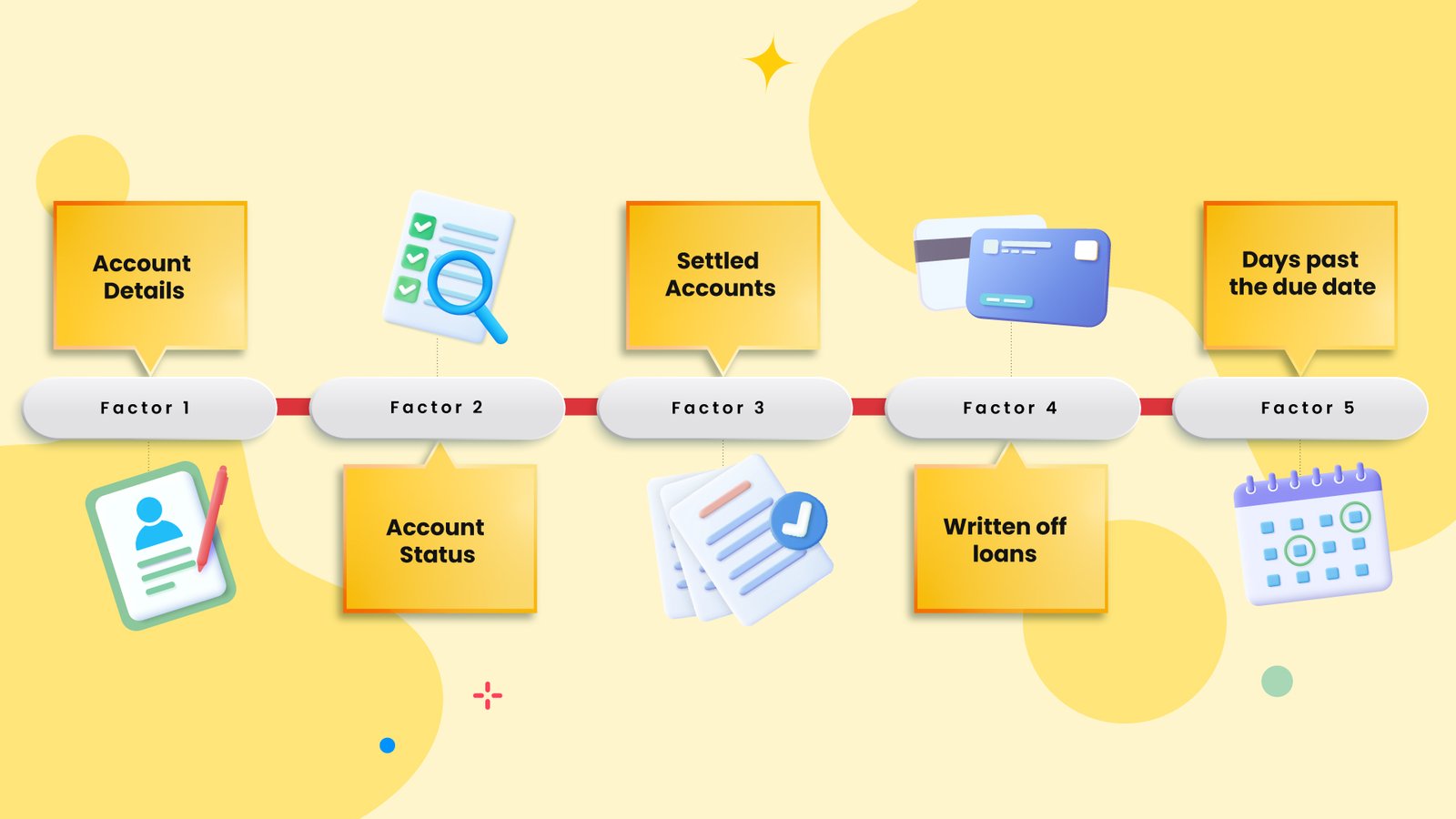

Factors Contained In and Affecting Your CCIR

So what factors and details are contained in the CIBIL CIR and score that can impact the lending decisions of banks, investors, financial institutions, investors etc? let’s quickly discuss these below.

