Every business entity registered under GST is required to furnish details of inward and outward supplies. However, there are situations when businesses may want to cancel their GST registration. This article discusses the reasons for the cancellation of GST registration and the procedure to be followed.

The cancellation of registration under the GST is a process by which the concerned authority terminates the registration of a taxable person. The registration authority can cancel the registration on its own accord or by an application filed by the taxable person.

Did you know? If the GST officer involuntarily cancelled the application, the taxpayer may request to revoke the cancellation. Within 30 days of the day the relevant officer cancelled the applicant’s GST registration, the applicant must submit a claim for the cancelled GST registration procedure using the GST site.

What is Cancellation of GST Registration ?

The registration of a business under the GST regime is a mandatory requirement; however, there are certain conditions under which the registration can be cancelled. The cancellation of registration is governed by the provisions of section 29 of the CGST Act, 2017. The reasons for cancellation of registration can be broadly classified into two categories:

(I) Voluntary Cancellation and

(ii) Involuntary Cancellation.

The registered person can make voluntary cancellation of registration on their own accord. The registered person must inform the proper officer in writing about their intention to cancel the registration. After due verification, the appropriate officer shall cancel the registration.

The proper officer can initiate involuntary cancellation of registration on specific grounds, such as if the registered person has not furnished the return for a continuous period of six months or more or if the registered person has obtained registration by furnishing false information, etc.

Cancellation of registration has specific implications, such as the person shall not be eligible for an input tax credit, they shall not be allowed to collect tax from their customers, etc. Hence, it is essential to understand the grounds and implications of it under GST before taking any decision.

Also Read: HSN Code for Paints – Importance & HS Codes with GST Rates

Key Takeaways

1. Cancellation of registration under GST is a process by which a registered person can get their registration cancelled.

2.It is allowed only in some instances, such as when the registered person has ceased to exist or is no longer required to be registered.

3.It can be made online, and the registered person must provide their GST number, PAN number, and other details.

4. Once the registration is cancelled, the registered person will no longer be liable to pay GST on their supplies.

Why is Cancellation of Registration Required Under GST?

Cancellation of registration is required under GST in the following cases:

1. If the registered person ceases to carry on business.

2. In case,the registration is obtained using fraud or misrepresentation.

3. If the person fails to file returns for three consecutive tax periods.

4.If the registered individual is guilty of a GST-related offence.

5. In case they no longer require the registration.

6. If the registered person shifts their business location to another state.

How to Cancel registration Under GST?

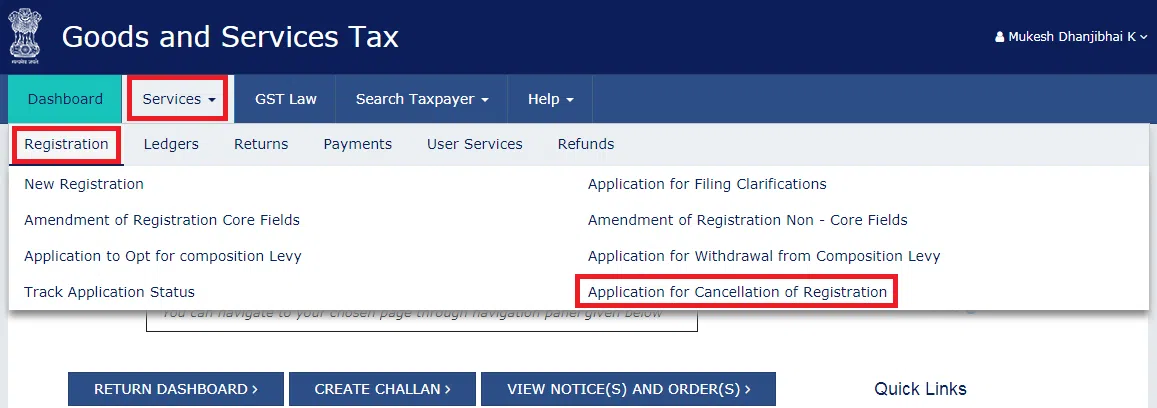

The GST registration can be cancelled by filing Form GST REG-16 on the GST Portal. The registered person needs to log-in to the portal using their credentials and navigate to the Services > Registration > Application for cancellation of registration option. They should select the reason for cancellation from the drop-down and upload the required documents. An application fee of ₹500 must be paid online using the available payment options. After the application is filed, the concerned officer will process it and inform the registered person about the decision through the portal.

