A journal entry for accrued expenses is an adjustment at the end of the year to document the expenses incurred during the current year but not paid until the following year. The matching principle explains that all expenses and revenue must match as per the year incurred and earned. Also, expenses typically benefit businesses as they help generate revenue by providing resources.

If you incur an expense during the year, you need to match the expense against the earnings generated by the expense over the period. Even if the expense was not paid in the year, it must be documented with an accrued expense entry in the journal. It would help if you compared the entry to the income. Costs that are incurred and not paid for are accrued expenses, and some of the most frequently accrued expenses include rent, utility bills and payroll.

Did you know?

Accrued expenses are listed as estimated amounts. These could differ from the actual cash amount paid/received in the future.

What Is an Accrued Expenses Journal Entry?

The distinction between cash-based and accrual accounting is in the time of revenue and

expense accounting – and, more specifically, in the conditions that need to be met for any revenue/expense to be recognised.

Accrual accounting records the revenue – that is, the item or service was supplied to the customer and the business reasonably anticipated the payment in exchange. The amount is reported in the income statement even if a customer is paying through credit (the customer hasn’t yet received, i.e., the cash). The amount is recorded as an accounts payable (A/R) line item on the balance sheet.

Even if cash payments were never made, the income in this scenario is recognised as accrual accounting. Also, if a firm gives a supplier credit instead of cash, the cost remains on the income statement, despite the invoice not being paid. It lowers the tax-deductible income for the present period. While the business may eventually pay cash for the services/products purchased, the cash remains still in the hands of the business for the moment and is reported in the balance sheets as account payable (A/P).

Also Read: Adjusting Entries – Types of Adjusting Entries & Why Adjusting Entries Important

Journal Entry for Accrued Expenses

An accrued expense refers to an expense that has been paid for, but there isn’t yet expense documentation. Instead of documentation, an entry in the journal is created to document the accrued expense in addition to an offsetting liability. If there is no journal entry for the cost, it might not appear in the company’s financial statements at the expense.

It would result in profits reports that are much more for that time. In essence, accrued expenses are recorded to improve the accuracy of financial statements so that expenses are better than the revenues associated.

A journal entry is typically made as an automatic reversed entry, which means that accounting software generates an offset entry at the start of the next month. After that, when the vendor ultimately submits an invoice to the business, it erases that reversed record.

Accrued Expenses Journal Entry Example

It is possible to accrue expenses through a variety of methods. Here are a few common examples of accrued liabilities

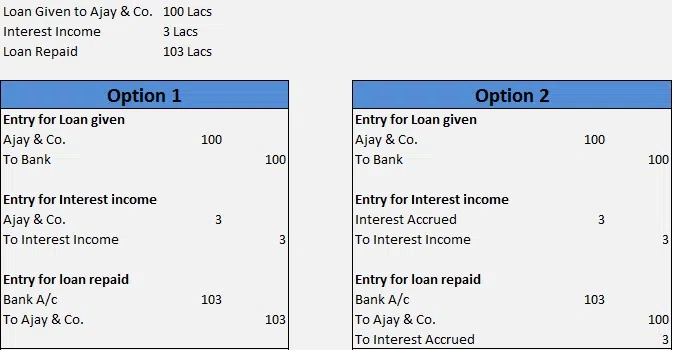

- Accrued Interest: You owe interest on a loan outstanding and haven’t yet been charged until the end of the accounting period.

- Accrued wages: Employees earn wages, but they are paid arrears, that is, in the following period (e.g., the pay period in October and payment date at the November’s end).

- Payroll tax: You hold back employment taxes from the employee’s salaries, but you owe them an upcoming accounting period.

- Accrued services and goods: When you buy the item/service you want, the vendor does not bill you until an earlier date.

- Accrued utilities: You have used utility services for your business but haven’t been charged.

Recording accrued liabilities allows you to prepare for expenses ahead of time. You can identify the costs before you get invoiced. So you can accurately calculate the amount owed.

Example

Jai’s Fashion Boutique employs three employees. Jai is paid ₹ 1,000 per month to lease a tiny location at the local shopping mall. He typically spends the equivalent of ₹200 per month on utility bills.

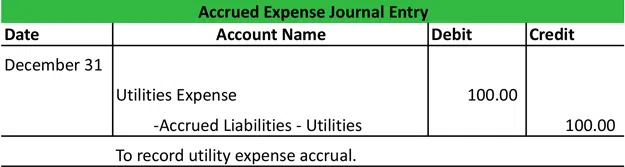

Jack’s electric bill is due each month on the 15th. John had gathered15 days of electrical costs by the month’s end but might not be able to pay them until the 15th of January. This utility charge of 15 days will be accrued after each year. Jack’s Fashion Boutique can accumulate its utility costs in this journal entry for accrued expenses report.

