Basic Tally is an ERP accounting software for recording a company’s day-to-day business data. Tally ERP 9 is the most recent version of Tally. Tally ERP 9 is one of the most widely used financial accounting systems in India. It is complete enterprise software for small and medium businesses. It’s a Goods and Services Tax (GST) program that is the perfect blend of functionality, control, and customizability. Inventory, Finance, Sales, Payroll, Purchasing, and other business systems can all be integrated with this program. The new release of Tally for GST has become all the more useful as all the Accounting and functions related to GST have been incorporated in it.

What is Tally ERP 9?

Learn about Tally Basic through the information given below:

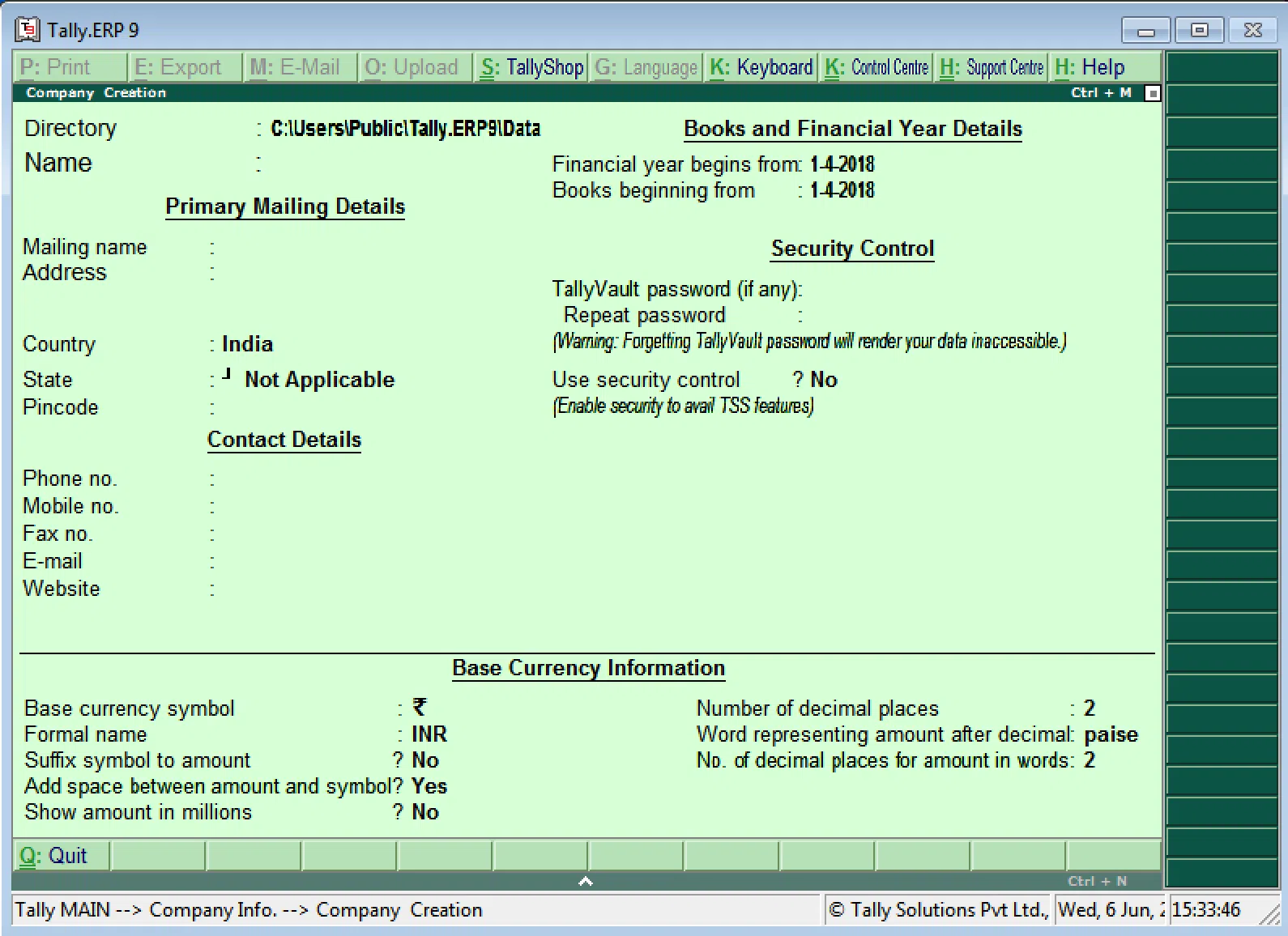

Company Creation in Tally–

- Firstly visit the Tally Gateway then press Alt F3> Create Company.

