A bank cheque leaf is also called a cheque. Once you open an account with a bank, the bank provides you with a chequebook with several cheque leaves. These are very safe financial tools for making payments. There are various types of cheques. Some are bearer, post-dated, order, crossed, open, traveller’s, self and stale. Every cheque leaf is an order you sign to the bank requesting it to make a specific payment amount available to the payee’s name indicated on the cheque. This could be a person, an institute, a business or even another bank. You also have a cancelled cheque leaf among the various types of cheques. This has two parallel lines across it with the word ‘cancelled’. This type of cheque validates your banking account with that specific bank. Such a cheque is often asked for when a person wishes to withdraw from an Employee’s Provident Fund (EPF) funds, for Know Your Customer (KYC) purposes, and other reasons. You do not need to sign such a cheque.

Did you know?

First, ten cheque leaves will be free of cost for cheque book services in a financial year. After that, ten leaf cheque books will levy ₹40 plus GST; 25 leaf cheque books at ₹75 plus GST and emergency cheque books will attract a charge of ₹50 plus GST for ten leaves or part thereof.

What Is the Relevance of a Cheque Leaf?

A bank cheque leaf ensures secure monetary transactions between individuals, business houses or any two parties involved in financial activity. You can transfer the money to make a payment by keying in the recipient’s details, the amount you wish to share and your signature on the cheque. This is a complete non-cash payment that is secure and assures you of the safety of the transfer of your funds. Most individuals and businesses have embraced digitisation. Payments are made online and via banking apps. But many still prefer making payments via cheques. Some individuals refer to a cheque as a written bill of exchange. The person who writes the cheque favouring the recipient is a Drawer. The person to whom the cheque is issued is known as a Drawee. A bank maintains the record of every payment you make through a cheque within the bank’s data bank, i.e. books of account. Your bank statement will detail all the payments you have made. This way, you can always keep an account of the same. When you draw two parallel lines on the top left of the cheque and write account payee only, you credit your cheque into the person’s account addressed on your cheque. When you issue a cheque to someone, it is on the premise that you have the requisite amount of money in your account for the recipient to receive it. It is fraud if you write a cheque knowing that your account does not have the requisite funds. A bank cheque leaf that bounces is liable to a penalty which could be paying a fine that involves double the amount stated on the cheque or even imprisonment. One of the most significant advantages of a cheque is that it enables you to make a substantial financial transaction seamlessly.

Also Read: Everyone Should Know About Different Types of Bank Cheques

Exploring Different Types Of Cheques

Given below are some of the various types of cheques:

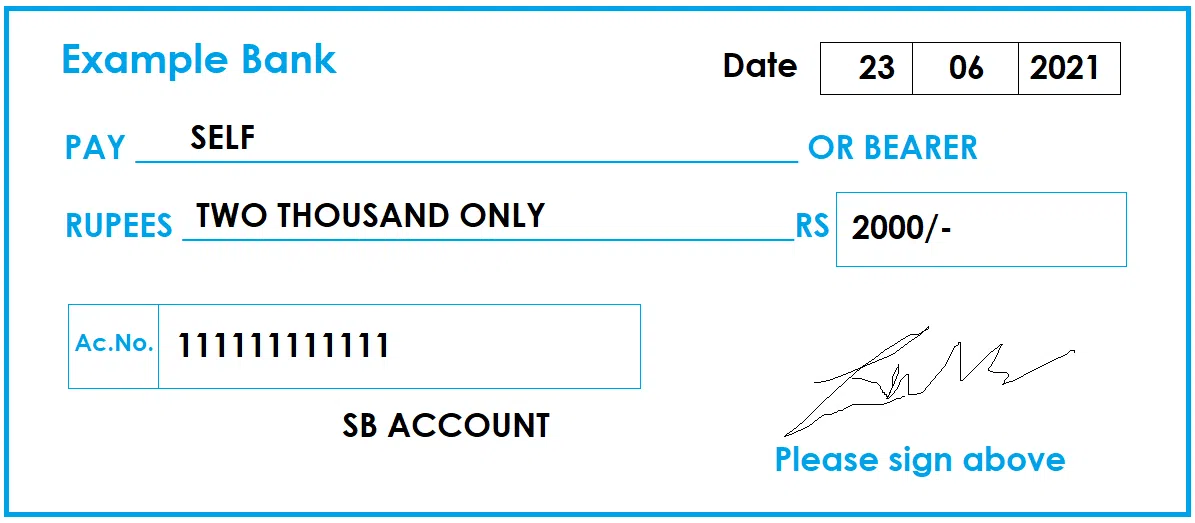

Self

This is like a bearer cheque. You write the word ‘self’ in the space provided that states, ‘pay to’. You receive the money from the bank where you hold the account and present a cheque.

