E-commerce has mushroomed across the world, providing goods and services across industries on a global platform. In simple words, e-commerce operators permit vendors of different wares to sell them on their platforms. The GSTR-8 is an official statement of tax which is collected at the source (TCS). It details the various deliveries made to clients every single month by individuals who are registered taxpayers as well as non-registered. It also includes details about the total tax collected and the amount of taxes which have to be paid and have been paid. All e-commerce operators who qualify for payment of such returns have to file them at the end of every month. This statement of tax returns clearly reflects the supplies which have been made through the said online platform and the exact sum of tax collected at the source of the said supplies. It is mandatory for all e-commerce giants to be registered for tax collected at source as well as procure a GST registration. There are certain conditions which qualify e-commerce operators to file GSTR-8.

Did you know? The maximum penalty for defaulting on GSTR returns is only ₹5,000 though an 18% interest is levied as a late fee.

What Is the Meaning of GSTR-8?

GSTR-8 is a monthly return that is binding on all e-commerce operators. They are obliged to file this return by the 10th of each month if they need to collect tax at the source, which is popularly referred to as TCS. This simple form contains information on all supplies that sellers make available on e-commerce platforms. It also includes the details of whether the sellers are unregistered or registered, brief details about the clientele, as well as the amount of tax (TCS) which is collected on the supplies provided to the operators. The mechanism of TCS is almost similar to that of tax deducted at source (TDS). When an e-commerce platform sells an item valued at ₹10,000, it is binding upon the platform to subtract and make a remittance of ₹100 to the government. This is considered as tax collected at source (TCS).

Who Should File GSTR-8?

In simple words, e-commerce operators constitute digital platforms which serve as convenient channels for registered as well as unregistered sellers to sell their merchandise. These operators must register for TCS and obtain a GST registration. These are two of the key requirements for these operators.

Who Classifies as an E-commerce Operator?

All e-commerce platforms that provide the facility of digitally managing commerce which involves products and services across industries, qualify as an e-commerce operators. They are best defined as:

- E-platforms function as a marketplace for merchants to sell their merchandise.

- They help connect providers of goods and services to a very large base of customers on a national and global platform.

- All e-platforms facilitate the selling of goods of manifold vendors at feasible price points.

Why Is GSTR-8 Important?

The goods and services tax-8 is a monthly filing of tax returns which is mandatory for all E-commerce operators with a GST registration. These operators are required to deduct tax collected at the source under the GST rules and regulations. It is of immense relevance because of the following reasons given below:

- It furnishes details of all the supplies which have been made through the e-platform.

- It provides details of the tax collected at the source of these supplies.

- Once the e-commerce operators file their GSTR-8 returns, the providers of the goods can avail of the input tax credit of the tax, which is deducted at the source (TCS).

- Details of the input tax credit are described in the GSTR-2A form of the said suppliers of merchandise.

Also Read: GSTR 2A – Details, Filing, and Format for GSTR 2A

When Is GSTR-8 Due?

There are many who are a little ambiguous about the correct timing of filing GSTR-8. All e-commerce operators are expected to file their GSTR-8 returns by the end of every month. However, they benefit from a grace period of 10 more days. This makes it possible for them to file the GSTR-8 return by the 10th of the forthcoming month, failing which they are penalised.

What Is the Penalty for Not Filing GSTR-8 Within the Due Date?

E-commerce operators who default on filing their GSTR-8 returns are levied taxes as follows:

As per the rules of the Central goods and service tax (CGST), these operators are levied a fine of ₹100 a day. As per the rules of the State goods and services tax (SGST), the operators are penalised ₹100 a day which makes the total penalty amount to ₹200. The maximum penalty amounts to ₹5,000. However, in addition to this, the operators have to bear the responsibility of an 18% annual interest. The taxpayers furnish details on the amount of tax that has to be paid along with the interest penalty. The time frame for the penalty comes into effect on the 11th day (the 10th day of the following month being the last date) until the date on which the amount has to be paid.

