Section 192 of the Income-tax Act, 1961 makes it compulsory for employers to deduct TDS. They should deduct TDS at the time of paying salary to their employees. The Act makes it clear that this section is applicable only when the total income of the employee exceeds the income exempt from tax. Currently, the income exempt from tax, after taking into account the rebate of section 87A is Rs 5,00,000.

What is Form 24Q?

Form 24Q is a return filed by the employer containing the details of the salary paid to the employees. This is a detailed form containing all the details of the employee’s salary and income. This is the TDS form for salary.

The act has separated the subsections based on employee category as below:

192 A: Government employees apart from central government employees

192 B: Non-government employees

192 C: Central government employees

For all the above-mentioned cases, the employer deducts TDS on salary. Later, the employer has to file and upload Form 24Q.

Form 24Q Due Dates

The table given below shows the due date of filing Form 24Q

|

Quarter |

Due Date |

|

April to June |

31st July |

|

July to September |

31st Oct |

|

October to December |

31st Jan |

|

January to March |

31st May |

Penalty for Non-Filing of Return

Section 234E levies a penalty if the actual date of filing exceeds the due date. There is a penalty of Rs 200 per day till the filing of the return. The penalty amount may equal the actual TDS amount but will never exceed it. As per section 271H, the Assessing officer may charge an additional fine between Rs 10,000 and Rs 1,00,000.

It is important to note that interest on non-deduction and non-payment of TDS under section 201A is at the rate of 1% and 1.5% per month respectively. This section does not apply when there is a delay in the payment of taxes.

Contents of Form 24Q

Annexure I Content

Challan Details:

- The serial number of the challan.

- BSR (Basic Statistical Return) code

- The date of deposit.

- Aggregate amount in challan

- Sum of TDS and interest (divided among the employers)

Details of the Employee:

- Employee reference number, (use the serial number if not available)

- Name of Employee

- PAN of Employee

- Date of Payment

- Amount Paid

- TDS Amount

- TDS Section Code

- Education Cess

Also Read: TDS Challan ITNS 281- Pay TDS Online With E- Payment Tax

Annexure-II Content

Annexure-II contains the division of the salary, any deductions as claimed by the employee. It also includes the income from other sources, house property and overall tax liability as calculated and submitted by him. The employer needs to fill this annexure only for the fourth quarter.

How To File TDS Return For Salary Online

The Employer can fill Form 24Q in two ways, either online or offline. For certain individuals, filing the quarterly return online is compulsory. These include employers such as –

- Government bodies. (Either central or state).

- The principal officer of a company.

- Whose accounts were tax audited for the last year under the Income Tax Act as per section 44AB.

- If the number of employees is more than twenty during any time of the financial year.

You can file your returns online through the Return Preparation Utility (RPU). There are several third-party applications with which you can file your return. They are also mentioned on the official website of NSDL.

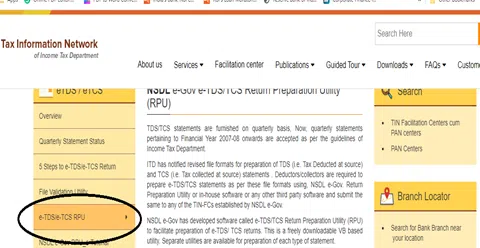

- Step 1: Download the TDS utility from the NSDL website. First, Log on to their website and select the utility as circled below.

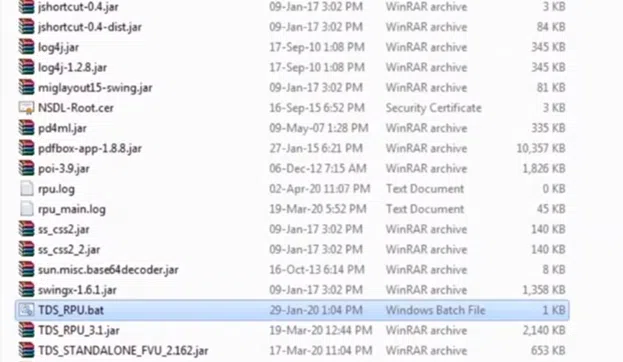

- Step 2: Download and unzip the folder. Then select the TDS_RPU.bat file. In case the Java software is not pre-installed, then you can install it by downloading it over the internet.