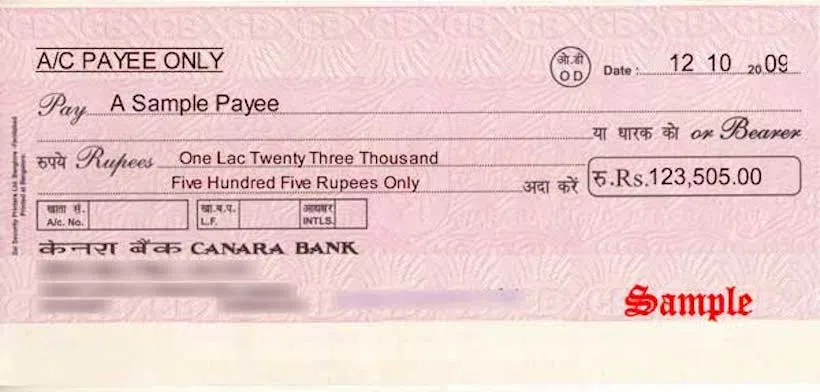

Account Payee

You draw two parallel lines across the top left of the cheque and write ‘account payee’ in between. The person’s bank account on the cheque will receive the payment made by you.

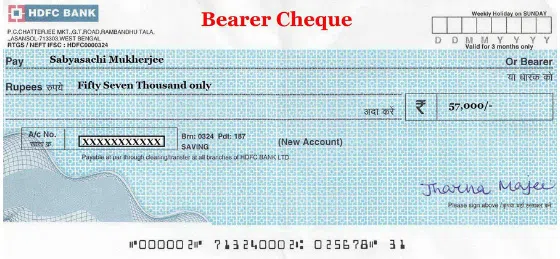

Bearer

These are the riskiest cheques as they do not require an endorsement. If you don’t encash it within a timeframe of 3 months, it is termed a stale cheque and requires a revalidation.

Banker’s Cheque

These are issued by a bank and serve as a guarantee for payment.

Traveller’s Cheque

These types of cheques are ideal for travelling overseas. Instead of carrying unsafe cash, you can carry traveller’s cheques encashed on foreign trips.

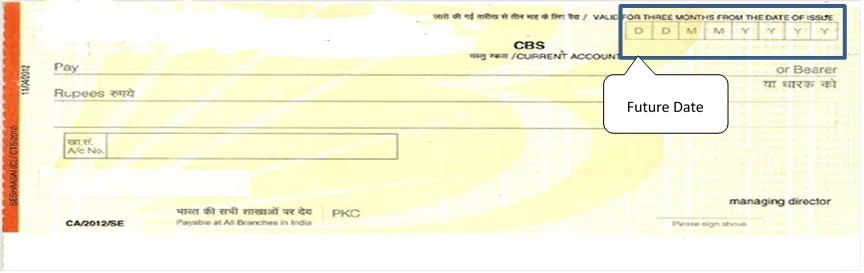

Post-dated

As the name suggests, you can fulfil the payment transaction at a date in the future. The date can extend up to 3 months from the date of issuance.

Cancelled

A cancelled cheque leaf bears two lines across the cheque with the word ‘cancelled’ written in between those lines. This proves that you are an account holder with the said bank.

What Does A Cheque Leaf Look Like?

Given below are all the cheque leaf details:

- A date. In the absence of a date, the cheque is considered invalid.

- The monetary transaction amount to be made should be both in words and in numbers.

- The receiver’s name (person or business) to whom you are making the payment should specify on the cheque.

- The Drawer’s signature is a prerequisite on every cheque.

- Every cheque has a 6-digit number—the cheque number displayed on the left-hand side of the cheque at the base.

- Every cheque has a Magnetic Ink Character Recognition Code (MICR)

- Every cheque displays the Indian Financial System Code (IFSC) code. This is an alphanumeric code that consists of 11 digits. This is always displayed near the bank account number on every cheque leaf.

- Every cheque has to be drawn from a particular bank.

Key Considerations When Writing A Cheque

- Avoid folding a cheque.

- Ensure you are using the same signature always.

- Avoid leaving a blank when filling in the details on the cheque

- Ensure that no space between the words and digits denotes the amount of payment on a cheque

- Overwriting on a cheque makes the cheque invalid unless the bank asks you to sign in that specific space again.

Also Read: Meaning and Need for a Cancelled Cheque

How Secure Is a Cheque Leaf?

Every cheque leaf is a monetary instrument. It makes it obligatory for the said financial institution upon which it is drawn to make the necessary payment mentioned in the cheque. The payment has to be made to the name of the person or business enterprise mentioned in the cheque. A cheque leaf is one of the safest and most secure methods of making a payment to someone. The bank maintains all the records of your financial transactions. Your cheque book has a provision for writing all the details of every cheque you have issued. You can maintain the details in an organised manner yourself as well. You must try not to misplace a blank cheque that carries your signature as it can lead to a misappropriation of funds if it falls into the wrong hands. Many are good at forging signatures, and you should not disclose your signature to anyone.

Conclusion

This article affirms that payments made by cheque are incredibly safe and secure. If you want to make a ‘stop payment’ for various reasons, you can do that as well by informing the bank of all the details of the said cheque. Banks are very resourceful in maintaining details of all financial transactions and can furnish you with the same whenever you feel something is amiss.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.