For every business to successfully transact an import or export transaction, you need to follow specific rules and laws. Import Export Code (IEC number) license is one requirement that a business must complete for an import or export business in India. It is also called the Importer-Exporter code. Let us know about the significance of IEC and how to obtain the IEC number.

Did you know?

The IEC code gets deactivated if not updated within the prescribed time, i.e., April-June.

What is Import-Export Code or IEC?

If you are thinking of starting your import-export business in India, then you must need the IEC number. This number is generated by the Directorate General of Foreign Trade (DGFT) in electronic form (e-IEC). DGFT office comes under the Ministry of Commerce of the Government of India.

IEC is a unique 10-digit alpha-numeric code having lifetime validity. It is issued based on the Permanent Account Number (PAN) of the business entity or individual. No person or entity in India shall be allowed to make any import or export without the IEC Code Number unless they are specifically exempted. Similarly, the import or export merchants cannot benefit from the DGFT IEC Code without availing of the code. If any individual is applying for the IEC number, they can do so either in the company’s name or in their name directly.

Benefits for IEC registration

Here are a few benefits that you can get if you get IEC registration:

- Expand your business – You can expand your business by purchasing and selling products and services in the global market.

- Additional benefits – The applicant can receive several additional benefits from DGFT, the Customs department, the Export Promotion Council, etc., based on their IEC registration.

- Easy Processing – You can obtain the IEC code registration within 10 to 15 days after submitting the filled application. There is no need to provide any proof of export or import for getting the IEC code.

- No return filing – IEC does not require any return filing. This is valid even for export transactions where you do not have to file any return with DGFT.

- No need to renew the certificate – The IEC certificate has lifetime validity; hence you do not have to renew it. Although, you have to update it annually.

Also Read: Top Performing Import-Export Business Ideas In India

IEC requirements

When is IEC required?

- When the importer has to clear the goods from the customs office, this code is required by the customs authorities.

- When the importer sends money outside India, this code is required by the bank.

- When the exporter has to send goods, then this code is needed by the customs port.

- When the exporter receives money in foreign currency, then this code is required by the bank.

When is IEC not required (exemptions)?

- IEC Code is not required for the service exporters unless the service provider is receiving benefits under the Foreign Trade Policy.

- It is not mandatory for the merchants registered under GST. Their PAN will be considered the IEC code for import and export purposes in such cases.

- Exporting or importing goods to or from Nepal if the total amount of a single consignment is up to ₹25,000.

- Exporting or importing goods to or from Myanmar through the Indo-Myanmar border, if the total value of a single consignment is up to ₹25,000.

The exemption from availing from the code will not be available to export Prescribed Organisms, Special Chemicals, Materials, Equipment and Technologies.

Things to know before applying for IEC

- You need to pay the application processing fee of ₹500 online (through debit card, credit card, or Net Banking method).

- The application may be done on behalf of a Proprietorship, Partnership, Limited Liability Partnership (LLP), Private Limited company or Limited Company, Hindu Undivided Family (HUF), Trust, Co-operative society, etc. All the IEC will be issued separately based on the applicant’s category.

- The entity must have a PAN, bank account, valid address in its name before applying.

- For Proprietorship firms, IEC will be issued against the PAN of the proprietor. For others, it would be issued against the PAN of the applicant entity (firm/company).

- There is an online form ANF 2A format that needs to be filed to get IEC at the DGFT portal.

- IEC shall not be taken for personal purposes and only for commercial purposes.

Steps to generate the IEC code

- Cover letter on the company’s letterhead.

- The applicant must sign each page of the application form.

- All the applicants must fill Part 1 and 4 of the form.

- You must avoid submitting hard copies of Part 1 in those cases where you are submitting the applications.

- You must submit 2 copies of the application in a prescribed format to your nearest regional Joint DGFT Office.

- Fill in only the relevant details of Part 2 of the application form.

- Pay ₹250 in Bank Receipt (in duplicate)/ EFT/ Demand Draft details as application fee as per Appendix 21B.

