GST Return is a statement of information given by the taxpayer to the Government or tax authorities on regular dates.

Information generally includes details like

- Business operations of the seller

- Sales value

- Value of tax

- Deductions in the GST

- Exemptions in the GST

- ITC claimed etc.

GST return is an important document that allows the tax authorities to calculate the amount of tax collected for a particular year.

The taxpayer is generally required to file a GST return in an allotted form given by the Government in electronic mode (online mode).

Also Read: Types of GST Returns: Forms, Due Dates & Penalties

What is GSTR-1?

GSTR-1 is the statement of outward supplies made during the year. It is filed monthly.

Taxpayers have to file the GSTR-1 monthly or quarterly. Every registered taxpayer doesn’t need to file the return.

What is Outward Supply?

Outward supply means the selling of goods or services or both. It can be in the form of the following

- Sale

- Transfer

- Barter

- Exchange

- License

- Rental

- Lease or disposal or any other mode

Who Should File GSTR-1?

Every registered taxpayer including a casual registered person should file the return. However, the following persons are not required to file:

- Input Service Distributor

- Non-resident

- Tax payable by the person under composition scheme

- A person who deducts tax at source

- A person who collects tax at the source

What Is The Form For Submission Of Details Of Outward Supplies?

A taxpayer has to submit the details of outward supplies electronically (online mode) in the form GSTR-1.

GSTR-1 DUE DATES

A taxpayer must file the return on or before the 10th day of the next month. In other words, taxpayers can file the GSTR-1 return of a month any time between the 1st and 10th day of the next month.

For example, A taxpayer can file the details of October month on or before 10th November.

Due Dates depend on the total sales of a business.

-

GSTR-1 Due Date When Turnover Is Upto ₹1.5 crores

The government allows the quarterly (i.e. after every three months) filing of GSTR-1 by small taxpayers with total annual sales of up to ₹1.5 crores in the previous financial year or the present financial year.

|

Months(Quarterly) |

GSTR-1 Due Date |

|

October 2020 to December 2020 |

13th January 2021 |

|

January 2021 to March 2021 |

13th April 2021 |

|

April 2021 to June 2021 |

13th July 2021 |

Note- Earlier, the filing of quarter GSTR-1 return was due by the last day of the month.

Also Read: GST Return – Who Should File, Due Dates & Types of GST Returns

-

GSTR-1 Due Date When Turnover Exceeds ₹1.5 crores

Taxpayers with a total sales value of above ₹1.5 crores have to file GSTR-1 every month.

|

Period (Monthly) |

GSTR-1 Due Dates |

|

April 2021 |

11th May 2021 |

|

March 2021 |

11th April 2021 |

|

February 2021 |

11th March 2021 |

|

January 2021 |

11th February 2021 |

|

December 2020 |

11th January 2021 |

|

November 2020 |

11th December 2020 |

|

October 2020 |

11th November 2020 |

|

September 2020 |

11th October 2020 |

|

August 2020 |

11th September 2020 |

|

July 2020 |

11th August 2020 |

Note- The Commissioner or Commissioner of State GST has a right to extend the due dates for filing GSTR-1

What Are The Details of GSTR-1?

- Basic and other details

- GSTIN (goods and service tax identification number)

- Legal name and trade name

- Total sales value in the previous year

- Tax period

- HSN – wise summary of outward supplies

- Details of documents issued

- Advances received/advances adjusted

- Details of outward supplies

- B2B (business to business)

- B2C (business to customer)

- Zero-rated and Deemed exports

- Debits/Credits notes issued

- Nil rated/ Exempted/ Non GST

- Amendments for the previous period

The government also asks to fill the information in the GSTR-1 relating to the place of supply (means a place where a seller sells the Goods) because the place of supply is important for deciding the share of every state in the tax revenue collected by the Government.

Details Of Filing GSTR-1

A taxpayer has to file the GSTR-1 with the following details

|

Invoice Wise Details- |

When you buy goods or groceries from a business for your business you get a tax invoice and it has the amount of tax mentioned in it. In the case of the person making those sales:

|

|

Consolidated Details |

A person making sales has to give details of total sales made, tax amount on a total basis but not invoice details in GSTR-1. This form shows the following details:

|

|

Debit and Credit Note |

Registered and unregistered persons (seller and buyer) receive these notes whenever required during the time of sales. |

Uploading invoices depends on the goods sold to a business or a customer. In other words, it depends on whether it is a B2B or B2C transaction and whether the sale takes place within or outside the state.