- Account Information: The account information details show your ability to repay loans and the risk factor you pose of turning into a defaulter. It contains information about the monthly debt to burden ratio, your history of loan repayments, etc. This is closely read by the lenders. The important account factors are as follows:

- Account Details: This section has all details about your CIBIL account information and sums up all details of all your availed credit facilities, the credit facilities type like a loan for the purchase of an automobile, a home loan, issue of credit cards and more, the credit lending institution or investor’s name, the account opening date, your loan account numbers, details regarding whether it is jointly or singly availed, the last payment date, its current outstanding balance, your loan amount, and a 3-year payment record of bills and loan EMIs reflected every month.

- Account Status: Your account status reflects several details that affect the lending decision of banks and lenders. The status contains details on whether a loan has been settled, written off or if a suit was filed for its recovery. Such instances indicate a not-so-clean status and cast aspersions on your repayment and borrowing history and thus affects the lending by bankers, investors etc. Here is what some of the terms in the account status mean.

- ‘Settled’ accounts mean the lender offered a settlement partial payment to close the outstanding loan account by waiving the accumulated interest and charges in the total loan outstanding. This also means a history of pending dues for a long period and is frowned upon by creditors and lenders alike.

- Written off meaning in CIBIL: ‘Written Off’ loans are those where the credit card or loan amount outstanding amounts stay in the ‘un-cleared’ and ‘no-payments’ lists for a period exceeding 6 months or 180 days. In such circumstances, the bank or lender places the account in the “written off” list and reports this to CIBIL and reflects it in your CCIR. Thus, non-repayment of bills, a settled or written off account status affects your credit report, score and loan eligibility adversely.

- DPD full form in banking: The credit card DPD means the ‘Days past the Due Date’ in any given month when making payments on your EMIs and card bills. The ideal DPD full form is ‘STD’ or ‘000’ here.

The Classification of an asset’s payments is made by certain terms discussed below –

- STD in CIBIL or Standard Payment Account indicates the parameter for the bill or EMI payments that have been made within the provided 90 repayment days specified.

- CIBIL SMA meaning is a reporting account created when a Standard Account repayments show a tendency to deteriorate and move to the Sub-Standard account of the SMA meaning in CIBIL classification. Thus the SMA full form in CIBIL is a Special Mention Account.

- SUB or Sub-Standard Account is a reclassified sub-standard account or SUB account when its payments are made consistently after the 90 repayment days specified.

- DBT or Doubtful Accounts are those SUB accounts that remain as SUB accounts for a period exceeding 12 months.

- LSS meaning in CIBIL is a loan or credit card account in which the outstanding amount is reported as uncollectible and an identified loss or (LSS) Loss Account.

- STD xxx or DPD “XXX” means that your account information in that particular month is pending the bank’s report to CIBIL. The DPD followed by xxx in CIBIL report or any number like DPD 025 means the xxx number is 025 and that the month’s payment is made 25 days after the provided 90 days period.

- The DPD ‘000’ status means there are no due days availed and the payment is on time. This also means zero late fees were levied for repayment and DPD deviations. Hence this score is considered ideal.

Enquiry Information

Ever wondered why applying to too many credit institutions is bad for you? The CIBIL information also reports the enquiry information details in your account. That means that every time your application for a loan is received by a credit institution, the lenders send an ‘Enquiry Information’ letter to CIBIL seeking your CIBIL score, rating and history. Multiple loan applications thus reflect multiple enquiries and show excessive short-term credit-seeking behaviour. This is why lenders frown on such requests and this information goes against your otherwise good rating and CIBIL score.

Conclusion

The Bottom Line is that you need to maintain your CIBIL score well if you wish to avail of loans or credit products from financial institutions, banks, lenders, investors, etc.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting