An account statement, also known as a bank statement, is a condensed form of financial activities over a certain time period on a person’s or business’s bank account with an institution.

Such accounts have been continuously printed on one or more pieces of paper and then mailed directly to the account owner or retained at the institution’s local branch for collection. However, there has been a significant shift toward electronic statements and some financial institutions now allow direct transfer into commercial banks accounting software systems such as tally ERP 9.

Recording these entries in tally based on account books, supporting vouchers in books of accounts has also been made easier through tally ERP 9. Entering the bank entries in tally ERP 9 as bank statements is the first step for creating entries. Therefore, the role of tally ERP 9 can be identified to be vital for every business since it can help in making routine statements easily.

Procedures for Banking Entries

Tally is used to register bank entries in tally ERP 9. ERP 9 is an abbreviation for Enterprise Resource.

The procedure for recording bank entries in Tally is given below.

Step 1: Create a ledger under bank accounts and save it.

Step 2: Go to the accounting vouchers menu, then choose which type of voucher you want to transmit through the bank account. To pass a bank entry in Tally, one can use one of three voucher types.

- Payment- To enter a payment, deduct from the Expenses Ledger (for cash transactions) or the Party Ledger (non-monetary events) and credit the bank. F5 is the shortcut key for Selecting Payment Voucher.

- Receipt- To enter a receipt for cash deposit entry in tally transactions, debit the Bank Ledger and credit the Party Ledger / Income Ledger (for non-cash transactions). F6 is the shortcut key for Selecting Receipt Voucher.

- Contra- Only use for cash transactions using Debit/Credit/Cash. F4 is the shortcut key for selecting Contra Voucher.

Also Read: How to Create, Print & Customize GST Invoice in Tally ERP 9

How Can I Access More Banking Functions In Tally ERP 9?

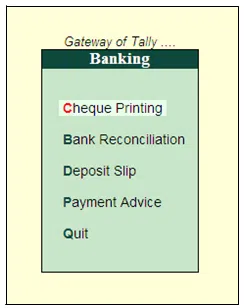

Cheque Printing: Go to the Gateway of Tally> Banking> Cheque Printing to reach the Cheque Printing screen.

The Select Bank screen appears, offering a list of banks where you have to choose accordingly: Enter after selecting ‘All’ or a specific Bank account for banking in tally. The selected bank’s Cheque Printing screen is now shown.

(Note: By default, this screen displays a list of outstanding cheques for the month of the current date.)

To view all of the cheques, press:

- F6: Show All

- F2: Timeframe- This button allows you to modify the period.

- F4: Bank- Select All/Other Required Bank from the list.

- F7: Modify the challan Details- This allows you to edit/update the columns Favouring Name, Instrument No. and Instrument Date.

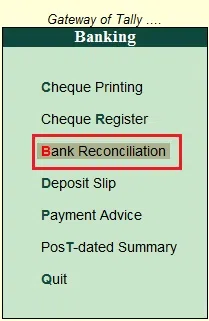

Bank Reconciliation: Follow these instructions to access the Cheque Printing screen:

- Navigate to Tally Gateway> Banking> Bank Reconciliation.

- The Select Bank screen appears, offering a list of banks.

- Enter the appropriate Bank account information after selecting it.

- The selected bank’s Bank Reconciliation screen is presented.

Deposit Slip: The Cash Receipt option in the Banks menu allows the user to generate the deposit slip for payments received via cheque/demand draft that must be deposited into the bank.

How To Enter Bank Transactions In Tally ERP 9?

|

Transaction Info. |

Explanation |

Voucher Type for Selection |

Journal Entry |

|

Cash Deposit Bank entry in Tally.ERP 9 |

Cash generated through sales proceeds is usually deposited into the bank.

It’s called a contra entry because this transaction does not create any result in business, and it’s just an internal moving of cash from cash in hand to cash at the bank. |

Contra Voucher Shortcut Key Press – F4 |

Bank A/c (Dr) To Cash (Cr) |

Contra Entry

Contra Entry is used to withdraw money from a bank or deposit money into a bank. You can also print Deposit Slips to deposit cash at a bank using Contra input.

To make a contra entry in tally ERP 9, go to Tally’s Gateway> Accounting Vouchers> Contra F4.

For example:

Tally Knowledge deposits ₹ 50000/- in a bank with the dimensions shown below.

- Notes in the denomination of Rs. 2000 – 20 No.

- Notes in the denomination of Rs. 500 – 20 No.

Then, for contra, create an accounting voucher and click F4. So, there is now ₹ 50000/- rupees in cash which can be done using Dr Cash. Due to the deposit of cash in the bank, this tally entry will lower cash and boost your bank balance.

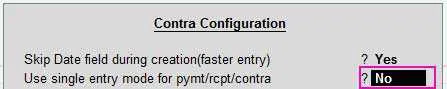

Payment Entry

Cheque Payment entry in tally is used to make payments for expenses, parties, banks, financial payments, among others. Payment vouchers can also be used to withdraw cash from banks, similar to a contra entry. The default system does not allow you to enter cash ledgers in payment vouchers. To use this feature, press F-12 and check the box next to the feature to Use payment /receipt as contra Voucher.