- After that, enter basic information such as the name, contact details, books of accounts, place of registration, Mailing name, etc.

- According to the Company’s demands, one out of Accounts should be for Inventory or needs to be selected to maintain books by selecting the Maintain field.

- The Financial Year will show the date from which the year will begin.

- If required, you can set a Tally Vault Password.

- Lastly, you need to save all the details by pressing the Enter Button or Y.

Details required in the Company Creation in Tally

1. Directory- It simply refers to the location where data is stored. All data input in Tally ERP 9 is saved in the tally directory.

2. Name field- The name of the company needs to be mentioned in this field.

3. Contact Details-

The following details are required:

- Phone Number- The contact number of the company needs to be mentioned in this.

- Fax Number- The fax number needs to be mentioned here on which the confirmation statements, ledger copies, and other documents might be delivered and received.

- Mobile Number- Enter the phone number of the authorised person to whom any questions about invoicing, product delivery, or product complaints should be sent.

- Website- If the company has any website, the link to the website can be given here.

- E-mail Address- The company’s E-Mail ID needs to be given here for any questions or other communications.

4. Primary Mailing Details-

The following details are required:

- Mailing Name – The name of the company needs to be mentioned in this field.

- Address along with the Country and the State – The company’s address needs to be mentioned in this field along with the state and company in which it is located for compliance purposes.

- Pincode – This should be of the place where the company’s office is located.

5. Details relating to the books and financial year

- The Financial year begins from- You must provide the financial year in the data box stating the starting year of your business. For Example – If you’re launching a business on October 1, 2021, you should start the financial year on April 1, 2021.

- The book begins from- Input the financial year of the start of your business in the data box. For Example – If you’re launching a business on October 1, 2021, you should start the financial year on April 1, 2021

6. Security control

- Setting a Tally Vault Password- If you want to prevent unauthorised access to a company’s data, you can use Tally Vault Password. This is done to encrypt the data. There are different colours of passwords which indicates the strength of the password. The green colour stands for a strong password, yellow for good, peach–orange for fair and red colour means a weak password. It is advisable to remember your tally vault password; otherwise, your data will be inaccessible.

7. Use security control

You can have complete control of data by enabling this data field. For specific purposes, you can assign different users like:

- Data entry operators could be given access to only voucher entry screens.

- Financial managers could be given access to financial data and reports.

- Billing clerks could be given access to only sales invoice vouchers.

8. Information of base currency

- Base currency Symbol- If you use the same currency for accounting, then in this data field, the country’s currency symbol is auto-selected by the previous data field.

- Formal Name- The name of currency chosen in the previous field needs to be given here.

- Suffix symbol to amount- This data field will ask you whether or not you need a currency symbol.

- Show amount in millions- The amount will be displayed in millions by setting this data field amount in the balance sheet. E.g. 100000000 will be shown as 100 (One million equals 1000000).

- Add space between amount and symbol- This data field gives space between amount and currency symbol like: Rs (space) 3200.

- Decimal places- Generally, two decimal places are used.

- Decimal places for the amount in words- This data field is used for the number of decimal places for the amount in words.

- The word representing the amount after decimal- This data field is utilised in printing, and the decimal part in the Indian currency is referred to as paisa. Set the official name of the decimal value in your currency in this box.

To keep track of the information entered on the business creation screen-

- If you have entered all of the information and it appears correct, you must accept the screen by pressing Enter and then Enter again to accept and store the information.

Note: If the Tally Vault password has been activated, the following page will ask for the user’s name and password information. After creating the company, the Tally ERP 9 will bring you to the Tally Menu Gateway, where you may build masters and enter the transactions.