If there is no adjusting entry to account for the interest expense incurred during December, financial statements on the 31st of December won’t include the ₹2,000 of interest (one-third of the ₹6,000) the company paid in December.

To ensure that your financial reports appear accurate according to the accrual-based basis in accounting, an accountant needs to create an adjusting entry at the end of December.

The adjustment entry will comprise an amount of ₹2,000 debited to the Interest expenses (an account on the income statement). Also, it will comprise a credit of ₹2,000 towards the Interest Payable (accounts on the balance sheets).

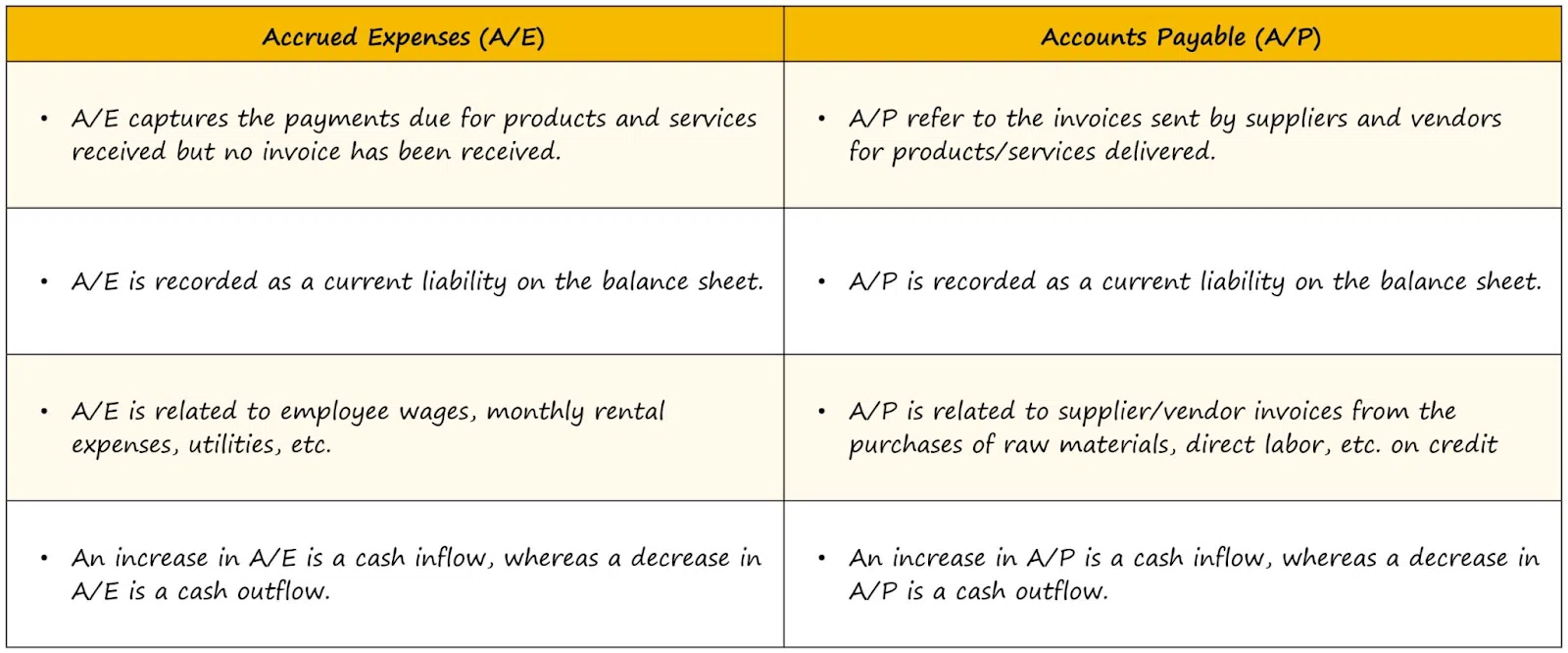

Accrued Costs vs Accounts Payable

Accrued expense is a term used to describe expenses that have already been incurred, but the invoice has not yet been received. This is different from accounts payable, which are the obligations to pay based on invoices from suppliers, and then recorded into the financial system.

There are two distinctions between these two concepts. One is that an accrued cost is not backed by an invoice from a supplier, unlike an account payable, which is backed by a vendor invoice.