- A Banker’s certificate of the applicant’s firm in the prescribed format as given in Appendix 18A.

- A self-certified copy of the PAN issuing letter or PAN Card.

- Submit 2 copies of your passport size photographs (must be attested by your Banker).

- Submit a self-addressed envelope with ₹25 postal stamps for the delivery of the certificate of IEC by registered post or DD/ challan of ₹100 for speed post.

Documents required for IEC registration

For IEC registration, you need the given documents:

- The applicant’s copy of PAN card

- The applicant’s copy of Voter ID or AADHAR or Passport

- The applicant’s copy of the cancelled cheques of his/her bank account.

- Applicant’s copy of rent agreement or electricity bill of the premise.

- Applicant’s address details for delivering the certificate of importer-exporter code by registered post.

How to get the Import-Export Code Registration?

To avail of the IEC code number, you need to follow a few steps mentioned below:

- Visit https://www.dgft.gov.in/CP/# (DGFT website).

- Click the ‘Services’ tab on the homepage of the DGFT website.

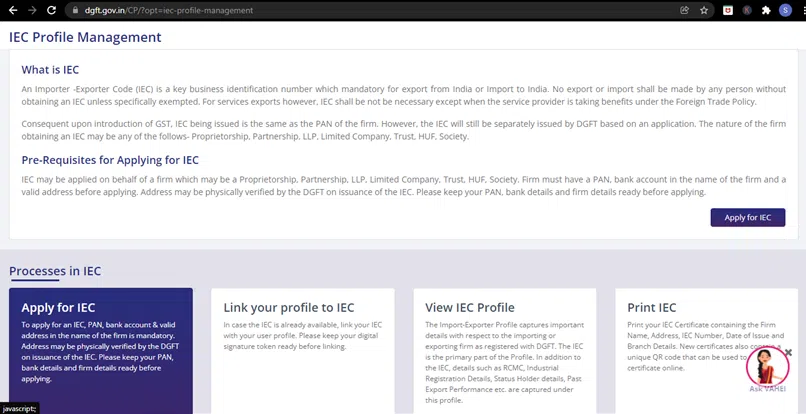

- Choose ‘IEC Profile Management’ from the given list.

- A page will open. Then select the ‘Apply for IEC‘ option on that page.

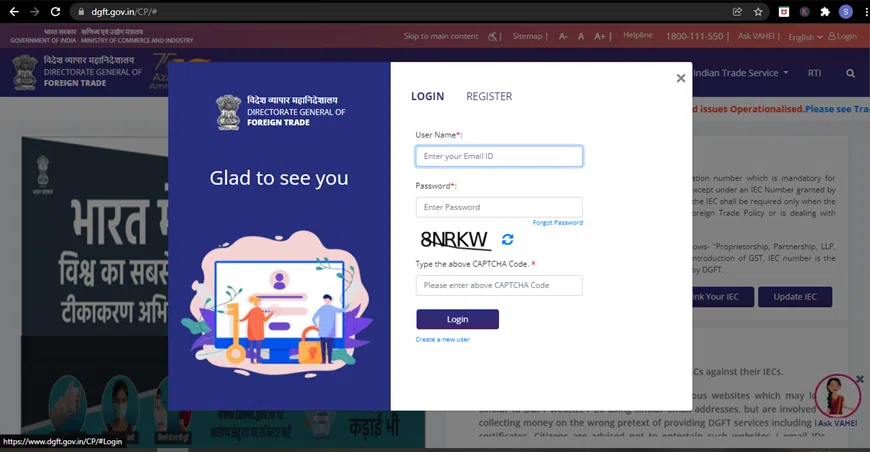

- A login/register tab will open. Select the’ Register’ option if you are a new user.

- Enter all the required details and click on the ‘Send OTP’ button.

- You will receive an OTP on your registered mobile number. Enter that OTP and select the ‘Register’ option.

- After the OTP is verified, you will get a notification that will contain a temporary password. You can also change this password after logging in to the DGFT website.