For example:

Party A purchased some stock from Party B for Rs. 50000, and Party A will utilise the payment voucher for clearing Party B’s account. So Party B has Rs.50000 in the bank. Include Party A’s Cheque number for the tally. Party A can also make payments to any party on a bill-by-bill basis.

Similarly, if you want to withdraw cash from a Payment voucher, you can do so at Dr Cash or Cr. Bank.

Also Read: How to Use GST in Tally ERP 9?

Receipt Entry

Receipt Entry is used to receive payment from third party accounts, bank interest, NEFT Credit, among others. Receipt vouchers can also be used to deposit cash in a bank; however, they do not print deposit slips like Contra Entry. In the receipt voucher, you can also select multiple transaction types. For example, if a Party directly transfers the amount in your bank via NEFT or Online transfer, you can enter the details as per Bank Transaction Nature.

ATM, Cash, Card, Cheque, ECS, E-Fund Transfer, Electronic Cheque, Electronic DD/PO, and Others are options available on the Bank Allocation screen. You must select the transaction type from the drop-down menu as per your needs.

Configuration Alternatives

To change the default display for the above report, click F-12: Configure or press F-12.

Show Narrations as well: Set this option to Yes to display the Client’s Narration entered during the Voucher input.

Show Received from:

- Select this option to display the name of the party to whom the funds are transferred.

- Set this option to Yes to display the Transaction Type- Inter Bank Transfer, Cheque, Deposit etc., that was selected during voucher entry.

- Set this option to Yes to display the Instrument Number entered during Voucher entry/reconciliation.

- Show Branch Details: Check this box to display the Branch details entered during the voucher input.

- Show Audit Status: Select this option to view the Vouchers.

- Set this option to Yes to see the person who audited the Vouchers.

- Show Clarification from Select this option to view the user who clarified the Vouchers, if any.

- Show Audit Status Vouchers: Select an Audit Status, and the Vouchers that have been tagged with that Audit Status will be filtered and presented.

- The appearance of Name: Choose the appropriate Display Name for the Ledgers from the list of Display Name Styles.

- Include Exceptional Vouchers: Set this option to Yes to include Vouchers marked as Optional in this report.

- Sorting Technique: Select the appropriate sorting method (Alphabetical, Amount wise manner)

A Step-by-Step Guide To Activate Auto Reconciliation In Tally

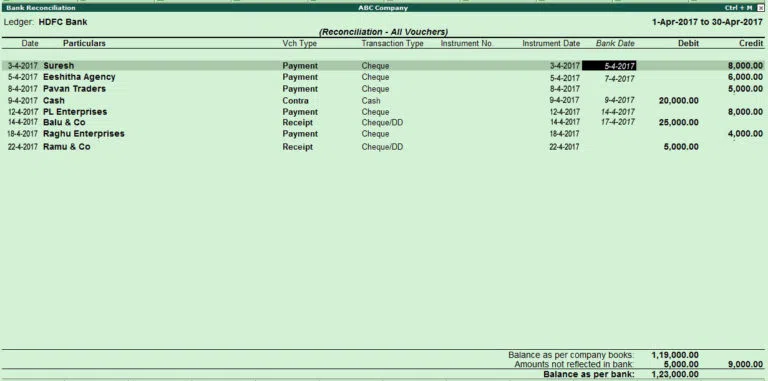

Assume we now have an HDFC Bank Account with specific transactions that must be reconciled.

- To automatically reconcile, return to the option of Bank Reconciliation.

- Select Tally Gateway> Banking> Bank Reconciliation> Bank List> To reconcile, select your bank.

- When you get there, you must first specify the location of the folder on your computer where your bank’s e-statements are stored.

- To automatically reconcile, return to the Bank Reconciliation option.

- Select Tally Gateway> Banking> Bank Reconciliation> Bank List> To reconcile and select your bank.

- When you get there, you must first specify the location of the folder on your computer where your bank’s e-statements are stored.

- To use the Auto Reconciliation tool, you must have e-statements. Tally ERP 9 supports the following formats for importing bank statements – excel and CSV in an understandable format.

- You must return to the Bank Reconciliation screen after configuring the location of the bank’s statements to complete the process.

- Now, press ALT- B or click on the button Bank Statement. This will display the folder and all supported files you chose during the Banking Configuration process.

- Choose the statement to be reconciled and then click With View or press ALT- I. This will display the bank statement that was in the folder.

- Now, in the upper right corner, click the Import icon to import the statement.

- It was the Automated reconciliation procedure. This strategy saves a lot of time and allows you to reconcile any number of bank statements in a short period of time.

You will be able to reconcile banks in the future quickly and will have no problems with Bank Reconciliation in Tally.

Mentioning the different ledgers that can be created in Tally ERP 9

Tally ERP 9 allows you to create the following types of ledgers:

- Making a Sales and Purchase ledger

- Making an Income and Expense Ledger

- Putting together a Party Ledger

- Making a Bank Account

- Putting Together a Tax Ledger

- Making a Current Liability Ledger

Also Read: Tax Deducted At Source For Business

Conclusion

The article describes the different procedures for bank entries in tally. To summarise it, create a ledger under bank accounts and save it. After this, go to the accounting vouchers menu and then pick the type of voucher you want to pass through the bank account. If you want to pass a payment voucher, for example, press F-5. Then you can choose the bank account ledger from which to pay the amount to a certain party. Deduct from the party and credit from the bank ledger and keep the voucher.