The filing of GSTR-8 involves a simple procedure that includes the following steps:

- At the onset, you have to visit the official GST website (www.gst.gov.in).

- Log into your account with your credentials.

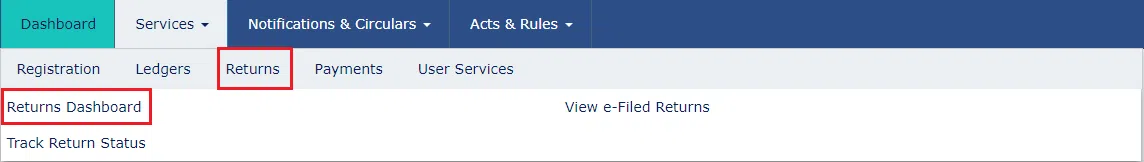

- On the new screen that appears, you have to click on the tab marked as ‘Services’, then on ‘Returns’ and then on ‘Returns dashboard.’

- Click on the ‘financial year and return filing period’ tab.

- Next, click on the ‘search’ tab.

- A new page by the name ‘file return’ is displayed on your monitor.

- This page includes relevant details that all taxpayers should read and understand in detail.

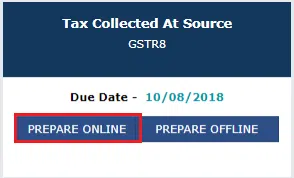

- Once you have familiarised yourself with these details, you need to click on the ‘prepare online’ tab, visible under the GSTR-8 option. This will enable you to make the requisite entries for filing the returns.

