As businesses strive to become more efficient and profitable, management accounting and cost accounting have become increasingly important. While both practices play a role in business decision-making, they differ in their objectives and approaches. Management accountants focus on forecasting future performance and creating strategies that will improve the company’s profitability. Cost accountants, on the other hand, are responsible for tracking actual costs and maintaining records of expenses. This blog compares and contrasts these two important aspects of financial management.

In this blog post, we will discuss the difference between management accounting and cost accounting and help you decide which system is best for your business.

Did you know? A cost accounting system involves quantitative cost data that can be measured in monetary terms. Management accounting uses both quantitative and qualitative data.

What is Cost Accounting?

Cost accounting is the process of determining the cost of producing a good or service. Cost accountants track the costs associated with each stage of production, from raw materials to labour to overhead expenses. Accountants use this data to determine the price of goods and services and assess the efficiency of the production processes. Because cost accounting requires a detailed understanding of production costs, it is an essential tool for businesses looking to optimise their operations.

For example, if a company is considering expanding its factory, cost accounting can be used to determine whether or not the expansion is likely to be profitable. As such, cost accounting is an essential tool for any business that wants to stay competitive. Cost accounting can also help businesses to identify areas where they may be overspending or where they could cut costs without compromising quality. In short, cost accounting is a vital tool for any business that wants to stay competitive by ensuring that its goods and services are priced correctly and produced efficiently.

Also Read: Learn about Inventory Accounting – Meaning, Objectives, Types & Method

What is Management Accounting?

Management accounting is a branch of accounting that focuses on providing information to managers within organisations to make decisions. This information includes tools for planning, decision making and performance management. Management accounting also encompasses the development and implementation of policies and plans that will help an organisation achieve its goals. The goal of management accounting is to provide information that will ultimately improve an organisation’s financial performance.

Management accounting focuses on providing information that will help managers to make decisions about allocating resources within their organisation. Management accounting is a critical tool for any organisation because it provides essential information for decision-making. Without accurate and timely information about costs, revenues and profits, it would be difficult for managers to make informed decisions about allocating resources.

The Purpose of Cost Accounting and Management Accounting

The purpose of cost accounting is to ascertain the cost of production/manufacturing of goods and services. Management accounting, on the other hand, is primarily focused on providing information to the management that would be helpful in the decision-making process. In simple terms, while cost accounting deals with recording, classifying and summarizing costs incurred during a period, management accounting covers financial planning and forecasting.

Cost accounting is useful for determining the selling price of products and services. It also helps managers to control and reduce manufacturing costs by identifying wasteful activities. Management accounting provides information about where the company stands financially, which is essential for making informed decisions about resource allocation and future course of action. Both these types of accounting are essential for any business as they provide different but complementary information that is crucial for effective decision-making.

Also Read: What are Expenses in Accounting? Meaning & Types of Expenses in Accounting

Difference between Cost Accounting and Management Accounting

|

Basis of Comparison |

Cost Accounting |

Management Accounting |

|---|---|---|

|

Meaning |

The recording, classifying and summarising of cost data of an organisation is known as cost accounting. |

The accounting in which both financial and non-financial information is provided to managers is known as management accounting. |

|

Information Type |

Quantitative. |

Quantitative and qualitative. |

|

Objective |

Determining the cost of production. |

Providing information to managers to set goals and forecast strategies. |

|

Scope |

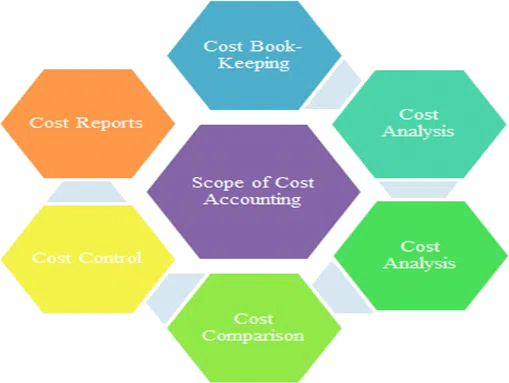

Interested in determining, allocating, distributing and accounting for costs. |

Impart and effect aspect of costs. |

|

Specific Procedure |

Yes |

No |

|

Recording |

Records past and present data |

It focuses on the analysis of future projections. |

|

Planning |

Short range planning |

Short and long-range planning |

|

Interdependency |

Can be installed without management accounting. |

Cannot be installed without cost accounting. |

Examples to Determine the Differences Between Cost and Management Accounting

In business, there are two main types of accounting: Cost accounting and management accounting. Cost accounting focuses on the direct costs associated with manufacturing a product or service, while management accounting provides information that can be used to make decisions about running the business. Both types of accounting are important, but they serve different purposes.

