Any individual who desires to start a business and become a director of an established agency in India must first get a Director Identification Number (DIN).

DIN is an 8-digit interesting ID number generated for every person becoming the director in any organisation by the government of India. The Ministry of Corporate Affairs issues it. When apportioned, the DIN number has lifetime legitimacy. With the DIN, the government can keep an information base of all the directors. An individual can have only one DIN; however, he can become a director for at least 2 organisations or more. The very DIN number can be used in different companies by the same person for the position of director.

Did you know?

The government initially introduced the addition of sections 266A to 266G of the Companies (Amendment) Act, 2006, containing the notion of a Director Identification Number (DIN). As a result, all current and prospective directors must get DIN.

DIN Application

The information or the applications connected with an organisation get submitted under any regulation. The director marking the return and application or data will refer to his DIN under his mark. DIN is used under the mark of director in a significant report, information letter, or a return.

Apply for DIN

The procedure to request the assignment of a DIN number is extremely straightforward. First of all, go through section 153 of the Companies Act 2013 and rule 9 of the Companies Rules 2014, which gives the arrangement to request for distribution of DIN number in MCA.

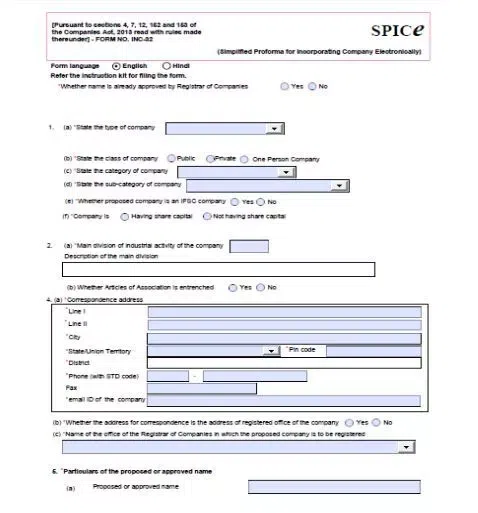

SPICe form: Apply for DIN to be proposed first to the directors regarding new organisations by the SPICe form.

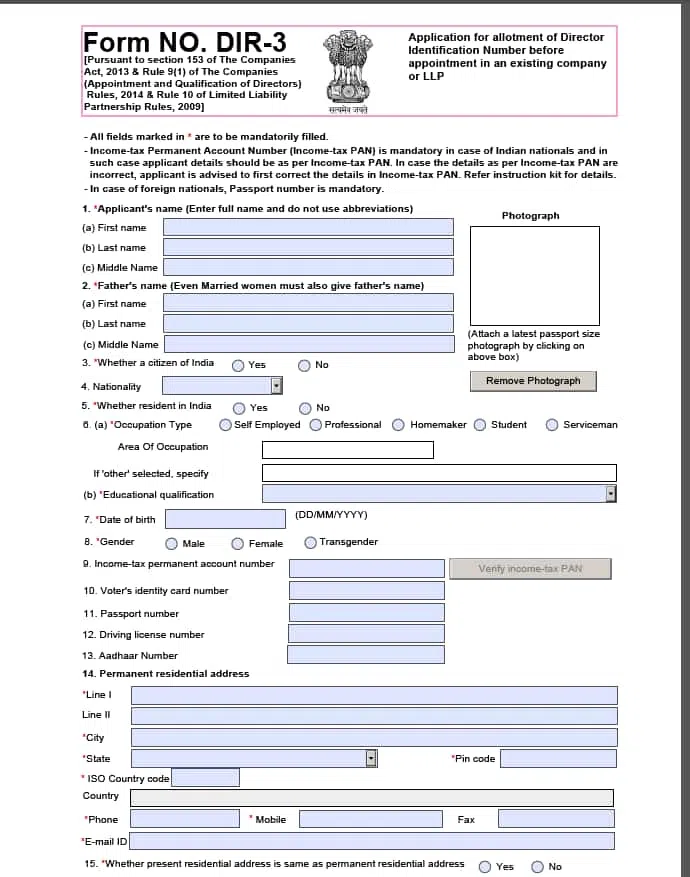

Form DIR–3: Any individual expecting to turn into a director, a generally existing organisation will need to create an appeal via eDIR form 3 for a portion of DINs. DIR-3 is a mandatory requirement.

