Business transactions that can be measured are recorded in the order in which they are entered, i.e., in chronological order. Journal is called the Book of Original Entry since every transaction is first recorded. Rules of debit and credit are applied to each transaction at the time of recording in the books of accounts. The transactions recorded in the Journal are posted into Ledger Accounts.

Ledger is called the Principal Book of account and can be obtained all the accounting information from this book. Both Journal and Ledger are necessary to complete a system of accounting.

Did you know?

“A Book of Original Entry is a Day-to-day record of financial transactions of a business.”-M.J. Keeler. Journal is subdivided into Books of Original Entry as there are many transactions in the larger-sized firm. It is subdivided into:-

- Cash Book;

- Purchase Book;

- Sales Book;

- Purchase Book;

- Purchase Return Book;

- Sales Return Book;

- Journal Proper.

The above Books are also called Supplementary Books, Special Journals, or the Original Entry Books.

- Purchases Journal:- Purchase Journal is an auxiliary ledger for making credit purchases of goods. Cash purchases of non-commodities such as tangible assets are not recorded in the purchase ledger.

- Sales Journal:- A Sales Journal is an auxiliary ledger that records credit sales of goods traded by a company. Cash sales are recorded in the cash book, not the Sales Journal. In addition, credit sales of products other than those traded by the entity (such as sales of property, plant and equipment) are not recorded in the Sales Journal, and they are recorded in the Journal Proper.

- Returns Outward Book:- Returns Outward Book is a Subsidiary book maintained to record the credit goods or materials returned to the sellers of goods purchased.

- Returns Inward Book:- Returns Inward Book is a Subsidiary book maintained to record the goods or materials returned by the purchaser sold on credit.

- Journal Proper:- Journal Proper is used for recording every transaction which cannot be recorded in any of the other subsidiary books.

- Cash Journal:- Cash Journal is a primary entry book in which receipt and payment are recorded.

Also Read: What is Accounts Receivables?

Components Of Books Original Entry or Books Of Prime Entry Or Day books

- In Chronological Order, the transactions are recorded in a book of original entries.

- Journal that is recorded before the transaction is posted to the ledger account.

- Capture both aspects of the transaction.

- The original entry ledger is a record that shows the full details of the transactions in the entry.

- Journaling is the process of recording a transaction in a journal, and the format in which it is recorded is called a journal entry.

Advantages of a Book of Original Entry

- Provides accounting data in chronological order:-Transactions in the Journal are recorded when they occur. Therefore, accounting data records will be available in chronological order.

- The chances of error are reduced:-The debit, and credit amounts are written side by side, reducing the chance of error. You can compare the two to credits to see if they are the same. If the account is written directly to the ledger, you may write the wrong amount. Alternatively, the amount written to the debit side could be greater, or there is a description that describes the entry and later underestimates the entry.

- Posting to General Ledger:- The Journal is the basis for posting transactions to the General Ledger account. The debit and credit aspects of a transaction are clearly identified as debits and credits, simplifying posting to the ledger account.

- Location of Errors:- Location of errors is facilitated in case of disagreement of Trial Balance.

Limitation of Book of Original Entry

- Not suitable for large numbers of transactions:- If you do not have many transactions, you can record all transactions in the Journal. The Journal book grows large with many transactions, making it inconvenient to keep a journal to reward all transactions.

- Your cash balance will not be displayed:- Record all transactions in the books of the original transaction. You can know your cash balance after the cash transaction has been posted to your cash account, and it is a hassle.

- After posting a transaction to a ledger account, there is no substitute for ledger information related to a particular person or head. Therefore, the Journal is not a replacement for the general ledger.

Types of entries in Book of Original Entry

- Simple Journal Entry

- Compound Journal Entry

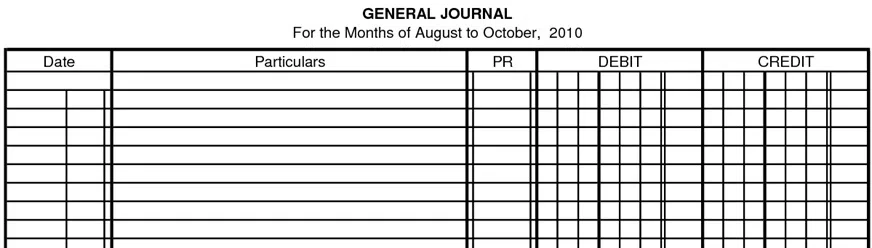

The Format of a Book of Original Entry

- Date

- Particulars

- Narration

- Ledger Folio

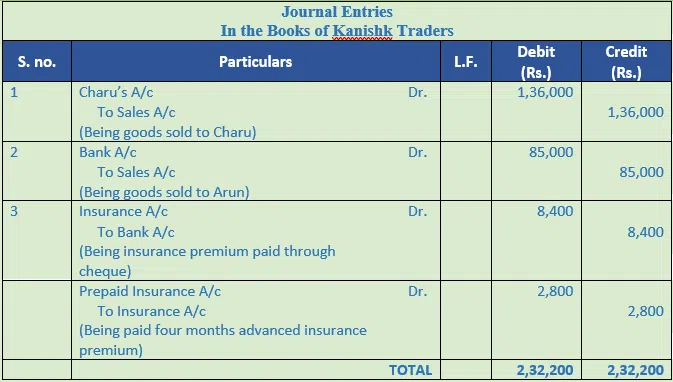

Example:

Also Read: Learn About Bookkeeping: Definition, Types & Importance

Characteristics of Book of Original Entry

- The transactions are recorded in a book of original entries in chronological order, i.e., they are entered daily.

- It is a Journal in which transactions are written before posting them in the ledger accounts.

- It records both aspects of a transaction.

- Books of Original Entry is a record showing complete details of transactions in one entry.

- Journalising is a process of recording a transaction in the Journal, and the form in which it is recorded is known as Journal Entry.

Conclusion

Business transactions that can be measured are recorded in the order in which they are entered, i.e., in chronological order. Journal is called the Book of Original Entry since every transaction is first recorded. Rules of debit and credit are applied to each transaction at the time of recording in the books of accounts.

The Book of Original Entry is also known as Journal. The transactions recorded in the Journal are posted into Ledger Accounts. “A Book of Original Entry is a Day-to-day record of financial transactions of the business.” -M.J. Keeler.

Follow Legaltree for the latest updates, new blogs, and articles related to micro, small and medium businesses(MSMs), Business tips, Income tax, GST, Salary, and Accounting.