If the registration is cancelled, the registered person will have to surrender their GSTIN and not be allowed to collect GST from their customers. They will also be unable to avail themselves of input tax credit and will have to pay GST on their inward supplies. cancellation of registration is a serious matter and should be done only after consideration. The registered person should ensure that they are not violating any GST provisions before applying for cancellation of registration.

Also Read: GST benefits – 7 Ways One Must Know How GST benefits the Economy

Steps to Follow for GST Registration Cancellation

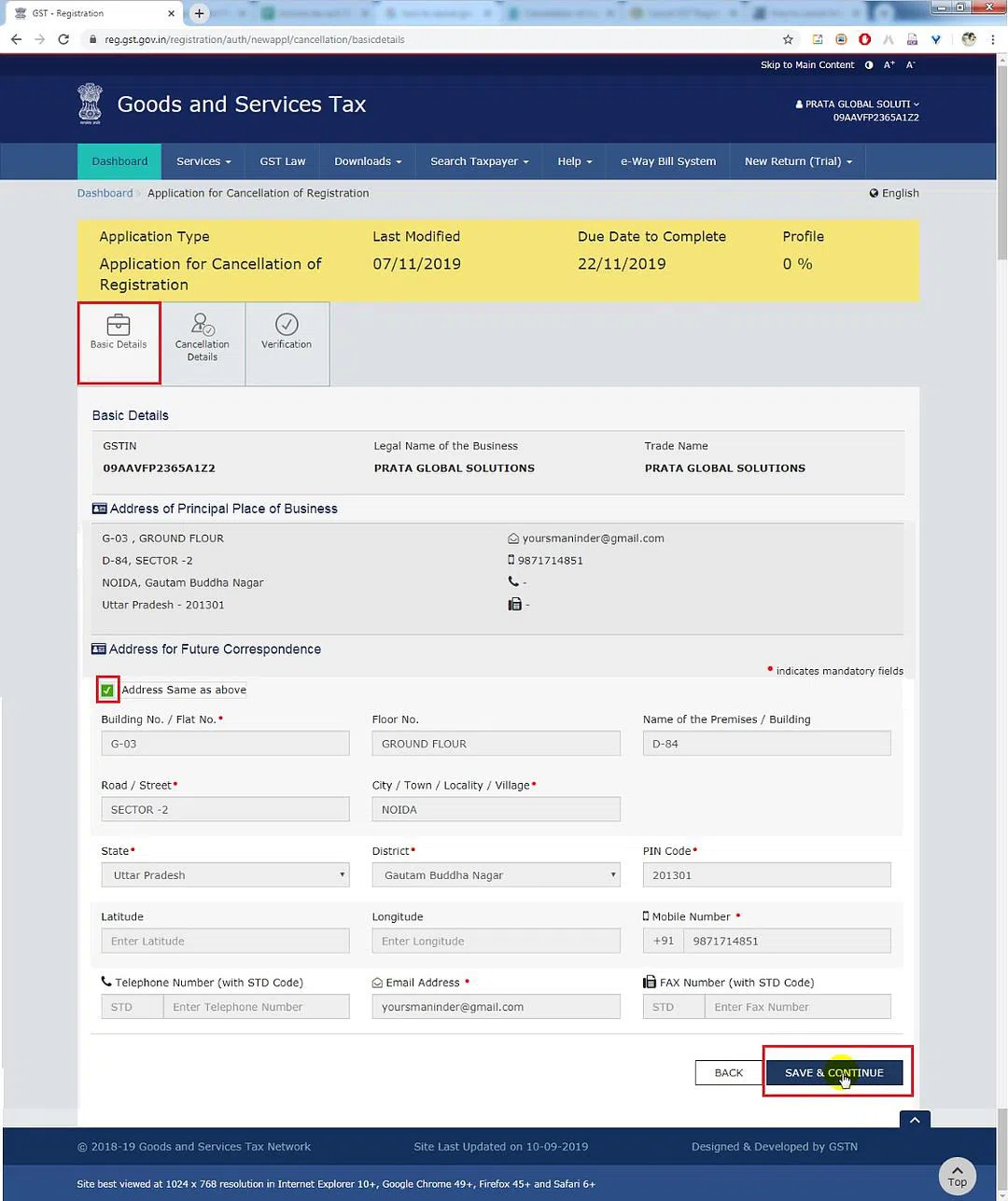

Step 1 – Log in to the GST portal and go to Services > Registration > Application for registration.

Step 2 – A page will open where you have to select the option of ‘cancellation of registration.

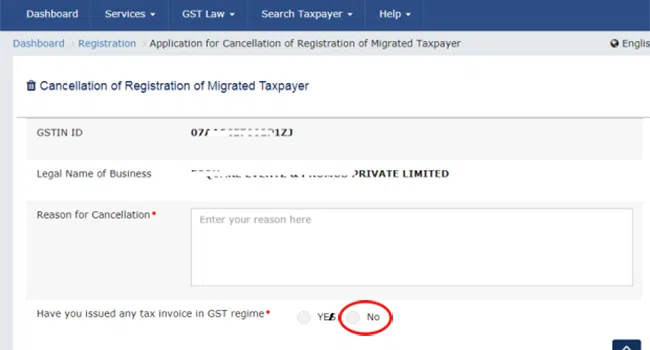

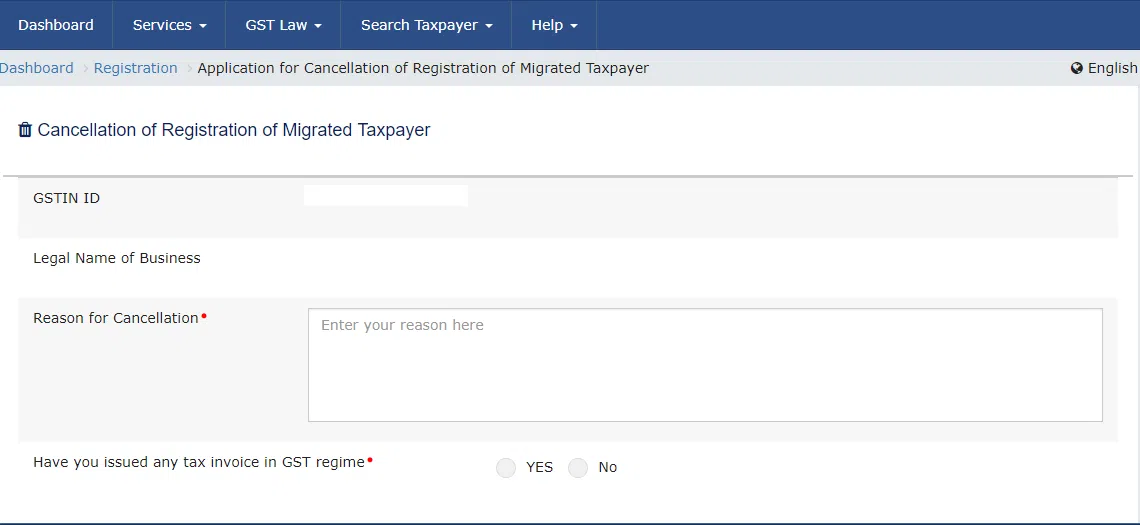

Step 3 – A new page will open in which you have to enter your GSTIN.

Step 4 – Enter the reason for cancellation of registration in the field provided.

Step 5 – Enter the email address and mobile number and click on the ‘Continue’ button.