Additionally, the accrued expense is counted as a cost. However, this is not the case with accounts payable. For instance, you could use an account payable to pay for fixed assets provided by a vendor, but a fixed asset is not categorised as an expense. However, it is eventually subject to expense throughout its lifetime through continuous depreciation.

Advantages

Here are some advantages of this kind of journals entries:

- The most important advantage is the accuracy of the earnings of the business.

- Because financial transactions are recorded at the time they occur. So, the chances of causing errors or discrepancies are virtually none. You can use the accrued expense journals to record every transaction, making its data easily accessible. It provides an understanding of the obligations.

- Another benefit is that the financial statement readers can view all the obligations and potential due dates. For instance, the financial statement will display the entire scope of transactions than the cash accounting.

- This kind of accounting journal entry employs a double-entry technique which means you could debit one account and credit another. This improves the accuracy of your accounting system and makes audits much easier.

Also Read: Journal Voucher in Tally – Examples, & How to Enter Journal Vouchers in Tally

Important Points to Consider About Accrued Expense Journal Entry

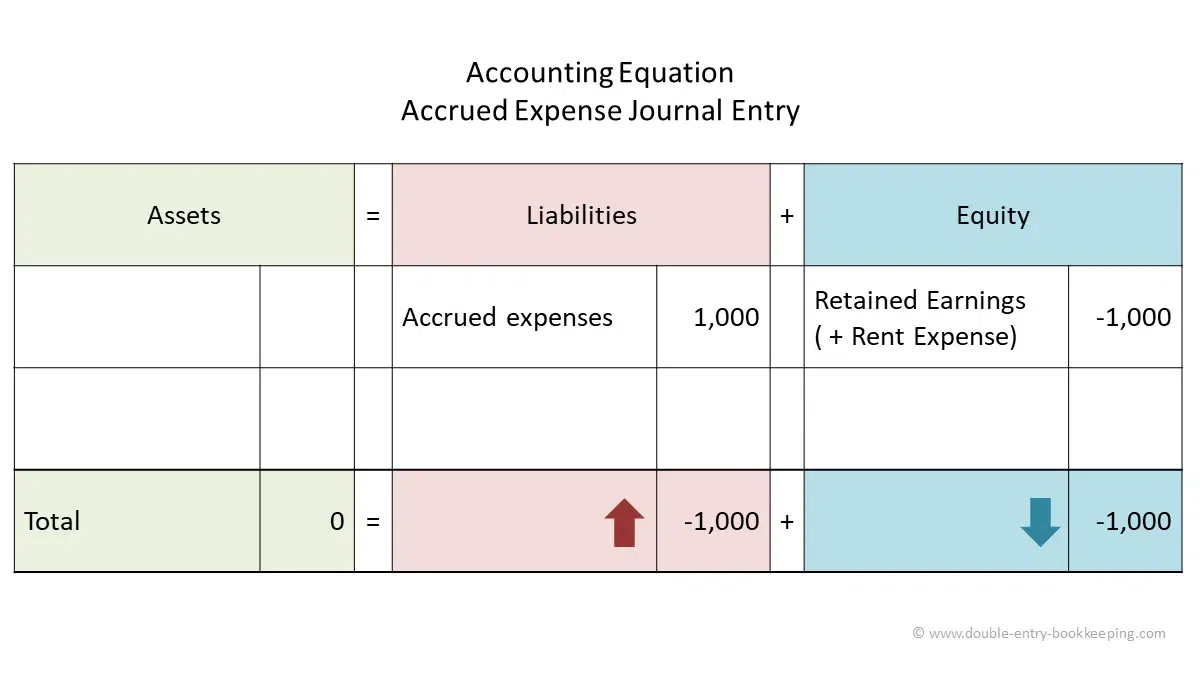

A company usually sees an increase in accrued expenses immediately. It is visible on the liability side of the balance sheet. Also, it’s famous for its “accrued expenses” name. It could also trigger an increased amount in the expense account.

However, the company can debit the account and add this as an expense line to lessen the impact. A large number of expenses could significantly impact the income statement. Paying off its outstanding accounts payable at the end of the year reduces accrued costs.

The process of debiting accounts payable to lower liability and crediting the cash account to increase assets is how a company can recognise a decrease in the amount of accrued expenses.

It’s crucial to understand that the cash used during the current month isn’t a charge in this time frame because the incurred expense was recorded before accounting. Thus the decrease in accrued expense doesn’t alter the income statement.

Conclusion

The information in this article describes the accrued expenses’ significance and meaning in extremely easy terms. It also provides examples of accrued expenses and their importance in assessing how financial stability affects an organisation. The balance sheets of accrued costs appear in current liabilities, and this is because they need to be met within a period which is twelve months.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.