With every passing day, new standards for digital banking are being established. Following the demonetisation effort in 2016, most public and private sector banks developed dedicated internet banking platforms for their client’s convenience. These net banking websites offer more than simply convenient internet banking; they also offer extra services such as opening fixed deposit accounts, paying taxes, etc. There are a lot of advantages of internet banking which allows you to work from home and get all your work done without approaching the bank, and you can know the entire details.

Did you Know?

Net banking does provide all the services online. Now you don’t have to travel and visit banks for the normal routine work.

What is Net Banking?

Internet banking, often known as online banking, e-banking, or net banking, is a service provided by banks and financial institutions that allows users to access their accounts using the internet. It’s an online system or service that allows users to access financial and non-financial banking items. It is convenient, but it is also a safe way to the bank.

Even modest services used to require customers to visit the bank. Customers no longer need to visit their bank’s branch office for minor services since the introduction of internet banking. Almost all banking services and products are accessible via the internet. Net-banking makes all banking tasks easier, from transferring funds to getting a demand draft. All you need to access your online banking account is a laptop, computer, or even a mobile phone with an internet connection. Also, there are a lot of advantages of internet banking.

Net Banking Fund Transfers

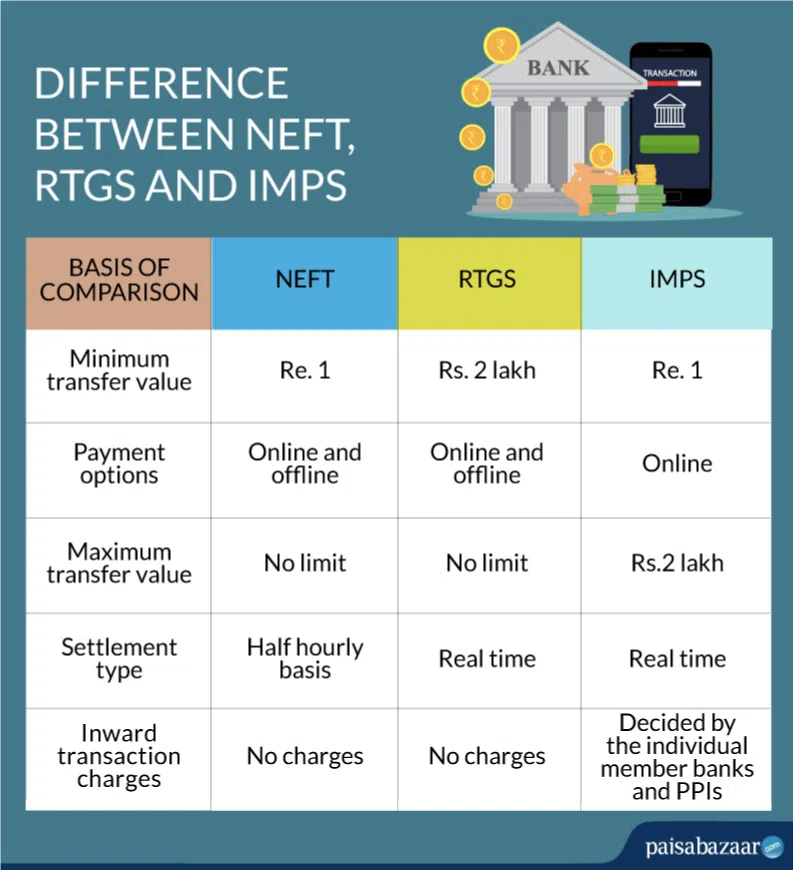

NEFT, RTGS, and IMPS are three alternative ways to transfer money from one account to another via the internet.

Also Read: Mobile Banking and Types of Mobile Banking Services

NEFT

One of the most widely used payment mechanisms for one-to-one financial transfers is National Electronic Fund Transfer (NEFT). It is a time-limited process at the bank, but it is available 24 hours a day, seven days a week on the internet banking portals. In most cases, funds are securely sent via NEFT in about 30 minutes. The time can, however, extend beyond 2-3 hours.

RTGS

Real-Time Gross Settlement (RTGS) is a method of settling funds in real-time on an order-by-order basis. This means that the RTGS system ensures that the money is credited to the beneficiary’s account as soon as possible. The Reserve Bank of India (RBI) monitors RTGS transactions, implying that successful transfers are irreversible. A minimum of ₹2 lakh must be transferred using this technique. RTGS is a time-limited service at the bank, similar to NEFT, except it is available 24 hours a day, 7 days a week via net banking.