Also Read: How to Generate, Print, and customize GST invoice In Your Tally ERP9

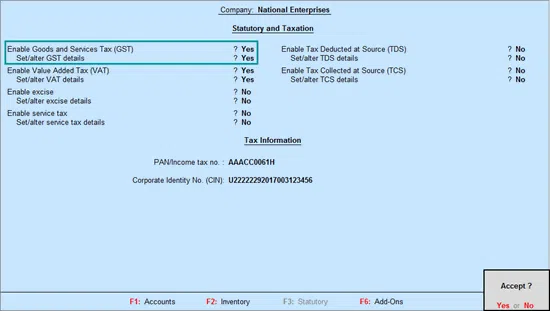

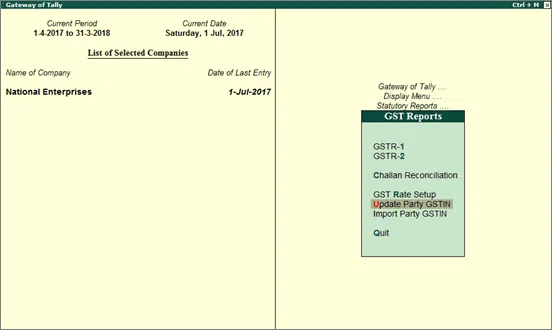

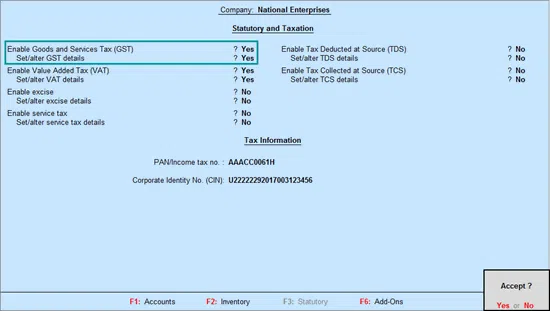

How to Enable GST in Tally?

Following are the steps in how to how to enable gst in tally ERP 9:

- First, Go to the Gateway of Tally

- Press F11: Features. After that, press F3: Statutory & Taxation for enabling GST.

- The following option will appear on the screen Enable Goods and Service Tax- Press yes.

- There will be an option to set or alter GST details – Click yes on the same.

- Another screen will open, which will show the GST Details such as Goods and Service Tax Identification Number (GSTIN), State in which company is registered, registration type, etc. After making the necessary changes if any press Y or Enter to save the changes

- You must activate the GST function in Tally.ERP 9 to use for GST compliance. GST-related features are available in ledgers, stock items, and transactions when activated, and GST returns may be prepared.

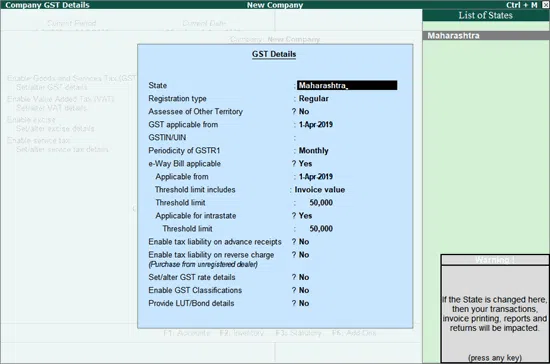

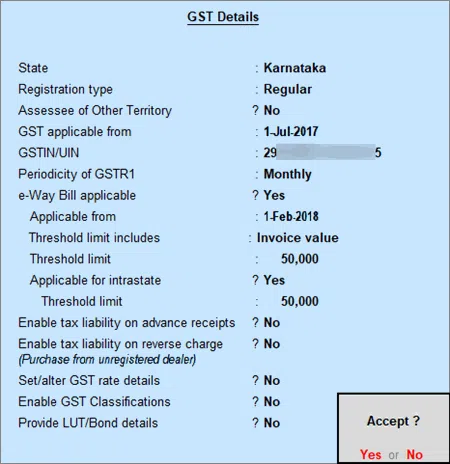

How to enable GST in tally for regular dealers?

1. Go to the company for which GST needs to be activated.

2. Then Press F11>F3

3. Click yes on Enable Goods and Service Tax

4. There will be an option to Set/alter GST details – On Clicking Yes, the screen showing GST details will appear

5. State- This field is particularly important as it shows the state in which the company is located, which helps identify intrastate and interstate transactions of the party.

- Changes can be made to this in the GST detail screen. This change will result in a change in the company master.

- Existing transactions will be effected once the company’s state is altered.

- When the state name is altered, a warning message appears to advise users of this consequence.

6. In the registration type Select Regular

7. For Location in the Exclusive Economic Zone (Another Territory), You need to select yes in the Assessee of Other Territory option.