Also Read: GST Certificate Download

B2B and B2C transactions

-

B2B Transactions

B2B transactions are business to business transactions. In these transactions, the business registered under the GST buys goods or services from another registered business or sells goods or services to another registered business.

-

B2C Transactions

B2C transactions are business-to-customer transactions. In such types of transactions, the seller is registered under GST and the person buying the goods is a customer and unregistered.

Uploading Invoices

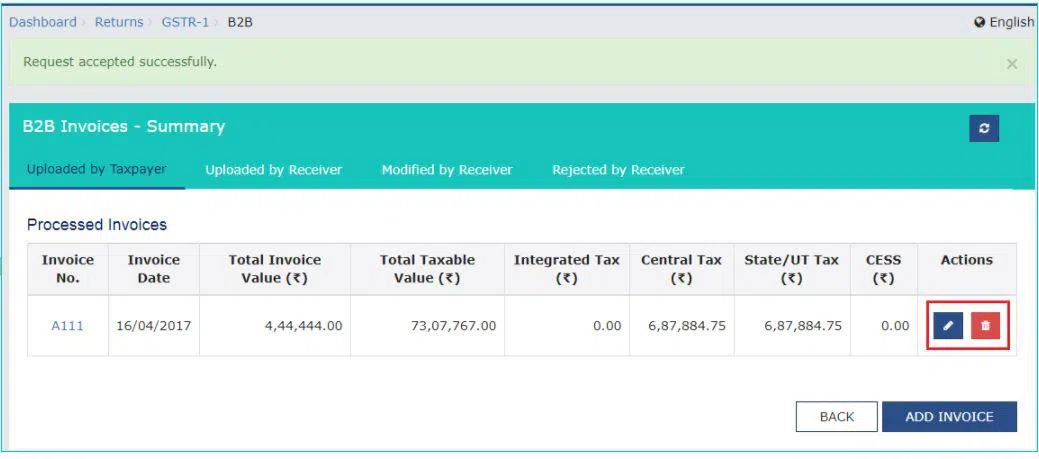

- In the case of B2B sales, the taxpayer has to upload all the invoices even if the business sells the goods to another business either within the state or outside the state. This helps the other business in claiming ITC based on the invoice given to them.

- In the case of B2C sales, the seller doesn’t have to upload the invoices because the buyer (customer) will not take ITC.

- Taxpayers can upload invoices at any time during the tax period and not just while GSTR-1 filing.

How to File GSTR – 1?

There are two methods for GSTR-1 Filing:

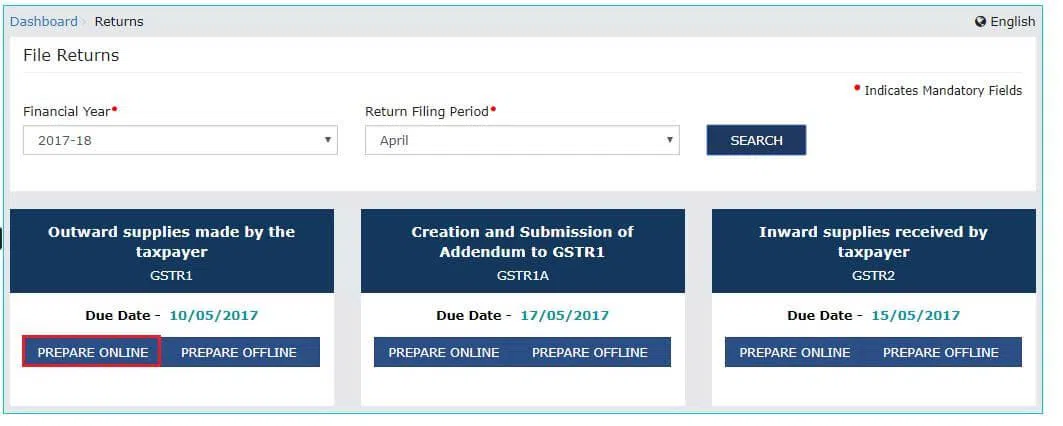

Method 1- Prepare Online

- When you are filing the statement you need a full internet connection and you have to keep yourself logged-in in the GST portal at the time while you are filing the GSTR-1. This method is best for small transactions. The taxpayer has to fill in every detail online.

