India is infamous for its complex taxation system. It was almost impossible for startups and SMEs to steer through direct and indirect taxes. However, with the introduction of the GST, things have changed.

This article should help you understand how GST is different from the previous tax systems, GST rules, GST item wise list, GST registration, what reverse charge mechanism is and so forth.

If your business makes taxable supplies and has an annual business turnover that exceeds the specified minimum threshold, it must be registered under the GST and hold a GST Identification Number (GSTIN).

You can collect an Input Tax Credit on the GST paid for supplies of goods and services only if you are registered. GST is charged on the value or selling price of the product you are selling.

You can recover the GST levied during business operations in the form of input tax under the Input Tax Credit mechanism provided for businesses registered under the GST Act.

If the output tax exceeds the input tax during the relevant taxable period, the difference is sent to the Government. However, if the input tax exceeds the output tax, the Government refunds the difference.

When you charge GST, you have to issue a GST compliant invoice that clearly shows the amount of GST charged and the supply costs separately. The tax invoice must be issued within 21 days from the date of supply.

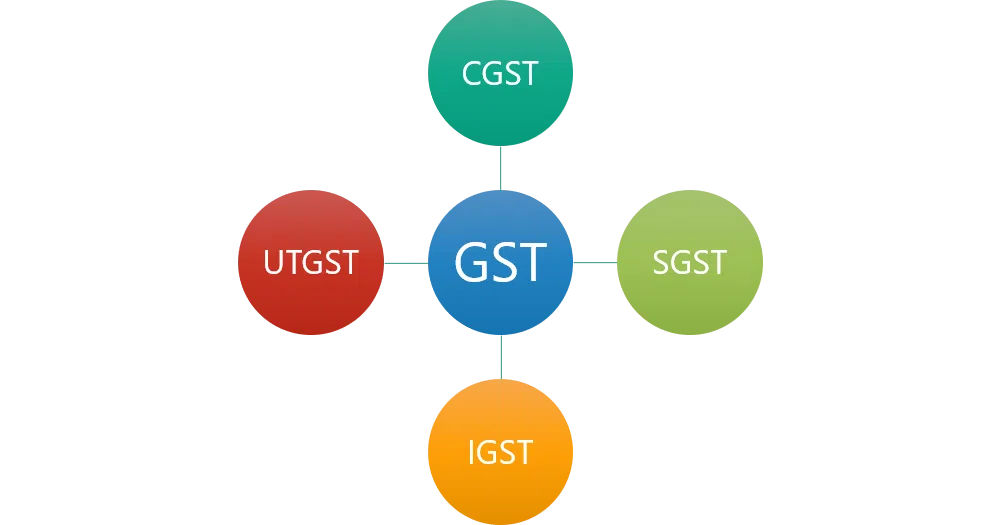

Types of GST

GST can be further classified into the following –

- CGST (Central Goods and Service Taxes)

- SGST (State Goods and Service Taxes)

- IGST (Integrated Goods and Service Taxes)

- UTGST (Union Territory Goods and Service Taxes)

Calculation of GST

Calculating the amount of GST is simple and straightforward. The taxpayer can calculate it in no time and find out the amount of tax that will be imposed on the commodity.

As we all know the GST is set at 18% before it was 26.5% after the amendment was passed.

We need to multiply 18 with the Net Price of the product and divide it by 100.

For example,

The price of the product – 1000

The GST rate – 18%

The price of the product including GST -1180.

Also Read : What is GST Amnesty Scheme? GSTR-3B Late Fee Relief, Benefits, Eligibility, and Last Date