Also Read: CIN Number– Guide (What is CIN Number, How To Get It, Meaning, Usage)

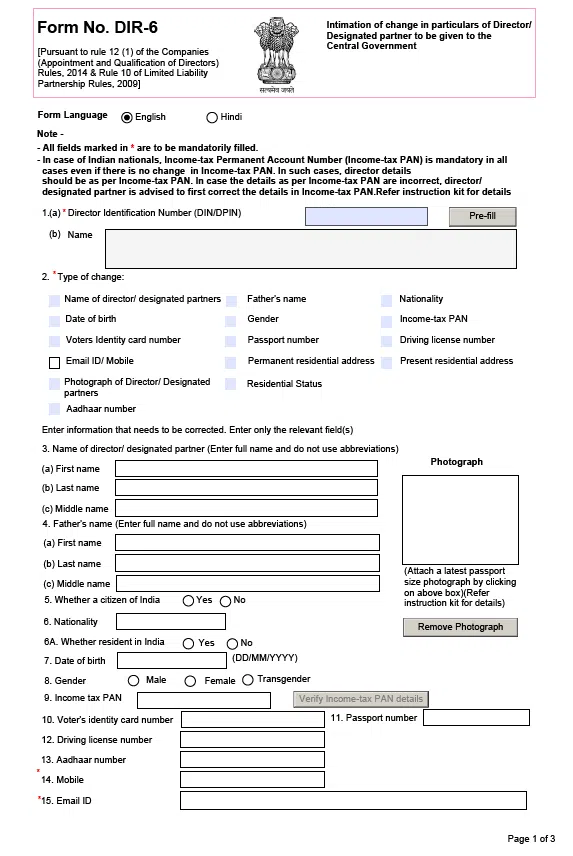

Form DIR-6: DIR-6 records each progression in the points of interest of directors. DIR-6 is used to update the central government about the changes made in any information within the DIN/DPIN. The information may consist of the director’s name, address, mail-ID, phone number, gender, photograph, nationality, educational qualification, etc.

These forms are documented electronically to request Director Identification Number (DIN). These must be carefully marked and later transferred to the MCA21 gateway.

Documents Attached with Forms

Form DIR-3

- Attachments: For DIR form 3, you need to attach a photograph, address proof, identity card, and passport if you are not a citizen of India.

- Attested documents needed: Documents mentioned above need to be duly verified by a CA, CS or a lawyer. In the case of a foreigner, the Indian Foreign Ministry can authenticate the reports. After transferring DIR form 3 with supporting reports, the candidate has to pay a minimal charge for the application, around ₹500. You can pay it through various modes of payment such as net banking, NEFT or card payment. There is no option for offline payment.

- Initiation of DIN: You can submit the application when the fees are paid, and the system produces a temporary appeal number. The government then handles the appeal and chooses the approval or dismissal. If the DIN appeal is endorsed, the local government will impart the DIN appeal to the candidate in 1 month or less. If the DIN appeal is dismissed, it will email the justification for dismissal to you with an explanation on the site. You will get a time-bound of 15 working days or (about 2 weeks) to correct the explanation.

- Disclosing DIN to the company: In no less than a month of getting DIN via the central government, the director needs to imply his Director Identification Number to all organisations where he serves as the director. Organisations will hint to RoC regarding the new DIN 15 days from the beginning of the director’s DIN through the end of the organisation. Disappointments of the board while the director hints DIN with organisation or disappointment of the organisation to suggest RoC regarding DIN will bring punishments.

Form DIR-6

To change any details referenced in the DIR-3 form and SPICe, you will need to submit form DIR-6.

The government may cancel the DIN for the following reasons:

- If a duplicate DIN was issued to the director

- DIN was obtained by fraudulent means

- On the death of the concerned person

- The person has been declared unsound mind by the court

- The person has been decided insolvent

The director can likewise give up the DIN in form DIR-5. With the form, you need to announce that you have never been a director in the organisation, and the DIN has never been utilised for recording any report. After confirming the e-records, the government will de-actuate the DIN.

When an individual is selected as a director in any organisation, according to the Companies Act 2013, they cannot give up their DIN from then on. Regardless of whether they stay as a director in that organisation or some other organisation, their DIN will exist for all intents and purposes.

Form Number and Purpose

DIR-3 – DIN allotment application form.

DIR-3C – Intimation of DIN by the company to the Registrar

DIR-5 – form for surrendering of DIN number.

DIR-6 – Form for changing details under DIR-3

Also Read: How To Get A Business License In India?

How to Make Changes in the DIR-3 Form?

Whenever there are changes in the information given in form DIR-3, the individual needs to notify the government by filling the structure form DIR-6.

- Download and fill out the form DIR 6

- Presently check it utilising a Digital Signature Certificate (DSC)

- Get it carefully endorsed by the rehearsing CA, CS, or CMA

- Submit it according to the given directions

Other Provisions Related to DIN

- In something like one month from getting Director Identification Number, the director needs to suggest it to every one of the organisations where you are working as a director.

- After getting DIN from the director, the organisation that is regarded organisation needs to suggest the DIN of the director to the Registrar of Companies in 15 days (about 2 weeks) or less.

Suppose the director or organisation neglects to consent to these arrangements within the period. In that case, it will be viewed as a repudiation of the law, and the party in question will be obligated to discipline under the law.

Conclusion

The applicant’s DIN remains valid for the rest of their life. Furthermore, a candidate must not renew for DIN following receiving one, i.e., really shouldn’t have well over one DIN anywhere at a given moment. IndiaFilings allows the user to search for a company or a DIN number.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.