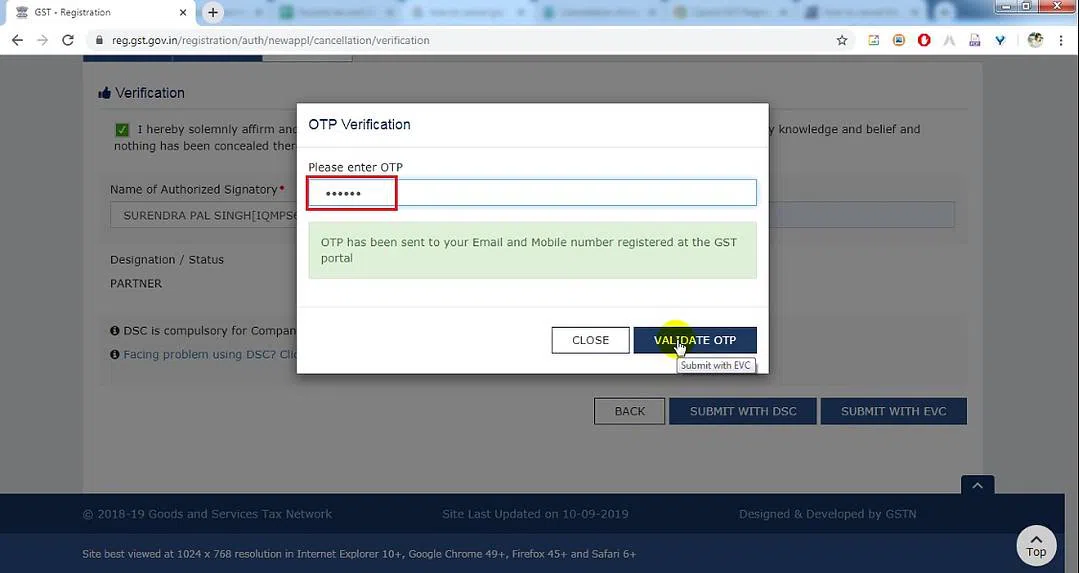

Step 6 – A new page will open in which you have to enter the OTP received on your registered mobile number and email ID.

Step 7 – After verifying the OTP, click the ‘Proceed’ button.

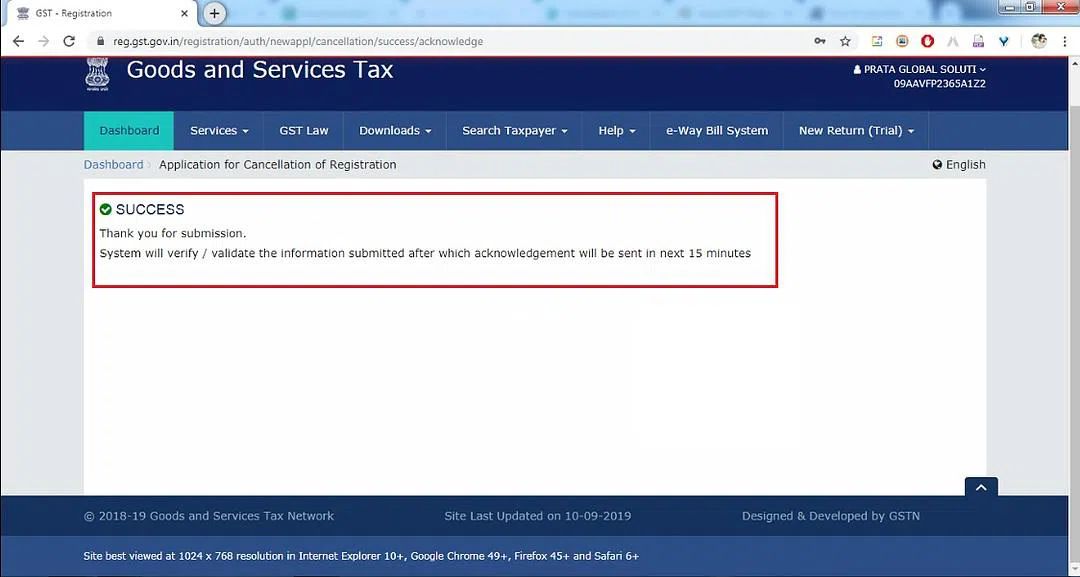

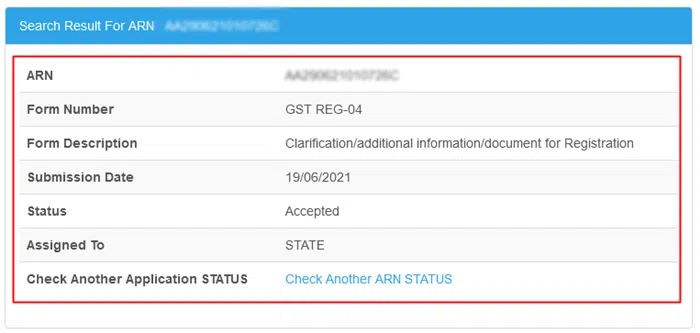

Step 8 – An ARN will be generated.