- After the registration, log in to the DGFT website by entering the user name and password.

- Select the ‘Apply for IEC‘ option on the website.

- You will have to fill up the online form (ANF 2A format) then upload the required documents to make payment of the required fees. Then select the ‘Submit and Generate IEC Certificate’ option.

- The code will be issued by the DGFT. You may take out the printout of the IEC certificate.

- In case the application of IEC is rejected, the applicant needs to follow the whole process once more and he must pay the processing fee once again.

Steps to register the digital signature for IEC

You need to follow the given steps to find the application for IEC:

- Go to the DFT website and log in- https://www.dgft.gov.in/CP/#.

- After you link to the IEC number or IEC Application, proceed with the details of the Register Digital signature. You need to click on ‘My Dashboard’ and click on the ‘View and Register Digital Signature Token’ option.

- Read all the information and ensure that all the pre-requisite for the Digital signatures are met. After ensuring, click on ‘Register New DSC’.

- Select and proceed with the digital signature details:

- When the prerequisites are done, you will see a list of e-Pass tokens after clicking on ‘Provider List’. Choose the e-Pass token from that list.

- Select the Certificate to sign from the Certificate list. Note that, Individual-based DSC is allowed only for proprietorship firms.

- You need to enter the DSC token pin in the ‘Enter Password’ field.

- A successful message will be displayed after the successful sign.

- Once the user has registered the Digital Signature details successfully, you will see the digital signature details under ‘Current digital signature details’. You can also conduct any action on the IEC number with the active Digital Signature.

Steps when the applicant does not possess Digital Signature

When the applicant of IEC does not have Digital Signature, he/she can follow the given steps:

- You need to take a printout of the application form.

- Put your signature before the ‘Name of the applicant‘, below the ‘Declaration/Undertaking’.

- Then upload the duly signed declaration form.

- Submit the printed and signed application form in the concerned Jurisdictional Regional Authority (RA) office through post or personally.

Importer/Exporter Profile

All the Importers/ Exporters shall be required to file their profile once with the Regional Authority in Part 1 of ‘Aayaat Niryaat Form – ANF2A’.

Steps to print IEC certificate

To print the IEC certificate, follow these steps below:

- Visit the DGFT website.

- Enter your username and password and log in.

- Then click on the ‘Services’ option on the homepage.

- Select ‘Certificate Management’ from the drop-down list.

- Click on the ‘Print Certificates’ option.

- A PDF will be displayed that you can print.

Updating IEC

The IEC allotted to the applicants has a permanent validity, but you need to update it annually not to get deactivated. If the IEC code is updated b etween April and June each ye ar, no fee shall be levied for its updation.

If the IEC update is not done within the prescribed time, it will be de-activated. But you can re-update it after deactivation, which will not account for any violation.

Duplicate Copy Of The IEC Code

If your IEC number is lost or misplaced, you can request the issuing authority to consider granting a duplicate number. It may be followed by an affidavit.

Surrendering IEC number

If the holder of the IEC does not wish to continue to operate with his/her allotted IEC number, they can surrender the same by informing the concerned authority. After the receipt of such intimation, the issuing authority will cancel the number and transmit it electronically to the DGFT. The same will be carried forward to the Customs and Regional Authorities.

IEC code check

PAN-Based IEC is generated by the DGFT over the country and is aggregated at the DGFT headquarters. To check whether your IEC has reached DGFT headquarters and its correctness, click IEC at the DGFT button.

From the DGFT headquarters, the data comes to ‘Customs ICEGATE. For the status and correctness of your IEC at the customs ICEGATE location, enter the IEC in the textbox and click IEC at the ICEGATE button.

Also Read: How to Export From India

Conclusion

If you want to engage in the import-export buisness, you need to have adequate knowledge about IEC code which is essential for doing buisness in this field. To increase the scope of your business, this import-export code is a mandatory requirement. We hope we cleared your queries regarding IEC. You can refer to the above guidelines and procedures to kick-start your global business.