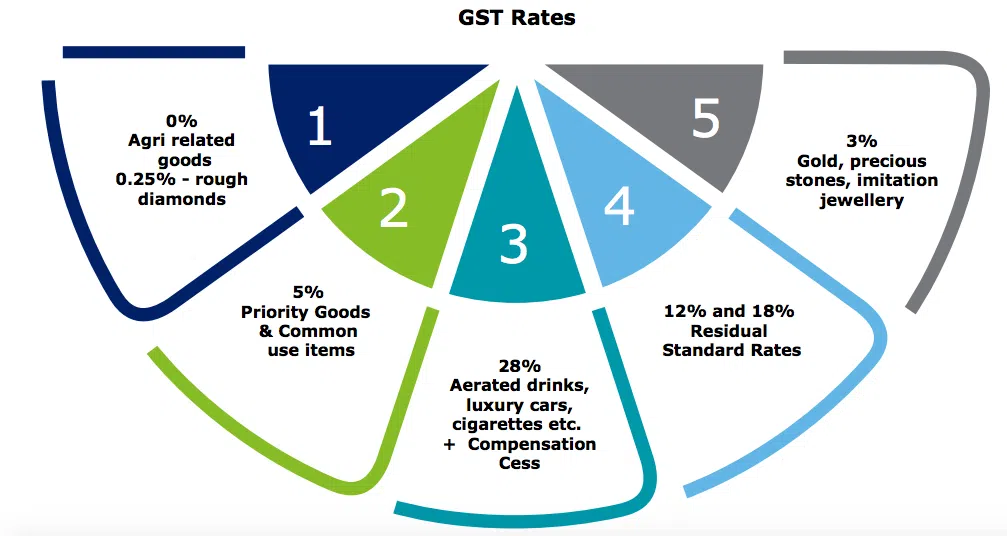

GST Rates

Goods and services are divided into 5 slabs that are ranging from 0-28%

GST Council finalized that the GST tax structure will be divided into 4 tiers – 5%, 12%, 18%, and 28%, with the understanding that the lower rates are for the essential items and the highest for luxury.

For common use items, the GST rate is 5%. There are two standard GST rates of 12 percent and 18 percent which are levied on the bulk of the goods and services including fast-moving consumer goods.

Ultra luxuries, demerit and sin goods (like tobacco and aerated drinks), will attract a cess for five years on top of the 28 percent GST.

What is a GST Return?

GST return is a form that contains all the sales, purchases, tax collected on sales and the taxes that are paid on purchases. A tax collected on sales is also known as output tax and tax collected on purchases are also known as input tax. It accounts for every transaction that the individual has ever made.

If your annual business turnover is over 20 lakhs a year then you’re liable to register your business under the GST registration regulations and also submit particular documents and details to avail of a GST Identification Number (GSTIN).

For certain states such as Arunachal Pradesh, Manipur, Assam, Meghalaya, Mizoram, Manipur, Sikkim, Tripura, Himachal Pradesh, Jammu and Kashmir, and Himalaya the annual turn over the threshold is 10 Lakhs or more.

Reverse Charge Mechanism

If you wish to get a firm grasp on GST, you must know about the Reverse Charge Mechanism (RCM) seeing how it is one of the most important aspects of GST.

When a registered taxpayer purchases goods or services from an Unregistered Dealer (URD) then the registered taxpayer is liable to pay GST under Section 9(A) of the CGST Act.

Back then, registered taxpayers did not have to pay GST on the goods or services from unregistered dealers up to a value of Rs 5000. Things have changed after the Reverse Charge Mechanism was put in action.

Also Read: GSTR 9: Annual Return Filing, Format, Eligibility and Rules

The Simplest way to File a GST Return

Taxpayers registered under the GST i.e. manufacturers, consumers, and every individual who has registered under the GST are required to file their tax returns. With the new GST regulations, filing taxes has become automated and can be carried out online through the GST software or the app provided by the GSTN (Goods and Services Taxes Network).

The steps to file your GST return are as follows:

- Go to the online GST Portal or use the GST software provided by the GSTN

- A 15 digit identification number will be issued based on your Personal Account Number (PAN).

- Submit the invoice stating all your purchases and sales. An invoice reference number will be against every invoice uploaded.

- After this, upload all the inward and outward returns, and the consolidated monthly return online. You can always rectify your errors by refiling the returns

- Before the 10th of every month, be sure to file the outward supply returns in GSTR-1 form using the information section at the GST Common Portal (GSTN)

- GSTR-2A lists all the details of the outward supplies by the supplier to the recipient.

- The recipient is required to verify, confirm, and adjust the details of outward supplies, and file the details of credit or debit notes.

- The recipient needs to provide the details of inward supplies of the taxable goods and services in the GSTR-2 form.

- The supplier has the option of accepting or rejecting the adjustments of the details of inward supplies made available by the recipient in GSTR-1A.