Step 9 – The cancellation application will be sent to the concerned authority for approval.

Step 10 – The authority will accept or reject your application.

Step 11 – If the application is accepted, your registration will be cancelled, and you will receive an email and SMS.

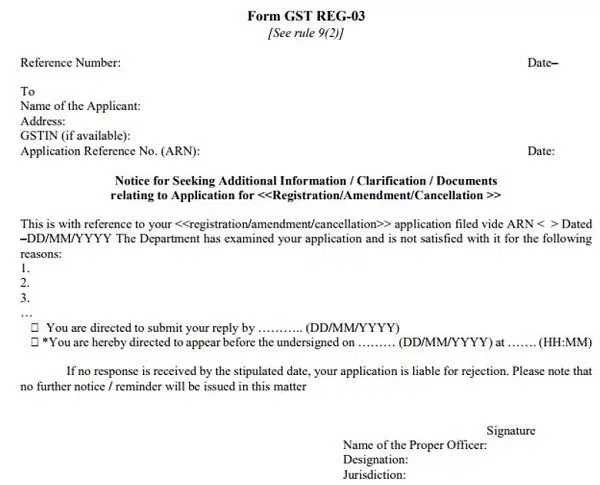

Step 12 – If the application is rejected, you will be asked to submit additional documents or information.

Also Read: Key Advantages and Disadvantages of GST for Businesses

Cancellation of Registration of a Taxable Person

A taxable person can cancel their registration under GST voluntarily or at the direction of the authorities. The taxable person can make voluntary cancellations by providing a notice of cancellation to the concerned authorities. The concerned authorities can also direct the taxable person to cancel their registration under GST.

Cancellation of Registration of a Non-Taxable Person

A person registered under the GST Act but is not liable to pay tax (i.e., a ‘non-taxable person’) may apply for cancellation of their registration. The cancellation of registration shall be granted by the tax authority, on receipt of a valid application from the registered person, from the date specified by the administration.

Also Read: Everything You Need to Know About the Latest Amendment to CGST Act

Cancellation of Registration of a Person Who Is Not Registered

Cancellation of registration of a person not registered under GST can be made by the person himself or by the concerned authorities. The person can cancel their registration by applying Form GST REG-14 and paying the prescribed fee. The concerned authorities can also cancel the registration of a person not registered under GST if they have reasons to believe that the person is not complying with the provisions of GST.

Cancellation of Registration of a Person Who Has Ceased to Be Liable to Be Registered

A person who has ceased to be liable to be registered under GST may apply for registration cancellation by using Form GST REG-14 to the concerned authority. After considering the application, the concerned authority may cancel the registration and intimate the person in Form GST REG-15.

Cancellation of Registration by the High Court or Supreme Court

The High Court or Supreme Court may cancel the registration of a person under the Goods and Services Tax Act, 2017, if they are found to have committed any offence under the Act. The cancellation of registration shall be effective from the date on which the court makes the order of cancellation. The person shall be liable to pay all the taxes and interest due from them under the Act. If the proper officer has reasons to cancel the registration of a person then he will send a show-cause notice to such person in form GST REG-17.

Revocation of cancellation of registration

Revocation of cancellation of registration is all about the decision to cancel registration has been reversed and registration is valid. One can apply Revocation of Cancelled GST Registration after 90 days under specific conditions. When a GST officer cancels registration for GST one can apply for abrogation.

Also Read: GST Rates in 2022 – List of GST Rates, Slab and Revision

Effects of Cancellation of Registration

The cancellation of registration under GST can have several consequences for businesses, including:

- The loss of the ability to claim input tax credits

- The imposition of GST on supplies that would otherwise have been exempt

- The loss of certain GST concessions

- The need to pay GST on any stock on hand at the time of cancellation

- The possibility of incurring penalties and interest charges.

Conclusion

Within three months after the date of cancellation or the date of the order of cancellation, whichever comes first, every individual whose registration has been cancelled is required to submit a final GST return in Form GSTR-10. In order to protect the taxpayer from any liabilities under Section 29 of the CGST Act, this is done.

Follow Legaltree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.