Method 2- Prepare Offline

-

Taxpayers can use this method when transactions are in bulk. The taxpayer has to use an excel sheet to fill in all the details. Once filled in, upload the sheet then submit and file the statement.

Steps to file GSTR-1 Online

Step 1: Log in to the GST portal with your login details

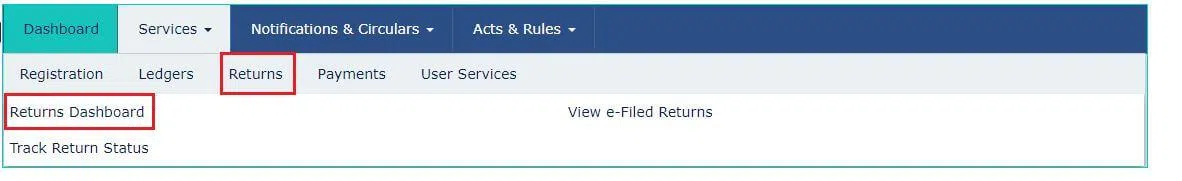

Step 2: The following screen will appear then click on the Returns Dashboard option

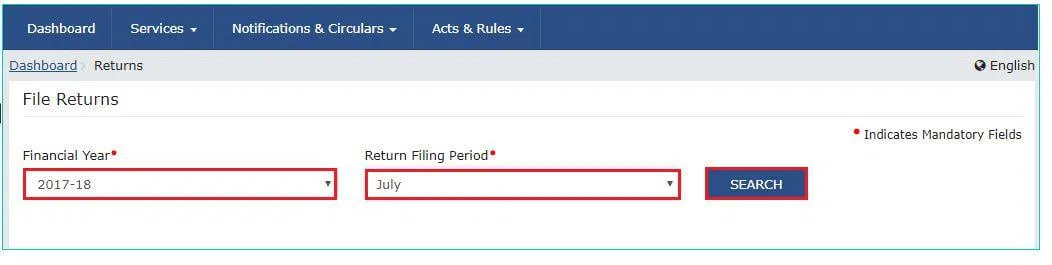

Step 3: Select the financial year and the month for which the return you want to file

Step 4: Then click on the GSTR-1 option to prepare it online

Step 5: Fill in the details in their respective columns.

Step 6: After adding all the details in their respective columns, click on generate summary option and wait for the summary to generate