- Step 3: Open the utility and select Form 24Q from the drop-down menu located at the centre. Then, select the regular icon since the revised form is not filed. Then, press ‘click to continue.’

- Step 4: The server will then direct to form 24Q. Y ou won’t be able to select Annexure-II for the first three quarters as it will appear only for the fourth quarter.

- Step 5: In the form window, the employer then fills in the basic details. These include the TAN number, PAN number, financial year, nature of deductor, and details of the employer. The fields marked with * are mandatory. Towards the end, the form requires the mentioning of the details of Form 24Q filed for the earlier period. The receipt number of the previous return is actually the confirmation of the previous filing.

- Step 6

- The challan tab contains the details of the amount of tax paid. The important columns are TDS amount, surcharge, interest and fees. The BSR code is available on the challan and the employer can retrieve it from there. In the ‘minor head of challan’ select 200.

- It is advisable for the business owners to maintain a separate excel form at the time of preparation of challan. It would help them in not referring to the individual challans one by one at the time of preparation of the 24Q return.

- Step 7: In Annexure I, add the details of deductees i.e., the number of employees.

- Initially, add the rows. The number of rows will be the same as the number of employees. In the “section under which payment made” select the appropriate section. Section 92 B is for non-government employees while 92 A and 92 B are for government employees.

- One common problem which employers face is regarding the employee code. This is the company-specific employee code. If the company does not have any such code they can use the serial number instead.

- The most important column is the PAN number of the employee. It must be correct.

- The date and amount of payment are the details of the total gross salary paid and not the TDS amount.

- Generally, the date of the deduction of TDS is the date of credit of salary in the bank accounts of the employees. So both the columns can have the same date.

- There is a separate column where the employer can mention the certificate number. Fill it up only in case of non-deduction or lower deduction.

- The assessing officer generally issues a certificate under section 197. Here he mentions that the employer will deduct lesser tax or no tax. In case there is an employee who has such a certificate, take the details from him.

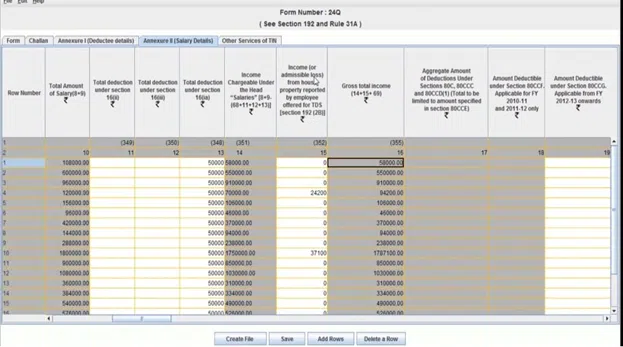

- Step 8: The most critical aspect of this return is Annexure-II salary details. At the onset, add the required number of rows, which would be equal to the number of employees.

- Then fill in basic details such as name, PAN number, category of employee, duration of employment. In column number 9, fill the details of the salary received from another employer. This is applicable specifically in the case of new joiners.

- The present or chosen employer will deduct tax at source on the total amount of salary (including salary received from the previous or other employers). The employee has the right to choose the “Chosen employer”.

- In column number 15, mention the house property income submitted by the employee.

- Column number 33 asks if the amount of HRA claimed exceeds Rs 1,00,000 or not. If it exceeds Rs 1,00,000, then mention the PAN number of the landlord.