IMPS

The Immediate Payment System (IMPS) also handles real-time money transfers. It’s most widely used to send money between banks in India instantaneously by mobile, internet, and ATM. The beneficiary’s mobile number is all that is required to send money using IMPS.

Internet banking is not available to all account holders. If you want to use internet banking, you must register for it either when you open the account or later. To get into your internet banking account, you must use your registered customer ID and password.

Features of Online Banking

Some of the important features of net banking are listed below:

- A safe and convenient banking method. Net banking is the entire online system that provides all the facilities to the customers. It would be best to not go to the bank for simple activities.

- A password-protected banking system. This reduces the chance of online fraud. The bank does provide the perfect security and the safety to the online transactions. This is very helpful to the customers and provides the perfect security that gains the customer’s trust for online transactions.

- Simple access to financial and non-financial banking products and services. Many options are available online, including the fixed deposit, savings account, Demat account, and many more. All the features of the bank are available online.

- You can access your bank account from anywhere at any time. As the technology grows, customers need not travel to various banks and fulfil their requirements. People can now directly open a bank account by being at home and utilising all the features by staying at home.

- Transfer funds online via NEFT, RTGS, and IMPS at any time. All the online transactions are performed within a fraction of seconds. Customers need not go to the bank to transfer the money. All they need to do is, sit at home and perform the online transactions.

- Process bill payments promptly. The bank does provide all the provisions for the payments of bills online. People no longer need to send in the queue to pay the required bills. The bank does provide the provision that even reminds the user to pay the bills.

- Keep track of mortgage payments, loans, savings accounts, and other automatic payments. All the features of the loans and other payments are also available online. The customer need not worry about online fraud, and the website does provide security against cybercrime.

- Channelise or cancel automatic payments. You need not worry about the timely payment of your instalments. The automatic bank payment does take care of everything.

Advantages of e-Banking

If you want to know what online banking is, read out the below advantages to know the details.

Accessibility

Banking services are available 365 days a year, 24 hours a day. The bulk of the services offered is not time-limited. You can check the balance of your account and make transfers whenever you want without waiting for the bank to open.

Simple to Use

The use of internet banking services is straightforward. Transacting online is considerably handier for many people than travelling to a branch to perform the same thing.

Convenience

You won’t have to drop everything to wait in line at the bank. You can carry out your transactions from any location. Online banking can pay utility bills, regular deposit account instalments, and other things.

Time-Saving

Internet banking benefits the users and allows you to finish any transaction in just a few minutes. Net banking allows you to instantly transfer funds to any account in the country or start a fixed deposit account.

Activity Tracking

Every transaction you make in a bank branch is logged, as are all transactions you make on the bank’s internet banking portal. This can be used to prove the transaction if necessary. Details such as the payee’s name, bank account number and amount paid, payment date and time, and any remarks will also be noted.

Disadvantages of Internet/Online Banking

Some of the disadvantages of internet banking include the following:

Internet Requirement

To use internet banking services, you must have a constant internet connection. If you don’t have internet access, you won’t be able to use any online services. Similarly, if the bank’s servers are down due to technical difficulties, you would be unable to use net banking services.

Also Read: What are the Different Digital Payment Methods?

Transaction Security

Online banking transactions are still vulnerable to hackers, no matter how many steps institutions take to ensure a secure network. Despite the high encryption measures used to keep customer data private, there have been cases where transaction data has been compromised.

Difficult for Beginners

Some have lived their entire lives away from the internet in India. Understanding how internet banking works could seem like a big deal to them. No one can explain how online banking works or how to use it. Inexperienced beginners will have a difficult time figuring things out.

Password Security

To use the services, each internet banking account requires a password to be typed. As a result, the password is critical to ensuring integrity. If the password is leaked to others, they may be able to use it to commit fraud. Furthermore, the chosen password must adhere to the bank’s standards. Individuals must update their passwords regularly to avoid password theft, which might be difficult for the account holder to remember.

Conclusion

With the upgradation in the technology, the bank does provide the provision to operate online. You no longer need to go to the bank to do your activity. All you need to do is sit at home and do all the transactions online. Most banks even provide the provision to open the account online by providing legit documents. This way, it is very helpful for the users to operate the functions online. Most banks are now trying to make things easy for their customers and are making minimum use of paper as much as possible. This, in a way, is a good scope for paperless transactions.

Follow Legal Tree for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.