For example, let’s say that a company makes widgets. The cost accountant would track the direct costs of making the widgets, such as the cost of raw materials and labour. The management accountant would track other costs, such as the cost of advertising and marketing, and use this information to make decisions about allocating resources.

In general, cost accounting is more focused on the past, while management accounting is more focused on the future. Cost accounting looks at how much it costs to produce a widget, while management accounting tries to predict how much it will cost to produce a widget in the future.

This difference is important because it can help managers to make decisions about where to allocate resources. For example, if a company is trying to decide whether to invest in new machinery, the management accountant would use forecasting techniques to estimate the future costs of production and make a recommendation based on that information.

Both cost and management accounting are important tools for business decision-making. By understanding the differences between these two types of accounting, you can choose the right method for the job at hand.

Also Read: What is Management Accounting? Learn Definition, Importance, Objectives

Pros and Cons of Cost and Management Accounting

Cost accounting and management accounting are two important tools that businesses use to track and control expenses. Cost accounting focuses on the cost of production, while management accounting provides insights into how those costs can be reduced. Each approach has its own advantages and disadvantages.

Cost accounting is a useful tool for businesses that want to understand the actual cost of production. By tracking all of the expenses associated with production, businesses can make informed decisions about where to cut costs. However, cost accounting can be time-consuming and complex, requiring businesses to keep detailed records of all their expenses. In addition, cost accounting does not always provide insights into how costs can be reduced.

Management accounting, on the other hand, helps businesses to identify opportunities for cost savings. By looking at expenses across different departments and areas of the business, management accountants can spot inefficiencies and areas where costs can be cut. However, management accounting can be less accurate than cost accounting, as it often relies on estimates and calculations rather than hard data. In addition, management accounting requires a significant investment of time and resources to be effective.

Ultimately, businesses need to weigh the pros and cons of each approach to decide which is best for their needs. Both cost accounting and management accounting have their own advantages and disadvantages, but each can be a valuable method for reducing expenses and controlling costs.

The Benefits of Using Cost Accounting and Management Accounting

In any business, it is important to have a clear understanding of the costs associated with production and operations. This is where cost accounting and management accounting come in. These two types of accounting provide businesses with critical information about where their money is going and how they can save money. Here are seven benefits of using cost accounting and management accounting in a business:

- Cost accounting can help businesses to identify areas where they are wasting money. This information can then be used to make changes that will save money.

- Cost accounting can also help businesses to negotiate better prices with suppliers. If businesses are equipped with accurate information about their costs, they can bargain for better deals on the material they need to produce their products or services.

- Management accounting provides businesses with information about their production costs, which can be used to make decisions about pricing their products or services. By understanding their costs, businesses can avoid pricing their products or services too low and losing money, or pricing them too high and missing out on sales.

- Management accounting can also help businesses to understand where they are most efficient and where they could improve their efficiency. This information can be used to make changes that will save the business time and money.

- Cost accounting and management accounting can both help businesses to prepare financial statements. These statements are essential for applying for loans, attracting investors, and making important financial decisions.

- Cost accounting and management accounting can provide valuable information for making marketing decisions. For example, if a business knows that its product is more expensive to produce than its competitor’s products, it may choose to advertise its product as being of a higher quality and durable.

- Finally, cost accounting and management accounting provide valuable information for decision-making in general. By giving businesses a clear picture of their costs, these two types of accounting help businesses make informed decisions about all aspects of their operations.

Also Read: Understanding the Limitations of Accounting in Detail | Legaltree

Who Should Use Cost Accounting and Management Accounting?

Cost accounting and management accounting are two important methods of finance that businesses can use to track and manage their finances. Both types of accounting provide valuable information that can help businesses make informed decisions about their expenses and pricing. However, there are some key differences between the two disciplines.

Cost accounting focuses on the costs associated with manufacturing a product or providing a service. This information can be used to make decisions about how to price products and services and to assess the profitability of different business activities. Management accounting, on the other hand, provides information about a company’s financial performance. This information can be used to make decisions about where to allocate resources and to set financial goals.

So, who should use cost accounting and management accounting? The answer depends on the needs of the business. Businesses that need to make decisions about pricing and profitability would benefit from cost accounting. Businesses that need to make decisions about resource allocation and financial planning would benefit from management accounting. Ultimately, both types of accounting can be useful for businesses, but it’s important to choose the right type of accounting for the specific needs of the company.

Conclusion:

The main difference between cost accounting and management accounting is that cost accounting focuses on understanding past costs while management accounting focuses on predicting future costs and making better business decisions. Both are important for companies looking to be efficient and profitable. However, it is crucial to understand which type of accounting you need for a specific situation. If you are interested in learning more about either cost accounting or management accounting, there are plenty of resources available online and in libraries. We hope you learned more about these two types of accounting with the help of this blog.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.