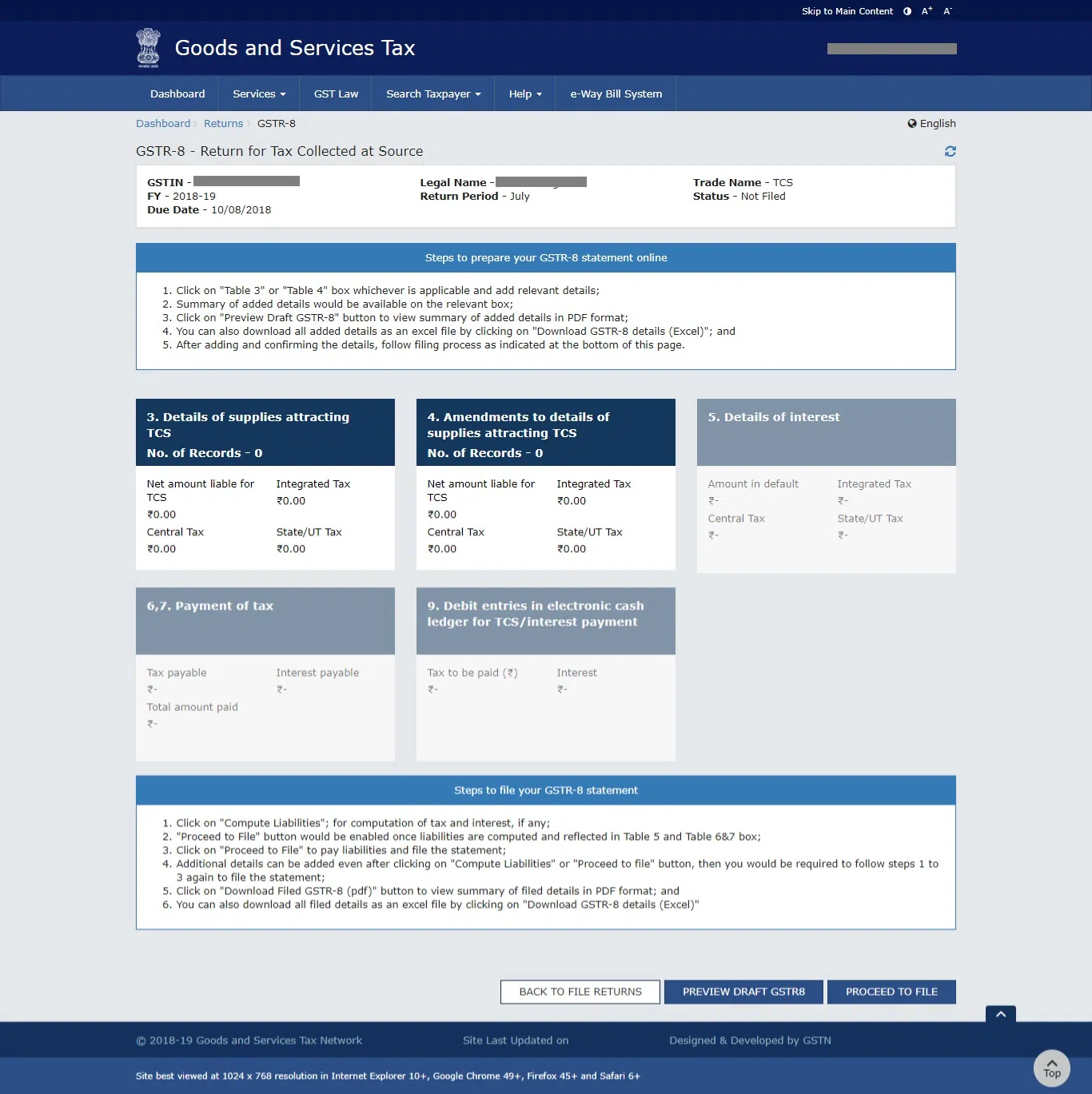

- After completing the above formalities, you will be able to view, under the same GSTR-8 tab, the ‘return for tax collected at source.

Given below is a screenshot of the final procedure of the above format for filing the GSTR-8 return.

How to Revise GSTR-8?

An erroneous entry made by e-commerce operators cannot be rectified. However, the e-commerce operators can make the necessary corrections when filing the returns in the following month. This will help nullify the errors committed in the form of the previous month.

Details to be Provided in GSTR-8

The process of filing GSTR-8 returns involves providing all relevant details to facilitate the entire process in a smooth manner. Given below are the various details that e-commerce operators have to provide:

- Details of their goods and services tax identification number (GSTIN). In the past, the tax authorities at the state level assigned a tax identification number (TIN) to e-commerce operators. GSTIN has replaced TIN.

- Once operators provide this detail, their legal details like name, etc. are automatically keyed into the requisite spaces provided.

- E-commerce operators have to furnish all requisite information about the total volume of supplies along with their gross value made to and returned by both non-registered as well as registered merchants. The difference in the value of the merchandise provided and returned is the sum which becomes applicable for tax collected at the source.

- All incorrect entries made in the previous return can be corrected in the current statement.

- E-commerce operators who have defaulted on earlier payments in the past have to file their returns with the amount of interest that has been imposed.

- Provide details of all the taxes paid under integrated goods and services tax (IGST), central goods and services tax (CGST) as well as state goods and services tax (SGST).

- Once e-commerce operators fulfil all their payment liabilities for a specific time frame of tax payments, they become eligible for a refund from the electronic cash ledger. They have to provide those details as well.

- Once you complete all the formalities, the system performs the necessary calculations and showcases the tax amount owed by you to the government. It also details the number of tax payments, the late fee payments as well as the penalties paid by you.

- The final step in this process necessitates your digital signature affirming that you have provided all accurate details.

Also Read: A Guide to Filing GST Annual Returns (GSTR-9)

Conclusion:

The above contents take you through the entire process of what GSTR-8 entails, who it applies to and what it involves. All e-commerce operators are liable to file GSTR-8 returns on a monthly basis. The details of this article clearly reflect the process of filing these returns, the penalty for late fees as well as the mechanism to correct all erroneous entries. The process is simple and easy to follow once you provide all the correct details. Do you have issues with payment management and GST? Install the Legaltree App, a friend-in-need and one-stop solution for all issues related to income-tax or GST filing, employee management and more. Try it today!