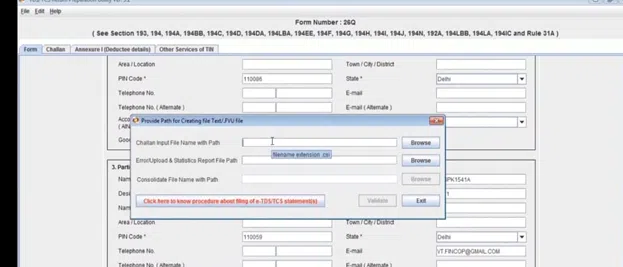

- Step 9: Now, click the ‘create file’ button. Then a dialog box will appear as shown below.

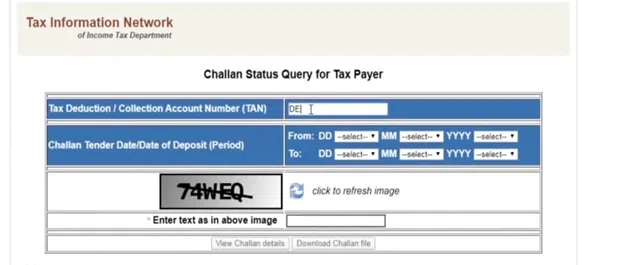

- The dialog box asks to upload the CSI file of challan. This file can be easily downloaded from the NSDL portal. Open the OLTAS Application of NSDL on the browser to get the challan file. Once the webpage appears, mention the TAN number and period. Then, download the file.

- Step 10: At the end, click the ‘Validate’ button. Then the FVU file and form 27 A will generate. After signing form 27 A by the employer, submit the form accompanied by the FVU file to the TIN facilitator centre.

Also Read: Time Limit To Deposit TDS And File TDS Return

How to Compute Salary Income

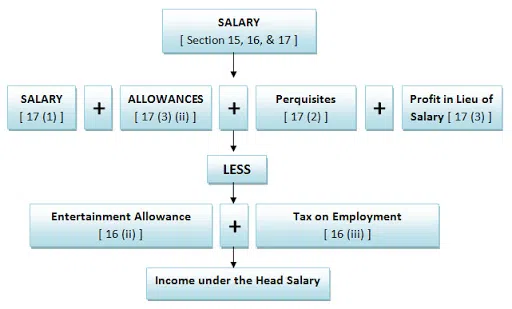

The employee computes his Salary income as per sections 15, 16, and 17 of the Income Tax Act. Section 15, gives the scope of this head and limits the incomes which form part of this head. Section 16 gives deductions allowed out of income taxable under the head salary.

Section 17 defines the term ‘salary’, ‘perquisites’ and ‘profits in lieu of salary’. Also, it is important to note that employer and employee relation is a must for an income to be taxable under the head ‘salary’. The table below describes the interlinking of the sections.

The employer needs to be aware of the deductions claimed by the employee so that excess TDS is not deducted. The employer needs to take necessary details from the employee as they will require it at the time of filing Form 24Q. The details include:

- Investment proof of the Employee: This is generally given by way of form 12BB.The employee gives it at the beginning of the financial year. This is only an estimation and the actual tax saving investment may vary. The employee can give documents and evidence of such investments at the end of the financial year.

- Loss from House Property: Under section 24, the employee can claim the benefit of interest paid while claiming deductions. However, the sections restrict the amount of loss amount to Rs 2,00,000. The employee should give the details of house property losses to the employer for claiming the benefit.

- Income From other Sources: Even if the employee fails to give details of income from other sources he may claim the benefit at the time of filing their income tax return.

- Deductions: The employee must provide the employer with the details of the deduction benefit claimed under the different sections of chapter VIA.

Conclusion

The income tax law requires you to file a TDS return Form 24Q. Unlike GST, where the return filing and payment of taxes occur simultaneously, here there is a clear separation. The taxpayer has to pay monthly tax followed by quarterly returns. This setup provides the tax authorities with enough information to fix loopholes and prevent evasion of taxes. For employers, it’s advisable to prepare regular excel sheets to fill in the details easily. This is only possible when the employer maintains a proper record of the transactions.