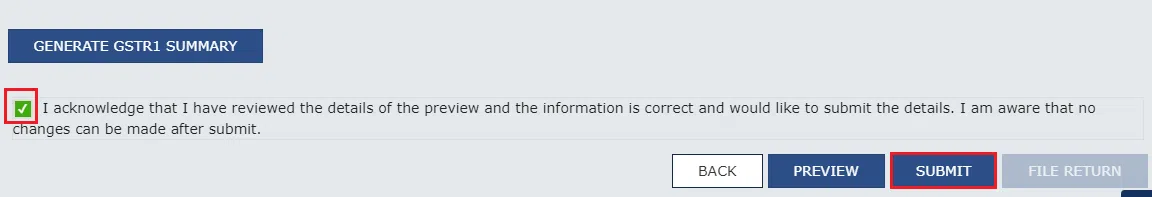

Step 7: Next, check the data once again and then click on submit button

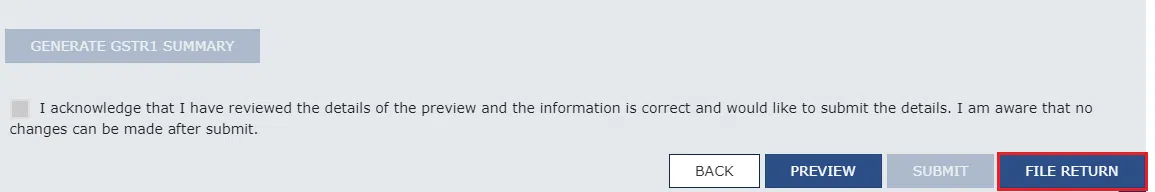

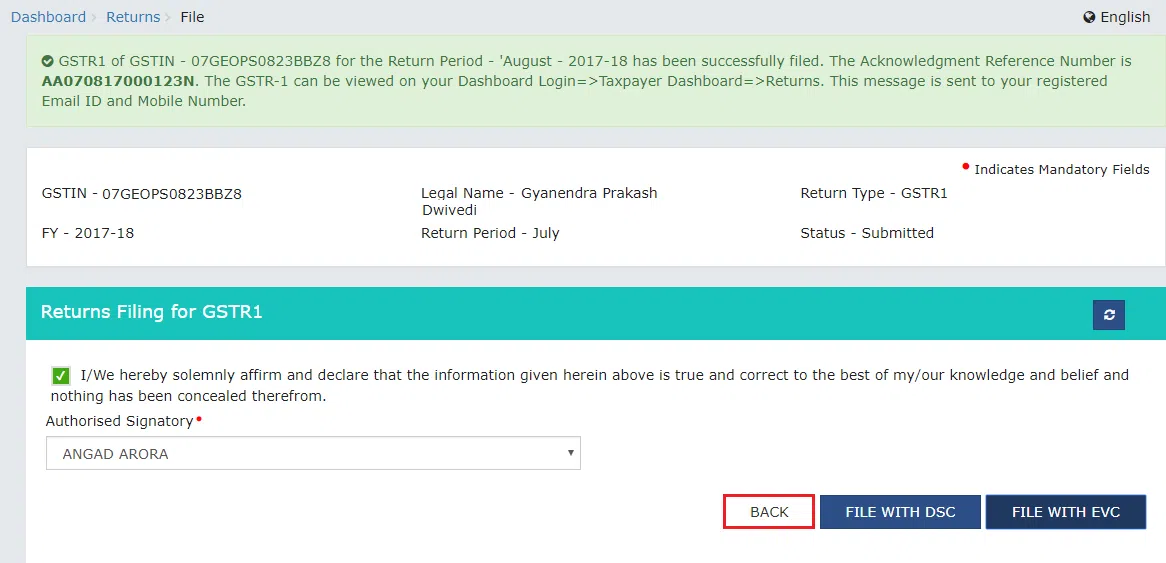

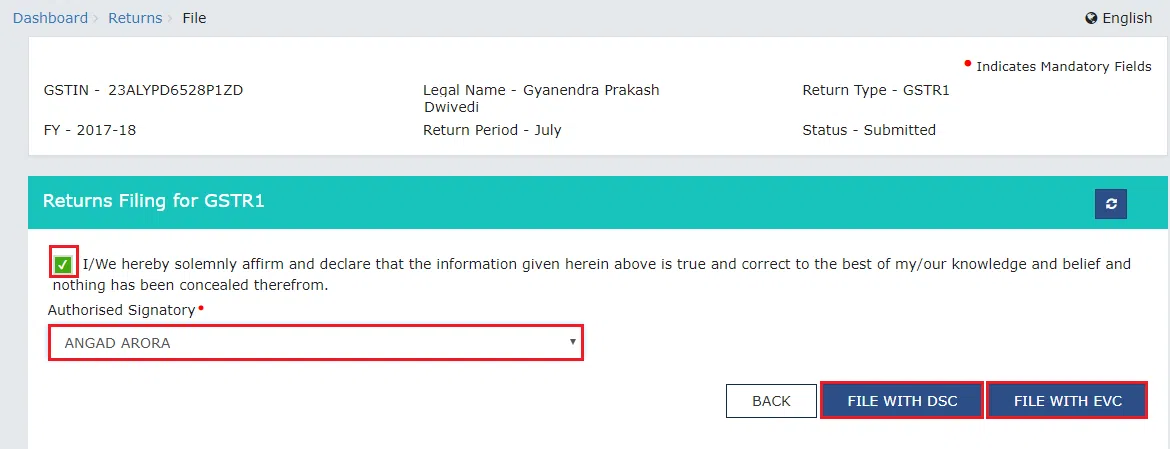

Step 8: After submission of data, click on the option file return and the following screen will appear

Step 9: Select the name of the person authorized to file the return

Then click on the file with the EVC option ( after verifying the OTP sent to the registered mobile number you can file the return)

Step 10: By clicking on the file with the EVC option, the below screen will appear, enter the OTP received on the registered mobile number and click on verify. Now your return is successfully filed.