8. Applicability of GST Beginning From – The date should be mentioned from which the GST is enabled.

9. Indicate the GSTIN/Unique Identification Number (UIN) for the company that can be printed on bills if necessary. This can also be specified later.

10. You can choose the monthly or quarterly option for your GSTR 1 based on your business turnover.

11. The option E-Way Bill Applicable is set to yes along with the applicability date and the threshold limit. In the threshold limit, the value needs to be selected. Also, change the option to yes if it is Applicable to Intrastate, i.e. it applies to your state and enter the threshold value.

Note: For a few states, additional fields may appear based on their statutory demands, such as-

- Ladakh– Recently, Ladakh was made a Union Territory separate from Jammu & Kashmir. Since then, a separate GST registration number has been assigned. This change has been made since 1st January 2020, and the new GST registration number should be entered.

- Kerala– In Tally’s new release of 6.5.3 and subsequent versions, two additional options are present: Kerala Cess Applicability and the Date from which it will be applicable. These are for those companies who have their registration as regular dealers in Kerala.

- Dadra & Nagar Haveli– There has been a new tally release for the same as the name of the Union Territory was changed to Dadra & Nagar Haveli and Daman & Diu, and it is changed in the masters automatically after the latest updates.

12. For calculation of tax liability in advance, click on yes in the given option.

13. To activate calculation of tax liability on reverse charge on purchases from Unregistered Dealers, enable the option to yes.

14. To enter GST details at the company level, enable set/alter GST rate details.

15. To create and use classification in the GST details, set Enable GST Classification to yes.

16. In the option to provide the Letter of Undertaking (LUT)/Bond Details, enter the required details.

17. At the end, for saving, you have to press the enter button.

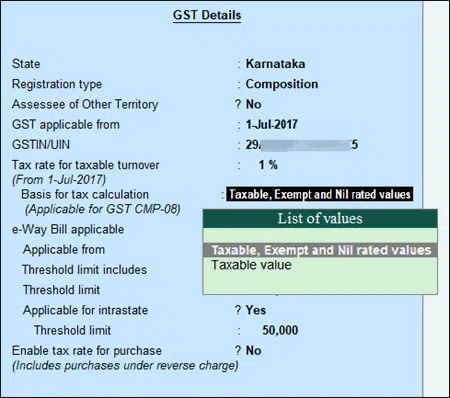

How to activate GST in tally for GST composition dealers?

GST composition dealers- Activation Procedure

In this, all the steps are the same as in the case of regular dealers except the following changes:

- While selecting Registration Type- Select Composition as the registration type.

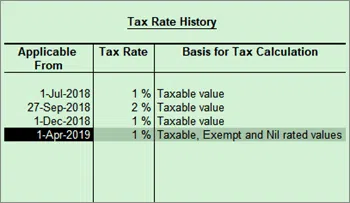

- The tax rate on taxable turnover looks to be 1%. To arrive at the taxable value, this rate is applied to your transactions.

- Note that if you change the registration type from regular to composition, the GST regular registration’s applicability date will be kept. You have the option to modify the date as needed.

- Select the Basis for tax computation based on your company type. The two options will be – a) taxable, exempt and Nil rated values,

- b) Taxable Value. The total of taxable, exempt, and nil-rated sales and the total purchases attracting reverse charge will comprise the first option. At the same time, the second option will comprise only of the total of taxable sales and total purchases attracting reverse charge.

- Select the Enable tax rate for purchases (including reverse charge purchases) option to Yes for direct calculation of GST in the transactions by entering the GST rate in each ledger and stock item. No, it should be selected for calculating GST in each transaction by providing the GST Rate.

In the end, for saving, you have to press the enter button.

Also Read: How to use GST in Tally ERP 9?

Conclusion

Tally is the most widely used and highly effective accounting software that makes an accountant’s life easier. Small and medium-sized businesses will benefit from Tally ERP 9. The main feature of Tally is the simplicity of the software, which makes Tally a popular choice as an ERP system for enterprises. The Tally ERP 9 release 6 for GST has become all the more valuable as all the Accounting and functions related to GST have been incorporated in it.

Anyone interested in entering the accounting sector or pursuing a successful career in accounting should learn basic Tally. You can go through this article for the basics of tally for beginners. We hope this article helped you know about all the steps for using tally, especially the Company Creation in Tally and How to Enable the GST in Tally.