The use of cheque books, deposit slips, and other paper forms has been greatly reduced thanks to the internet banking facilities that are now available. A cancelled cheque is significant in a banking or financial transaction. Therefore, you must be aware of what a cancelled cheque means and the circumstances in which it may be useful. Read on to know more about the uses and format of cancelled cheque.

What is a Cheque?

A cheque is an instrument that instructs the bank to pay a specific amount from the drawer’s bank account to whomever it is issued to or to the order of the specified person or bearer of the cheque.

A cheque has three parties:

- Drawer of the cheque: The drawer is the person who signs the cheque or orders the bank to pay a specified sum of money using a cheque.

- Drawee of the cheque: The drawee of a cheque is the bank ordered to pay the specified amount per the cheque.

- Payee: The payee is the person to whom the bank is ordered to pay the amount.

Types of cheques:

There are various types of cheques, such as open cheques, self-cheques, crossed cheques, bank cheques, stale cheques, and cancelled cheque. In this article, we’ll focus on all the fundamental aspects of a cancelled cheque.

Cancelled Cheque

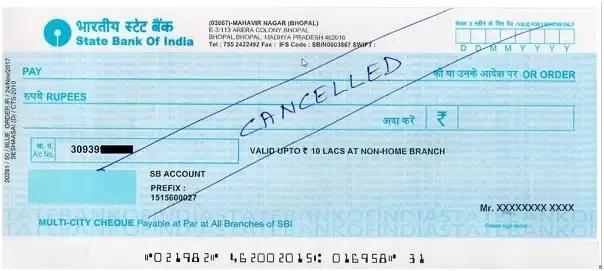

A cancelled cheque is crossed with two lines and the word “cancelled” is written across it. The word “cancelled” is all that is needed to cancel a cheque. Hence, it is referred to as a “cancelled cheque.” The cheque is usually cancelled/voided so that it cannot be misused.

However, a cancelled cheque acts as evidence that the individual has a bank account. The account number, the account holder’s name, the Indian Financial System Code (IFSC), Magnetic ink character recognition (MICR) code, the name and branch of the address where it’s located, as well as the cheque number can be found on a cancelled cheque leaf, even if it can’t be used to withdraw money from the account.

You’ll be able to tell the difference when you see the cancelled cheque image. On the cheque, the term “CANCELLED” will appear between two parallel lines. Below is an example of a cancelled cheque format:

Also Read: All You Need To Know About Cash Deposit Slip

How to write a cancelled cheque?

Cancelling a cheque is critical because cheques can be easily misused. Before submitting a cheque for a specific purpose, the following steps should be followed:

Step 1: Take a new cheque from your cheque leaf and cancel it. You should not sign anywhere on the cheque.

Step 2: Across the cheque, draw two parallel cross lines.

Step 3: Between those two lines, write “CANCELLED” in capital letters.

If you want to cancel a cheque due to an error on the cheque, you can follow the steps outlined above in step 2.

Tips while issuing a cancelled cheque:

- While drawing parallel lines across a cheque, it should not cover details like account number, account holder’s name, MICR code, IFSC code, bank address, or branch details.

- Nobody can withdraw from a cancelled cheque, but many fraudulent activities can occur even when the cheque is misused. When you hand over a cancelled cheque to someone, make sure you do not sign it.

- Always make sure you hand it over to the proper person in charge of collecting it.

Purpose of a Cancelled cheque

If there is any error while writing a cheque, the issuer cancels it. While a cancelled check cannot be utilised to obtain cash, it can be put to good use in several different ways. Some examples include:

- Know Your Customer (KYC): A cancelled cheque can be used in various KYC procedures while investing in mutual funds or stock markets. It is because it contains relevant information, such as the individual’s account number, name, branch address, and proof that they are a bank customer.

- Demat Account: A Demat account is used by individuals to hold shares in electronic form. When opening a Demat account, a cancelled cheque, a form for opening an account, and other KYC documents such as proof of identity, proof of address, and so on must be submitted to the stock brokerage.

- Equated Monthly Installments (EMI): EMI options are available in many loans, including car loans, education loans, and home loans, among others. A cancelled cheque is be required by the bank or company to complete the formalities of assigning such monthly payment methods.

- Electronic Clearance Service (ECS): ECS is a way to transfer money electronically from one financial institution to another. The bank requires a cancelled cheque from you as one of the documents along with the ECS form to set up an ECS from your account for a monthly deduction.

- Withdrawal Of Employee Provident Fund (EPF): When withdrawing money from the EPF, a cancelled cheque must be given to validate the individual’s account information money.

- Insurance Policies: Some insurance companies require a cancelled cheque from the customer interested in purchasing a policy to process the transaction.

Also Read: All You Need To Know About Post-dated Cheques

Conclusion

Cancelled cheques can be used for more than just banking transactions. To open an account, Demat account, buy mutual funds, insurance and more, a cancelled cheque is a critical document that serves many different purposes. We hope that this article has provided you with a definition of a cancelled cheque, as well as guidelines for writing one. For more information on payments, salaries, GST, income tax and more, subscribe to Legal Tree.