Also Read: GST State Code List and Jurisdiction

Amendments(Changes) of Details In GSTR-1 and Correction of Mistakes

Changing of Details In The GSTR-1 Provided In The Previous Months:

GSTR-1 provides tables in the dashboard on the GST portal on the page of returns, where you can find the “amendment table” for each return that you have filed in the previous months.

Generally, these tables show the details like:

- Original debit notes

- Original credit notes

- Refund vouchers issued by the taxpayer

- It also includes the information of revised debit notes, credit notes

- Refund vouchers of GSTR-1 given.

In those amendment tables, you can change (add, delete or include any document) till the submission of return. Once you have submitted you cannot take back the return, but you can correct it in the Amendment table while filing.

Correction of Mistakes In The Invoice:

If you find any mistake or deletion of detail in the invoice, you can correct the same during the tax period in which such a mistake took place in the return filed.

For example, A taxpayer finds a mistake in the details of the invoice in the GSTR-1 for August month after submitting. He can correct the said mistake in the GSTR-1 in October month.

How To Amend GSTR-1 After Filing?

Below are the steps a taxpayer has to follow to amend(change) the invoice

- Log into GST portal

- Click on the form GSTR-1

- You can find individual tabs for each invoice

- Click on the table you want to amend with the “amended” option

- Amend the invoice, debit note or credit note

- A screen will appear asking to input the financial year and invoice number you want to amend

- Fill in the required details and click on amend option

Is There Any Time Limit For The Correction Of Errors?

Suppose for some reason, you could not correct at the time of filing of GSTR-1 for October month then you can make such corrections in the coming months.

However, the maximum time limit within which a taxpayer can make such corrections is given below:

- Date of filing of monthly return for September following the end of the financial year to which such details belong or

- Date of filing of the related annual return

Can a Taxpayer Modify The Invoice of GSTR-1 After Uploading?

Yes, taxpayers can modify/delete the invoices any number of times till they submit the GSTR-1. The taxpayers can find the uploaded invoice details in a draft file till they submit the GSTR-1. The taxpayer can make changes to it irrespective of the due date.

GSTR-1 Late Fees And Penalty

The late fee is an amount charged by the Government for delay in filing a GST return. Government charges the late fee for each day of delay when a taxpayer misses filing a GST return.

GSTR-1 Late filing fees for not filing GSTR-1 is ₹200 per day. The Government charges the late fee for GSTR-1 from the date after the due date till the date of filing.

The Government has brought relief to the taxpayers by reducing the GSTR-1 late fees because of the current pandemic situation.

As of now, after the notification given by the Government up to February 2021, the government continues to charge at a reduced rate of Rs.50 per day of delay from Rs.200 per day of delay and Rs.20 in case of nil return.

For example:

If a taxpayer didn’t file a GST return for August 2020 for which the due date was 10th September 2020 and if the taxpayer files the return after a delay of 10 days then the GSTR-1 late filing fees for the delay of 10 days will be 10*200₹ = ₹2000 (for now, the government charges the reduced rate i.e., ₹50. Therefore, 10*50₹= ₹500) and if it is a nil return then the late fee is ₹20.

Some Important Points

- A taxpayer needs to file the GSTR-1 even if there is no business activity. In this case, a taxpayer has to file a Nil Return.

- As a taxpayer, if you choose for voluntary cancellation of GSTIN then you have to file GSTR-1 for the time you had been active with your business.

- In cases where taxpayers convert themselves from a normal taxpayer to a composition taxpayer then they have to file the GSTR-1 only for that time as a normal taxpayer.

Also Read: GST Tracking – Track Your Application Status Online

Conclusion

One of the most important things in the GST system is timely uploading and submission of the returns and statements. It is important to stay informed of the GSTR-1 Returns and related details if you are running a business, whether big or small.