A balance sheet is normally prepared as on a particular date and is a synopsis of the organisation’s financial condition. The form of balance sheet is an equation that equates the sum of shareholder equity and liabilities of the organisation to the organisation’s assets. Balance sheets assist in calculating ratios and conducting fundamental analysis with the help and involvement of other financial statements. It provides a snapshot of an organisation as on a particular date about its Owings and ownership. It plays an important role in seeking investors, selling a business, or securing a loan. Therefore, let’s know the fundamentals of the balance sheet and balance sheet preparation process.

What is the balance sheet?

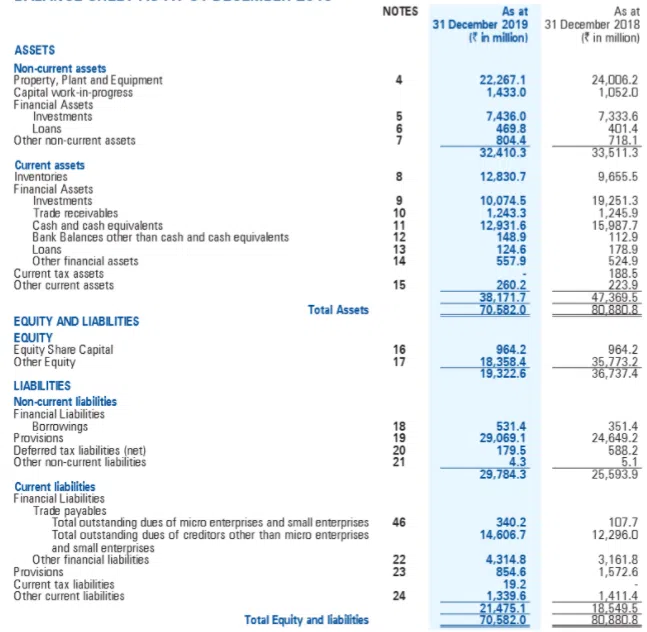

A financial statement that poses the book value of the assets and liabilities of an organisation is called the balance sheet. The balance sheet depicts the current and past performance of the company. It also provides the company’s plans and projections for the future. Therefore, balance sheet preparation is essential for external and internal analysts such as institutional investors, stakeholders, and outside regulators.

The equation for the balance sheet can be given as,

Shareholders’ Equity + Liabilities = Assets

What is the purpose of a Balance Sheet?

The balance sheet is the mirror image of the entire financial health of an organisation as it reveals every transaction of the organisation since its inception. Balance sheets are prepared to overview how much investment is done in the organisation and how much liabilities are accumulated for payments. It also gives you the chance to analyse if you have enough assets to meet the liabilities and upcoming payments.

Calculation of vital financial ratios like the debt-equity ratio, current ratio, and many more can be done from the data and information available on the balance sheet. The debt-equity ratio provides the capability of the organisation to make payments through the equity only if the need arises ever. The current ratio is calculated as current assets over current liabilities. It provides the information if the organisation can discharge all its liabilities in the next 12 months using its current assets.

The comparison between the current and the previous balance sheet lets the user understand the change in financial conditions of the organisation over a period. It states if the organisation is growing positively or has stagnant or negative growth.

Did you know? Bengaluru has the highest number of unicorns in India followed by Delhi (NCR) and Mumbai.

What are the components of a Balance Sheet?

The balance sheet is prepared at the closing of an accounting period. It varies in respect to different industries and their business. Therefore the balance sheet items would differ from organization to organization. However, some line items are common in almost all the balance sheets of an organization. Some of such items are briefly discussed below:

1. Current Assets

- Cash and cash equivalents

The first line of the balance sheet contains liquid assets such as cash. The cash equivalents are those assets that have a short-term maturity that mature within three months. It also includes those assets that the organization can liquidate without or at very short notice, such as marketable securities. The company balance sheet format will always include the details of the cash equivalent in the footnotes on the notes to accounts.

- Accounts receivable

This item of the balance sheet includes the balances outstanding for credit sales as of the date. The accounts receivable decreases as and when the amount is recovered from the debtors, while the cash and cash equivalent will increase with the same amount.

- Inventory

Finished goods, work-in-progress goods, and raw materials in a manufacturing or trading industry are included under the head inventory. The inventory is normally valued at the cost of goods or market value of the same, whichever is lower. Goods are sold out of inventory with the addition of profit margin.

Also Read: What is Trial Balance – Meaning, Features and Purpose

2. Non- Current Assets

- Property, Plant & Equipment

This item comes under the tangible or the fixed assets of the organizations. The fixed assets are normally accounted for at the amount net of depreciation accumulated over the years. The fixed assets are also classified and categorized as building, land, plant and machinery, furniture, etc. All other assets are depreciable except for land.

- Intangible Assets

All the intangible assets that can be identified or not are covered under this heading. Some identifiable intangible assets include licenses, patents, and others, while unidentifiable intangible assets include goodwill, brand, and other assets.

3. Current Liabilities

- Accounts Payable

An organization that owes the amount to the suppliers for goods and services purchased on credit is called accounts payable (AP). When the entity starts paying off the accounts payable, the cash and bank balances also start decreasing with the same amount.

- Notes Payable or Current Debt

The obligations or liability apart from the accounts payable that are due within one year or one operating cycle is termed as current debt. Notes payable may have a maturity of more than one year and are usually required to be paid off within five years.

- Current Portion of Long Term Debt

This account is sometimes merged with current debt. Though they seem to be similar, they do have a slight difference. The amount categorized under this account is the amount that is that part of long-term debt that is due within years. For example, the interest on an ongoing bank loan or the EMI portion of the loan due every month. Though the loan is a long-term debt, the EMI or the interest is a part of this long-term debt due for payment every month or as the period is decided.

4. Non-Current Liabilities

- Bonds Payable

The debts with regular payment associated with the entity’s bonds are categorized under this account.

- Long Term Debt

All the debts due for a longer period, probably more than a year, are categorized under this account. Long-term debts are detailed in the debt schedule of the entity. It contains the principal repayment, interest expense, or the outstanding debt for the relevant period.

5. Shareholders Equity

- Share Capital

The value of funds that the owners or the shareholders of a company are invested in an organisation is called share capital or shareholders funds. The shareholder’s funds or capital is normally the amount with which the organisation is established. The cash balance that the shareholders bring in is utilised for running the initial business and set up of the entity.

- Retained Earnings

Retained earnings are the profit in the normal course of business kept with the entity after all the expenses are paid out. It is the net income that is left with the entity out of the business’s profits in the operating cycle. The dividend to the shareholders is also paid out of the retained earnings. The bonus to the employees or the shareholders is also declared out of retained earnings. The retained earnings are added to or deducted from the previous year’s balance of retained earnings every year. And thus, the balance that arises is carried forward further to the next year.

Equation of the balance sheet

The answer to the question, what is a balance sheet in accounting is the equation as mentioned below:

Owner’s Equity + Liability = Assets

This equation can be further explained as the assets from one side of the balance sheet. In contrast, the other side is composed of the liability of the organisation towards the day-to-day transaction and the equity funds or owners’ funds. Both sides should have the same amount of balance with each other. Therefore the name is termed as a balance sheet.

It can be said that the liability of the company and the owner’s funds have a stake in all the organisation’s assets. Therefore, every organisation should have enough assets, including current and fixed assets, to discharge the liabilities and the owner’s funds.

Does a Balance sheet always balance?

A balance sheet, as the name suggests, should necessarily always be balanced. The preparation of a balance sheet is typically so done that it falls true to its name, stating that the assets and liabilities of an organisation should be equal to each other. However, there may be certain reasons when the balance sheet does not balance. Some of such reasons are mentioned below:

- A miscalculation in depreciation or amortisation of loans

- Calculation mistakes in equity calculations

- Error in calculation and valuation of inventory

- Calculation mistakes in currency exchange rates

- Inappropriate entry of transactions

- Misplaced or incomplete data

How to prepare balance sheet?

An individual can prepare a balance sheet with basic accounting knowledge. With the advancement of technology, preparing a balance sheet becomes simpler, easier, and quick. The automation process and with the assistance of various software and accounting system such as excel, Enterprise Resource Planning (ERP), and others, a balance sheet can be extracted from the books of accounts at any point in time. However, understanding the concept of why a balance sheet is prepared and how to make a balance sheet in excel and other software would curb the potential errors.

The guide to creating a basic balance sheet is as mentioned below:

1. Determine the reporting period and date

A balance sheet is typically reporting of assets and liabilities on a particular date. This date is normally at the end of the reporting period and is termed as a reporting date. Some organisations prepare the balance sheet quarterly, while the normal practice is to create a balance sheet annually.

2. Identify the assets

The next step on how to make a balance sheet is identifying the assets as on the reporting date and splitting them into line items. Categorising the assets in different line items makes it easier to analyse and tally the reporting items.

The classification is normally done as:

- Current Assets

- Inventory

- Accounts receivable

- Short term marketable securities

- Cash and cash equivalents

- Other current assets

- Non-Current Assets

- Intangible assets

- Goodwill

- Property

- Long Term marketable securities

- Other Non-current assets

3. Identify the liabilities

The liabilities as on the reporting date should also be identified. They should be subtotaled and then totalled together to be reported in the final column of the balance sheet.

The classification is normally done as:

- Current Liabilities

- Current portion of long term debt

- Deferred Revenue

- Accrued expenses

- Accounts payable

- Other current liabilities

- Non-Current Liabilities

- Long term debt

- Long term lease obligation

- Non-current deferred revenue

- Other non-current liabilities

4. Calculate shareholders equity

It’s easier to calculate the shareholder’s equity of a private company than a public company. This is because the latter depends upon the various types of stocks that are held.

5. Add liabilities and shareholders equity and compare with assets

Comparison between the asset and liability sides is essential as it should be balanced at any point in time.

Also Read: What is Inventory Management Software System?

Conclusion

The balance sheet forms an essential basis of all the financial reporting. It is a financial statement that provides a snapshot of the financial health of the organization. Learning how to create a balance sheet and resolve the problems to balance the financial statement would be a valuable addition to the entity. Now easily create a balance sheet